Gaetano Crupi

I previously wrote about the “holy trinity” of materials that startups should have in their Series B data room: memo, deck and forecast. These three key documents should do the heavy lifting of capturing attention and communicating information across the partnership with high fidelity.

Now, I want to highlight how founders can tie these materials together for investors. If done well, these materials, along with various phone calls and presentations, will create the blueprint and backbone for an in-depth Series B due diligence process.

This blueprint is important because someone will likely read every single document in your data room, and you do not want them to get lost. Instead, you want to make their job very easy. The next set of materials falls squarely under the “minimize work” objective. By making things easy, you increase the chances of the outcome being in your favor.

Series B companies generally have sales, detailed cost breakdowns, forecast actualization records, patents, board presentations and more. There is a lot of information to go over because you have been around for a lot longer than a seed stage or Series A company.

Getting serious about Series B: 3 documents that will help founders control the narrative

The best offense is a strong due diligence questionnaire

As an investor, I’m shocked that I don’t see DDQs more often. Not to be confused with a legal DDQ, this DDQ is often a 60- to 80-page document divided into sections and answering questions that investors will invariably ask.

Some questions will be straightforward. For example:

- When and how was the company founded?

- Please discuss the company’s vision and values.

- How many employees does the company currently employ?

- Please summarize the relevant expertise and experience of the management team.

The DDQ offers a good reference guide for such simple questions. It also should include some preemptive questions that investors like to ask, such as:

- What additional key leadership hires need to be made?

- Please describe the environmental footprint of the company compared to traditional products.

It is good to take time to think of elegant and cogent answers to these questions, because they will invariably come up.

Finally, there are the questions you don’t want investors to ask:

- What prevents your competitors from also doing the same? There does not seem to be a technical moat to your business model.

- Your business model requires a lot of CAPEX. How much capital do you need to raise, and how much should investors in this round expect to be diluted?

- Many startups have tried this exact business model, like X and Y. What makes you different?

The DDQ is an excellent opportunity to defuse these tough questions up front. They will come up, so it is up to you to decide when and how they come up. Include the most brutal questions in your DDQ. Your investors will respect you for it.

Some final thoughts on the DDQ:

- Every firm has a slightly different investment memo format (not to be confused with the strategy memo we discussed), but the major sections are generally the same. Construct your DDQ in a manner that lets a very, very lazy investor lift entire sections from it and create their own investment memo. They probably won’t, but fortune favors the bold.

- The DDQ is a living document. Use a hosting site like Docsend for your DDQ so that you can continuously update the document with the best questions you get from investors. Answering questions before they are asked or even contemplated reduces the amount of work investors have to do.

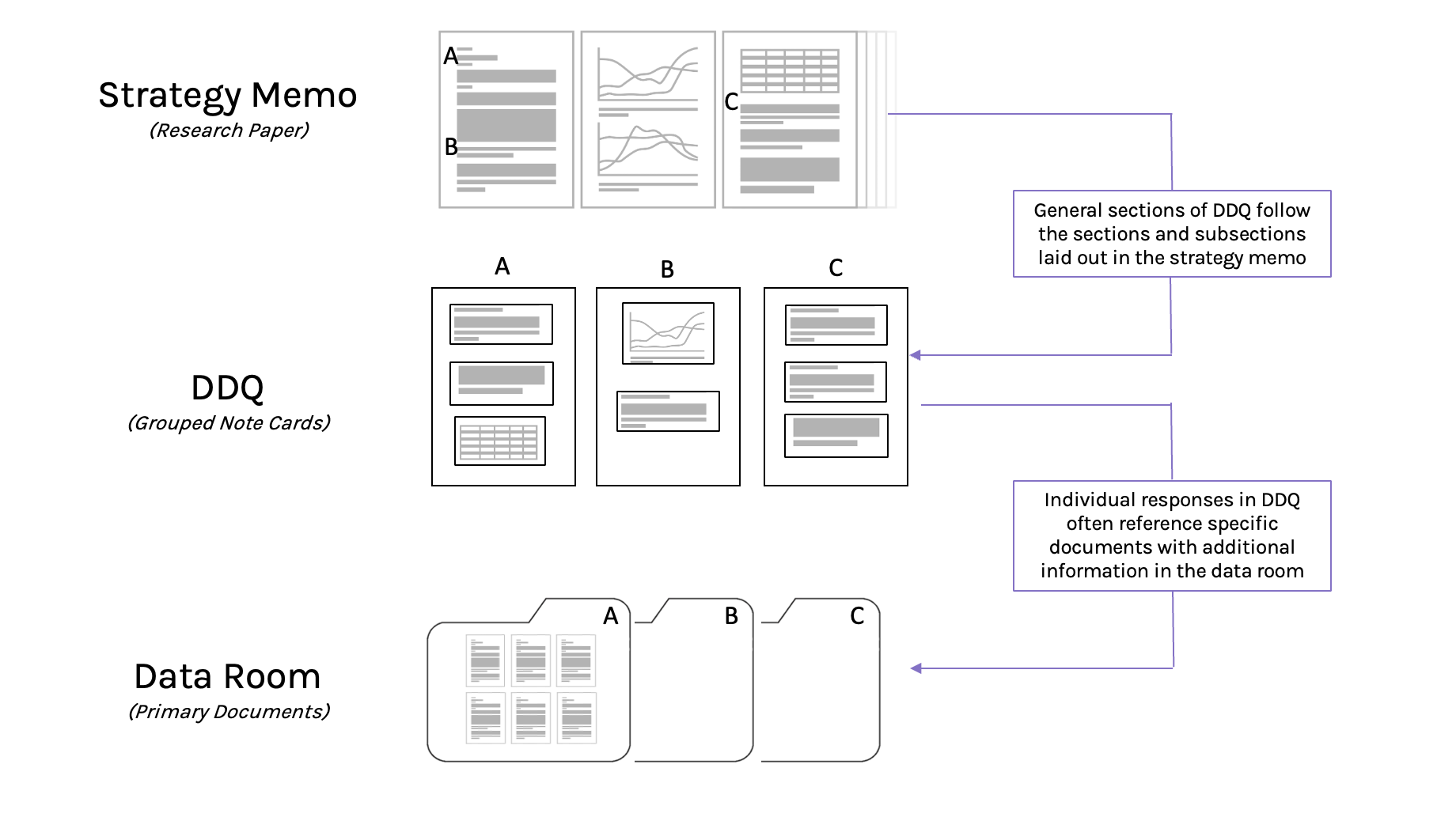

- The DDQ should link to specific documents in your data room. This lets it serve as a guide for navigating the data room. In fact, I like to think of the strategy memo, DDQ and data room through the lens of an old school research paper. I am about to date myself, but: If your strategy memo is your finished research paper and your data room is where you store all your primary documents, your DDQ is like your note cards organized in piles.

The escape data room

One major mistake people make is organizing their diligence data room like they would a legal diligence room. Lawyers probably want every single data room to look the same — here are your patents, here are your commercial contracts, here are your employment agreements, etc.

But if I am trying to match the story you have been telling me in your deck and forecast to primary documents, do you want me to jump in and out of generic folders trying to find information? Or, do you want to guide me through the information exactly how you have done in every interaction?

Don’t make your data room so complicated that investors can’t find their way out of the details into accepting your arguments.

A good data room is organized in the same way as the argument you are trying to make. If your narrative starts with a macro trend, zooms into the current landscape, then talks about a tech breakthrough and how that breakthrough, coupled with your team and customer insights, has lead to incredible commercial traction, then your data room might look like this:

- Overview Materials

- Market Landscape

- Competitive Analysis

- Technology Overview

- Team

- Customer Insights

- Commercial

- Finance and Metrics

- Other

Organize your folders and subfolders so they mirror how you tell your story. When people start digging into your data room, your narrative will be continuously reinforced. If you have done a solid job with your DDQ, strategy memo, deck and forecast model, investors will breeze through a data room that feels like checking boxes toward an inevitable conclusion rather than hunting for threads in a tapestry they can’t clearly see.

Breakout decks

Lastly, it can be helpful to have a few topic-specific decks. Think of these as deep-dive decks for key areas that are important to your narrative. If an investor doesn’t want to go through the details of your go-to-market strategy, a summarized overview of the competitive landscape, product differentials, customer archetypes, etc. in a more visual deck format can help communicate the information effectively.

These decks often form the basis for breakout meetings with other leaders at the company. At Series B, investors expect to see a much deeper bench around the CEO. My partners and I have direct relationships with multiple members of the management in each of our companies. I even have standing meetings with COOs, VPs of finance, etc. across the portfolio. These breakout decks allow those key members to shine and truly own their verticals. A CEO that keeps an iron grip on points of contact and doesn’t allow anyone else to talk independently with investors is a red flag at this stage.

We always do a full day or two on-site with our Series B companies, and we’ll see different departments present their respective decks. It’s wise to proactively create and distribute those decks so that the partnership has time to review them prior to those meetings and can also easily share them internally.

The three decks that we generally see at Series B are a technical deck, a go-to-market or commercial deck and a manufacturing/techno/economic/financial deck.

Putting it all together

I hope this overview grants some clarity on the package of materials investors expect at Series B, and how the materials work together in a system.

Below is an overview of each piece of content and where it does the heavy lifting:

| Capture Attention | Communicate | Minimize Work | |

| Pitch deck | ✓✓✓ | ✓ | |

| Strategy memo | ✓ | ✓✓✓ | ✓✓✓ |

| Forecast model | ✓✓✓ | ✓✓ | |

| Breakout decks | ✓✓ | ✓✓ | |

| DDQ | ✓ | ✓✓✓ | |

| Data room | ✓✓ |

By keeping the information you provide tightly coupled with the initial story that captured investor interest, you create momentum within the partnership. Every piece of additional information and every additional point of contact creates more excitement.

I want to emphasize that the tactics and suggestions outlined above are not a recipe for “tricking” investors. Real diligence that is beyond your control will be conducted: Past employees and employers will be called, as well as customers and competitors. Investors will not take your word for everything.

If your company is not ready for a Series B, you will rarely even get a first meeting. The advice presented here will only help companies that have really good fundamentals. You have to have the goods — all the other stuff is window dressing that tips luck in your favor.

Comment