Fintech decacorn Plaid is expanding beyond its core product of account linking — its first major expansion since its 2013 inception.

In conjunction with its “Plaid Forum” event, the startup today unveiled a number of “product enhancements and new initiatives,” which include moving into identity and income verification, fraud prevention and providing new tools for account funding and disbursements.

The move comes two weeks after payments giant Stripe announced it was encroaching on Plaid’s territory with a new product of its own. The news positions Plaid even further into direct competition with Stripe as the two fintech giants are increasingly offering more and more of the same services.

In a blog post entitled “Ushering in fintech’s next phase,” Plaid CEO and co-founder Zach Perret noted that the majority of Plaid’s network traffic has run through direct bank APIs that are made possible through bank partnerships and Plaid Exchange, a data access offering that is used by over 1,000 banks and fintechs to deliver API-based data access to their customers.

But now, the company has expanded its data connectivity offering to include Core Exchange, which Perret said offers banks, fintechs or “data partners” another way to “securely” share data when using Plaid.

Alain Meier, Plaid’s head of identity, told TechCrunch that account connectivity has always been the company’s core focus. Over the years, he points out, Plaid has helped power the connectivity to millions of accounts — especially as more consumers use digital financial services.

Over time, as Perret shares, the company has added more fintech companies to its network including Chime, Dave, Robinhood and SoFi. It’s also added new types of data connections, such as payroll data so people can verify their income and employment details when doing things like getting a loan or buying a car.

And as fintech adoption has grown in recent years, so has demand from Plaid’s customers for the company to address more of the onboarding experience.

“This ultimately helps build trust and security for the entire ecosystem as more people onboard to new fintech apps and services,” Meier said. “That’s why we are expanding our platform to now include identity verification and new tools for fast and easy account funding and disbursements.”

The move into identity verification is not at all a surprise considering that Plaid shelled out $250 million in January to purchase Cognito, which offered ID verification, along with help with thorny issues like KYC rules and anti-money laundering requirements.

“When Cognito joined Plaid, we estimated that about 90% of Plaid customers need some type of ID verification, so this is a natural extension for Plaid,” Meier told TechCrunch. And Perrett confirms that Plaid’s new identity verification offerings indeed bring Cognito’s products to the Plaid API.

Plaid buys Cognito as it moves beyond merely connecting accounts

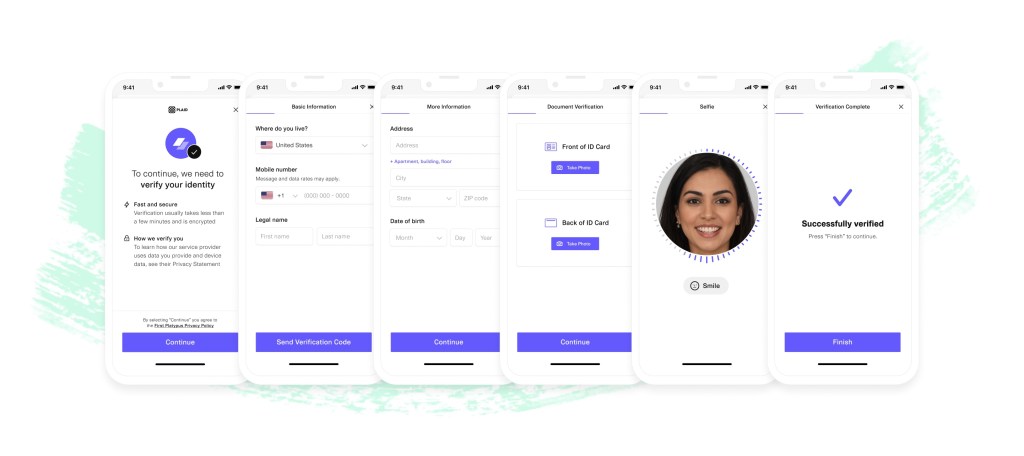

The company has integrated its new verification product into Plaid Link, with the aim of giving customers to link their accounts and verify their identities in “a single, seamless user experience,” Meier said.

Identity has always been top of mind for Plaid, he claims, starting with an API for confirming account ownership during authentication. In the past, Plaid customers had to work with six to 12 different vendors in order to handle all of the different aspects of the ID verification and compliance flow, noted Meier.

Beyond those new offerings, in what is perhaps the most surprising new news to come out of the company today, Plaid said it is also hoping to turn new users into active customers through account funding, which will give people a way to pay, or be paid, for goods and services.

“Funding an account is the first step a user takes to invest, send money or to begin using a digital wallet,” Meier said. “We are working to make account funding and transfers a seamless part of the overall onboarding experience to improve this critical activation step.”

Finally, the company believes it is now offering risk-based tools designed to help lower risk and fraud in account funding and transfers via ACH. Its new Signal (transaction monitoring) offering for example, uses machine learning to analyze more than 1,000 risk factors and provide scores and insights that Plaid says provide “more certainty that a transaction will settle,” so a company can accelerate access to those funds without increasing risk. Early customers, Plaid claims, have seen “significant reductions” in unauthorized returns and NSF fees.

Plaid in April of 2021 raised a $425 million Series D at a valuation of $13.4 billion. The nine-year-old company made headlines last year when the deal it had struck to be acquired by consumer credit giant Visa for $5.3 billion fell through due to regulatory concerns — an event that many say turned out to be a blessing in disguise for the startup.

Identity verification is an increasingly crowded, and well-funded, space. Socure, a company that uses AI and machine learning to verify identities, last November raised $450 million in funding for its Series E round led by Accel and T. Rowe Price. Persona, a startup focused on creating a personalized identity verification experience “for any use case,” which says it helps businesses customize the identity verification process — and beyond — via its no-code platform secured $150 million in a Series C funding round last September. And last August, a pair of early Affirm employees raised $70 million for SentiLink, an identity verification startup.

My weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.

From partners to competitors: What Stripe’s latest move means for Plaid

Comment