A/O PropTech is a European VC that officially launched last week after raising €250 million in what it describes as “permanent capital” to invest in companies disrupting the €230 trillion real estate industry.

This approach sees the firm structured more like a corporation with various shareholders, rather than a traditional venture capital fund with a typical life cycle of two-to-five years. The group invests from Series A to later-growth stages and claims to be more patient with regards to the timing of any exits.

A/O PropTech’s investors are described as some of the largest institutional real-estate companies in Europe that hold a pool of residential, commercial and hospitality assets. Proptech companies that the VC backs can potentially leverage these assets as a sandbox to test, pilot and “fast-track the commercial and operational scale” of their offerings, according to a company statement. To date, the firm reports eight proptech companies in its portfolio that span 14 countries and serve 200K real estate units.

I put some questions to A/O PropTech founder and CEO Gregory Dewerpe to drill down into the firm’s investment thesis and how it hopes to stand out from other firms investing in the space. More broadly, Dewerpe discusses the billion-dollar opportunities he believes are there for the taking in property tech over the next decade and beyond.

TechCrunch: A/O PropTech is described as a proptech VC, investing in companies enabling the “disruption” of the real estate industry. However, proptech is a term quite loosely bandied about, so perhaps you can start by helping us define the term from A/O PropTech’s point of view?

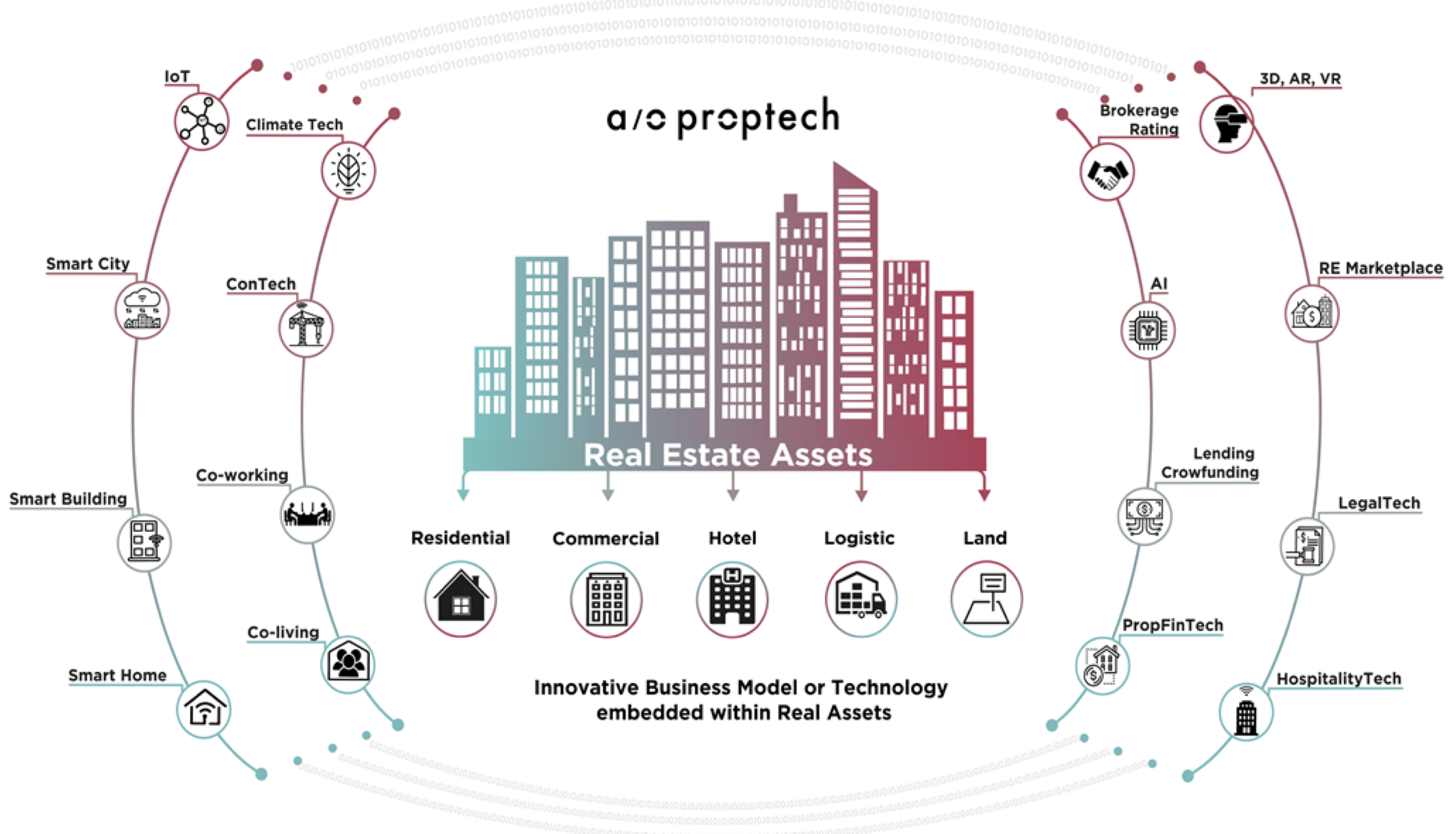

Gregory Dewerpe: Proptech is indeed quite a loosely used term. But it is a fairly new definition, which is dynamic and bound to evolve over time. We define it as any innovative technology or business model that is embedded within real estate with the potential to transform:

- How we interact with real estate assets (building, buying, selling, renting, living).

- How those assets are managed: property and asset management, procurement, transparency, etc.

- How smarter assets can become: gathering valuable data (IoT, data science, AI) to improve user experience, optimize usage and unlock additional value.

- How its space is re-invented: Real estate is evolving into a more consumer-centric and climate-conscious industry. Space becomes a service and alternative uses are made possible through innovation and digitization. Space as a service means that space is provided on demand and is used and designed to provide specific aspects and services relevant for the user of that particular space. A totally new approach in the industry.

Digging a bit more into your investment remit, you back companies at Series A to later-growth stages that have the potential to “transform the real estate industry.” Can you be more specific with regards to the size of check you write and the types of companies, geographies, technologies and business models you are focusing on?

We want to stay true to our ethos, which is to work very closely on the integration and scale of our portfolio companies. Therefore, we need to limit ourselves in the number of transactions we complete each year. As a result, we typically write initial checks between $3 million and $15 million, with the possibility to go above $20 million on strong convictions and later-stage follow-on investments.

Flexibility is key to our investment strategy. Some of the segments we target are still nascent (such as climatetech and AI in real estate, for example). We stand ready to enter earlier with smaller tickets into those companies ($1-2 million checks) knowing that we will be able to invest in more meaningful rounds in the not-too-distant future. Similarly, we are flexible how we interact with other investors; we do not always lead and will help the companies structure the best round by bringing other relevant VCs alongside us.

What we look for is business models that are scalable, asset light and are addressing pain points in the industry, sometimes underpinned by marketplace, sharing economy or AI dynamics that create strong market tailwinds. We like B2B, B2B2C and selectively B2C, although we see this as much more difficult and expensive to crack.

With regards to the geographies, we focus primarily on companies which are targeting markets where we can be impactful, so you will find that most of our investments are in Europe, but can extend to U.S. or Israeli companies that are scaling in our core European markets.

Positioning yourself as different to a more traditional venture capital firm, where a new fund might be raised every few years and has a lifetime of up to 10 years, A/O PropTech claims to take a “permanent capital” approach, enabling the firm to be stage-agnostic and a more flexible and patient investor.

What do you mean by this and how is the fund structured to allow this?

We are not structured as a traditional fund, but as a corporate. With no comparison intended, we are similar in structure to how Berkshire Hathaway or Danaher were set up. Within our corporate structure we have designed an innovative framework that allows us to replicate fund economics without its structural limitations whilst offering clear incentives to attract talent in our team. Our investment strategy is unconstrained by typical fund timelines (investment period of two-five years and fund life of seven-10 years),

Over time, we can issue new shares or recapitalize to raise more funds in the vehicle and continue to invest over the long term without limiting ourselves or our investors. But permanent capital structures are not for everyone (yet). Some large strategic investors have approached us but can only invest in fund structures. We plan to have a fund-like investment vehicle to accommodate them and accompany our permanent capital vehicle side-by-side in order to stay true to our thesis.

LPs in A/O PropTech are some of the largest institutional real-estate investment companies in Europe and hold a range of residential, commercial and hospitality assets, which you have described as offering a “ready-made sandbox” that portfolio companies can use to pilot products.

How will this work in practice and can you provide any examples from A/O existing investments where this is already happening?

We have created protocols with our investors which allow us to very efficiently set up pilots and integration with a view to scale rapidly across the entire portfolio when successful. This is where we have spent the most time to design an efficient operating model developed over the years in other industries.

We run regular workshops with the asset and property management teams, as well as the finance, IT and procurement divisions within our investor base. We also work closely with senior leadership to design the adequate transition plan in order to make new technology integrations possible and efficient across the organization. Disrupting large corporations is definitely a challenge, probably the biggest one proptech is facing, but our team has managed that at large scale in previous jobs and we are therefore able to capitalize on that invaluable experience to roll out our strategy. We have also carefully selected our first real estate partners who are forward-thinking and committed to make the transition more efficient from the beginning. Our unique process allows us to act much faster than any other player out there currently.

We are working on various integration into our strategic real estate portfolio with a few of our companies. Some examples below:

- Integrating Fornova into 10,000 hotel bedrooms (in less than a year), with a plan to reach 50,000 over time.

- Rolling out Plentific into over 30,000 apartments in Europe (within 12 months), with plans to double or triple in Germany and enter the U.S. with 20,000 units in 2021.

- Integrating the Bricklane platform into the residential acquisition team of one of our investors to deploy about $120 million over the course of this year in London.

- Rolling out Residently into a significant London residential portfolio gradually to create a consistent tenant engagement platform

Our model allows us to integrate essential real-time operational and commercial feedback loops and circulate it back to our portfolio companies who can iterate faster and more precisely their products along the way.

We pride ourselves in working very hard to service our portfolio companies as well as our investors. Collaboration and transparency are key.

For proptech startups that may want to pitch you for investment, what are some of the proptech and real estate problems you have identified that have yet to be solved? I understand making property more environmentally friendly and sustainable is one.

This is honestly such a huge opportunity with so many different facets to it. We need to remain vigilant and open-minded in our investment approach. The industry’s transformation is still nascent and there will be many iterations, trends and opportunities along the way.

Thanks to the diversity of our investor’s assets (residential, office, retail, hotels, land and logistics), we are able to understand those many verticals in depth, identify their pain points and focus on solutions enabling transition from analogue to digital, data-driven and tech-enabled.

Below are examples of some of the trends/themes that we follow closely at the moment:

Smart real estate: How valuable data sets input and insights can transform the management and operations of real estate assets, from the user experience, to tenant engagement and management in and around apartments, buildings and adjacent communities.

Hospitality tech: The implementation of technology and advanced analytics in the hospitality industry to improve the performance at the core of the hotel business; improve direct booking, design amenities, facility management, staffing requirements and deliver seamless experiences to customers.

Shared economy: Focusing on the occupier markets, and how the new sharing economy can give a new life usage to certain spaces — ultimately this will change the way we interact with certain assets. Co-working and co-living are the poster children of the sharing economy in real estate and we believe in the evolution of how we work and live but with a strong focus on asset-light business models that can scale with limited exposure to the direction of the market. Typically lease arbitrage models are asset-heavy, which we do not consider as technology-driven.

Real estate fintech or propfintech: Technologies targeting transactional real estate — addressing how we buy, sell, rent, securitize or exchange. Currently most of those processes have been analogue at best, creating significant potential for improvement, transparency and speed. Being able to transact at the click of a button will eventually be possible, but a lot of the analogue processes embedded in these transactions will have to change for it to be possible.

Climatetech: We are interested in solutions focused on the decarbonization of the real estate industry. This includes technologies that enable the measurement and reduction of carbon footprints. This can be done through more efficient energy consumption, mixed usage of assets, waste reduction, development of new climate-friendly materials and data-driven optimization of planning and construction.

Contech: These are technologies that change how we design, plan and build. Enabling engineers, architects and builders in order to reduce costs, timelines and maximize the use of space in a sustainable manner. Rising payroll and raw material costs, as well as new regulations, are putting pressure on developers to innovate and technology will help remove some of the most systemic pain points.

Comment