On Monday, the National Venture Capital Association and Thomson Reuters released some surprising data. Despite few opportunities to exit from their investments, 57 venture firms managed to raise $12 billion in the first quarter — more money than VCs have raised since the second quarter of 2006. More, just seven firms counted for nearly two-thirds of all that money, with four raising north of a billion dollars apiece.

“It’s not just the size of the funds but the velocity” at which VCs are returning to their investors, known as limited partners (or LPs), says an astonished Bill Gurley of the venture firm Benchmark. “The Kauffman fund said that billion dollar funds sucked, then everybody went out and raised billion-dollar funds.”

Gurley is referring to a 2012 Kauffman Foundation report that suggests venture capital isn’t a great place for institutions to invest, and that big venture funds are a losing proposition almost entirely.

According to the organization’s findings, which it based on its 20-plus years of investing in more than 100 venture funds, only 20 percent of its investments had generated returns that beat a public market equivalent as of 2012, and even then, the funds outpaced those public market indices by a measly three percent. Kauffman further found that only four of 30 venture funds that exceeded $400 million delivered better returns for investors than a small-cap common stock index.

What’s changed in four years’ time? As far as Gurley is concerned, not a thing. Gurley — whose firm raised one billion-dollar fund in the late ’90s and quickly reverted back to sub $500 million funds — says he doesn’t think big venture funds add up for anyone other than VCs, whose management fees typically equal two percent of a fund.

“If you talk with an LP, you’ll hear that funds raised in times of scarcity perform the best, while those raised in peak [fundraising] moments don’t have the best returns. The only type of return that’s guaranteed is excessive fee income. You get that no matter what, which is a conflict, for sure.”

Indeed, Gurley thinks he knows why his fellow venture capitalists have been busy rounding up money — and a lot of it.

The venture industry has “record [internal rates of return] on paper and record low liquidity” meaning their markups have not been turned into cash-on- cash returns just yet. Add to that the numbers of still-private companies like Snapchat, Dropbox, Blue Apron that have seen their value publicly marked down and up and down again by their mutual fund shareholders, and you can understand their nervousness. “Some of these funds are afraid that their paper IRR is going to melt away in the future, and they’re raising money before that happens,” Gurley notes.

Of course, many LPs are highly sophisticated. They have the same data as Gurley, which begs the question of why they’re investing so much right now, instead of waiting to see more returns from their venture clients.

Gurley says interest rates are one reason. “The low-to-no interest rate environment that we’ve been in is just radical.” (When the interest on cash that banks pay is close to zero, other kinds of investments look more attractive because the risk-free alternatives produce so little.)

Low interest rates have “already caused the natural gas industry to boom and bust,” he says. Other industries aren’t immune either.

Gurley also observes that LPs are “in a tough spot.” These managers themselves get measured on their performance over a very long cycle, and if they get kicked out of a venture fund for not writing a check when its VC managers come calling, it can probably feel ruinous. The reality is that most venture funds invest over a period of a decade, and some VCs have very long memories. As Gurley notes, “The decision to opt out of a particular fund can easily impact an institutional investor for 20 years. I don’t think it’s easy to say, ‘We’ll pass on this one,’ because you’re passing on that brand for the rest of your career.”

Not everyone takes such a dim view of the money that’s continuing to flood into venture, despite a dearth of IPOs and high-priced acquisitions in recent years.

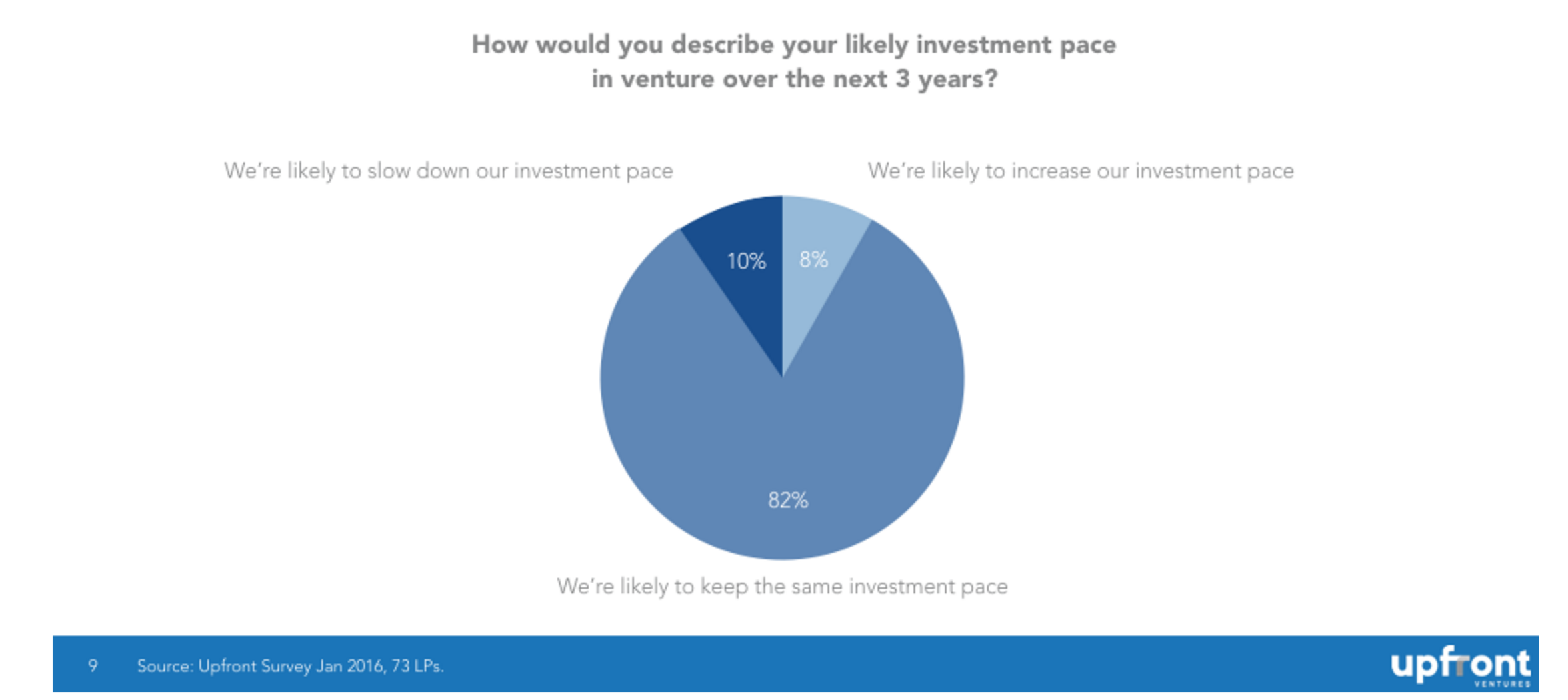

Investor Mark Suster of Upfront Ventures says that his own extensive survey of LPs has shown that “despite their worry about valuations in the short term, they believe that VC is an important part of their asset management, and they want allocation to the best funds.” Suster adds, “The trend they’re observing is that big companies are being created and — right or wrong — they think they can chase that alpha by investing in venture.”

Chris Dixon of Andreessen Horowitz also puts more faith in LPs, though he admits that it’s hard to know exactly what’s going on right now.

“I don’t try to do macroeconomics, I don’t think economists do it very well, and I don’t think VCs should try to do it,” he says. But he thinks that “in general, tech is becoming more and more important, and it’s impacting more and more industries,” which could explain institutional investors’ willingness to write giant checks to venture firms.

“It used to be that tech meant building computers and spreadsheet software, and there was a limited domain of things you could do. Now,” says Dixon, “we’re talking about things that can address the whole economy . . . the car industry . . . the hospitality industry . . . healthcare and finance and transportation. Now, tech is at the heart of [these things].”

Dixon says it’s also worth noting that the “VC industry is very small. It’s a microscopic portion of [the investments that institutions make].”

Either way, perhaps the better question at this point is what all that new capital means for valuations, which have softened in recent months as public market prices (now rebounding) have drooped.

On this front, the investors seem less certain. Gurley says he doesn’t know what to expect of valuations in 2016 but that he has seen less reckless behavior on the part of other VCs, which seems to give him some degree of optimism that prices won’t soar skyward again soon. Suster similarly attributes overheated valuations last year to mutual and hedge fund investors, who’ve seemingly retreated from venture capital (for now).

As for Dixon, he also says he doesn’t know if valuations will be impacted, but he seems to enjoy watching the industry chew it over. “Two years ago people were super excited and now everyone thinks everything is going out of business. I think the truth is somewhere in the middle.”

Andreessen Horowitz is currently raising a new, $1.5 billion fund, sources have told us in recent months. Upfront Ventures meanwhile closed on a $280 million fund about 16 months ago. Benchmark closed its current fund with $425 million in December 2013.

Comment