Byron Deeter

More posts from Byron Deeter

As interest rates have returned to historical norms, the world has returned its focus to cost of capital and free cash flow generation. Businesses are working hard to conform to traditional heuristics like Rule of 40 (i.e., the idea that the sum of revenue growth and profit margin should equal 40%+, a metric that Bessemer helped popularize). Executives of both private and public cloud companies often believe free cash flow (FCF) margins are just as important as (if not more important than) growth and that the trade-off is 1:1. Many finance executives love the Rule of 40 for its clarity, but assigning equal weight to growth and profitability for late-stage businesses is flawed and has caused misguided business decisions.

Our take

Growth needs to remain the primary priority for businesses with adequate FCF margins. While the focus on efficiency is well-founded, the traditional Rule of 40 math is dead wrong as you approach breakeven and turn free cash flow positive.

The world has over-rotated into an FCF margin mindset over a growth mindset, which is backward for growing efficient businesses. Long-term models show that even in tight markets, growth should be valued at least ~2x to 3x more than FCF margin.

Why?

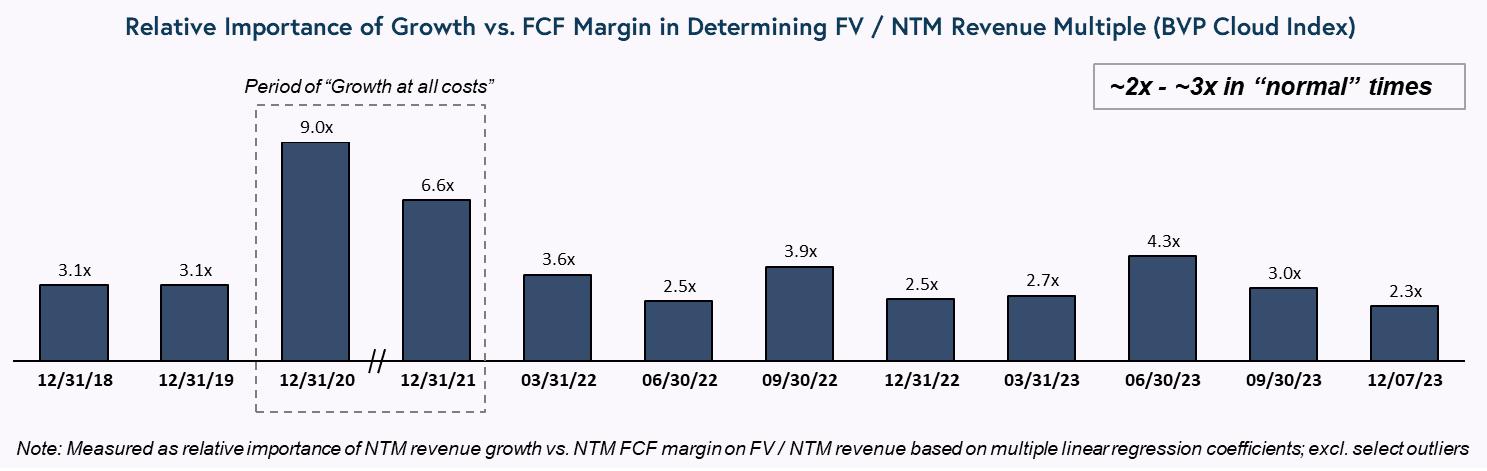

While a margin increase has a linear impact on value, a growth rate increase can have a compounding impact on value. We show the detailed math below, and it’s confirmed by public market valuation correlations when you backtest the relative importance of growth versus FCF margin. The actual ratio fluctuates massively in the short-term — ranging from ~2x to ~9x in the past handful of years — but over the long-term, the ratio typically settles at 2x to 3x more value for growth over profitability.

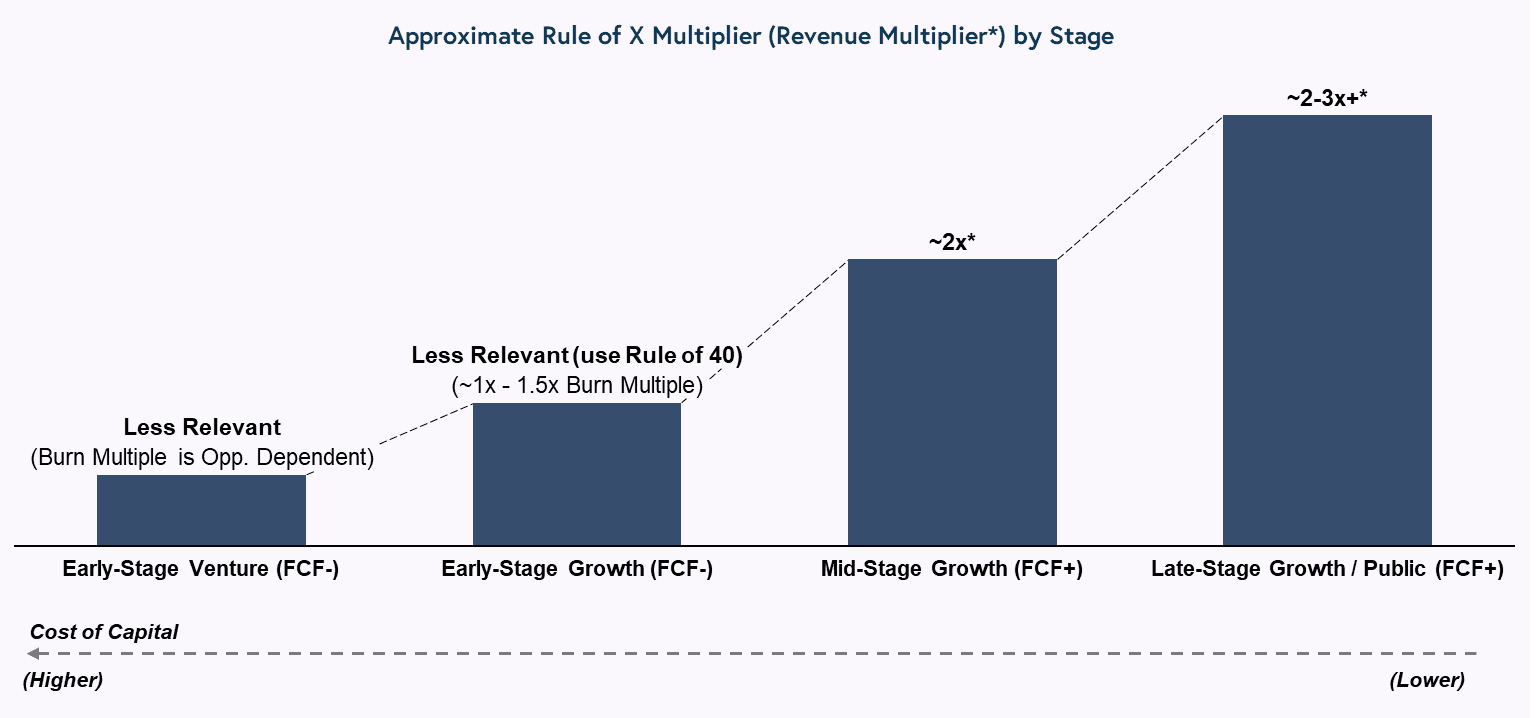

We recommend that even the most conservative financial planners can safely use a ratio of ~2x growth over profitability for late-stage private businesses; public companies with lower costs of capital can use a ~2 to 3x multiple (as long as the growth is efficient).

Introducing the Rule of X

At Bessemer, we wanted to introduce a new metric that more accurately represents a cloud business’s valuation by placing a more accurate weight on its growth and future recurring revenue.

Introducing the Rule of X. As the name suggests, the Rule of X is an adjusted form of Rule of 40, taking composition (and weighting) into account.

* = Multiplier on growth rate, which today is ~2x for private companies and ~2x to 3x for public companies.

Our advice to founders, CEOs, and CFOs: As you do your own financial business planning for the future, it’s critical that you keep a growth mindset and the proper math in mind to ensure that you’re maximizing the value potential of your business. Let’s further explain the Rule of X, the analysis and fundamentals of our thinking, and why leaders need to optimize for growth — at appropriate costs!

Breaking down the Rule of X

Let’s look at a hypothetical scenario to illustrate the point. If someone offered you (A) $1 today or (B) to invest that $1 now and get back $1 starting next year and every year after that, you should take Option B every time. This is the power of the cloud model. For every dollar an efficient cloud SaaS business spends on sales and marketing, the company will see a dollar of recurring revenue materialize ideally into perpetuity. Even if you adjust these cash flows for gross margins — for example, $1 in FCF today versus $0.70/year (70% GM x $1 of new revenue) for 10+ years — the math is still compelling at $7 returned for the $1 invested.

(Admittedly some current public market investors are behaving more like kids in the marshmallow experiment and demanding their FCF now, but we encourage you to think longer term.)

The Rule of X is a valuation metric used to explain this concept mathematically taking composition (and weighting) into account. But first, let’s compare the two:

As the Rule of 40 states, businesses with a Rule of 40%+ are deemed increasingly valuable. For example, if you are growing 30% per year and your profit margin is 15%, then your Rule of 40 is 45%.

In comparison, to understand the math, if we were to take the Rule of X (where the growth rate multiplier is 2x), it would be 75% (30% x 2 + 15% = 75%).

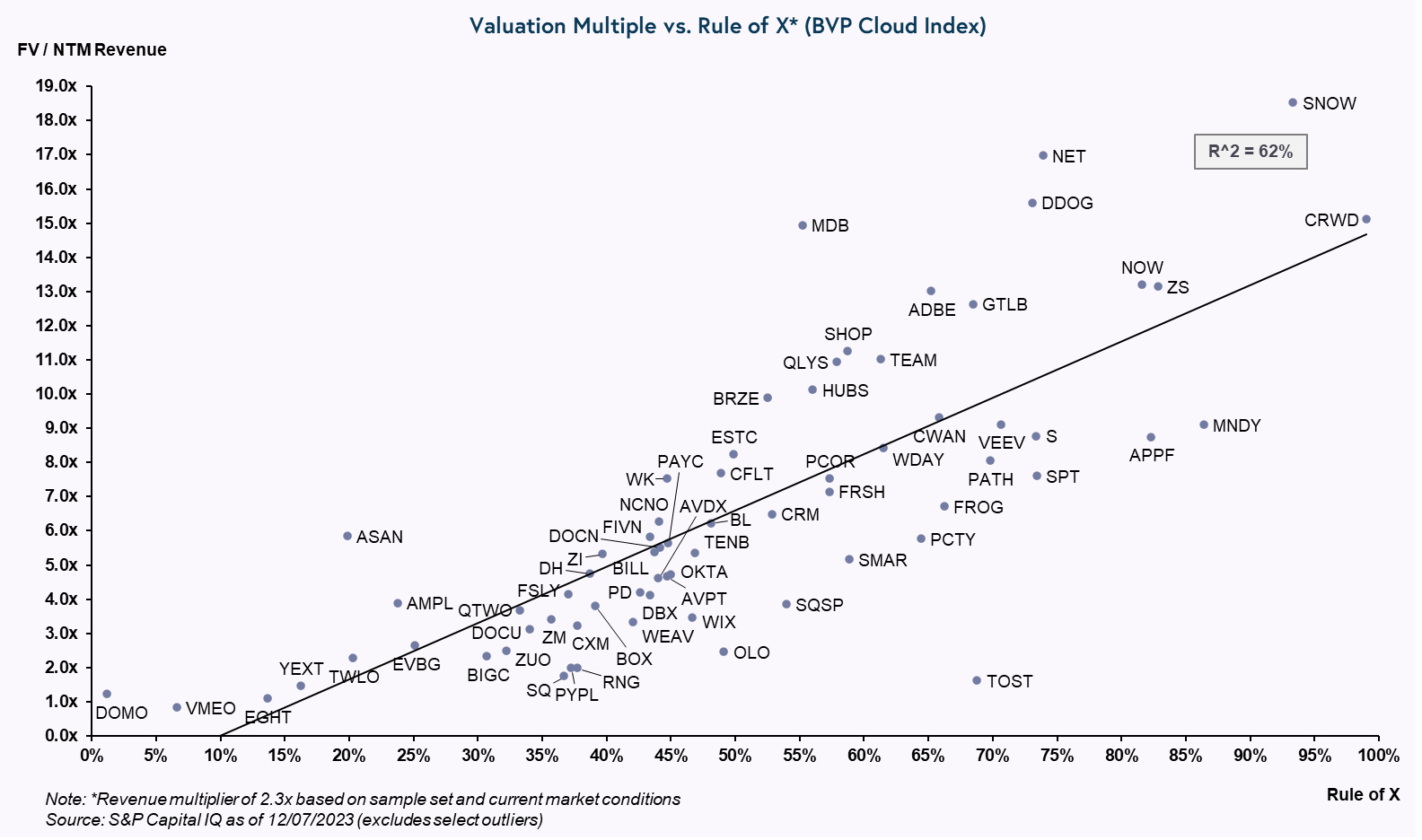

To now highlight the differences, all else being equal, a business with 30% growth and 15% FCF margins should be valued more highly than a business with 15% growth and 30% FCF margins (same Rule of 40, different Rule of X). This is validated by fundamental discounted cash flow analyses and confirmed by public market data (examples shown at the end). For a public cloud business in today’s market, this means that a 1% increase in growth rate has 2.3x the positive impact on valuation multiple versus a 1% increase in FCF margin.

Growth versus burn trade-off

The traditional Rule of 40 has been deployed historically to help value a business, but the metric alone — and even the Rule of X — cannot be used in a vacuum. As venture investors, we focus on additional factors such as market size, economic moat, unit economics, customer quality, retention, product roadmap, balance sheet strength, financing environment, and much more.

We know that for CEOs, every decision is a trade-off. For cloud businesses, the most common trade-off is between growth and burn (e.g., what will we get for our burn?). Keep in mind, some fuel sources burn more cleanly than others. Ultimately, burn is a form of investment and can be used for product development, sales and marketing, G&A, and other areas that will ideally go on to yield future revenue.

We’ll warn you that it’s harder to apply the Rule of X math to earlier stage private businesses that are growing greater than 125% and burning more than 75% for extended periods. However, in periods with lower cost of capital, the math holds even at earlier stages. Snowflake is an extreme example — the company famously burned $1+ billion ahead of becoming FCF profitable in FY 2022. Snowflake, which was the largest cloud IPO of all time, raised ~$3.4 billion with a first-day closing market cap of ~$70 billion. The moral of the story? Burning $1+ billion yielded a ~$60 -70 billion business which is still compounding at 30%+.

Market analysis on growth versus FCF margin for cloud businesses

If we look at the BVP Cloud Index through the lens of a multiple regression over the past five to six years, the weighting of revenue growth versus FCF margin on determining valuation multiples has ranged from ~2x to ~9x. In our view, 2020 and 2021 were outlier periods, where investors placed a significantly higher importance on growth versus FCF margin, emphasizing the “growth at all costs” mindset. In a normalized period, we offer up ~2x to ~3x as a conservative base assumption but encourage you to tailor the multiplier on revenue growth based on current market dynamics and your future assumptions (hence the “X” in the Rule of X). This multiplier will float over time, so do not get distracted by short-term fluctuations. Your Rule of X will also change depending on the stage of your business. Logically, businesses with higher cost of capital will place a relatively lower premium on growth over margin. Additionally, becoming “default alive” and crossing into FCF+ territory can help build independence as well as create a bump in valuation.

As of late 2023, the average Rule of 40 for the BVP Cloud Index was ~31% and the average Rule of X is ~50% (the respective medians are similar to the means). Whereas top decile cloud businesses trade at a ~48% Rule of 40 (with the top few being 50%+) and an ~80% average Rule of X (based on a 2.3x multiplier . . . with the top few trading at ~90%+). That is what awesome looks like, and those should be your targets.

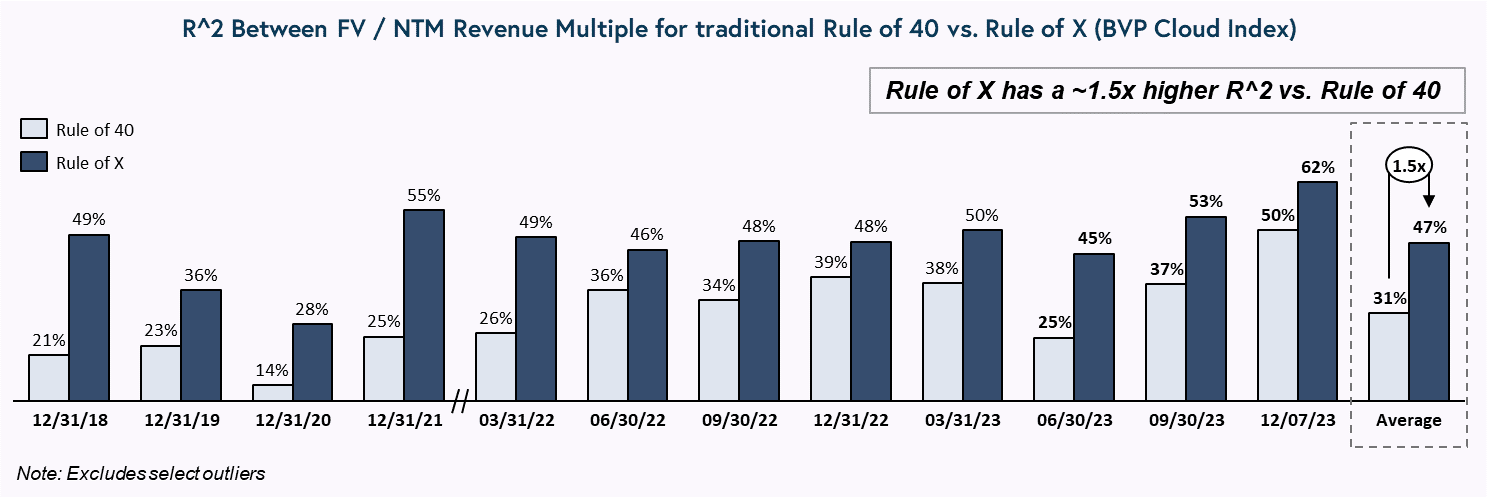

To further test this on public data, the valuation multiple correlation has proven to be much stronger for the Rule of X versus the Rule of 40.

In today’s environment, Rule of 40 versus FV/NTM revenue R2 is 50% whereas Rule of X yields a 62% R2. Rule of X has consistently shown higher correlations versus the traditional Rule of 40 over time (e.g., Rule of X is greater than the Rule of 40). On average, the coefficient of determination for Rule of X is ~1.5x stronger versus the traditional Rule of 40. This indicates how well Rule of 40 or Rule of X predicts the variation in FV/NTM revenue multiple — higher is better.

Don’t starve growth for the sake of FCF

Before many great businesses gain market dominance, they often require significant investment. We’ve been fortunate to work with many industry-defining companies at Bessemer Venture Partners, including Shopify, LinkedIn, Twilio, Canva, Pinterest, Toast, ServiceTitan, and numerous others that have collectively invested billions of dollars into their businesses before IPO and before achieving profitability.

Efficiency is critically important to building a healthy business and you should manage your five Cs of cloud finance closely, but don’t be afraid to lean into growth to secure and maintain a foothold in your market. Putting the Rule of X to good use means making judicious long-term investments in your business, be it a new Second Act product, robust partnerships strategy, or research and development. As venture investors, we use the concepts within the Rule of X to collaborate with our portfolio companies and recommend that you also use the Rule of X to maximize value in your business. Oh, and if you’ve got a great team and an awesome Rule of X score, we’d love to meet you!

Comment