When Nvidia announced eye-popping earnings on Wednesday with three-digit year-over-year growth, it was easy to get caught up in the excitement. The company brought in $13.5 billion for the quarter, up 101% over the prior year, and well over its $11 billion guidance. That’s certainly something to get excited about.

Nvidia is benefiting from being a company in the right place at the right time, where its GPU chips are in high demand to run large language models and other AI-fueled workloads. That in turn is driving Nvidia’s astonishing growth this quarter. (It’s worth noting that the company set the groundwork for its current success some time ago.)

“Data center compute revenue nearly tripled year on year, driven primarily by accelerating demand for cloud from cloud service providers and large consumer internet companies for our HGX platform, the engine of generative and large language models,” Colette Kress, Nvidia’s executive vice president and chief financial officer, said in the post-earnings report call with analysts.

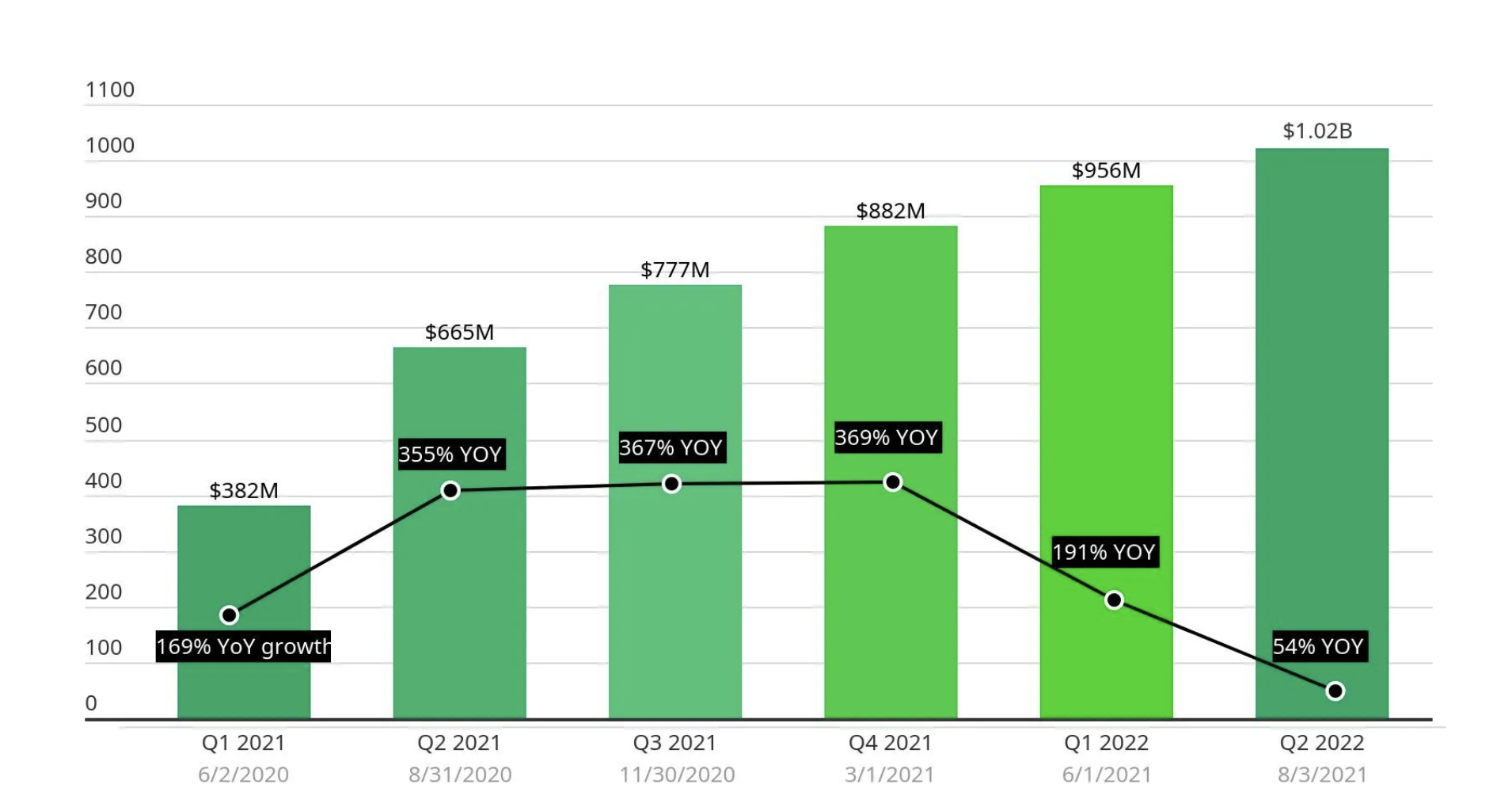

This kind of growth brings to mind the heady days of cloud stocks, some of which soared during the pandemic lockdown as companies accelerated their usage of SaaS to keep their workers connected. Zoom, in particular, took off with five quarters of absolutely astonishing growth during that time.

Today, even double-digit growth is long gone. For its most recent report earlier this month, Zoom reported revenue of $1.138 billion, up 3.6% over the prior year. That follows five straight quarters of single-digit growth, the last three in the low single digits.

Could Zoom possibly be a cautionary tale for a company like Nvidia riding the generative AI wave? And perhaps more importantly, will this drive unreasonable investor expectations about future performance as it did with Zoom?

Data center demand isn’t going anywhere

It’s interesting to note that Nvidia’s biggest growth area is in the data center and that web scalers are still building at a rapid pace with plans to add over 300 new data centers in the coming years, per a Synergy Research report from March 2022.

“The future looks bright for hyperscale operators, with double-digit annual growth in total revenues supported in large part by cloud revenues that will be growing in the 20–30% per year range. This in turn will drive strong growth in capex generally and in data center spending specifically,” said John Dinsdale, a chief analyst at Synergy Research Group, in a statement about the report.

At least some percentage of this spending will surely be devoted to resources for running AI workloads, and Nvidia should benefit from that, CEO Jensen Huang told analysts on Wednesday. In fact, he believes that his company’s expansive growth is much more than a flash in the pan.

“There’s about $1 trillion worth of data centers, call it, a quarter of a trillion dollars of capital spend each year. You’re seeing that data centers around the world are taking that capital spend and focusing it on the two most important trends of computing today: accelerated computing and generative AI,” Huang said. “And so I think this is not a near-term thing. This is a long-term industry transition, and we’re seeing these two platform shifts happening at the same time.”

If he’s right, perhaps the company can sustain this level of growth, but history suggests that what goes up must eventually come down.

Business gravity

If Zoom is any indication, some businesses that see rapid growth for one reason or another can hold on to that revenue in the future. While it’s certainly less exciting for investors that Zoom’s growth rate has sharply moderated in recent quarters, it’s also true that Zoom has continued to grow. That means it has retained all its prior scale and then some.

But software is not hardware. Zoom makes for a good historical example that rapid growth often becomes slower growth later on, but hardware companies have it harder than their digital cousins. (In Zoom’s case, it appears to have undergone a demand pull forward instead of a long-term change to its growth rates.)

How did Zoom manage to continue growing after a period of outsized customer acquisition? One key element of software in the modern business context is that existing customers tend to spend more over time. This native growth, called net retention or similar by SaaS wonks, helps ensure that software companies rarely see their top line decline. Sure, growth can slow as it becomes harder to land new accounts and upsells become rarer, but an actually falling revenue line item is rare for software companies today.

Nvidia’s history shows how different things are for hardware companies. For example, in the first quarter of 2023, the company reported revenues of $7.19 billion, a figure that was 13% lower than its year-ago result. Nvidia then went on to utterly crush the second quarter.

Therefore when we consider slowing software growth — Snowflake’s falling, if still impressive, net retention numbers, for example — the analogy only extends so far into the world of making and selling chips. We cannot expect Nvidia to follow a Zoom-like trajectory, in other words.

But if hardware revenue is more chaotic than software incomes, how can Nvidia capitalize on its present-day demand spike and profit bump, ensuring that it levers the moment as best it can? Simply enough: It can invest its outsized scale that it is enjoying today in future incomes and future shareholder contentment. Both should help it defend its valuation in the future, and both are underway.

On the R&D side, Nvidia spent $2.04 billion in the second quarter on research and development. That’s up from $1.82 billion in the year-ago quarter. Thus far in 2023, the company has spent $3.92 billion on R&D, up from $3.44 billion in the first half of last year. That’s a big investment in near-term product competitiveness and long-term product ascendancy; Nvidia is using its gains to help build more, better and faster chips.

The second area where Nvidia could invest its present-day demand boom is by making its shares more valuable individually. It is doing so by repurchasing its own equity. Sure, Nvidia is buying at a pretty high price today, but that doesn’t seem to be slowing it down. As the company wrote in its most recent shareholder earnings letter (emphasis added):

During the second quarter of fiscal 2024, NVIDIA returned $3.38 billion to shareholders in the form of 7.5 million shares repurchased for $3.28 billion, and cash dividends. As of the end of the second quarter, the company had $3.95 billion remaining under its share repurchase authorization. On August 21, 2023, the Board of Directors approved an additional $25.00 billion in share repurchases, without expiration. NVIDIA plans to continue share repurchases this fiscal year.

That $25 billion is a massive sum for any company. And by approving that level of spend, Nvidia is working to ensure that future profits will be spread across fewer shares, boosting per-share profitability and therefore value.

While there have been supply chain issues for chip companies in particular in recent years, the company insists that they can keep up with demand in the coming quarters. “Regarding our supply, yes, we do expect to continue ramping our supply over the next quarter, as well as into next fiscal year,” Kress told analysts.

There is little that Nvidia can do to control the economy, or even fully influence market demand for its chips. (The company has shown that by building chips like the H100, it can bolster demand, but I don’t think that anyone considers Nvidia entirely in control of its market’s destiny.) But it can invest in its future and in its shareholders. And it is doing so.

Keep an eye on Nvidia’s Q3 2023 R&D spend and how much it changes from its Q2 levels. If we see an even bigger figure there, we’ll know that the company is not resting on its present laurels.

Comment