In the latest fintech megaround, Brex has confirmed that it has raised $300 million in a Series D-2 round that ups its valuation to $12.3 billion.

TechCrunch in October was the first to report that Brex was raising the capital and had achieved decacorn status. Greenoaks Capital and TCV co-led the financing, which brings the three-year-old San Francisco startup’s total raised to $1.2 billion.

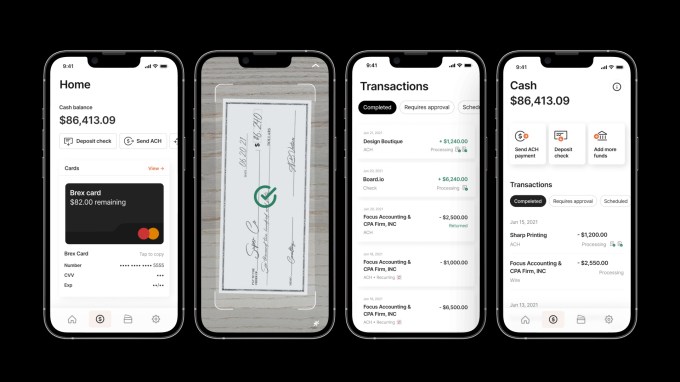

Brex started its life focused on providing credit cards aimed mainly at startups and SMBs. It has gradually evolved its model with the aim of serving as a one-stop finance shop for these companies. Last April, Brex said it had combined credit cards, business cash accounts and new spend management and bill pay software “together in a single dashboard” as part of a service called Brex Premium that cost $49 per month. Today, the company is focused on the corporate card product it’s been building since its inception, banking products and expense management products. Or put more simply, it aims to serve as a “financial operating system” for its customers.

Its latest raise follows a year that saw a “more than doubling” of revenue, according to co-CEO and co-founder Henrique Dubugras, who declined to reveal hard figures. Existing investors made up about 95% of those participating in the Series D-2 round, he added.

“We didn’t open up to new ones because we had so many new investors with deep pockets who we’d promised we’d give more allocation to over the years,” Dubugras told TechCrunch. “They were comfortable that we had hit the targets we said we were going to so that gave us some credibility to them.”

In conjunction with the funding announcement, Brex also announced that it has hired away an exec from Meta (previously known as Facebook): Karandeep Anand. Anand has been named the company’s chief product officer after having led Meta’s business products group, which served more than 200 million businesses globally. Prior to that, Anand spent 15 years at Microsoft, where he led the product management strategy for Microsoft’s Azure cloud and developer platform efforts. The exec will lead Brex’s product portfolio expansion efforts, where a good portion of its new capital will be directed.

“Karandeep is an engineer by background so he is product and engineering-oriented but also business and customer-oriented,” Dubugras told TechCrunch. “He’s a unique hire in that sense, and that’s particularly important for Brex. Our software and card touches most of the employees in a company even though it’s the CFO that decides to buy it. Since we want to provide a consumer-like experience, he’s going to help there.”

For his part, Anand described Brex as “a market disruptor.”

“The opportunity to create economic opportunity for millions of people and businesses globally through innovation in financial products is incredibly exciting,” he said in a written statement. “The opportunity ahead for Brex is expansive, and I’m grateful for the opportunity to create products that will help our customers grow their businesses.”

In terms of customers, Brex continues to serve startups or e-commerce companies that might be smaller businesses but with higher growth. As its earlier customers have grown and matured, Brex is now adapting to also serve mid-market to larger businesses which have different financial needs as they grow. This is where it appears Anand will be able to offer the greatest value.

The landscape for startups clamoring to meet companies’ financial needs seems to increase by the day. One of Brex’s most well-known competitors, Ramp, is also growing impressively and last August, announced it had raised $300 million in a Series C round of funding that valued the company at $3.9 billion. With its move to serve larger and more established companies, Brex seems to only be further encroaching into Ramp’s territory.

Nell Mehta, founder and managing partner of Greenoaks, believes Brex has been able to build a card that meets the needs of “modern” businesses and startups. And while that alone was compelling enough to attract his firm’s attention, Greenoaks also saw the broader potential for a “truly extensible platform that could solve a universal set of problems,” including providing better controls over employee spend, “painless” expense reporting and rewards tailored to a company’s specific needs.

“The result is a differentiated experience that shows up in attractive customer loyalty, and some of the best growth metrics we’d ever seen,” he wrote via email. “On top of this, we’ve been consistently impressed with Brex’s team, who build excellent products fast, with a profound vision for the future of business banking.”

Mehta went on to say that Brex has become the “cognitive referent” for modern business banking. He touted features such as instant onboarding and virtual card provisioning; an “easy to use UX”; no account fees; “compelling” rewards; and technology “that’s built to integrate into its customers’ financial workflows.”

“We think few companies can so effectively serve such a diversity of businesses, from day one startups to sophisticated enterprises with complex needs,” he added.

The fact that Brex has “built all its technology from scratch” is a big differentiator for the company, according to Dubugras.

“We don’t use third-party legacy vendors like banks do, and we’re pretty specialized on high-growth businesses,” he told TechCrunch. “A lot of competitors have single line products, but with us, you can do your banking, you can do expense management, you can get a venture debt line.”

Founded in 2017 by Pedro Franceschi and Dubugras (who are now in their mid-20s), San Francisco-based Brex was valued at $7.4 billion this April after raising a $425 million Series D led by Tiger Global Management.

The company told TechCrunch at the time of its last raise that it was “onboarding thousands of new tech and non-tech customers every month.” Brex also said then that it grew its “total customer” figure by 80% in the first quarter of 2021, “with total monthly customer additions increasing by 5x.”

The company expects to have 1,000 employees by month’s end. Because it is still focused on growth, it is not yet profitable.

Brex just signed a term sheet for $300M at a $12.3B valuation

Comment