News that U.K.-based used car seller Cazoo intends to list in the United States via a SPAC is not surprising. After all, the SPAC boom we’ve seen in recent quarters means that there are a host of American blank-check companies in the market looking for deals — why would they stop at domestic borders?

But the Cazoo deal is not a surprise for other reasons as well. We’ve seen the value of related American company Carvana spike in recent years after its 2017 IPO, for example. And Carvana has shown the sort of gross-margin improvement that Cazoo intends to manage in the coming years, so there’s precedent for its sales model to show economic improvements over time.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But coming at the same time as a sunny investor deck detailing why the Cazoo-AJAX I deal is a good idea are a number of public-market trembles that could indicate uncertain risk tolerance among public investors. We can see this in the slack debut of several Chinese companies, as well as the downward pressure on the public offering for Deliveroo, a food-delivery platform.

Is the public market’s enthusiasm for tech listings slowing? If so, it would be bad news for companies that have announced SPAC-led debuts, firms like Latch that priced their combination during a particular market climate, one that won’t match well to a risk-off environment — if that’s where things are headed.

Is the public market’s enthusiasm for tech listings slowing? If so, it would be bad news for companies that have announced SPAC-led debuts, firms like Latch that priced their combination during a particular market climate, one that won’t match well to a risk-off environment — if that’s where things are headed.

This morning, let’s parse the Cazoo deck briefly and then ask ourselves what the market tea leaves are telling us about investor appetite for risky shares.

Cazoo

After reading the Cazoo and Deliveroo news this morning, I have to ask if there’s something particularly British about companies ending in -oo. Let me know.

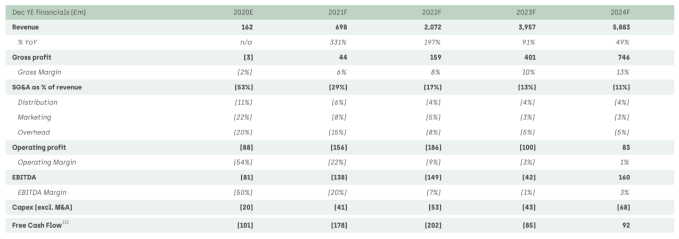

Regardless, the Cazoo investor deck for its SPAC deal is here. Follow along if you want. We’re starting on page 33, where the company discloses its 2020 results and forecasts the next several:

There are a few assumptions in there, including regular gross margin improvements, strong revenue growth and falling operating costs as a percentage of revenue. Put another way, if every profit-input metric goes well for the company for several years, it may stop burning cash in 2024, the same year that it will reach adjusted profitability and effective operating-margin breakeven.

The company does have big plans, including expansion inside of Europe, some financial product work and more subscription car sales. Cazoo also intends to raise gross margins by boosting sales of high-margin finance products and improving its time-to-sale car flow. Throw in what the company estimates could be falling customer acquisition costs thanks to more online car ordering, and you have a reasonable look at the company’s plans.

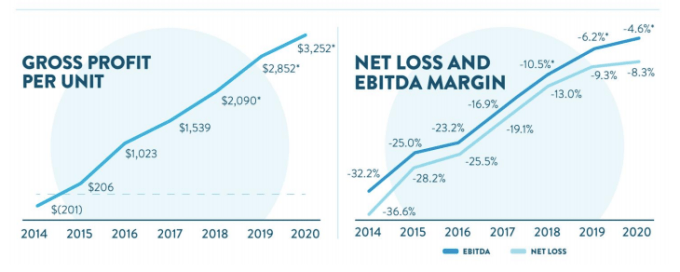

But do they make any sense? Yep, somewhat. Carvana, the American Cazoo, shared the following charts in its Q4 2020 report:

Carvana also sells cars directly to consumers and delivers them to their houses on a truck, so it’s a good comp for Cazoo. You can see in the left chart that the American company has managed regular improvement to its gross profit per car, which imputes to aggregate gross margin improvements at the company.

The chart on the right is the company’s aggregate adjusted and GAAP profit margins, which improve along with the company’s gross profit results, as you would expect. But Carvana shows that it is possible to raise used car sales gross margins and translate those results into smaller corporate deficits over time. At least in America.

Carvana is worth $44.2 billion today. Its shares bottomed out at $22.16 in mid-March 2020 during the COVID-19 selloff. It’s worth $255.68 per share as of this morning. Using its Q4 2020 revenue to set an annual run rate for Carvana, it closed 2020 with $7.30 billion in top line. At today’s valuation of $44.2 billion, that’s a multiple of just over 6x.

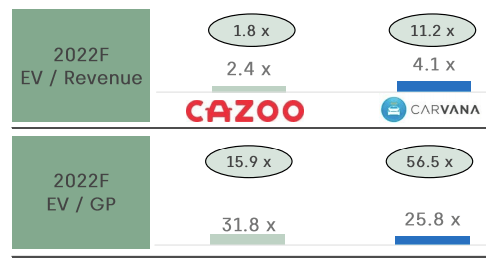

How does Cazoo stack up? It had £162 million in 2020 sales, or $223.2 million in today’s dollars. At its expected market value of $8.1 billion (an enterprise valuation of $7 billion), it’s priced at around 36x sales.

I hear your question: Why would anyone pay that much for Cazoo today if Carvana is more profitable and whatnot? Well, growth. That’s the argument anyway.

If you look ahead to 2022’s forecasted Cazoo revenues and use its enterprise value instead of its expected equity valuation (because it’s a smaller number), you can kinda make things look less silly:

Cool.

We did all of that work to figure out how the Cazoo deal was priced. I think I can summarize our effort by saying that it feels aggressive. Not that that is a sin, but it does help us understand how the company expects the market to be willing to value it when the deal closes.

Which is when? Per the company’s release: “The transaction is expected to close in the third quarter of 2021.”

Ah.

This is a good reminder that when a SPAC deal is announced, it’s not done. Those press releases are more akin to engagement notices. The wedding comes later, followed by post-combination married life. What Cazoo investors are expecting, then, is that the public markets will stay heavily interested in growth-oriented shares in Q3 2021 to the extent that its bullish revenue forecasts are viewed as plausible and worth paying for when it does begin to trade.

Market chop

In the last few days, Deliveroo had to cut its IPO price, BiliBili’s Hong Kong debut flopped and Zhihu went splat as “the China-based online content company’s stock opened 15.3% below its initial public offering price,” MarketWatch reports. And that was from an IPO that priced at the bottom of its range.

Software stocks have also sold down from recent highs. The Bessemer Cloud Index is off more than 20%, putting it in a technical bear market. And many SPACs are trading at underwater prices. Hell, even bitcoin has stopped going up.

Can the market hold up the optimism that many SPAC-led debuts are implying in their pricing? I do not know. But there are a lot of wagers being made in the market today that are giving me pause.

Comment