Jake Saper

More posts from Jake Saper

VCs have avoided solar deals ever since Solyndra became a four-letter word. But while their attention has strayed, the industry has been on a tear. In 2010, U.S. solar installers hit a milestone of 1 GW per year. Five years later, they’re installing more than 1 GW per month.

This tremendous growth has fed a swelling herd of solar unicorns populated by the likes of SolarCity, SunEdison, SunPower and more.

Recently, the industry has been buffeted by a variety of tailwinds that should drive even faster expansion. The landmark Paris climate accord promises stronger regulatory support across the world. Concurrently, a group of billionaires led by Bill Gates announced the Breakthrough Energy Coalition to fund this roll out.

And the U.S. Congress has extended the solar Investment Tax Credit (ITC), which has raised installation forecasts through 2020 by more than 50 percent. Add to this mix innovation in large-scale battery manufacturing and the future of distributed power generation looks bright indeed.

It’s also creating an opportunity to build the first SaaS unicorn focused on distributed generation. As this industry grows, so does the need for software to improve efficiency and lower costs. “Soft costs,” like permitting, financing and customer acquisition, now represent roughly two-thirds of installed costs of residential deployments. As I’ve written about before, the best way to address such soft costs is with software.

As an example, the manner in which solar developers identify, track and quote potential customers today is decades behind other industries. The leading solar players today use a “spit and glue” combination of Salesforce, homegrown code and Excel. It’s not shocking, therefore, that SolarCity’s customer acquisition costs have actually increased year over year, while installation costs have plummeted.

Other industries have solved this problem with software tailored to the specific needs of industry users. In the pharmaceutical space, Veeva Systems (an Emergence portfolio company) built a customer relationship management (CRM) solution focused exclusively on solving customer acquisition problems in pharma. This vertical-specific solution improved sales productivity by an average of 66 percent.

A similar tool for solar could marry building data with customer demographic information to make developers substantially more effective at closing deals. Solar needs a Veeva-like tool to accelerate the path to grid parity (the point at which solar electricity costs the same as average grid electricity and growth skyrockets).

The good news is that a lot of folks are working to build this type of industry cloud application. The Department of Energy’s SunShot Catalyst program is funding a slew of early stage solar software companies. Powerhouse, a solar-focused accelerator, is incubating still more. And even the VCs have started to put money back into the sector, including Obvious Ventures’ recent $3.5 million funding of Sighten.

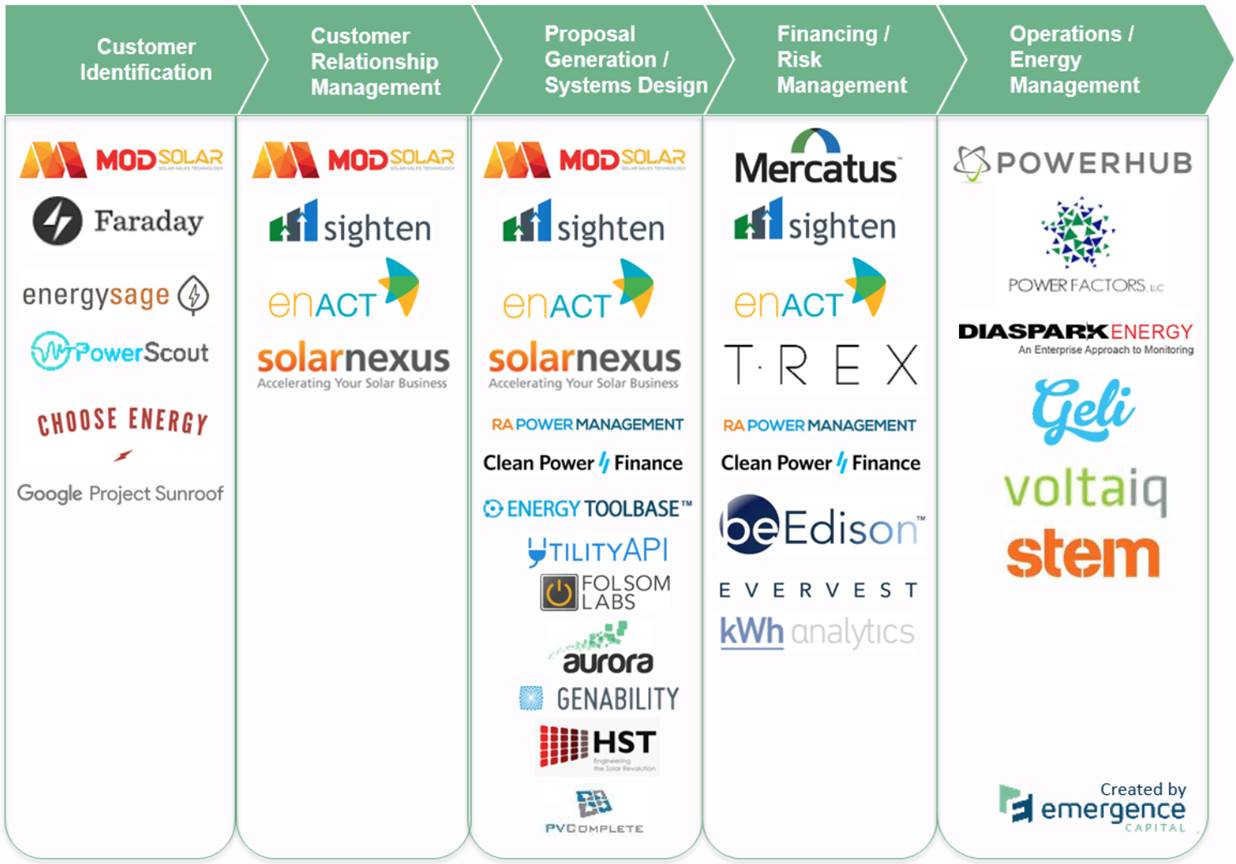

This momentum has resulted in an exciting emerging ecosystem of SaaS providers focused on the distributed generation (DG) opportunity created by the rise of solar and energy storage. I’ve taken a stab at illustrating it below. I’m sure I’ve left folks off, and others will become miscategorized over time, so feel free to ping me with hate (or love?) email.

This is a great start, but it’s still very early innings. Most of these companies are addressing important problems, but doing so as point solutions. To scale, they’ll need to expand beyond these entry points.

Here’s my stab at a recipe for how to build the first solar/DG software unicorn.

Focus on the top line: Start by solving a revenue problem (lead generation, CRM, proposal generation, etc.) versus a cost problem (error reduction, headcount reduction, etc.). It’s typically easier to get in the door with top-line-focused solutions, which is particularly important in industries that are relatively new to significant software spend. Sell by showing a clear return on investment (ROI) of increased sales relative to software spend.

Build sticky, scalable software: Ensure you are used every day. Get to a point where an important employee group literally can’t do their job without your software. Further, it’s critically important to make sure this is true recurring software revenue and not professional services. I can’t emphasize this point enough. Do not become a software consulting firm doing custom builds. Write flexible software that customers can configure themselves.

Layer the cake: Become a suite (expand products). Once you’re sticky in your core product and have become your customers’ most trusted technology provider, expand to solve other pain points. Veeva (the pharma-focused CRM I mentioned earlier) did this and built a nearly $4 billion company in the process.

Expand to the incumbents: To capture the largest possible market size, it will be important to sell not just to today’s distributed generation players but to service the much larger utilities and independent power producers (IPPs) moving into the space — and which desperately need help selling to customers. Remember, these are the folks that have traditionally viewed their customers as “rate payers.”

Expand modalities: Aim to be the software platform for each component of the distributed generation ecosystem (not just solar). Elon’s Gigafactory will only accelerate the coming of distributed storage, which will also require smart software to be sold and integrated effectively.

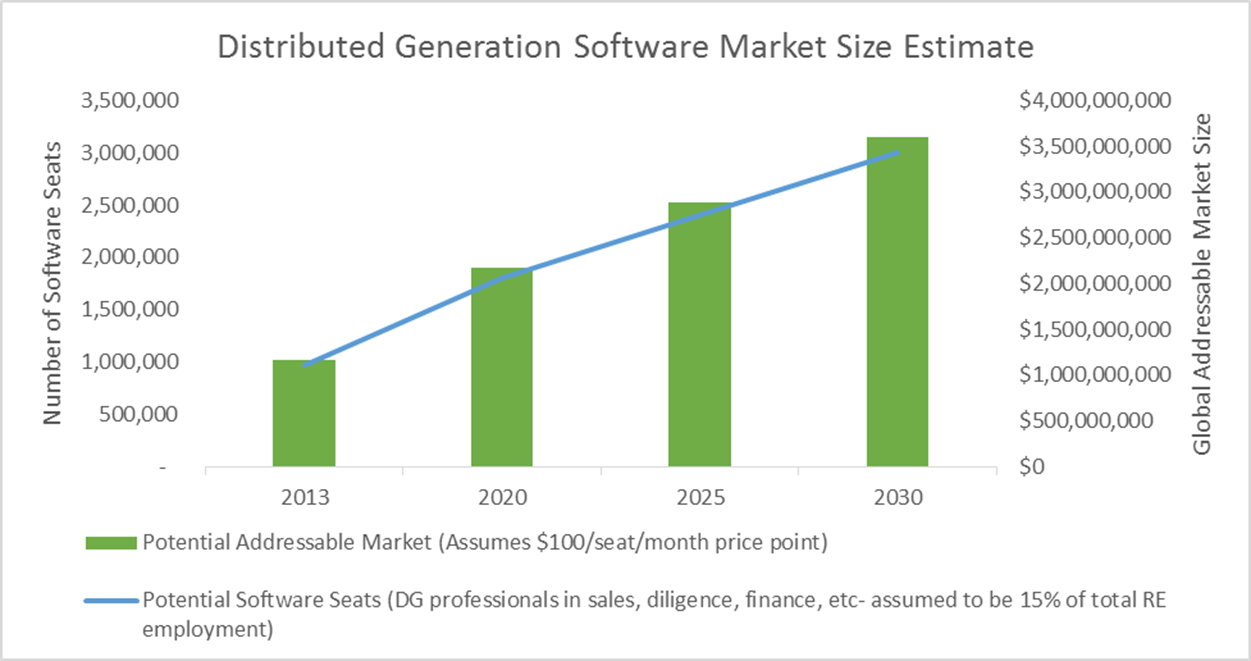

To clear the mythical $1 billion valuation hurdle, today’s DG software players will need to expand their addressable market. The good news is that the overall solar industry is growing at a rapid clip, so the underlying trends are favorable. Getting a firm grasp on total potential market size is much more of an art than a science, but we can take the International Renewable Energy Agency’s (IRENA) global renewable energy employment forecasts as a basis for estimation.

I’ve roughly assumed 15 percent of IRENA’s global employment forecast will be distributed generation professionals in roles like sales, finance and diligence. I’ve also assumed these professionals would buy SaaS software at $100/seat/month. This rough math gets us to an addressable market today of roughly $1 billion, scaling to $2.25 billion by 2020 and more than $3.5 billion by 2030.

This would be a very exciting future for today’s incipient DG SaaS market. But I see a critical element missing from most of the current players, which will prevent this scale: enterprise SaaS talent. Most DG software executives today have tremendous experience in renewable energy, but they haven’t built and scaled large subscription-based software companies. Getting this talent in the door and pairing it with the solar pros is the only way I see companies scaling the mountain.

Unfortunately, there’s not a lot of cross-pollination going on today. Solar folks tend to hang with solar folks and SaaS folks with SaaS folks, like they’re on different planets. We have to find a way to bridge these worlds to birth a unicorn.

Thus, I’ll leave you with a challenge. If you’re on the solar side of things, open up LinkedIn and find your buddy or your buddy’s buddy who works at Salesforce, Box, etc. and offer to buy them a beer. If you’re on the SaaS side of things and interested in applying those skills to solving the biggest existential crisis of our time, drop me a note and I’ll be happy to connect you.

Speeding the transition toward clean energy is our best bet at averting a catastrophic temperature increase. With a little interplanetary collaboration, we can build the software necessary to do it.

Comment