Just how lucrative is the buy now, pay later (BNPL) market? New data from Klarna and recent earnings results from Affirm make it clear that building a global business in the fintech space is far from inexpensive.

The two companies, Affirm American and Klarna Swedish, are among the most valuable players in the BNPL market today. Both recently reported financial results.

Today we’re looking at Affirm’s earnings for the second calendar quarter of 2022 and Klarna’s for the first half of the same year and asking ourselves what we can glean from each dataset. (And, listen, this is a bit of a slog. If you want to trust our math and skip the currency conversions, just scroll on down to the “Why does BNPL lose so much money?” section.)

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Keep in mind that Klarna was recently repriced all the way down to $6.7 billion in its latest funding round. Today before the opening bell, per Yahoo Finance, Affirm was worth $6.74 billion. The two companies temporarily sporting the same valuation means that we have a firmer foundation to compare them than we usually might. We’ll first talk about their results individually and then in contrast to one another and their shared value.

Why do we care? For one, the price at which Klarna eventually finds an exit matters greatly to a number of European investors and potential founders, making its financial results rather important. In addition, we care because there are just so many BNPL startups out there.

In a January 2021 entry, Christine Hall (then at Crunchbase News, now at TechCrunch) wrote that as Affirm went public, “some 25 companies in the BNPL space have raised $1.7 billion in known venture capital funding since 2016, according to Crunchbase data.” A quick peruse of that same data query now yields 76 startups and a multiple of that capital figure.

So for founders and VCs around the world, not just in Europe, how the two leading lights of the BNPL space perform is not small potatoes. Let’s take a look.

Affirm

Shares of Affirm fell around 14% in the wake of its earnings report, per CNBC. You can tell from that data point that its future guidance were not entirely welcome with the investing set.

At issue was a greater-than-expected loss for its most recent quarter (calendar Q2, the fourth of its fiscal 2022) and guidance for its new fiscal year (starting calendar Q3 2022) coming in under certain expectations. So what does that look like in numerical terms? The following:

- Gross merchandise volume (GMV) of $4.4 billion (+77% YoY).

- Total revenue: $364.1 million (+39%).

- Total revenue less transaction costs: $184.3 million (+25%).

- Adjusted operating loss: $29.3 million, compared to a $14.2 million profit in the year-ago period.

- Net loss: $186.4 million, compared to a $123.4 million loss in the year-ago period.

How would you value that company?

Clearly, Affirm is managing strong results in terms of driving GMV; consumers are hungry for BNPL services, even if we are now reading depressing stories of folks using the credit option for purchases as mundane as groceries. But the business is very expensive to run; even allowing Affirm to greatly edit its operating costs, the company was stuck in the red in its most recent quarter.

Looking ahead, Affirm expects $20.5 billion to $22 billion in total GMV for its new fiscal year, revenue less transaction costs of $760 million to $810 million and an adjusted operating margin of -6.5% to -4%.

If you take the company’s most recent quarter and convert its results into annualized run rates, you get $17.6 billion worth of GMV and $737.2 million worth of revenue less transaction costs. Affirm is therefore projecting a good amount of GMV growth in its new fiscal year but not as much revenue growth as we might have anticipated. (After publication Affirm reached out noting that its business is seasonal, and therefore it’s a bit risky to annualize any particular quarter. The company’s guidance is noted above, for reference and comparison.)

The company notes a mix shift in its revenue makeup as part of its earnings report, which could come into play here, but no matter how you slice it, the mega-growth days for Affirm are behind it, and it appears that the red ink is set to continue. (Affirm stressed to TechCrunch that it expects to reach “adjusted operating income basis, by the end of fiscal 2023,” even if we tend to lean more heavily GAAP metrics for public companies.)

Klarna

Welcome to currency conversion land. For the sake of transparency, we’re using Wolfram Alpha conversion figures for USD totals and have included links to all calculations so that you can see updated figures using more recent forex data if you wish.

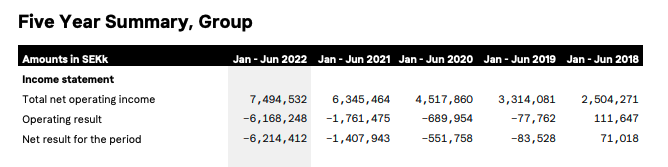

Klarna, a private company, reports frequently on its financial results. Per the company, in the first half of 2022, it saw GMV grow 21% year on year to SEK396 billion ($37.3 billion) and total net operating income of SEK7,495 million ($706 million), up 18% compared to the year-ago period. (Recall that Klarna’s net operating income under International Financial Reporting Standards is net interest revenue added to net commission revenue, with the net result from “financial transactions” thrown in.)

At the company, interest-based income grew a more modest 15% on a year-over-year basis for H1 2022. Why? The growth rate of interest income was “below total net operating income growth as consumer demand for our interest-free, shorter-duration payment products outpaced other payment alternatives,” something to keep in mind as you mentally handicap the company’s GMV growth.

Now, expenses. Klarna’s operating expenses came to SEK10,810 million ($1.02 billion) in the first half of 2022. Credit losses totaled SEK2,853 million ($268.8 million) in the same period. The result of those operating costs against the company’s gross profits (more or less) came to a loss of SEK6,168 million ($581.1 million). Klarna’s net loss came in very close to its operating loss, meaning that we can use the latter and disregard the former for our purposes today.

Klarna is growing slower than Affirm in both GMV and revenue terms. That said, if we convert Affirm’s calendar Q2 revenues (net of transaction costs) to a half-year pace, we can see that Klarna is larger. Klarna also sees far greater GMV throughput. This means that we are seeing the market value a larger, slower-growing BNPL player at the same price as a smaller, faster-growing BNPL player.

This creates a spread of sorts for BNPL startups to observe and value themselves against. Venture capitalists, too.

Why does BNPL lose so much money?

What I find striking in the above is just how unprofitable BNPL work is proving to be. As we can see in the following table, the larger Klarna gets, the worse its profitability becomes:

That is not so good.

Affirm has other data points on offer that make us wonder how lucrative BNPL may wind up being.

For example, in its fiscal year concluding June 30, 2021, Affirm secured 5.2% of its GMV as revenue less transaction costs. In its fiscal year concluding June 30, 2022, that number slipped to 4.3%. Over the same time frame, Affirm’s total revenue as a percentage of GMV fell from 10.5% to 8.7%. Its operating margin also worsened alongside a lesser adjusted operating margin.

Scale is not helping the leading BNPL players; they are not demonstrating the sort of operating leverage that we associate with long-term, growing cash flows from operations. Which is, of course, the very thing that investors covet.

Where does all the above leave us? After running through all the numbers with you today, I am less interested in trying to parse which company at $6.7 billion is the better deal.

Instead, I am a bit perplexed why they are worth as much as they are, given that they are unprofitable, cash-consuming businesses that are seemingly unable to generate corporate net income off of consumer lending despite a presumed technology advantage. I think we all expected more.

Comment