When First Republic Bank was in its final moments, Silicon Valley didn’t convulse with shock or lather itself into a social media tizzy.

Instead of panic, which rippled throughout the startup community in March when Silicon Valley Bank signaled trouble, there was widespread malaise. Part of the reason for that may be that we’ve been here before, and part of the reason may be that FRB had a faster resolution than SVB: Earlier this week, FRB was officially put under FDIC receivership so its assets could be sold to a bidder.

As startups scrap together new money management plans, fatigued with banking and stressed by the downturn, they’re finding that a gap has been left behind by the collapse of these venture-friendly institutions.

Marisa Ricciardi, founder and CEO of marketing agency The Ricciardi Group, wondered if the two bank failures called for the “death of relationship banking for small businesses.”

“Now that FR is Chase and SVB essentially doesn’t exist, what good options are there for founders?” Ricciardi asked. “Which bank will [let me] actually have the cell phones of bankers who will answer day or night? Which bank will give a founder a loan to put their kids through school or to buy a house, and understand the value of equity and options, etc.? It’s not just about these two banks: It’s about a new gaping hole in the overall founder and small business ecosystem that no one at present is able to fill. Entrepreneurship will be stifled by this in a meaningful way for a period. It will be interesting to see who stands up as a small business and growth bank.”

Hustle Fund’s co-founder and general partner Eric Bahn has used First Republic Bank as the firm’s bank for the past six years. He describes it as “one of those canonical institutions when you’re an emerging manager.”

“Just a couple months ago, there were just two options of banks to work with: Silicon Valley Bank or First Republic Bank,” he said.

While he is happy that JPMorgan stepped in to buy First Republic, he’s not that happy that one of the world’s largest banks ended up being the buyer. “I think we lost something big here, and my only hope is that JPMorgan respects the brand and the customer service that [FRB] has spent decades to build.”

“I was hoping that it’d be PNC,” Bahn said, referring to the Pittsburgh-based bank that was said to be among the bidders for FRB. “I thought that it’d be nice to see another slightly smaller bank win to consolidate and maybe strengthen this position for themselves to compete with the larger banks.”

He added that there are concerns around what JPMorgan’s customer service and tech perk strategy will be, explaining that “it’s really rare to find a venture bank that will be able to spot-loan you a few hundred thousand bucks to make sure that you can have cash to invest between your capital calls.”

Stuart Winchester, founder and CEO of insurance startup Marble, meanwhile feels neutral about the deal. Like other founders, his investors advised him to park his money at JPMorgan, FRB’s new owner, which he did, or split up cash into $250,000 chunks across FDIC-backed accounts.

Yet, as the startup and tech ecosystem returns to thinking about different ways to protect assets, Winchester said it’s tricky to balance the “very aggressive sales campaigns” from non-banks such as Brex and Mercury, which would mean setting up lots of little accounts with bank startups, or waiting in line for JPMorgan.

Sure enough, those campaigns have been going at full speed. Wealthfront earlier this week said its cash account offers up to $5 million FDIC insurance through its partner banks. Dave Myszewski, vice president of product at Wealthfront, told TechCrunch+ that the company can offer more FDIC insurance on its cash account deposits than is available in a regular savings account because it sweeps its clients’ money to multiple partner banks.

“At any given time, our clients’ cash could be at up to 20 partner banks, which is why they get up to 20x the FDIC insurance they’d get in a regular savings account. We work with multiple FDIC-insured banks who all undergo an initial risk assessment to be considered for the program as well as regular quarterly risk reviews to remain in the program,” he added.

Meanwhile, Don Muir, co-founder and CEO of Arc, a competitor of Silicon Valley Bank and First Republic Bank, says his company offers $5 million in FDIC coverage overall, $5.25 million through its insured cash sweep programs with the Bank of New York Mellon, and an additional $500,000 of coverage, where customers can invest in their selection of money market funds. Any residual amount above $5.75 million can be invested in U.S. treasury bills, which are backed by the U.S. government and are what “many consider to be the safest place in the world to park cash,” Muir says.

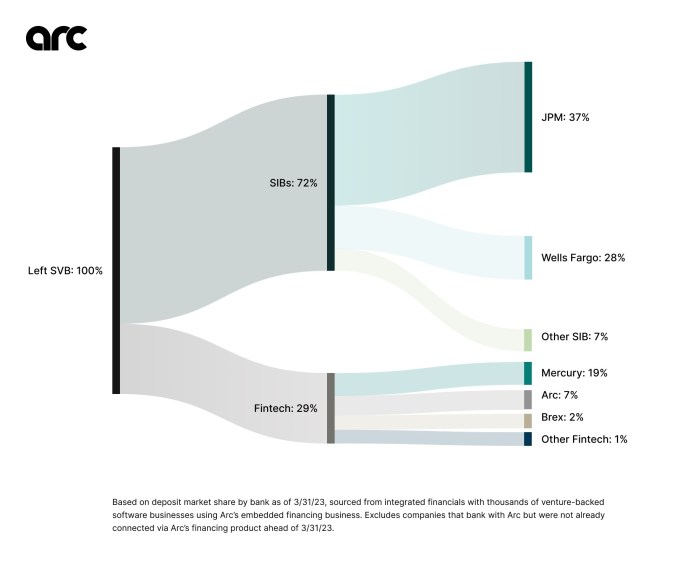

“The writing has been on the wall for First Republic since SVB went down,” he told TechCrunch+. “Most of these deposits had already left FRB before the announcement was made that they had lost $100 billion in deposits.” According to data analyzed by Arc, the “lion’s share of deposits” in the first quarter went to JPMorgan Chase, or about 37%; another 28% went to Wells Fargo, and the remaining 30% was split among startups Brex, Mercury and Arc, each taking about 2%, 19% and 7%, respectively.

(Note: Arc’s data is geared toward revenue-generating companies with sufficient financial performance history, meaning that this data and below chart primarily reflect medium-to-large startups — Series A and later — rather than early-stage startups (pre-seed/seed). Therefore, the data is not fully comprehensive.)

Muir, naturally, believes that startups are seeking a different type of service than they will receive from the larger banks and will likely be looking for alternatives.

“This is a very unique profile of business that is often cash-burning rather than cash-generative. So, the companies that banked with SVB and FRB and are now banking at JPMorgan Chase because their VC investors told them to are being underserved and experiencing imperfect banking relationships,” he said.

Comment