If you’ve been following cryptocurrency news for the past few months, there’s one word that keeps coming back — DeFi, also known as decentralized finance. As the name suggests, DeFi aims to bridge the gap between decentralized blockchains and financial services.

The original purpose of bitcoin hasn’t changed; it’s a crypto asset that lets users transfer money digitally without any bank in the middle. During the early days of bitcoin, people claimed that the blockchain could replace banks altogether.

But retail banks provide a ton of services beyond payments. If you have a bank account, it’s unlikely that you only use it to store, receive and send money. You may have a credit card, a savings account, a loan, some shares, etc.

That’s why developers have been looking at ways to port financial services to blockchains that support smart contracts. Some blockchains, such as Ethereum, EOS or Tezos, let you add a script to a transaction. The script is executed when some conditions are met.

And this is a key element of DeFi — the financial product shouldn’t be managed by a central server. Everything happens on the blockchain. If you want to read the fine print of your financial product, you can look at the code on the blockchain directly.

It provides many advantages over financial products sold by traditional institutions. For instance, banks must comply with many different regulatory frameworks to accept customers and conduct transactions in different countries.

But because DeFi is pure code, it doesn’t compete directly with traditional financial products. You could become a user of a DeFi project that was started on the other side of the planet. Nobody is going to look at your past financial statements to tell you whether you can use a DeFi product or not.

As you may have guessed, these advantages also create significant risks. For instance, lending protocols need to be rock-solid when it comes to handling payment defaults and interest rates. I’m sure we’ll also learn about vulnerabilities and hacks in the near future, as well.

If DeFi gets enough traction, banks are also going to raise red flags, which could lead to increased scrutiny and more regulation. For instance, should you report taxes when you earn interest using a DeFi savings product? Nobody knows for sure.

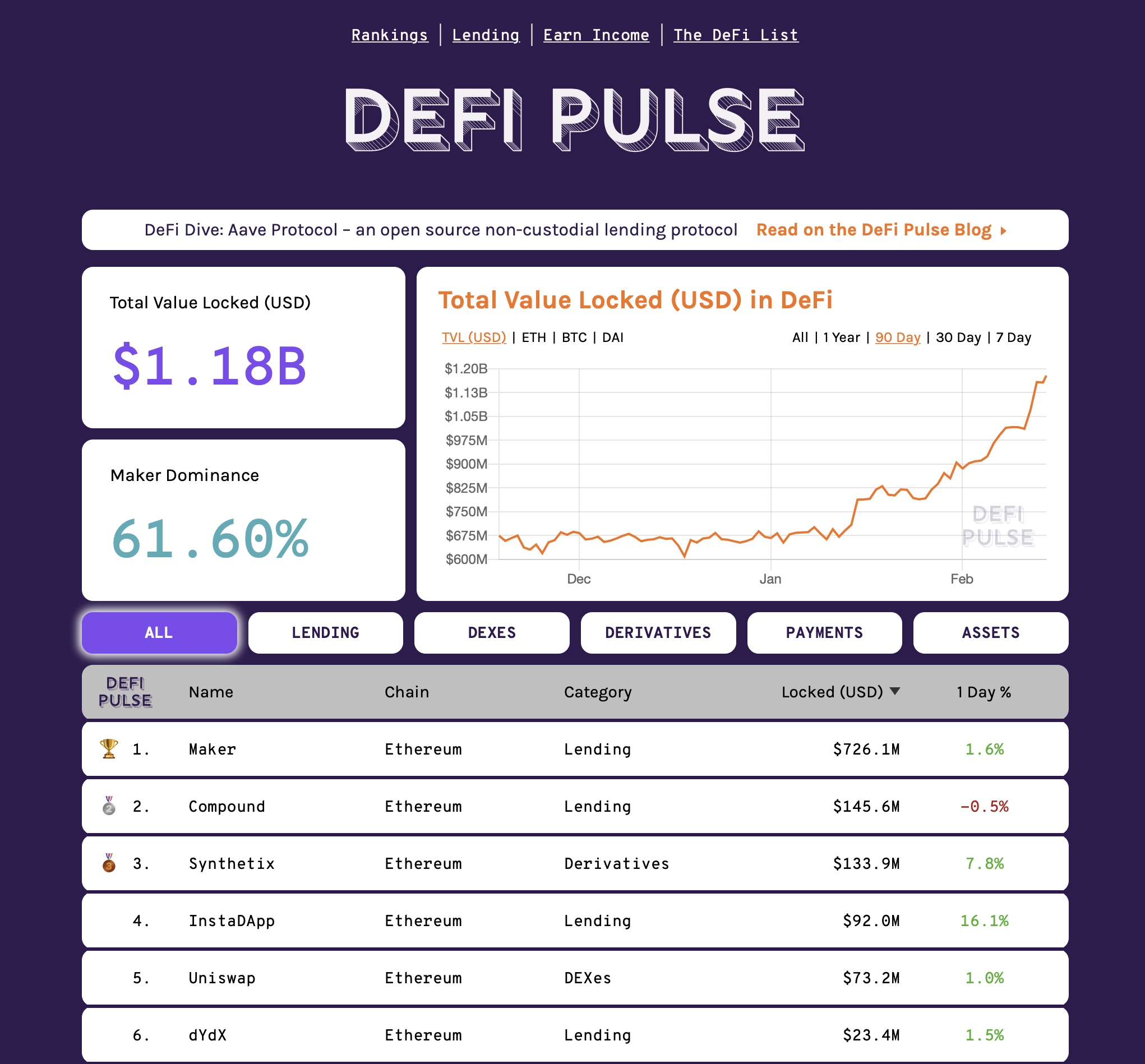

But there’s one thing for sure, DeFi is growing rapidly. As you can see on DeFi Pulse, there is currently $1.17 billion locked in smart contracts tied to various DeFi projects. Let’s go through some examples.

Lending

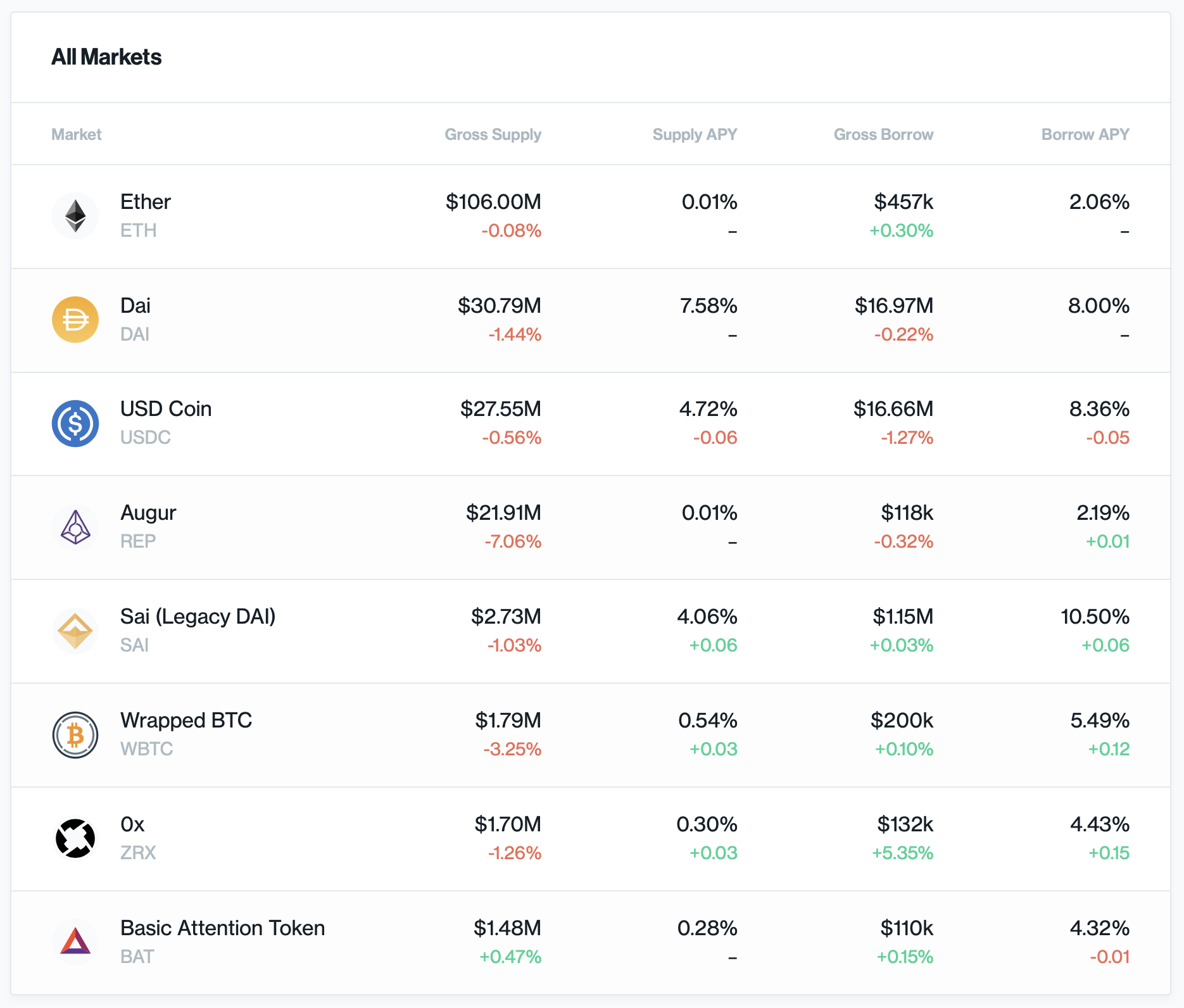

Those lending protocols work pretty much like LendingClub, but on the blockchain. Some users send money to a DeFi lending project to contribute to liquidity pools. Other users borrow money from that pool. Interest rates go up and down depending on supply and demand. For instance, if many users want to borrow USD Coin but there’s not a ton of USD Coin in the liquidity pool, lenders will receive a high interest rate as an incentive. Some projects, such as Dharma, match lenders and borrowers directly.

Most protocols rely on collateralized borrowing in order to avoid default payments. You have to supply an asset as collateral in order to borrow. As your collateral assets become more valuable, you can borrow larger sums.

Popular projects in this category include Compound (pictured below) and dYdX.

Derivatives

Synthetix lets you invest in assets you can’t usually acquire on a cryptocurrency exchange, such as gold and silver. The contracts match the value of those assets, which means that you can own gold without having it in a safe at home.

Decentralized exchanges and stablecoins

Some DeFi projects are decentralized iterations of existing centralized projects.

Cryptocurrency exchanges are nothing new, but they represent a single point of failure. If you want to convert crypto assets, you must first upload them to an exchange, but exchanges and user accounts can be hacked. Keeping crypto assets on an exchange is nowhere near as safe as keeping money in a wallet under your control. If you don’t own the keys, someone else could access your account and transfer all your crypto assets.

That’s why decentralized exchanges like Uniswap are interesting. It uses liquidity pools instead of order books. As liquidity pools evolve, prices go up and down.

Similarly, stablecoins have become quite popular over the past couple of years, such as Tether and USDC. These ERC-20 tokens are worth exactly one dollar. But you can send and receive them on the Ethereum blockchain, you can keep them in an Ethereum wallet and you can invest them in DeFi projects.

But Tether and USDC are backed by a handful of companies. They try to be as transparent as possible by holding a reserve of dollars in real bank accounts (although USDC seems way more transparent than Tether). In other words, you have to trust audit reports, which doesn’t feel right for a crypto asset.

Maker has created another stablecoin, Dai. Once again, 1 Dai is worth 1 USD. But the central reserve is handled by Maker Vaults. Users can contribute to those vaults with crypto assets that act as collateral assets for Dai. Everything is auditable on the Ethereum blockchain, and there is no bank account involved.

It’s still early days

DeFi projects currently attract thousands of users — not millions. They’re hard to understand and way more difficult to use than Square Cash. They’re not going to replace banks overnight and they might not replace banks at all.

Yet, there’s still something exciting about replacing financial institutions with smart contracts. Let’s hope it leads to a more transparent alternative financial system that is fairer for everyone. But it’s going to take a while.

Disclosure: I own small amounts of various cryptocurrencies.

Comment