Joanna Glasner

More posts from Joanna Glasner

Startup investors in the U.S. and Canada have been putting a little less money to work across a lot fewer deals in recent months.

After three quarters of rising investment at early through growth stage, VCs have cut back in the fourth quarter of 2017. They participated in fewer deals and invested less capital compared to both the prior quarter and year-ago periods, according to Crunchbase projected data. (For a quick explanation as to why this report now includes Canada, see the end of the post.)

Overall, investors put a projected $21.9 billion into seed through technology growth-stage rounds in Q4, down from a projected $28.1 billion in Q3. Deal count fell most markedly at the earliest stages, with the projected number of closed rounds for seed-stage startups down by more than one-third from the prior quarter.

The Q4 pullback contrasts with upbeat comparables for the full year. For all of 2017, U.S. and Canadian startup investors put a projected $89.4 billion to work, up from $82 billion in all of 2016. A smattering of really big, mostly late-stage rounds, boosted by SoftBank’s unprecedented spending spree, contributed to the higher annual totals.

Below, we look at some of the key data points for the just-ended quarter and year, including early and late-stage funding, round counts, M&A and IPOs.

Adding it all up

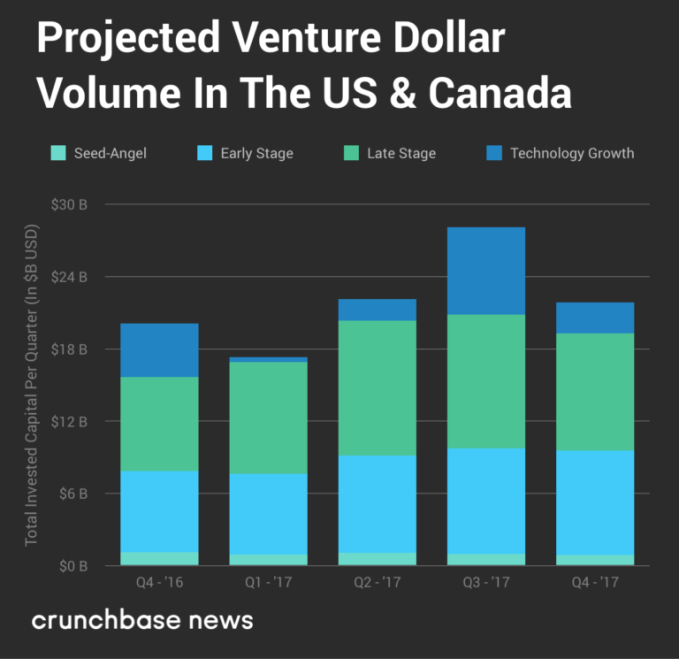

First, we’ll look at investment totals for the quarter and full year. Broadly, Q4 showed some pullback from Q3, but projected investment totals were still up year-over-year across most stages for 2017.

Quarterly totals

Let’s start with Q4 numbers. Out of the $21.9 billion in projected total investment for the quarter, about 44 percent, or $9.7 billion, went to late-stage deals.

Another 12 percent, or $2.6 billion, went to technology-growth rounds, a newly redefined category for Crunchbase News that includes many of the big financings for established unicorns. (For stage definitions, see the bottom of the post.)

Early-stage (Series A and B) rounds, meanwhile, drew $8.7 billion in Q4, boosted by some unusually large deals. Seed and angel deals, which are always the smallest in dollar terms of any stage, brought in a projected $886 million.

In the chart below, we look at investment totals by stage for Q4 and the preceding four quarters. It should be noted from this that the notion of a Q4 pullback is relative. The third quarter of 2017 was a particularly strong one for early through growth-stage investment. So while Q4 was down quarter-over-quarter, it still ranked third for total funding out of the past five quarters.

As usual, a handful of big deals made an outsized contribution to the quarterly totals.

At the late stage, the largest round was for Magic Leap, a developer of virtual reality display technology that raised $500 million in Series D funding in October. Another big funding recipient was Compass, a technology-driven real estate platform that secured $550 million in Series C financing during the quarter.

At the early stage, Grail, a developer of diagnostics for early cancer detection, closed a $1.2 billion Series B round, the largest early-stage deal for Q4. Following Grail was a $200 million Series B for augmented reality game developer Niantic, developer of the hit game Pokémon GO.

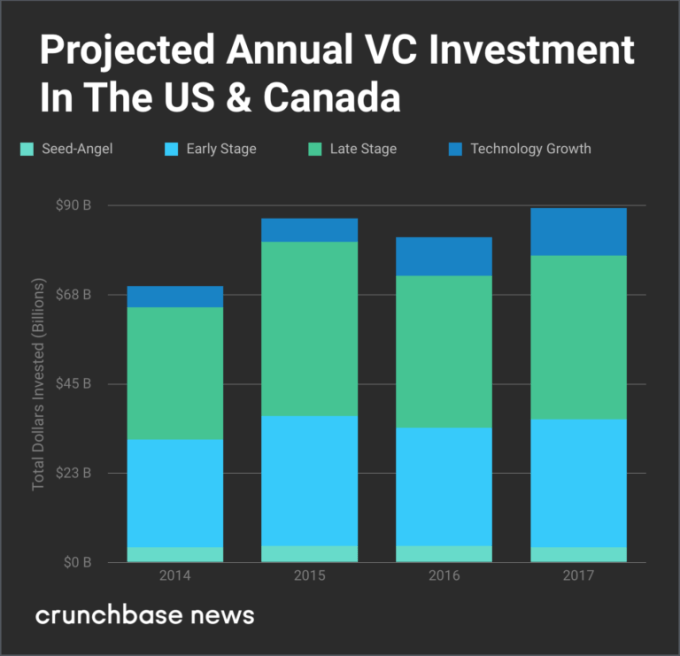

Annual totals

Now let’s turn to the 2017 numbers. Total projected venture investment was up year-over-year at every stage, but rose the most at growth and late stage.

As previously noted, for all of 2017, U.S. and Canadian startup investors put a projected $89.4 billion to work, up from $82 billion in all of 2016.

From early to the technology-growth stage, investment totals were up. Only seed-stage investments saw a reduction in year-over-year projected funding totals. Technology growth in particular saw the highest annual total in four years, driven in part by SoftBank’s voracious dealmaking.

In the chart below, we look at funding totals at each stage for the past four years. It’s noteworthy that while there have been fluctuations, totals across stages have ranged within the $80 billion to $90 billion range over the past three years.

Rounds get fewer and bigger

The typical venture round has gotten bigger, but fewer startups are managing to secure funding.

That’s the broad takeaway from Crunchbase projections for round counts at seed through growth stage. Here’s a breakdown of what we saw.

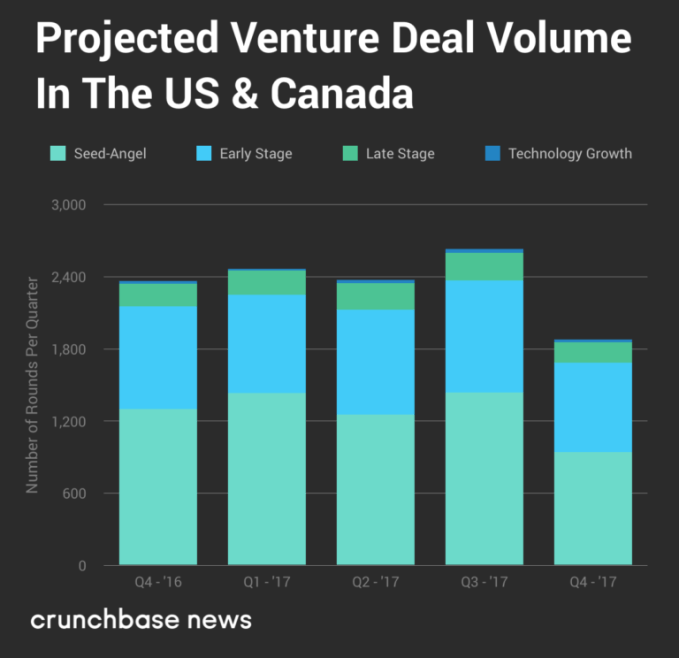

Quarterly round counts

After three quarters of holding up at levels relatively flat, the number of startups securing seed and venture funding fell sharply in Q4 of 2017.

Across all stages, Crunchbase projects a total of 1,880 companies will close funding rounds in Q4, down 28 percent from Q3 and 21 percent from the year-ago quarter.

The most pronounced decline was at the seed stage. The projected Q4 seed and angel round count is just 944, down more than a third from the prior quarter and down about 25 percent from year-ago levels.

Early-stage (Series A and B) is also down. Crunchbase projects a total of 742 early-stage rounds for Q4 of 2017, down about 20 percent from the prior quarter and down about 13 percent from year-ago levels. Round counts were also down at late and technology-growth stage, as evident in the chart below.

While it’s not entirely clear what’s driving the pullback in seed and early-stage rounds, industry insiders have been documenting the drop for a while and raised a number of possibilities. Reasons include a cyclical investor backlash to inflated seed-stage valuations, increasing preference among established investors for later-stage and larger deals and a decline in funding for new mobile app and SaaS-focused startups.

Annual round counts

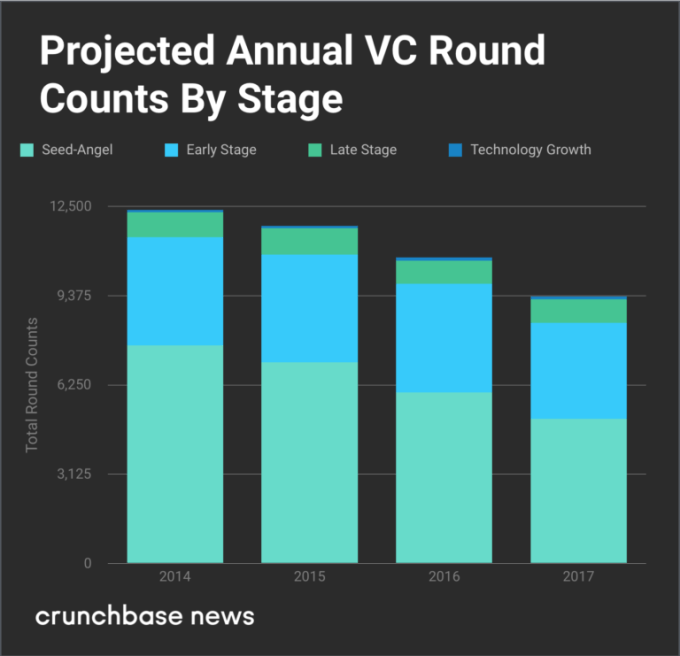

The late-in-the-year decline in seed-stage rounds was pronounced enough to affect year-over-year comparisons. For all of 2017, projected round counts total 9,353 across all stages, down about 13 percent from the 2016 total of 10,711.

In the chart below, we look at round counts by stage over the past four years to get a picture of how 2017 ranks. Overall, the number of late-stage and growth deals stayed relatively flat year-over-year, with investors continuing to chase big rounds for unicorns and near-unicorns. Virtually all of the decline is due to seed and early-stage trends.

Exits

As noted in the sections above, investors did put an exceptionally large amount of capital to work in 2017. But how did they do in terms of getting money back?

It’s tough to provide a precise accounting of annual or quarterly venture returns, given that purchase prices are undisclosed in many M&A transactions and share prices fluctuate massively in many IPO exits.

However, if we were to generalize for both the quarter and full year, it would probably be along these lines: Exits were pretty so-so. The IPO window was open, but public market investors were picky and fickle. Acquirers, meanwhile, kept up a decent dealmaking pace, but didn’t do a lot of really big deals.

Let’s look at some of the numbers, and significant deals.

M&A

Those waiting for big, profitable acquisitions involving venture-backed unicorns will have to keep waiting.

The fourth quarter of 2017 delivered a number of solid, high-return exits. However, like the prior two quarters, we didn’t see deals above the $1 billion mark. Instead, we saw a lot of smaller deals involving early-stage companies, a few purchases at apparent markdowns from private market valuations and some larger transactions in the mix.

One company that made a big hit on the M&A market in Q4 was Musical.ly, the developer of a popular lip-syncing app that sold to China’s Toutiao in a deal reportedly valued at between $800 million and $1 billion. Other large transactions involved Black Duck Software, a security provider that sold to Synopsis for $565 million, and Shipt, an online grocery delivery service that Target bought for $550 million.

For all of 2017, venture-backed M&A was decidedly lackluster. Cisco’s $3.7 billion acquisition of enterprise software provider AppDynamics, announced in January, ranked as the year’s only known multi-billion dollar M&A transaction involving a venture-backed company.

IPOs

As for IPOs, 2017 was certainly more action packed than 2016, an unusually dull year for venture-backed public offerings. The biggest IPO event of the past year was Snap’s Nasdaq debut in March. And although the self-deleting messaging provider subsequently managed to delete a huge chunk of its market capitalization, the blockbuster offering did seem to usher in a period of greater tech IPO activity.

But 2017’s IPO cohort delivered mixed results.

Top performers for the year included streaming media device maker Roku, analytics provider Alteryx and tech-enabled real estate company Redfin.

Yet some startups that achieved IPO turned laggard. Snap made that list. So did meal kit company Blue Apron and storage technology provider Tintri, both of which ended the year with shares down more than 50 percent from their initial offer price.

For Q4 of 2017, a couple of tech offerings stood out for aftermarket performance. Shares of Stitch Fix, an online provider of clothes curated by personal stylists, were recently trading up more than 70 percent from their initial offer price. Shares of email delivery platform Sendgrid also climbed sharply following the company’s October debut.

Looking ahead

While the seed-stage slowdown has raised concerns about the health of the startup ecosystem, the venture industry remains awash with cash. Whether investors remain flush, however, will depend to a great extent on their ability to produce exits.

Optimists have reason to expect improvement on the exit front. In particular, some industry insiders are predicting a pick-up in big M&A deals in 2018.

Additionally, the passage of tax reform, including lower corporate tax rates and greater incentives to repatriate capital, could lead to a rise in big-ticket deals involving U.S. startups.

Others, however, maintain that inflated startup valuations are keeping acquirers away. And while those valuations could certainly be corrected, it’s not the outcome startup investors would prefer.

Methodology

The data contained in this report comes directly from Crunchbase, and in two varieties: projected data and reported data.

Crunchbase uses projections for global and U.S. trend analysis. Projections are based on historical patterns in late reporting, which are most pronounced at the earliest stages of venture activity. Using projected data helps prevent undercounting or reporting skewed trends that only correct over time. All projected values are noted accordingly.

Certain metrics, like mean and median reported round sizes, were generated using only reported data. Unlike with projected data, Crunchbase calculates these kinds of metrics based only on the data it currently has. Just like with projected data, reported data will be properly indicated.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events as reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Why U.S. and Canada?

For the first time, in this latest quarterly and annual report, we shifted our data collection to include both the U.S. and Canada. Previously, we reported U.S.-only quarterly numbers, in addition to our global reports. The reason for including Canada was in part to provide a differentiated data set. We noticed there are a few reports that come out covering the U.S. venture scene, and some data on Canada, but not much focused on North America more broadly. (We thought about a broader North American data set that includes Mexico, but due in part to differences in the rate and timing of self-reporting of startup funding, we deemed this might not fully capture the breadth of Mexican investment activity.)

Glossary of funding terms

- Seed/angel include financings that are classified as a seed or angel, including accelerator fundings and equity crowdfunding below $5 million.

- Early-stage venture include financings that are classified as a Series A or B, venture rounds without a designated series that are below $15 million and equity crowdfunding above $5 million.

- Late-stage venture include financings that are classified as a Series C+ and venture rounds greater than $15 million.

- Technology growth includes private equity investments in companies that had previously raised venture funding.

Illustration: Li-Anne Dias

Comment