Editor’s note: this is a guest post from venture capitalist William Quigley, managing director at Clearstone Venture Partners.

Earlier this week I issued a report about the positive changes that have recently taken place in the venture capital industry. These changes are profound and will have a lasting effect on both the venture capital asset class as well as today’s start-ups.

Much has been written about the so-called “golden age” of venture capital in the late 1990s dot-com era, when the likes of Netscape, Yahoo, Amazon and eBay were created.

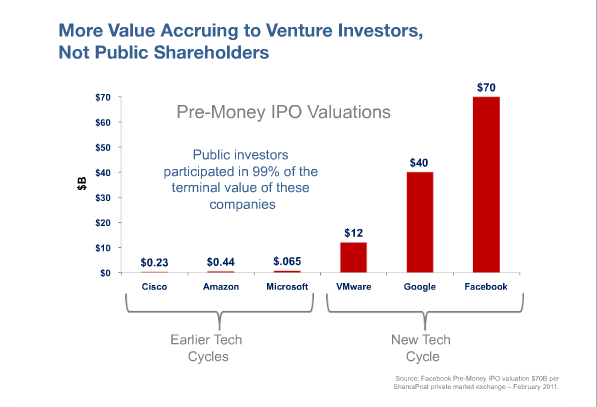

Yes, those certainly were great times for founders and early stage investors, but I will let you in on a little secret: for all of the brilliance, ambition and hard work that went into building these iconic companies, the vast majority of the capital appreciation in these businesses took place only after they went public.

To put it another way, the rewards for building a truly great business – say, the world’s biggest etailer or the largest online auction site – accrued mainly to the public shareholders. That’s right. The ones who went through all the hard work of logging into their E*Trade accounts and clicking the “Buy” button. They participated in over 99% (literally) of the value created from these brilliant entrepreneurs and their wonderful companies.

Now understand, I don’t begrudge the public investors, but as either a founder, early stage company employee or investor (angel or VC), why bother taking all of the early stage risk when you could have earned far more just buying shares of your company once it went public?

Let’s also keep in mind that public companies are generally a lot less risky than private ones. Less work and lower risk. That is how it used to be for public shareholders, but that era has ended for good. Let me give you some perspective on how much things have changed since the last tech cycle.

Amazon.com, the world’s largest Internet retailer, went public at a $440 million valuation. Hard to believe, isn’t it? A company worth $90 billion today was worth just over $400 million when it went public in 1997. That skimpy valuation represented less than one times its forward 12 months of revenues, a multiple more closely associated with a corrugated cardboard manufacturer than the most important innovator in retailing in the past 100 years.

eBay went public at a $650 million valuation, representing less than three times its forward revenues. Amazingly, this valuation was considered adequate even though at the time of its IPO, eBay had already established itself as the pre-eminent auction site on the web. Go back to the earlier part of the 1990s, and it gets even more extreme. Cisco, the most important company in computer networking infrastructure, went public at $225 million, a valuation representing just over one time its annual revenues.

Remember, this was supposed to be a time when venture capital and entrepreneurship was highly rewarded. It turns out, until very recently, public investors, those who waited until the hard work was done and the upside was evident, were the ones who earned the greatest returns. Nice work if you can find it.

We have now entered a new era, a marvelous era, in fact, for those brave enough to start a company and bold enough to build a global business. This new era, what I call the “real golden age” for company builders and private investors, allows for enormous value creation before a company even goes public.

Google was the catalyst for this change. When it went public in 2004 at a $40 billion market cap, many thought the Internet bubble had returned. Something had changed, but it wasn’t a new bubble mindset. It was the understanding that some companies were now able to create value far faster than was possible before. Those investors who thought Google was overvalued at $40 billion soon learned that, in fact, it was dramatically undervalued. In 2010, Google earned nearly $19 billion in gross profit and almost $12 billion in operating profit!

Of course, if investors had known that when Google went public, they would gladly have bought the shares at the $40 billion valuation. Then again, some investors gladly did. So what happened in the span of six or seven years that caused public investors to go from valuing Amazon or eBay at a few hundred million dollars to valuing Google at $40 billion? I believe three permanent changes occurred during that time period that allowed heretofore unprecedented valuations to take hold.

First, the proliferation of Internet access. When my partners and I launched our consumer Internet fund – idealab Capital Partners – in 1997, we already thought of the Internet as a mainstream phenomenon. How wrong we were. Consider that, even by the year 2000, only one-third of the U.S. population had Internet access. Today, nearly every US household has Internet access, many with a high-speed broadband connection. The growth rate in China makes the U.S. figure look downright sluggish. China has gone from about 20 million Internet users in 2000 to close to 500 million today.

These extraordinary growth rates in Internet adoption were not fully reflected in company valuations in the last tech cycle. Now they are, and investors are giving businesses like Facebook, Zynga and others the benefit of the doubt that they will capitalize on the value created by far higher global Internet penetration rates.

Second, the rise of the hedge funds. Since 2000, the number of hedge funds have doubled and the assets they manage have nearly tripled to $2 trillion. Why is this important? Because hedge funds often specialize in particular asset classes, like technology stocks, and with that specialization comes superior knowledge and a greater insight into the potential terminal value a company can achieve. This was not the case in the 1980s and 1990s, when many of the iconic technology start-ups were born.

Microsoft went public in 1986. Keep in mind this was 11 years after its founding, by the way, for those who think the present eight-year standard for going public is too long It was offered to the public at a $640 million valuation, or about three times its annual revenues. Yet, at the time of its IPO, Microsoft’s Windows was already the world’s dominant operating system. However, there were few technology-focused mutual funds, which were then the primary buyers of tech IPOs.

And so, very few investors appreciated the speed and scale at which Microsoft could grow. Accordingly, the company was valued modestly by its investment bankers and nearly all of the gargantuan value of the Microsoft franchise was made available to the public shareholders. Think that Facebook ‘s public shareholders will have the same luxury?

The investors who bought Microsoft shares at its IPO and held onto it for the same amount of time it was a private company – 11 years – were treated to several hundred billion dollars of capital appreciation, not the $650 million that Bill Gates, Paul Allen and the other early employees earned for their 11 years of grueling start-up work. Compare the Microsoft, Cisco, Amazon or eBay examples to what we see in the post-Google era.

VMWare went public in 2006 at a $12 billion valuation. It quickly rose to a $30 billion market capitalization. Thus, the existing investors (parent company EMC in this case) captured over one third of the company’s likely terminal value. Google’s founders, pre-IPO employees and early investors also did quite well, capturing a respectable 25% of the companies likely terminal value. And what of those earlier tech giants – Microsoft, Cisco, Amazon and eBay? The founders and early investors of these extraordinary businesses captured less than 1% of the terminal values of their businesses while they were still private.

The valuations of today’s private tech leaders – Facebook, Zynga, Groupon and possibly Twitter – are such that I believe upwards of 50-75% of the terminal values of these companies will be captured by the folks who did the real work and took the real risks, those who quit their jobs and begged, borrowed and cajoled friends, families and angel investors to take a chance on their far-fetched idea.

Here is the important, and game-changing, point: in order to participate in the great wealth creation taking place in this and future technology cycles, you will have to be a founder, an early employee or a private investor. The so-called easy money will be earned before a company goes public. This is a radical shift from earlier technology cycles.

The third factor contributing to the far high valuations accruing to private companies today is the speed at which companies can now exploit the global marketplace. When I was at idealab in the 1990s, none of our start-ups attempted to address international markets in the first few years of their existence. In fact, for many of those companies, international markets didn’t become a serious focus until after they went public. How times have changed.

Today it is possible to pursue an international growth strategy almost as quickly as a domestic one. The cost of running a global business has dramatically shrunk, and while costs of going overseas have plummeted, the revenue opportunities have increased manifold.

Just consider where three of the largest economies were 10 years ago, and where they are today. India was a $500 billion economy in 2000. Today it is a $1.4 trillion one. Brazil was a $600 billion economy ten years ago, compared to $2 trillion in 2010. The growth of China’s economy in the last decade is breathtaking, from $1.2 trillion to $5.7 trillion in just 10 years. Combined, these three economies have added $6.8 trillion to world GDP since 2000.

Public investors are aware of these economic figures, and they are rewarding companies addressing the global marketplace sooner in their lifecycle. Groupon has taken note. It is just four years old and already operates in 35 countries. Given its international ambitions, it is likely that within two years Groupon will have upwards of 20,000 employees outside of the U.S. A potential $25 billion IPO valuation awaits it for going global faster than its peers.

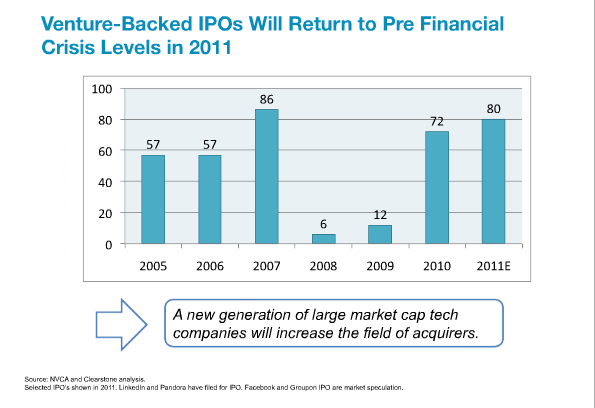

What makes the change I have just described so fascinating is that so many of the traditional limited partners to venture capital funds have withdrawn from the asset class in the last few years, understandable perhaps after 10 years of poor returns. But just as the game has shifted to rewarding private investors over public shareholders like never before, limited partners have decided to look elsewhere for exceptional returns.

I believe that is a mistake.

Going forward, those who participate in building new companies and providing the start-up capital to fuel the growth of those businesses, will be handsomely rewarded like never before.

Comment