Rational or not, public markets are where consensus gets formed on how much listed companies are worth, impacting the value of private companies in the process. But in a downturn, such as the one everyone suddenly agreed we are going through, that consensus can shift quickly.

Most of the stock fluctuation tends to hit public companies whose performance falls somewhere in the middle. Great is still great. Not great is still not great — and now more frequent. But how about companies that are doing well on one front, and not so well on another? That’s where there’s room for a shift in preferences.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

When it comes to cloud software stock, preferences have been shifting particularly quickly in the last few weeks. This led investment firm Battery Ventures to replace its annual report with a quarterly one that will better account for market volatility.

The first issue of Battery’s new report, The Cloud Quarterly, provides us with interesting insights on what type of SaaS companies have seen their valuation take a hit — or resist — in recent months, and what they have in common. Let’s explore.

The first issue of Battery’s new report, The Cloud Quarterly, provides us with interesting insights on what type of SaaS companies have seen their valuation take a hit — or resist — in recent months, and what they have in common. Let’s explore.

Rule of 40 101, and why it matters

The key takeaway from the report, from our perspective, is that investor preference for software (SaaS) companies has changed from a weighting favoring growth toward a greater focus on profitability. Naturally, there has been chatter about this “return to fundamentals” in startup land as tech stocks slid in early 2022, but just how things have shifted — and how far — is illustrative and critical comprehension for today’s technology and startup markets.

In simple terms, investors now value software companies that meet the Rule of 40, but with a greater free cash flow focus than sheer top-line expansion. The Rule of 40 states that a software company’s growth rate added to its profitability should equal 40. So if a company is growing at 25% year over year and has 15% profit margins, that’s great — it meets the Rule of 40. A company with 20% growth rates and 5% margins would not, to provide another example.

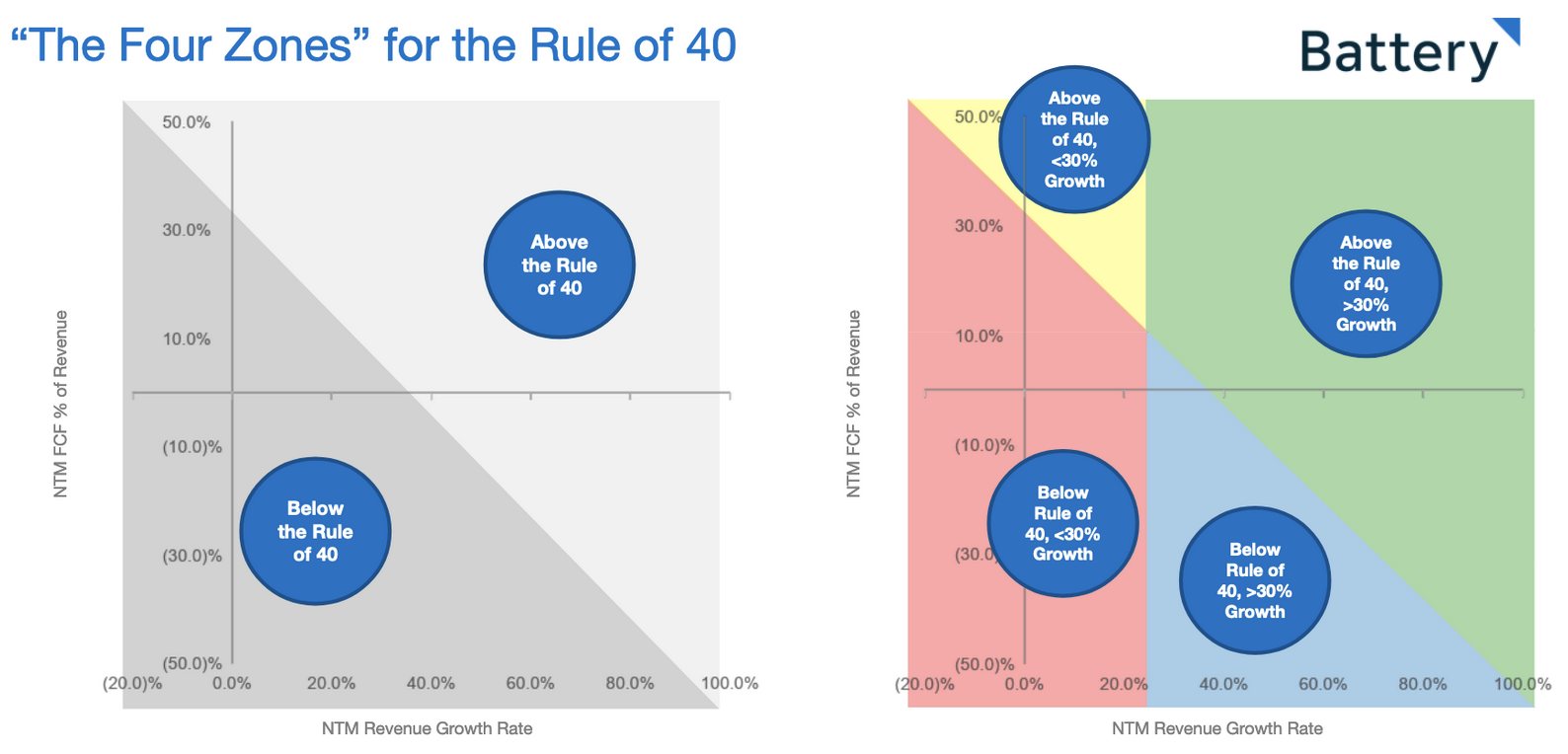

To understand what we’re talking about, we need to get into the nitty-gritty of a few charts. Trust us that this will be worth your time. We begin with how the Rule of 40 looks in chart form, starting with the one on the left.

Note that the x-axis is next-12-month (NTM) revenue growth in year-over-year percentage terms, while the y-axis is NTM free cash flow (FCF) expressed as a percentage of revenue, a favored profit metric by software investors more focused on cash consumption and generation over GAAP income results during expansion. Companies want to meet or exceed the Rule of 40, meaning that they want to be in the upper right side of the chart on the left.

The chart on the right is more complex — and more useful. It breaks the Rule of 40 into a few zones. What we care the most about are blue and yellow areas. The blue zone contains software companies that fail the Rule of 40 test but are growing at a rate of greater than 30%. Given the tradeoff in Rule of 40 terms between growth and profit, we can infer that companies that failed the Rule of 40 and are growing quickly are more unprofitable than other companies, which the chart confirms.

Companies in the yellow region are those that meet or exceed the Rule of 40 but do so thanks to their profitability (free cash flow as a percentage of revenue) more than their growth.

Now, why do we care about those two chart regions? Because they show how investors have tightened their investing standards and how investor preferences have flipped. Observe:

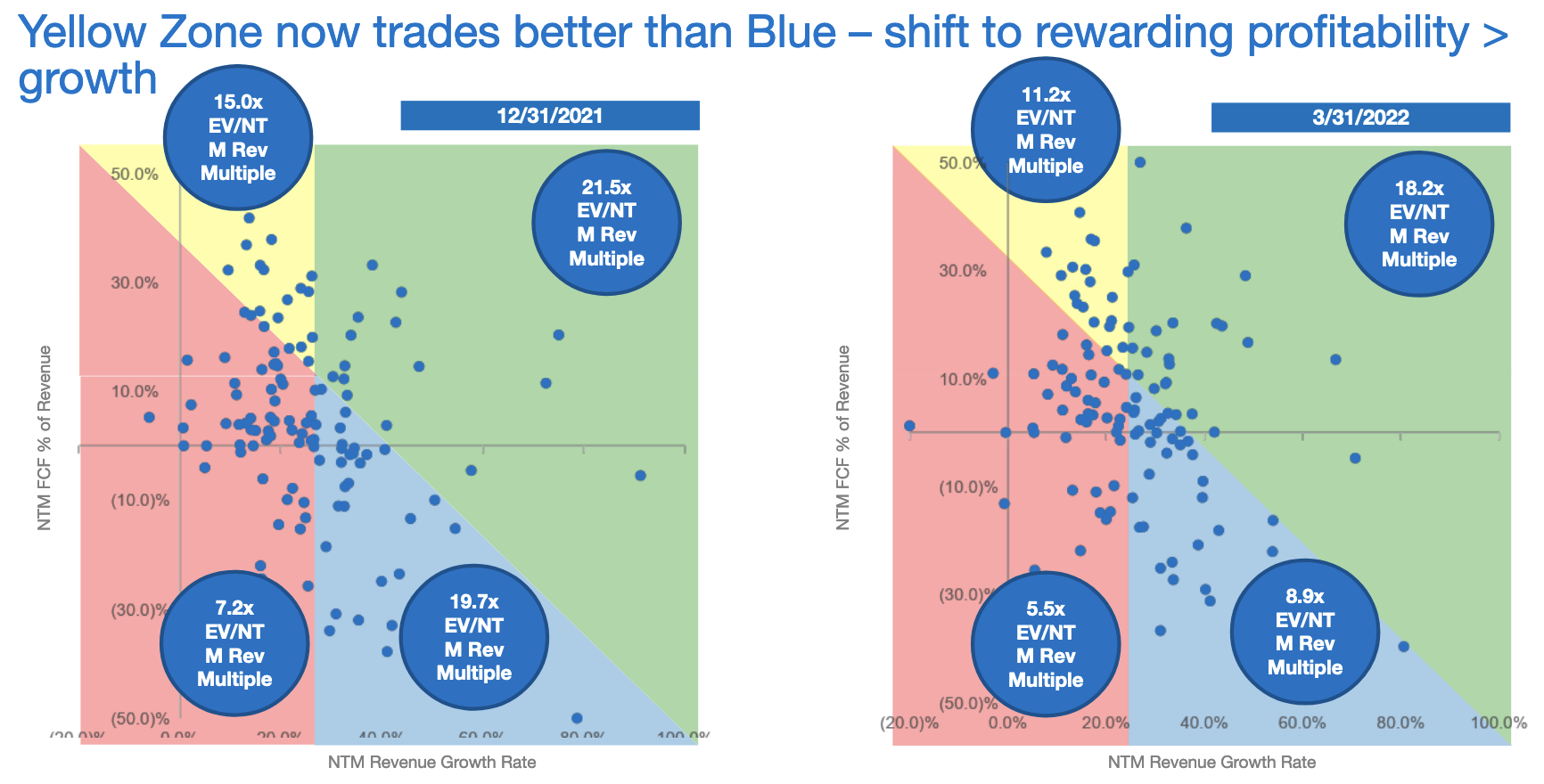

As you can see in the chart on the left, built with data from the end of 2021, investors at the time valued companies that were growing quickly but failed the Rule of 40 (blue area) more richly than companies that were growing more slowly, but thanks to profitability, met the Rule of 40 test (yellow area). The second chart, on the right, shows more recent data and an inversion of investor preferences.

Now, measured in revenue multiples terms, companies that meet the Rule of 40 even with modest growth are more valuable than startups that are growing quickly and fail the Rule of 40 test. From this swap, we can tell that investors today want companies that are higher quality (Rule of 40 compliant) and weighted more heavily toward profit than growth.

Of course, there are outliers in each bucket. For instance, companies like Atlassian and MongoDB enjoy similar revenue multiples, despite the fact that the former falls into the yellow area and the latter in the blue one.

When looking at medians, however, the shift is clear. At the end of 2021, companies above the Rule of 40 and with growth rates below 30% were awarded a median 15x valuation multiple. Fast forward to the end of March 2022, and that only fell to 11.2x. Meanwhile, companies failing the Rule of 40 test but growing at a rate of greater than 30% saw their median valuation drop from 19.7x to 8.9x. Yellow beats blue: 11.2x is better than 8.9x.

In other words, the era of inefficient, faster growth being rewarded is over. For now. For a host of startups and unicorns, this is terrible news; a period of effectively free capital for many growing tech companies did not breed cultures of cost control. And shifting from growth at all cash costs to a more balanced model will upset more than a few apple carts.

Comment