In 1999, Mike Lincoln co-founded the first East Coast office of top Silicon Valley law firm Cooley LLP. Over the last two decades, he has built out the practice to extend well beyond the region, today covering Boston and New York too, while also heading up the firm’s business department, and serving as an adjunct professor at the University of Virginia.

Along the way, he has collected an impassioned group of founder clients, more than two dozen of whom had a lot to tell us about how he has helped them.

On being a startup lawyer:

“[I]f you really believe you can make dreams happen and that you can help create jobs and you can help cure disease and other things that startups do, then your practice will flourish and the money will follow because people will see it in your eyes. They’ll see that you’re passionate about helping to grow a company, helping to solve real-world problems, helping to create jobs…. You should not do this because you are trying to figure out a way to make millions of dollars. You do it just like entrepreneurs do it, with passion and commitment and a higher calling to try in your own small way to change the world.”

“He is my first recommendation to any founder and I work with him on every project that presents the opportunity.” Hooman Radfar, San Francisco, partner at Expa

On his approach:

“Early on, I think it is being part of a firm that values the time spent going out to scout for new companies. And then once you’ve found them, I think that the key role — to use another metaphor — is to be a good Sherpa. A startup lawyer is climbing the mountain with the entrepreneur and there are lots of paths up the mountain, and knowing which path to take on which day is the role that I think a good startup lawyer plays, which is not really pure legal advice.”

On the DC-area tech scene:

“There is a rich talent pool here of people often coming out of government or three-letter agencies that start companies grounded in cybersecurity and national defense. So for example, we just did the Tenable IPO here in the DC market. That would be an example of a local company that I work with that was born out of that sort of DNA. And then another example of that would be a company like Netwitness, which I worked with from early on and which sold to EMC. Yet another of a strong company in this sector is Mandiant, which we helped to sell to FireEye for $1.3 billion.”

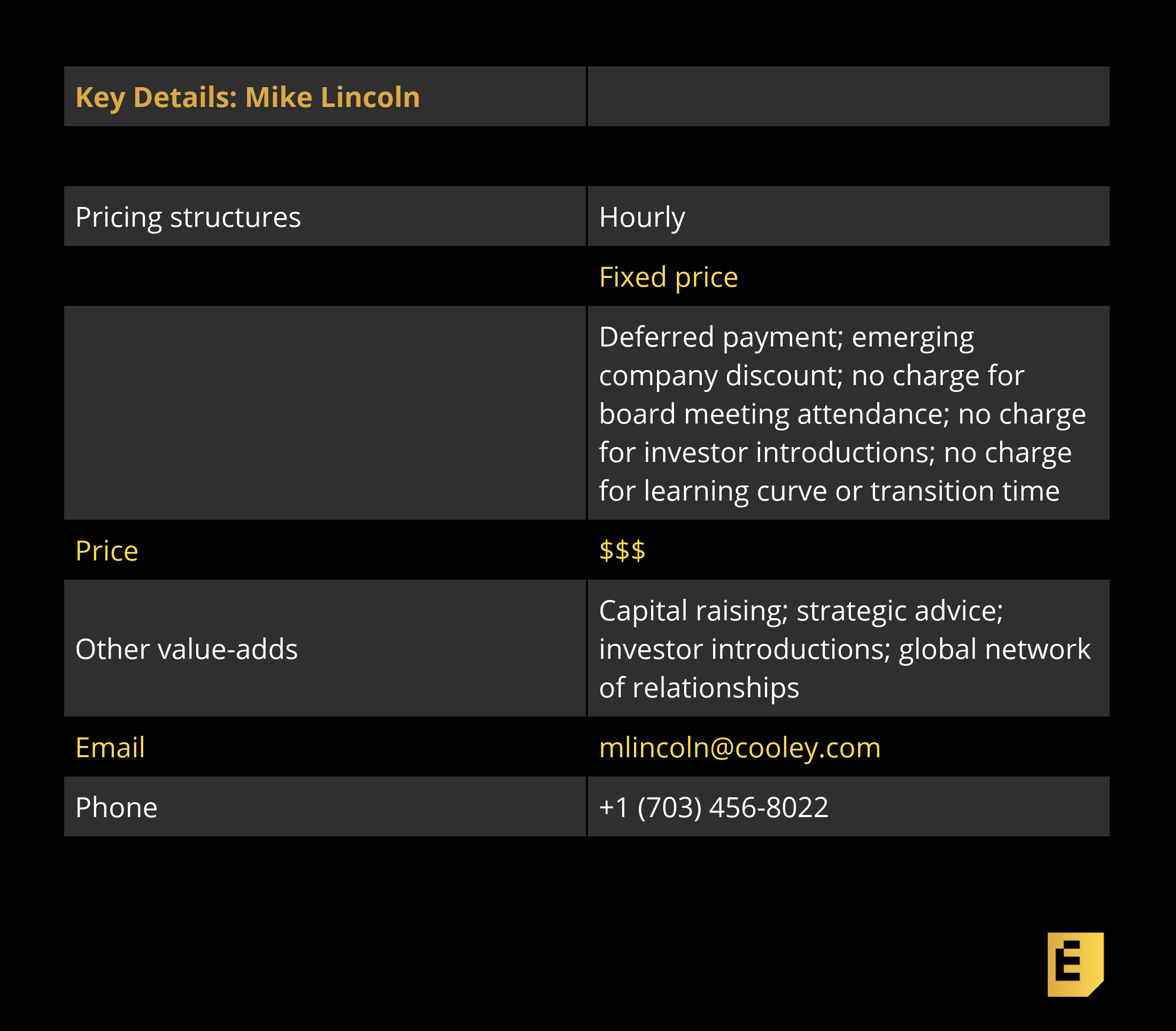

Below, you’ll find founder recommendations, the full interview and more details like pricing and fee structures.

This article is part of our ongoing series covering the early-stage startup lawyers with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already. If you’re trying to navigate the early-stage legal landmines, be sure to check out our growing set of in-depth articles, like this checklist of what you need to get done on the corporate side in your first years as a company.

The Interview

Eric Eldon: I’d love to hear more about your background and how you got into startup law.

Mike Lincoln: Out of law school, I clerked for a federal appellate court judge in Chicago and then I went to Latham & Watkins in DC. I have always been drawn to entrepreneurship and startups. I started a few very small companies myself in high school and after college and so had a bit of the entrepreneurial bug. After more of a Wall Street type of practice at Latham, I saw what was going on in the Washington, DC market in the 90s. Venture capital was starting to flow in to the market and companies like AOL were going public and I said to myself, “That’s what I want to do. I want to go work with startups and emerging companies and venture-backed companies.” And so I set out to go do just that.

After talking to a few Silicon Valley based law firms, we ended up deciding to go with Cooley. So Joe Conroy and I launched the office in 1999 in Reston, Virginia and that was really the first Silicon Valley firm to make the move east. For the next decade after that, we were heads-down building a practice and a brand up and down the East Coast. My co-founder Joe Conroy is now the CEO of Cooley and I am now head of the business department. Even though I live in the DC area, I spend a great deal of time in Palo Alto because that’s where we’re headquartered and I have spent a lot of time in more recent years helping to launch our offices in New York, Boston, London, Los Angeles, Brussels and other places. But despite my travel schedule and my firm duties, I still do exactly what I have always done and that is to work with interesting entrepreneurs and startups every day of the week. That’s what I love to do.

I tend to work with very early-stage companies, often companies that are pre-funded and pre-revenue and a big part of that role is a coaching relationship. Before a company is funded, there really is no money to be made for a lawyer or law firm and so there has to be a willingness to make an off-balance-sheet “investment” in these companies. As a general proposition, we are in the business of identifying companies that have the prospect of being funded because we don’t make any money if the company doesn’t get liftoff. So I think of it as a little bit like the role that you play as a scout for a farm league baseball team and you’ve got to be willing to go down into high schools and colleges to look for talent — a key part of being a good scout is having an eye for future success.

It’s obviously an intangible. No one bats 1,000 in this business, but I think the best startup lawyers just have an eye for this and a nose for this and are skilled at spotting next-generation talent and great ideas, much like good venture capitalists do. And if you do that right, it actually is very lucrative for law firms over the long haul — otherwise firms like Cooley wouldn’t be able to do this, but it requires that some of these companies become real businesses that go public or get sold, raise venture capital and do the things that allow us to actually, eventually make money.

Early on, I think it is being part of a firm that values the time spent going out to scout for new companies. And then once you’ve found them, I think that the key role — to use another metaphor — is to be a good Sherpa. A startup lawyer is climbing the mountain with the entrepreneur and there are lots of paths up the mountain, and knowing which path to take on which day is the role that I think a good startup lawyer plays, which is not really pure legal advice.

Indeed, it is not really legal advice at all in many cases and it is about pattern recognition and bringing that pattern recognition to bear, especially for somebody who is not a seasoned entrepreneur. Once somebody is a seasoned entrepreneur, just like somebody who is a seasoned climber, they get better and better at it and maybe they don’t quite need a Sherpa in quite the same way — but even for seasoned entrepreneurs, startup lawyers tend to play the Sherpa role because the paths to get up the mountain are never the same and are constantly evolving.

Eric Eldon: Right. So, what’s your day look like, I mean is it generally, a 30 / 30 / 30 split between early-stage, growth-stage and late-stage companies? That’s sort of the number that everyone seems to throw around with some variation.

Mike Lincoln: Yes, I think that is generally accurate. I would say many of us on the early-stage side are evolving to a somewhat different split where we actually team up with a colleague who prefers later-stage companies. I still go to board meetings and I still maintain a relationship, but when you talk about the day-to-day work of a later-stage or pre-IPO company, I think that it is a somewhat different skill set and so, for some of us, there is a hand-off and the baton gets passed to a partner who specializes in companies at this stage. And then once a company’s gone public, it tends to be someone in our public companies group who teams up with a partner like me to run point together.

Eric Eldon: Gotcha. And so tell me more about what you’re up to in the DC area. I mean obviously it’s grown a lot as a startup hub, but the impression is generally that the DC area is more oriented toward government and government-related work.

Mike Lincoln: I think that it is accurate to say that, as a strategy, an emerging companies lawyer has to focus on what sectors are strong in his or her local market. DC is a strong, good market but it’s not the same as Silicon Valley, Boston or New York. And so you have to play to your strengths. In our market, an example of a really strong sector is cybersecurity — there has been a lot of capital raised in the last 15 years in this sector and so we have been very focused on it.

There is a rich talent pool here of people often coming out of government or three-letter agencies that start companies grounded in cybersecurity and national defense. So for example, we just did the Tenable IPO here in the DC market. That would be an example of a local company that I work with that was born out of that sort of DNA. And then another example of that would be a company like Netwitness, which I worked with from early on and which sold to EMC. Yet another of a strong company in this sector is Mandiant, which we helped to sell to FireEye for $1.3 billion. These three companies — Tenable, Netwitness and Mandiant — are all local companies in the security sector that raised venture capital and all sold or went public.

And that sort is one great example of the DNA that comes out of the DC market. There are other strong sectors in the DC area, like digital health and data analytics. Companies like Capital One brought a lot of data scientists to the area and larger public companies like that spawned newer companies because of the talent that they brought to this market, particularly in areas like data analytics.

As another element to our strategy, we also focus on a set of smaller markets that have thriving technology markets but that are arguably underserved when it comes to infrastructure, places like Charlottesville, Blacksburg, Nashville, Pittsburgh and Richmond.

Eric Eldon: And the Research Triangle?

Mike Lincoln: Yes, the Research Triangle, exactly. So as another example, we recently handled an IPO for an Atlanta-based company. It used to be the case 20 years ago that an emerging companies lawyer like me would focus — quite literally — on companies within a two-hour radius by car. And what we find today is that if you’re an emerging companies lawyer, you can very effectively extend your market reach to these other great tech markets that are not in your own backyard.

We love vibrant markets like Silicon Valley, which in most respects is really still the epicenter of the technology and life sciences market.

That is where we are headquartered. And we love other strong technology markets like Boston and New York. We opened in Los Angeles five years ago and our office has absolutely blossomed. We did the Dollar Shave Club deal there and we have worked with The Honest Company and we handled the Snap IPO, all companies in that market.

Venice and Santa Monica have been explosive and so there are markets like that have garnered a lot of attention. There are other places like Columbus, Ohio or Nashville, Tennessee that have seen remarkable growth too, and so we believe that there is a lot of opportunity for our firm in these other markets. But we also think that there is actually a social impact which is good for our economy to have other places that can develop well-paying jobs. There are attractive features to investing in companies that are in places like Columbus, Ohio, or Nashville, Tennessee, which has a lower cost structure and lower employee attrition.

Now it usually has to be centered near a university that can naturally produce the talent you need to build most of the types of growth companies that we are talking about, and if you have that talent pool and you can attract outside capital, the ingredients are there to spawn growth companies. One of the things that’s changed in the last 20 years is that many investors are more willing to consider those markets and not just invest in their backyard. And so we think in our own small way, we can help bridge that gap and we can bring to bear our talents in these markets — coaching of entrepreneurs and also facilitating introductions to sources of capital that might not otherwise look at companies in these markets.

And so we believe that it’s an important role that we can play. We’re not trying to supplant the local infrastructure. We’re trying to supplement it. And again, what we find is that when companies reach a certain point, if they really have a shot at raising money from a Silicon Valley firm or a Boston firm or a New York firm, a lot of times they do need help. They do need introductions and they do need somebody to coach them through. If a company tells us that they are going to make a trip to Boston for a day or two, we can help facilitate introductions with investors that will do a $3 – $5 million Series A financing in a particular sector. You just have to know how to get in front of those people and the players in the ecosystem — including lawyers — can help facilitate that. Like Steve Case and his Rise of the Rest campaign, there is an element of social good here by helping to build up the infrastructure and the ecosystem in these other markets which results in job creation. And of course we also think it’s good for business. We think there are lots of great opportunities for a firm like ours if we’re willing to get on a plane or get on a train and go spend time with entrepreneurs.

Eric Eldon: Yeah, that’s interesting. What’s a way that you helped a particular company successfully navigate a tricky legal situation?

Mike Lincoln: I will give you a couple of examples. Vubiquity is a company that started in a conference room in our office and last year sold to a public company called Amdocs. The founders were coming in every day and I would go down to a conference room and strategize and eventually they moved out of the conference room, but they went on to do a sizeable exit after multiple rounds of venture capital. While we are not an incubator or accelerator, at least as it relates to physical office place, we do play this role in that sense.

We often have companies come in and spend time with us strategizing and we are not making any money on that. Obviously we cannot really send them a bill for that coaching, advisory role, but trying to help them craft a strategy to get funded is a big part of our role. Vubiquity would be an example of a company that we helped to spawn and I now work with that CEO on his next venture-backed company and he calls me virtually every day.

For us, there are two primary sources of introductions: serial entrepreneurs and serial investors, who come back time and time again and go back at it and they start these companies even after they’ve made fabulous sums of money. The ironic thing in our businesses is that entrepreneurs who are highly successful do not usually check out and instead the do it again and again, and it’s a very, very well-known pattern that is counterintuitive to many people.

Another example would be a local company called Optoro. I started working with the founders when they were in their 20s and the business was in a warehouse as an Ebay reseller business and was not a model that would be disruptive and grow significantly. But these were sharp young guys who planned to make a pivot and they have gone on to raise money for Kleiner Perkins and a bunch of great funds and they are one of the strong high-flyers in our market. We have been there with them every step of the way and done a lot to facilitate introductions.

I teach a class at UVA Law School and I’ve been teaching that class for 20 years. It really is more of a business class than a law class and, in some sense, it is my way of giving back a little bit. A few decades ago, law schools on the East Coast did not have a class of this nature the way that schools like Stanford and Berkeley have long offered this to students. And so we started offering this class 20 years ago at UVA and I have been teaching it ever since. I have guest lecturers each week, from entrepreneurs to investors to investment bankers, and so this exposes students to the ecosystem in a way that stands out from most law school courses.

Eric Eldon: Great. So just go in the opposite direction. Can you tell me about any horror stories you’ve seen, precautionary tales for what you tell people to avoid, especially in the early stages?

Mike Lincoln: I represented a company called CrowdRise. It was co-founded by the actor Edward Norton and there were plenty of angels willing to back the company. So this was not a matter of access to capital but access to the right capital to really propel growth. We conferred on the finance strategy and the company ended up raising a round from Fred Wilson at Union Square, along with Spark Capital. The founders were very focused on the social good that comes from the platform and so in that sense it was very much a double-bottom line company. CrowdRise subsequently merged with GoFundMe. The cautionary tale in my mind is that for disruptive companies to ultimately be successful, all of the pieces of the puzzle have to come together and in this case one of those pieces was not just money but smart institutional money and smart advisors to help propel the company to be one of the winners in the space.

Eric Eldon: How you do billing? How do you work when somebody comes in and they just have an idea or maybe they did their incorporation paperwork already, how do you run the clock? How does this work?

Mike Lincoln: I think about this much like a software development firm. If you approach a software development firm and you say, “Can you build this module with this functionality and what will it cost?” They think of it in modular terms: how many programmers or engineers does it take to build this deliverable? I don’t think about hourly rates but rather in terms of deliverables and what that deliverable should cost. Entrepreneurs want predictability and they want real value. We deliver that predictability and that value.

And then with respect to the advisory, coaching and hand-holding side of working with startups, that time is generally not billable and so it is, in essence, an off balance sheet investment in the companies we take on. But by taking that risk and really helping to add value, founders tend to be deeply loyal to their startup lawyers because most of them get the fact that it is tantamount to a real cash investment in the company.

It may be $10,000 or $20,000 of time, or more, but there is some amount of time invested and for a service provider, the key issue is opportunity cost. If you are going to take on startups, you have to invest some non-billable time and that is kind of like an investment in the company. It is an in-kind investment, no different than if I own office space and I said to somebody, “You can have 5,000 square feet and I’m not going to charge you for the first several months.” With each company that I take on, I am making an investment in the form of thousands of dollars of in-kind “time” and that goes back to being a good portfolio manager. A startup attorney has to build and manage an accretive portfolio of companies that eventually get funded, and if you do that right, you’ll reap the long-term rewards. You just don’t reap them on the front end the way most large law firms do. You reap them on the back end.

The truth be told, not many jobs allow you to get paid to use your brain. When you work with entrepreneurs, it’s deeply gratifying to be at a closing dinner and to have somebody thank you for helping to get their company up off the ground. Or in my case, I will never forget the story of an immigrant who told me how his mother and father were professionals in their home country and they came here and sacrificed everything — his dad drove the cab and his mom cleaned houses. He made a fortune and he bought his parents a house and he thanked me for making that possible. This is deeply embedded in paying his parents forward for the sacrifice they took leaving their country to come here and they had to lower themselves to doing those jobs because for various reasons they could not get other kinds of jobs. My only point is, when I hear somebody say, “Thank you for helping,” it often has larger meaning than accumulating personal wealth. In this story, the founder did not go out and buy a Ferrari or a big house for himself. Rather, he bought his parents a house. I tell this story because it illustrates why this practice is so gratifying — if you really believe you can make dreams happen and that you can help create jobs and you can help cure disease and other things that startups do, then your practice will flourish and the money will follow because people will see it in your eyes.

They’ll see that you’re passionate about helping to grow a company, helping to solve real-world problems, helping to create jobs, or, in my example, helping to repay a debt of gratitude to immigrant parents who made a sacrifice. I believe, and I tell my students when I teach my class, that’s what is going to make you successful. You should not do this because you are trying to figure out a way to make millions of dollars. You do it just like entrepreneurs do it, with passion and commitment and a higher calling to try in your own small way to change the world.

Founder recommendations

“As a startup, you are always looking for great and affordable legal support and I have worked with a few legal folks who seem most interested in near-term fees. On the other hand, Mike is focused more on the long-term relationship and is genuinely interested in our success. He knows we cannot afford his hourly rate so he makes an investment in us by providing non-billable coaching time since he knows as we grow and need more legal services, we will stay with him because of our mutual trust and relationship. He always goes above and beyond and I believe we got really lucky when we found him.” — A founder of an early-stage startup in Reston, VA

“Mike Lincoln has been serving startups since I started my first startup in 1998. Mike’s greatest contribution to my startups and the startups I have been apart of is his knowledge of the venture community and in applying the law in a common sense approach. He is more of an advisor, a counselor and his approach is always what’s best for the organization, the mission, the team. Mike never takes sides and gives advice based on a win-win approach for all the shareholders. Mike is the best attorney for any startup or venture-backed company. I have worked with over 100 startups and will always call Mike first.” — Mark Modica, Reston, VA, CEO of Centerline Biomedical

“Mike is an entrepreneur’s lawyer. He gets right to the important business issues and ensures that the lawyering supports the business goals. Additionally, he has such a broad experience working with so many different types of technology businesses, that he very often is a tremendous coach on business and executive issues as well. Having significant experience with venture capital, venture growth and private equity, he knows what’s market and how to get to better than market results.” — Andrew H. Rosen, Washington, DC, CEO of Interfolio

“Mike Lincoln has been my go-to lawyer for each of the businesses I have established and has worked with us from formation through funding rounds through a 9-figure exit. His vast range of experience makes him adept at taking complex legal issues and dispelling them in a way that facilitates quick business decisions.” — Haroon Mokhtarzada, Washington, DC, CEO of Truebill

“Mike Lincoln is the best corporate and deal lawyer an entrepreneur can ever meet. He made a tremendous difference to us and played a key role in a number of areas, including: addressing company formation, stock grants, powerful introductions to investors, deal negotiations, and helping get the word out about us. He never billed for his time and help until we received our funding. He also ensured we got the right expertise and helped us negotiate and close successful multiple term sheets. Mike and his team made us feel we had the best legal expertise and helped us build trust with investors. He also played a key role in promoting the entrepreneur. Mike has played an important role in us being named the 7th fastest company on the Deloitte Technology Fast 500 2018.” — Harish Chidambaran, Bethesda, MD, president and CEO, iLearningEngines Inc.

“I’m not sure how Mike does it but he has helped every growing tech company in the Washington, DC area. He has given us the personal care and attention needed to navigate two financing rounds and to help us grow the team to 15 employees. Mike has helped us through various legal scenarios, assisted with corporate governance, provided customer introductions, and offered business friendly advice along the way. I’m looking forward to continuing to work with Mike through our next phase of growth.” — Param Jaggi, Washington, DC, CEO of Hatch Apps

“We have had two employee / HR / related issues in the past couple of years that Mike and Cooley jumped right into making sure got resolved quickly and without disruption. Working with previous employment lawyers, it always felt like they were reactive or passive and just encouraged us to dig our head in the sands, hope nothing happens, and we can respond if it does. Mike and team were strategic and proactive to ensure the issues were resolved. This is in addition to the basic blocking and tackling of helping us close financing rounds, negotiate contracts, etc.” — A co-founder in San Francisco

“Mike Lincoln @ Cooley has represented me in three different startups. 1) He knows the pitfalls of not getting a Series A/B done correctly which can create major issues later on in a sale. 2) He tries to find business solutions that are fair to founders, management and investors — so that everyone wins. With this reputation, all folks around the table trusts him. 3) He goes beyond legal and tries to help you with the business and connect you with relevant folks. 4) He is very responsive.” — Dev Ganesan, Chicago, IL, CEO of ItemMaster (now part of Syndigo)

“Mike Lincoln is the consummate startup attorney. I am now CEO of my third startup. The first company went all the way to IPO; the second was acquired by a public company; my third is now closing a $20 million Series A. Mike is incredibly knowledgeable and a great advisor for startup management teams. He is also well-connected across the Venture, Growth and Private Equity community. Mike has extensive M&A and IPO experience as well. A startup executive would be hard-pressed to find a more capable lawyer or better trusted advisor than Mike. Mike has helped my companies secure several rounds of capital as well as navigate the M&A process to successful exit.” — A serial entrepreneur and CEO in Washington, DC

“Mike and Cooley supported my startup when we didn’t have funding, helped us through various challenges and helped through a $30 million investment and it just keeps going.” — Matt Dorman, CEO, Credible Behavioral, Rockville MD

“I’ve worked with Mike Lincoln and Cooley on four startups, three funding rounds of $14 million, and one $60 million exit. His expertise across all areas of formation, contracts, HR, and intellectual property is top-notch. Mike knows everyone and is an excellent connector, a real value add for early founders. On top of that, Cooley is super easy to work with and truly focused on business value. After four startups, Mike is the first person I call when I need legal counsel – no one else.” — A serial entrepreneur in Washington, DC

“As a CFO for seven growth-stage tech companies, I’ve come to depend on Mike’s legal expertise, problem solving abilities, contacts and broad business skills to raise well over $100 million in debt and equity financings, navigate 10+ M&A transactions, manage board and shareholder issues, and address myriad other expected and unexpected challenges that businesses at this level face every day. He has built a very strong team of business-oriented legal professionals that share his cultural underpinnings and character, and he and they have always, without exception, delivered outstanding services as a trusted business partner in the truest sense. I know if I have a legal or even a business problem that he/they can be counted on to help me resolve it.” — Brian Daum, Reston, VA, CFO

“Mike Lincoln was instrumental in helping our company navigate our Series A financing and cleaning up our cap table structure of over 100+ folks. Mike has an immense amount of knowledge on the formation and M&A process, connections to venture capital firms — overall he’s an amazing attorney.” — Josh Anton, Washington, DC, CEO of X-Mode

“Mike led us through a less than 30-day due diligence process, from term sheet to close with a top-tier venture firm. He provided great advice on company structure, compensation and real world business matters.” — A CEO of a mid-stage company in Arlington, Virginia

“Mike has been my go-to lawyer for venture-backed companies I have worked for in the DC area. Whether you are an pre-funded start-up or a $100m+ growth company, Mike puts in the same high level effort and diligence When I was starting my career, Mike helped guide me through the VC fundraising and corporate governance process. When I founded my own company, Mike was the person I turned to for guidance. He is not only a great lawyer and person, but also is surrounded by excellent associates and partners, creating a valuable team for any company.” — Bob Latchford, Bethesda, MD, CFO

“Mike has been helpful in structuring our company, closing financing rounds and working through strategic deals and very complex transactions. He’s also built a great team of specialists around him that we can tap for specific things such as data agreements, etc.” — A startup CEO in Herndon, Virginia

“We had a founder dispute early in the lifetime of the company and he went way above and beyond to support in it, spending dozens of hours on it and being accessible at all hours via text & phone. He knew we had to get through it and so he didn’t bill us a single hour for it. Now two years later, he’s continued to be incredibly available not only for our legal issues (where he is great) but also in other supportive ways for our company (introducing us to local angels in the early days, etc). Couldn’t recommend him more highly.” — A co-founder in Washington, DC

“Mike has been my go-to attorney for over ten years. While I’ve served as a partner at Expa, Mike has been an invaluable resource to our companies. When he engages alongside his firm Cooley, they are not only a trusted guide regarding legal questions, but also a critical partner when making key business decisions. I met Mike while I was founder and CEO of AddThis, now a division of Oracle Data Cloud. Mike served as our counsel and attended board meetings. His contributions to our firm were many, but some of his key contributions occurred during two acquisitions we made, as well as when we sold AddThis to Oracle. Mike was an instrumental member of our team as we negotiated and closed these three key transactions along with his associates. Without his help, our company may not have achieved the outcomes it did with respect to M&A. Moreover, Mike was also a great personal mentor to me as a first-time CEO and founder. He was often my first call when tackling issues with my team, board and strategy. He is my first recommendation to any founder and I work with him on every project that presents the opportunity.” – Hooman Radfar, San Francisco, Partner at Expa

“Mike Lincoln is not only counsel, but he is a great business partner. Has seen it all and provides not just great legal advice but business advice too.” — Ramu Potarazu, Tysons Corner, VA, CEO of Binary Fountain

“Mike and his team at Cooley were very involved with our growth at our company from seed stage to negotiating our acquisition by one of the world’s most valuable companies, for a lot of money. Mike attended all board meetings, provided legal but also great general business advice. He opened up his network to us for both hiring and fundraising and had a ton of experience that helped guide us away from potentially bad relationships. When it came to selling the company, the deal was very high pressure and the legal team on the other end was huge, but Mike and the Cooley team were able to pull resources to match the other side, and guide us through the process. I believe we got a much better end deal because of them. Also compared to previous acquisitions I have been a part of, their fees were very reasonable. Mike has stayed in touch and friendly for years after selling the company, and is still available to help. Can’t recommend enough.” — A serial founder and executive

“Mike Lincoln is one of the most sought after and influential tech personas in the DC Metro area. For more than two decades Mike has solidified himself as our region’s most prolific sounding board; in fact, there is not a deal that goes by in the DC Metro area that doesn’t first stop at Mike’s desk. I have worked hand-in-hand with Mike now on three separate startups, and in every case he has played the role of change-maker, aiding in these ventures succeeding and growing to new frontiers of success. In my first venture, Mike acted as a connector, introducing me to our first VC partner, helping us to begin this great journey. While not all partnerships work out and even when things got ugly for us, Mike showed incredible character and an uncanny level of compassion as he worked to protect this founder and my venture. During my second venture, I again leaned on Mike’s mindshare and leadership as he helped me elegantly navigate through a set of complex issues with one of my former partners. Finally, amidst the exit of my third and most influential venture, paired with one of the most life-changing moments of my life, Mike’s influence was the silver-bullet that helped get the M&A deal over the line, near the midnight hour, allowing for a founder’s dream to come true. It is tough to put into words to justly describe the impact that Mike Lincoln’s leadership, generosity, and grit has had. Mike Lincoln represents a different breed of practicing law, and the DC Metro area tech-ecosystem is thriving because of it!” — Sundeep Sanghavi, founder and managing partner of DXFactor

“I would not be where I am today in my entrepreneurial journey if it was not for Mike. He has been the calming force in the ups and downs of starting and running a growing company. When I first met Mike, I realized who he was and asked him why he was meeting with me several times without charging me for a single minute. He said that he believed in me as an entrepreneur and he wanted to be a part of whatever project I did in the future. When I started to build Rooam in stealth, the first person I told was Mike. He has been one of our biggest supporters and he has a big role in Rooam’s growth. Every entrepreneur needs a ‘Mike’ supporting them. For the next 50 years of my entrepreneurial journey, I will not start a single project without having Mike Lincoln on my side. He is the best startup lawyer in the country. Period.” — Junaid Shams, Washington, DC, CEO of Rooam

“Mike is a business lawyer first and foremost. He always thinks as a business person before providing legal advice and guidance. As a way of example of his greatest contribution, I will describe a time in which the board was considering a purchase of another entity with a complex deal structure. As it happens the board was divided in terms of moving forward and emotions had taken over. Mike, as outside legal counsel, had observed and participated in the month-long deliberations and realized that the board needed a fresh perspective. He made a very persuasive case as to the reasons for which this acquisition was very good for the company in the long term even though some of the deal terms and price may have been different that what the board had expected. Furthermore, even though some of the legal terms were not market, Mike thought the deal overall was a reasonable and the combined company value was higher than the sum of the parts. The deal closed and the company integrated the new entity. The combination increased shareholder’s value to a number higher than what the board had anticipated and expected. In summary, Mike not only provides legal advice but he also offers years of practical business guidance which is very useful to startups and entrepreneurs.” — Jorge Forgues, Tysons Corner, VA, CFO of Binary Fountain

Comment