Pranav Deshpande

There’s an old trope in the West that India is like Indian trains — exotic, lurching and slow.

But tropes can be bad as a business strategy — and this trope is causing American companies to miss out on Indian moonshots and trillion-dollar opportunities.

In this article I’ll focus on fintech, which is leapfrogging in a way traditional banking never could. Morgan Stanley expects India’s digital payments penetration to increase from 5 percent today to 20 percent, and the e-commerce market to reach $200 billion, with 475 million e-commerce shoppers, adding up to a GDP upwards of $6 trillion — all by 2027.

Just like India’s mobility revolution. Most Indians went from having zero connectivity to being on the mobile internet without ever seeing a PC or even a landline. India now has 800 million mobile phone users with 430 million having internet connectivity. According to Morgan Stanley, the number of internet users is expected to grow to 915 million by 2027.

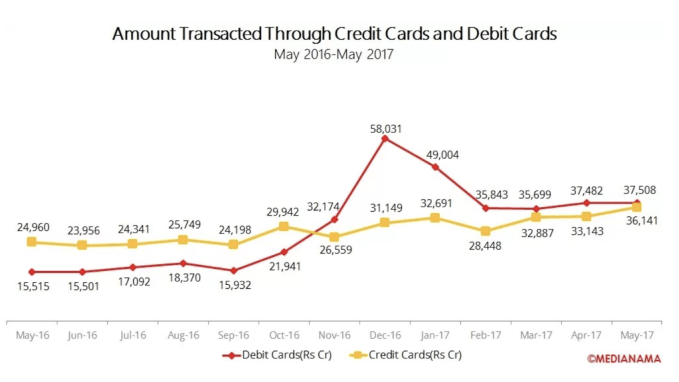

The same leapfrogging is unfolding in payments. While the internet changed how Indians communicate, read news and get entertained, it didn’t change how they transact. As this graph shows, the number of credit and debit cards in India has grown only incrementally. Even top-down initiatives by the government, such as the controversial demonetization decision, struggled to reduce reliance on cash.

Debit card usage spiked in November and December 2016 after demonetization. But it looks like it’s returning to levels below credit card transactions again.

What does this have to do with America? And who could the big US of A lose out to?

China. Because China has already tackled the two biggest obstacles to digital payments — building infrastructure and changing consumer behavior in its own backyard and front yard. By developing a rich ecosystem with strong network effects, WeChat has become the Operating System of China. Alipay has done the same with commercial payments. In 2016, China’s digital payments were already 50 times America’s. Alibaba and Tencent understand ecosystems better than anyone else in the world, including American companies.

And now China is showing the boldness to capitalize on a new generation of payments infrastructure and the patience to win the hearts and minds of Indian consumers.

India’s payments infrastructure is on fire. Bank accounts are the building blocks of financial inclusion, and in just three years, 285 million bank accounts have been added through the JAM program. UPI, or United Payments Interface, also has matured. UPI allows any Indian with a mobile number linked to a bank account to instantly send and receive money. Managed by the NPCI (a nonprofit organization), it also has APIs that allow any application to easily embed instant payments. Tech companies like Google and Flipkart already have UPI-based payment apps in Tez and PhonePe. Major Indian banks also have added UPI to their apps. WhatsApp also has plans to roll out it out to its Indian users.

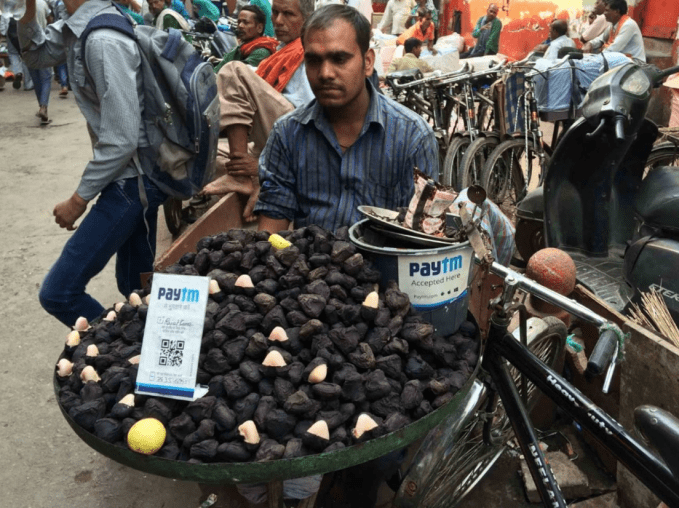

Payments infrastructure means little without accessible experiences. A new generation of mobile wallet apps is solving that problem. PayTM is the largest with 200 million users. PhonePe also has wallet functionality. With these apps, users can connect their bank accounts or debit cards to transfer funds to the wallet to use for peer-to-peer payments, transact with small businesses or buy cellphone minutes. PayTM made serious inroads after demonetization, with street vendors, nannies and drivers also accepting it.

Alibaba is the single largest shareholder in One97 Communications, PayTM’s parent company, with an investment over $1.2 billion. Alibaba isn’t just looking for a venture scale return on investment. This is a strategic partnership unlike any other seen in India. They’ve publicly stated they see PayTM as a local partner with whom they will share their expertise in e-commerce and payments. There also are strong similarities between the strategies of both companies, with the focus on owning payments to own the consumer. Alibaba wants to get to 2 billion users by 2036. They’re not getting there without significant market share in India.

The second hard problem is changing consumer psychology. Indian consumers are value conscious. They’re wary of new products and require significant social proof before trying them. There’s also a high bar for trust that products need to overcome before a product can be adopted. And let’s face it. Understanding digital payments is hard to understand for most of us. This explains those low debit card usage numbers. Most people don’t even trust debit cards, even though they’re issued by a bank they trust!

China has solved this problem differently than American companies have.

China is looking beyond the 60-100 million affluent Indians and the retail stores that use credit cards. They’re also not getting tripped up by the less affluent 300-500 “middle India” consumers who don’t really use debit cards or trust digital payments. They’re addressing these consumers by studying and investing in where they’re spending their time.

Tencent already has 1 billion users in China who use their products every day to order food, buy tickets, play games and hundreds of other activities. Tencent is instead investing in adjacent industries. Thus, they’ve participated in a $1.1 billion round for Ola, India’s largest ridesharing company, and a $1.4 billion round for Flipkart, the largest e-commerce company.

Where is America in all this? American companies still largely view the Indian financial sector as stodgy and are focused on the urban affluent consumers, versus the entire country.

So far, American investment in India’s booming payments space have been paltry by Chinese standards. The only company with skin in the game is Amazon. They’ve committed $5 billion dollars to India and are buying stakes in Indian retailers. But we’re not seeing the same level of strategic investment and partnerships with local companies.

Despite the deep economic and military ties between the U.S. and India, at the present moment China has stolen a march ahead of America in investing in the Indian fintech frontier. There’s a real risk of American companies being left behind.

Comment