Editor’s note: John Frankel is founder and partner of ff Venture Capital and has been an early-stage venture investor since 1999. He has served and/or now serves on the boards of 500px, Adcade, Apparel Media Group, AppyCouple, Alerts.com, Centzy, ClearPath Immigration, Infochimps, InteraXon, Gobbler, Klout, Patents.com, Parse.ly, Phone.com, Quigo Technologies, StrongTech, The Goldman Sachs Trust Company, Track.com, VolunteerSpot and Voxy. Follow him on Twitter.

Having spoken with many limited partners, it is clear that there is a lack of access to the research out there that compares return generation from different venture classes and, in particular, compares angel returns with those of venture funds. I finally have had the time to collate the research we have found, and am happy to share it. This post is quite technical, but the bottom line is simple: angel-stage funds outperform.

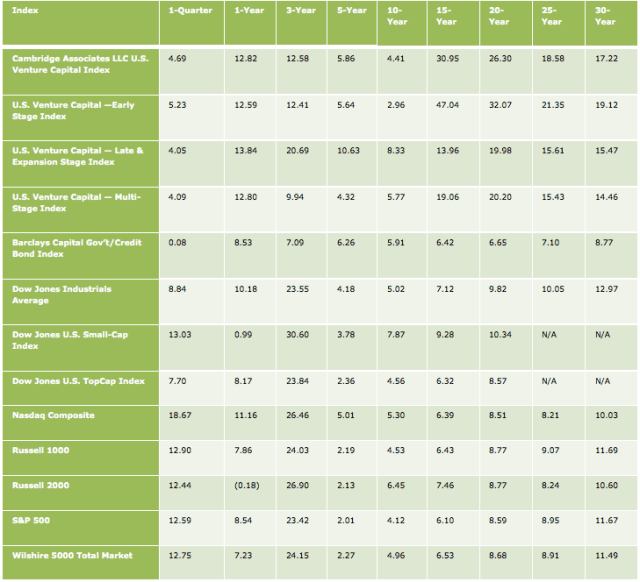

Venture capital funds, in aggregate, managed an anemic 4.41 percent end-to-end pooled return over the last 10 years.[i] Despite the risk and illiquidity of the asset class, they haven’t outperformed public markets.[ii] As one Kauffman Foundation report sums it up, “since 1997, less cash has been returned to investors than has been invested in VC.”[iii] Return dispersion for the asset class is high, however, with a mean difference in internal rate of return (IRR) of 12.6 percentage points between the 75th and 25the percentile funds from vintage years 2000 to 2006.[iv] This means that the best funds do much better than the average in this class; or simply that top performers are still generating impressive returns and that it is worth putting the resources to work if they can improve performance.

End-to-end pooled return, net to limited partners

Source: 2012 U.S. Venture Capital Index, Cambridge Associates

Source: 2012 U.S. Venture Capital Index, Cambridge Associates

There are diverse views as to why venture funds have struggled—in part because it is difficult to isolate causes of failure, and in part because the funds’ returns are measured over a decade-plus. The existing research, however, is quite informative and gives us a sense that misalignment of incentives and overcapitalization are highly contributory.

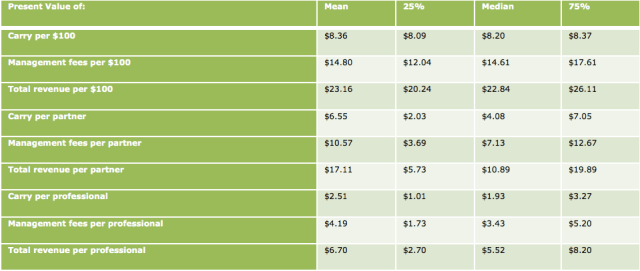

Angel investing is hard to scale, so most angel investors scale simply by adding more capital. Large funds allow them to lock in high levels of fee-based personal income.[v] Indeed, a typical firm now makes two-thirds of its revenue from annual management fees rather than performance-based carried interest.[vi] The larger the fund, the more likely it is that income is tied to fund size rather than performance. The incentive becomes raising larger funds rather than generating stronger returns.

Venture capital fund characteristics (94 funds)

Source: The Economics of Private Equity Funds, The Review of Financial Studies

Source: The Economics of Private Equity Funds, The Review of Financial Studies

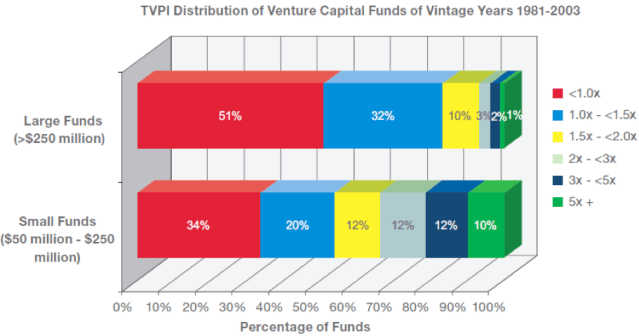

What’s more, the preponderance of evidence indicates that large funds are generally at a disadvantage in generating strong returns.[vii], [viii] It is not only individual funds that have grown too large; the industry as a whole may have absorbed too much capital to produce reasonable returns.[ix] To achieve 3x gross returns on $25 billion of committed capital, exits would need to accrue $150 billion (assuming that half the companies’ equity is held by venture firms).[x] Venture-backed exits peaked at $88 billion in 2000, and haven’t come close since.[xi] As this logic would suggest, increased capital commitments did indeed lead to a collapse in performance.[xii]

Source: Dialing Down, Kauffman Foundation

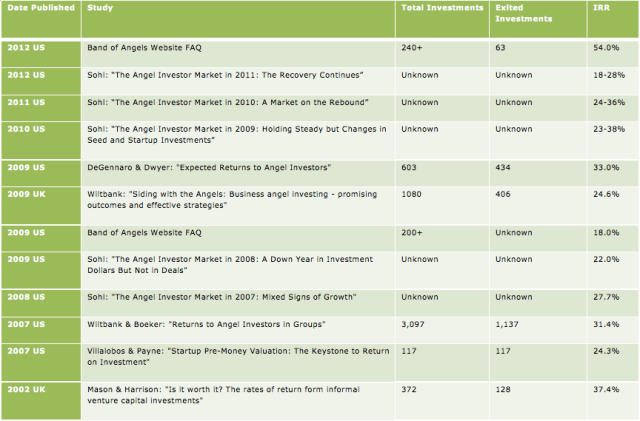

Angel groups, on the other hand, have done exceptionally well.

Every large angel return study has mean angel IRRs ranging from 18 percent to 38 percent.[xiii] Since the angel space has one of the widest return dispersions available to investors, individual investors are likely to see variation from the mean. Even so, detailed exit analysis has revealed that angels have robust rates of “home run” (5x or more) investments, while maintaining a decisively lower level of risk.[xiv], [xv]

Source: Historical Returns in Angel Markets, Right Side Capital Management (and other sources)

Source: Historical Returns in Angel Markets, Right Side Capital Management (and other sources)

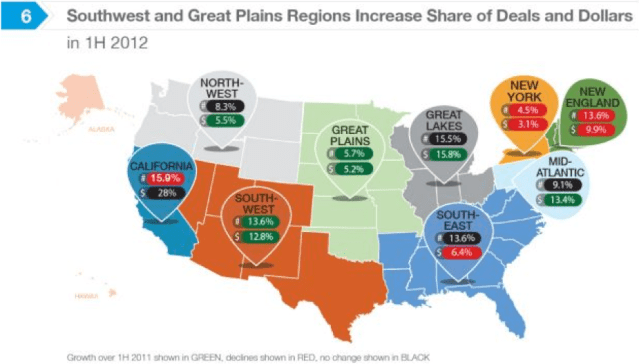

It is informative to know that amongst angels, top performers conduct more due diligence before investing and are subsequently more actively involved with ventures.[xvi] Compared with venture funds, angel investments are less distributed by stage (with a decided focus in early and seed stage companies), but more distributed by geography.[xvii], [xviii], [xix]

Source: 1H 2012 Halo Report, Silicon Valley Bank/Angel Resource Institute

The above is the sum of the research we have found on the sandpit we play in. It argues that smaller funds, focused on the angel space, with deep resources for due diligence and an ability to help their companies get to the next level, should outperform. Our objective is to stay in the top decile of fund performance. Strangely, our strategy is one that very few others follow.

ff Venture Capital is an institutional player in the angel space. After all, the firm grew out of my personal angel investing, and, rather than grow into a standard venture firm, we have taken the stance of hacking the venture model by staying in the angel space. We invest in early stage companies all over the country as well as internationally, combining the rigor and resources of a venture capital firm with the market strategy of an angel. We deliberately run relatively small funds.

As noted above, it takes time to prove out a strategy, but we have performance validation over the past 12 years, as well in our 2008 and 2010 funds. The irony is that most institutional limited partners feel constrained by having too much capital to consider investing in funds of our size, despite the performance characteristics of the space. Until that changes, it keeps capital out of our space and maintains high returns for funds such as ours.

Thanks to Matt Joyce and Yong Kwon for help researching and drafting this.

i Q1 2012 U.S. Venture Capital Index, Cambridge Associates

ii Q1 2012 U.S. Venture Capital Index, Cambridge Associates

iii We Have Met the Enemy…and He Is Us, Kauffman Foundation

iv Q1 2012 U.S. Venture Capital Index, Cambridge Associates

v We Have Met the Enemy…and He Is Us, Kauffman Foundation

vi The Economics of Private Equity Funds, The Review of Financial Studies

vii Dialing Down, Silicon Valley Bank

viii We Have Met the Enemy…and He Is Us, Kauffman Foundation

ix The VC Math Problem, Fred Wilson

x The VC Math Problem, Fred Wilson

xi 2002 Venture Backed Exit Activity Report, Thomson Reuters / NVCA

xii Right-Sizing the U.S. Venture Capital Industry, Kauffman Foundation

xiii Historical Returns in Angel Markets, Right Side Capital Management

xiv Angel Investor Performance Project, Kauffman Foundation

xv Ongoing Research, Harvard Business School

xvi Returns to Angel Investors in Groups, Kauffman Foundation

xvii The Angel Investor Market in 2011, Center for Venture Research

xviii Yearbook 2012, NVCA

xix 1H 2012 Halo Report, Silicon Valley Bank / Angel Resource Institute

Comment