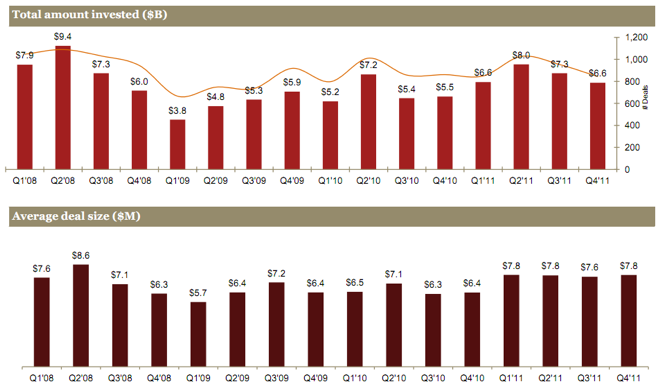

VCs poured significantly more money into deals in 2011, according to a recently released MoneyTree Report by PricewaterhouseCoopers and the National Venture Capital Association, based on data from Thomson Reuters. Venture capitalists invested $28.4 billion in 3,673 deals in 2011, an increase of 22 percent in dollars and a 4 percent rise in deals over the prior year. The amount of venture dollars invested in 2011 represents the third highest annual investment total in the past ten years.

In terms of the fourth quarter, investments in the quarter totaled $6.6 billion in 844 deals, which is actually a 10 percent decrease in terms of dollar amount and an 11 percent decrease in deals from the third quarter of 2011 when $7.3 billion went into 953 deals.

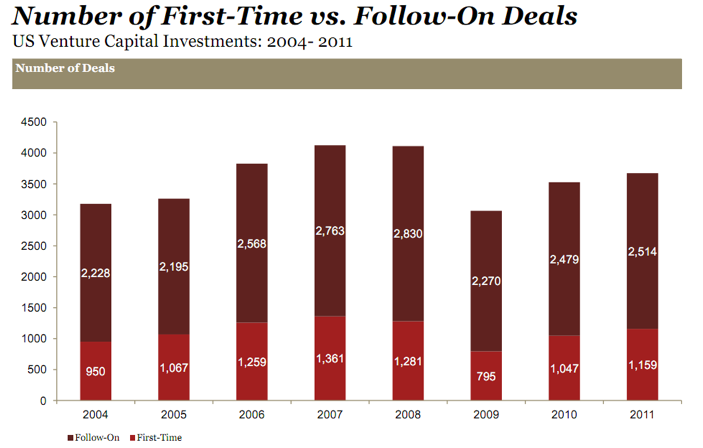

Double-digit increases in investment dollars in 2011 were spread across a number of industries, including the Clean Technology and Internet sectors. Investment dollars also increased across every stage of investment categories, with the exception of a 48 percent decrease in seed stage investments. First-time financings rose in 2011 compared to the prior year, however, fourth quarter investing did show a decline in both first-time dollars and deals when compared to Q3 2011.

Tracy T. Lefteroff, global managing partner of the venture capital practice at PricewaterhouseCoopers observes that investors “are acting prudently and not chasing excessive valuations” and we’re “unlikely to see these sectors overheat like we saw in the 1999 to 2000 era.”

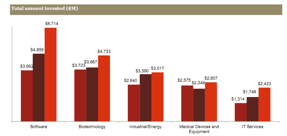

The Software industry brought the most VC dollars by sector for the year, with the amount raised up 38 percent over 2010 to $6.7 billion in 2011. VCs invested into 1,004 software deals, a 7 percent rise in volume over the prior year. Reflecting the fourth quarter decline, software investing was down in the last quarter of 2011 with $1.8 billion going into 238 deals. Despite this decrease, software was also the number one sector for dollars invested and total number of deals in Q4 and counted more than double the number of deals during the quarter than the second largest sector, Biotechnology.

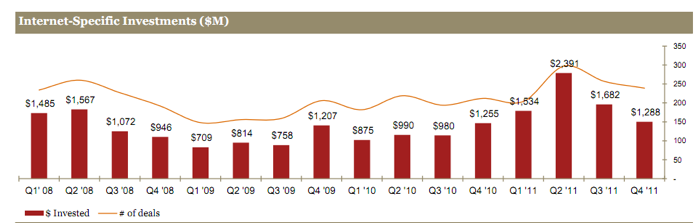

Internet companies also saw a significant increase in investing in 2011 with $6.9 billion going into 997 deals. That’s a 68 percent increase in dollars and 24 percent increase in deals from 2010 when $4.1 billion went into 807 deals. In fact, 2011 marked the highest level of Internet investment over the past decade.

For the fourth quarter specifically, internet-specific investment declined 23 percent in dollars and 7 percent in deals with $1.3 billion going into 239 deals, compared to $1.7 billion going into 257 deals in the third quarter of 2011. Internet companies accounted for 24 percent of all venture capital dollars in 2011, up from 18 percent in 2010.

Thirteen of the 17 industry categories experienced increases in dollars invested for the year. Industry sectors experiencing some of the biggest dollar increases in 2011 included: Consumer Products & Services (103 percent); Media/Entertainment (53 percent); Electronics/Instrumentation (52 percent); and IT Services (39 percent).

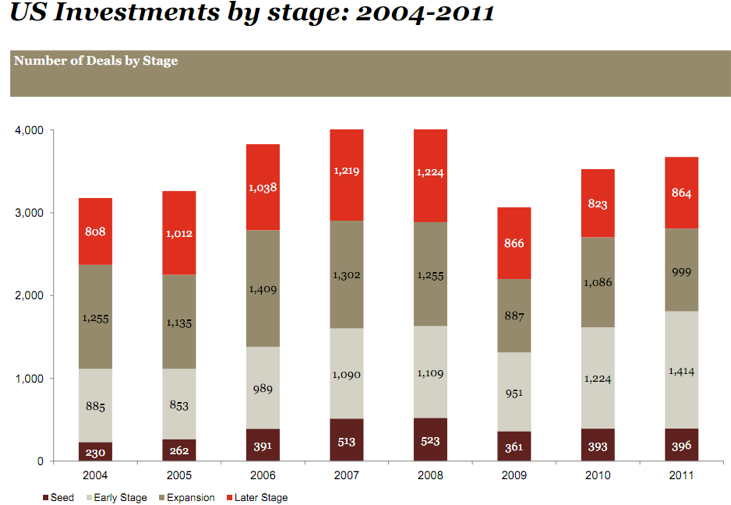

In terms of venture capital by company stage, investments into Seed Stage companies decreased 48 percent in terms of dollars and were flat in terms of deals with $919 million going into 396 companies in 2011. For the fourth quarter, venture capitalists invested $134 million into 80 seed stage companies, a 40 percent decrease in dollars and a 28 percent decline in deals compared to the third quarter of the year. Seed Stage companies attracted 3 percent of dollars and 11 percent of deals in 2011 compared to 8 percent of dollars and 11 percent of deals in 2010. Seed stage deals were the only stage to experience a decrease in average round size for 2011.

Early Stage investments experienced double-digit increases, rising 47 percent in terms of dollars and 16 percent in terms of deals in 2011 to $8.3 billion in 1,414 deals. For the fourth quarter, Early Stage investments increased, with $2.3 billion going into 364 deals, an 11 percent increase in dollars in Q3 while the number of deals was flat. Early Stage companies attracted 29 percent of dollars and 38 percent of deals in 2011 compared to 24 percent of dollars and 35 percent of deals in 2010.

Expansion Stage investments increased in 2011 by 9 percent in dollars and dropped 8 percent in deals with $9.7 billion going into 999 deals. Expansion funding dropped in the fourth quarter, dipping 9 percent from the prior quarter to $2.4 billion. The number of deals also decreased during the quarter, falling 21 percent to 222. Expansion Stage companies attracted 34 percent of dollars and 27 percent of deals in 2011 compared to 38 percent of dollars and 31 percent of deals in 2010.

In 2011, $9.5 billion was invested into 864 Later Stage deals, a 37 percent increase in dollars and a 5 percent increase in deals for the year. For the fourth quarter, $1.8 billion went into 178 deals, which represents a 26 percent decrease in terms of dollars and a 9 percent decline in terms of deals from the third quarter of 2011. Later Stage companies attracted 33 percent of dollars and 24 percent of deals in 2011 compared to 30 percent of dollars and 23 percent of deals in 2010.

Comment