Amid a global slowdown in venture investments for crypto projects, some companies continue to buck the trend. SynFutures, a decentralized crypto derivatives exchange, has completed a $22 million Series B funding round. Pantera Capital led the round, with participation from HashKey Capital and SIG DT Investments, a member of the Susquehanna International Group.

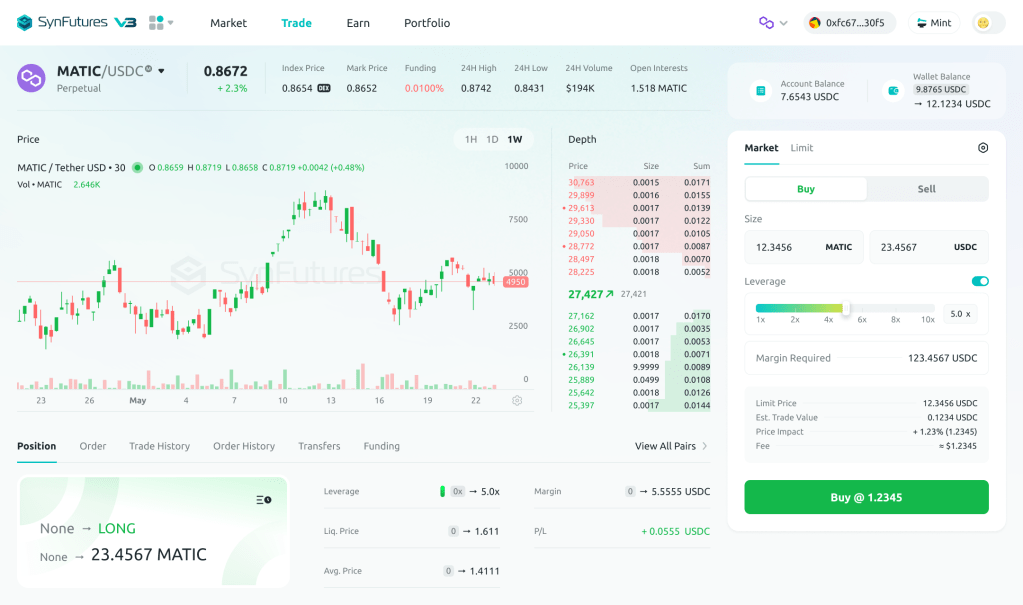

SynFutures is rolling out its proprietary automated market maker (AMM) called Oyster alongside its new raise. AMM, which emerged with the rise of decentralized finance or DeFi, uses algorithmic robots to make it easier for traders to buy and sell crypto assets, rather than having them trade with a traditional order book.

In an interview with TechCrunch, SynFutures’ co-founder and CEO Rachel Lin compared her company to Amazon where “any market maker can list assets in 30 seconds.” The speed is possible thanks to the use of smart contracts, which are lines of code on a blockchain that execute actions based on predetermined conditions. On Oyster, these programs are responsible for everything from pricing to settlements to PnL (profit and loss) analysis.

While AMM has become the backbone of DeFi, SynFutures wants to address one of DeFi’s biggest challenges today — capital efficiency — by enabling on-chain orderbook functionalities that are normally associated with traditional finance.

As we explained in our coverage of Brine Fi, another Pantera-backed DeFi exchange:

An orderbook, as in a traditional stock market, matches buyers and sellers based on price and quantity. It allows for types of orders not possible on a DEX, which are ideal for institutional traders because it lets them better manage their positions under different market conditions and minimize slippage, the different trade execution price than intended.

SynFutures’ target users, according to Lin, are “high net-worth individuals and small institutions.” To date, the company has amassed some 100,000 all-time traders (though one trader might have various wallet addresses). Its trading volume since October 2021 has reached $21 billion.

That’s a lot of money overseen by SynFutures’ small team. Compared to the behemoth size of centralized exchanges, the startup has managed to stay lean thanks to its use of smart contract that automates listing, employing a team of around 20 employees.

Demand for decentralization

SynFutures is one of many startups capitalizing on a new demand spurred by FTX’s demise, namely, the need for more transparent, decentralized forms of crypto trading. All transactions facilitated by SynFutures happen on-chain, and users’ funds are stored in self-custodial wallets.

“There’s no way for us to do any backdoor out there,” noted Lin. “For every fund, you could see yourself: how are the funds doing? What is the exact price that you’re trading at? What is the exact liquidity line?”

Lin expects another DeFi boom in the next two years as its underlying blockchain technology matures. She noted that three years ago when “DeFi summer” came, crypto spot trading volume was less than 1% of the market’s total spot trading volume; right now, its share is 13-14%.

“Derivatives have another dimension, call time, so it has a much higher requirement on infrastructures because there’s liquidation involved,” Lin explained.

SynFutures has bold ambitions to challenge centralized exchanges and even traditional financial giants like JPMorgan someday. Of course, these entrenched players are not complacent and gearing up to defend their positions.

Having worked at Deutsche Bank, Lin observed that traditional financial institutions are indeed experimenting with blockchain — one needs to look no further than Fidelity and BlackRock’s rush into Bitcoin ETF. However, these efforts tend to be quite separate from their core money-making products. “There are a lot of departments and internal politics,” she added.

Uncertainty abounds

As with centralized finance, security is a major concern for DeFi as the underpinning smart contracts are vulnerable to hacking attempts. Curve, one of the largest decentralized exchanges, lost $62 million this year due to a programming bug.

Another pressing issue for DeFi is regulatory uncertainty. While regulators are currently fixated on centralized crypto services like Binance for their significant market size (it’s also easier to target a centralized entity), there are still no clear guidelines from any jurisdiction on how compliance can be done on DeFi, said Lin, though there are examples to draw from.

One of the existing practices requires institutions to undergo a know-your-customer (KYC) process before they can participate in certain whitelisted-only pools. The other way to work toward compliance is for DeFi protocols themselves to remain permissionless — the gateways, for example, wallets and exchanges that offer access to the protocols — to introduce the KYC layer.

“For example, for the latter approach, users burn or mint USDC via their KYC’d wallets, but once that USDC is minted, it can be freely transferred to third parties,” explained Lin. “Here, while on-chain AML [anti-money laundering] checks would still apply due to the industry’s ‘blacklist’ practice, which blocks known terrorist or hacker wallet addresses, these third parties would not be KYC’d.”

Comment