Picking up where we left off Friday, let’s spend some more time in the GitLab IPO filing.

It’s going to be an IPO week, mind; Toast and Freshworks are set to price Tuesday after the close of trading and begin to float on Wednesday. Expect final notes on the value of each and reports on how they trade when they do. The Exchange will also try to get on calls with the CEOs. But because it is Disrupt week, things are going to be a little chaotic.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

But that’s tomorrow. This morning, we’re digging back into developer toolkit GitLab and its impending IPO. Let’s start with a dive into the venture capital players that are going to make out in its public offering. And for the sake of having fun on a Monday, we’ll look back at the GitHub-Microsoft deal. The former CTO of GitHub dropped some interesting data on the company’s historical results that we can use to back into what the deal would be worth today if it happened.

From there, we have some extrapolation to do. And we’ll close with an examination of GitLab’s quarterly data to see if a more narrow view of the company’s operating results tells us anything useful. Let’s have some fun!

From there, we have some extrapolation to do. And we’ll close with an examination of GitLab’s quarterly data to see if a more narrow view of the company’s operating results tells us anything useful. Let’s have some fun!

GitLab’s rich list

As a private company, GitLab raised huge sums of capital — more than $400 million, per Crunchbase data. The capital came in increasingly large chunks from the company’s seed rounds back in 2015 through its late 2019 Series E.

Khosla Ventures led the company’s early rounds before GV, Goldman Sachs and ICONIQ Capital took the baton.

Unsurprisingly, those names are the ones we can spy on in the company’s major shareholder list. From the GitLab S-1 filing, what follows are share counts and percentage ownership stakes for the company’s investors that own more than 5% of its stock:

- August Capital: 14,931,200 Class B shares, or 11.1% of that equity class.

- GV: 8,888,776 Class B shares, or 6.6% of that equity class.

- ICONIQ: 15,472,204 Class B shares, or 11.6% of that equity class.

- ICONIQ: 1,150,784 Class A shares, or 100% of that equity class (to be diluted in IPO).

- Khosla: 19,028,320 Class B shares, or 14.1% of that equity class.

Given that GitLab was valued at $6 billion earlier this year in a secondary transaction, the percentages above convert to huge sums. August Capital, for example, at that price point, is set to reap north of $600 million. That’s bigger than the entire fund from which it snagged ownership, the firm’s $450 million Fund VII.

The GitLab debut is set to make a lot of funds material coin.

The interesting element in this is guessing what GitLab could be worth in its debut. The company’s quick ARR growth — 69% — puts it in richly valued company in the world of public software companies. GitLab could manage a price north of $6 billion, at which point the above firms will enjoy even greater returns.

This is the outlier sort of result that makes venture investing potentially lucrative. Smaller investors in the company are also set to do well, of course. At a $6 billion price point, Khosla could net north of $1 billion. At a $10 billion price tag, the number scales materially.

All this math makes the Microsoft-GitHub deal appear incredibly cheap. Per the company’s former CTO:

Given a higher revenue base and a faster growth rate, GitHub would be worth more than GitLab if valued today. By quite a lot, frankly. And it sold to Microsoft for $7.5 billion, meaning that, if we consult today’s pricing for software valuations, Microsoft got a steal when it bought the company.

More broadly, all exit prices for software that happened before the expansion in the value of software revenue we’ve seen since the start of 2020 are now very low; the market has decided that software is worth more than it previously thought, so lots of deals got done at what we might describe today as discounted rates.

Not that I will ever, ever cry about a multibillion-dollar transaction, but the ∆ in SaaS valuations does create some wonky comparisons.

Quarterly notes

How GitLab is eventually priced will lever heavily on its historical results. When we last dug into the company, we mostly looked at its H1 2021 results, or a two-quarter period. Let’s focus a bit.

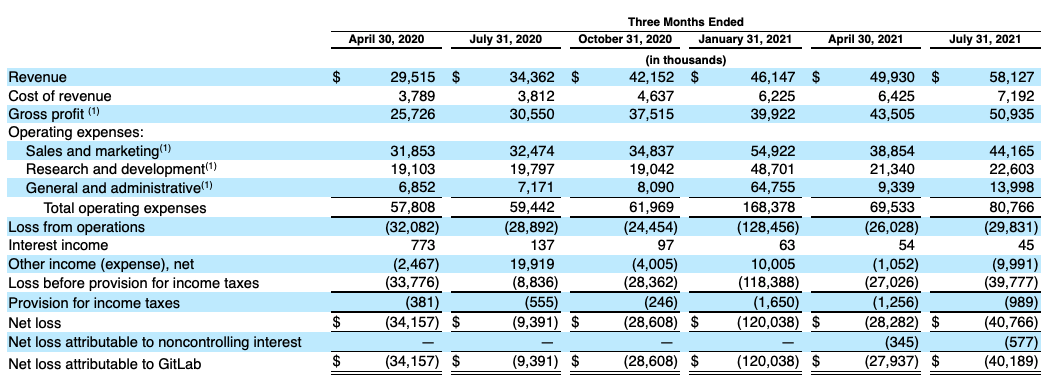

Here’s GitLab’s quarterly revenue breakdown:

There’s good and bad in the above. Let’s start negative.

It’s not exactly great to see a company post a net loss of nearly 3x revenue in a recent quarter when it’s prepping to go public. Sure, GitLab’s income statement cleaned up mightily in its April 30, 2021, quarter, but oof, that final quarter of its most recent fiscal year. And it’s also not confidence-inspiring that GitLab’s losses ticked up again in the July 31, 2021, quarter from its preceding result.

We noted previously that the company’s H1 2021 operating losses were narrower than its H1 2020 (referring to calendar periods loosely associated with fiscal periods for the sake of not writing “fiscal” an extra 400 times). But when we consider the company’s net losses, it’s harder to find a similarly optimistic perspective.

In more positive terms, the company’s revenue growth hit a new record in GitLab’s most recent quarter. Here are the gains to its top line in each quarter displayed, starting with the July 31, 2020, period:

- $4.8 million (July 31, 2020 quarter).

- $7.8 million (October 31, 2020 quarter).

- $4.0 million (January 31, 2021 quarter).

- $3.8 million (April 30, 2021 quarter).

- $8.2 million (July 31, 2021 quarter).

The most recent GitLab quarter posted much greater sequential revenue growth than what the company managed in the corresponding year-ago period. Investors looking for a growth story in GitLab — and willing to dip one step more deeply than its recent half-year results taken in aggregate — may be able to find one here.

There’s another to be found. If we observe GitLab’s growth in six-figure customers, we find the following:

- January 31, 2020: 173.

- January 31, 2021: 283.

- July 31, 2021: 383.

That works out to +100 in a year, and then +100 in a half-year, which is quite good, but partially predicated on the company’s strong net-dollar retention that we noted in our first look at the company’s IPO filing. More simply, because GitLab does a good job charging existing customers for more of its services over time, seeing rising large accounts is not a surprise.

But seeing the pace at which customers are acquired at that cost threshold — or who graduate into it — double in pace so quickly is bullish, full stop.

What’s ahead? An initial price range. When we get our hands on that, we’ll stop waving our hands and knuckle down to some harder calculations. Chat soon!

Comment