While the old adage goes, “Find a job you love doing, you’ll never work a day in your life,” it’s safe to assume this was well before the age of the YouTuber, “plandids” and the stock market of things. StockX may be a multibillion dollar juggernaut with massive influence radiating throughout sneaker culture today, but it started with taking the leap to transforming a personal passion into a business plan.

For founder Josh Luber, keeping his love for sneakers separate from his career was very intentional at first. As he continued to invest into his hobby, he saw something from his corporate jobs that was altogether missing from sneakers — data. As he established and dove deeper into the numbers, an entirely different vision arose. A basketball game, a check and a business later, StockX was born.

The timing was remarkably fortuitous. Sneakers crescendoed from a rising niche to a frenzy over the past decade, and the demand for authenticated goods likewise soared. Few other companies put together the core mechanisms required for a market to function effectively for this category. What began as a basic price chart of online sales that screamed more Microsoft Excel than startup unicorn has now become one of the most intriguing marketplaces in the world.

What’s a sneaker worth?

Before co-founding StockX, Josh Luber was consulting at IBM, deliberately working outside of sneakers to maintain it strictly as a hobby. That setup continued until he realized the opportunity to organize data around his beloved collection.

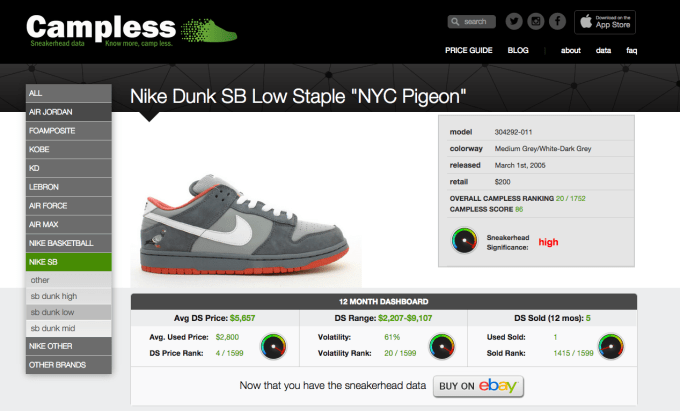

Markets can’t exist without prices, and the price of a sneaker in the secondary market a decade ago was difficult to discern. There was, of course, the retail price, but popular sneakers often gained value over time based on demand, which could wildly fluctuate over time. By scraping data openly available on eBay for over 13 million transactions, Luber and a team of 17 volunteers established Campless, a constantly updated sneaker secondary market pricing guide that launched in 2012.

“While it had a lot of flaws in it and required a lot of manual work, it gave probably the best reference point at the time,” COO and co-founder of StockX Greg Schwartz says. The Campless team was simply pulling prices from closed eBay auctions and analyzing trends from there, much like any individual seller would probably do before posting their own shoes. By scaling up the size of the dataset though, they were getting much more accurate market-clearing prices than were previously available for both buyers and sellers.

Similar to the auto industry’s Kelley Blue Book that offers estimated values for cars by model and year, Campless offered in-depth numbers on the secondary sneaker market that would eventually become a tentpole and proprietary offering of StockX.

Helicopters over malls and the chaotic rise of the sneaker craze

When Luber and his team launched Campless, there weren’t easily accessible options for buying sneakers in limited releases. Enthusiasts could buy directly from the retailer by lining up and camping out for in-store drops, scour eBay for the most legit-looking seller with the best price, or have a plug or backdoor avenue to get their prized pairs. All three options were fraught.

Campless’ name and “know more, camp less” tagline referred to consumers camping out — sometimes spending days in line — for the latest, most coveted sneaker releases. Flight Club, which opened in New York City in 2005, was initially for consignment and typically carried rare, older shoes rather than new pairs. For individual resellers though, eBay and Craigslist were the only options to set up a one-on-one transaction at their own discretion, and neither platform had the necessary safeguards for sneaker authentication or price regulation.

This fractured system might have been sufficient for a market that remained a relatively small niche. But it had been steadily growing in popularity since the 1980s, and the scale got even bigger in the 2010s.

In a 2014 interview with eBay, Luber shared the significance of this period, pointing to one shoe as causing a sea change in the popularity of the category: the February 2012 NBA All-Star Weekend release of Nike’s “Galaxy” Foamposite, part of a celestial-themed pack worn by basketball greats like LeBron James, Penny Hardaway, Amar’e Stoudemire and Kevin Durant.

Trusted sneaker blog Sole Collector called this specific release “one of the most chaotic sneaker releases of the last decade” because it caused “riots nationwide as sneakerheads tried desperately to get their hands on pairs.”

“That was definitely the first time I remembered people other than my group of friends that loved shoes talking about a ‘drop,’” 24-year-old sneaker enthusiast Mark Sabino said.

Andy Oliver, director of e-commerce at the sneaker and streetwear lifestyle brand Kith, looks back on it as a tipping point as well. “I think it was a combination of the right model — Foams were super hot — with a graphics treatment that was really unique at the time. Then, from a marketing perspective, it’s tied to All-Star Weekend, which was a huge deal in 2012. When everyone started to get a sense that they were mostly unattainable, they blew up on another level.”

Brendan Dunne, co-host of Complex Media’s sneaker show Full Size Run, said the release set a new benchmark for chaos and hype. “I think the image of helicopters flying over the mall in Orlando where they released is the enduring image.”

A community that had been around since the 1980s was hurtled into the mainstream eye. Yet even more fuel was added to what Luber called “limited edition sneaker collecting” with the growing popularity of Instagram. For the first time, sneaker enthusiasts could share their favorites with the entire world, showing off their rare finds to potentially millions of people on their feeds and not just their friends in person. Securing that All-Star Weekend drop meant not just being cool, but globally cool, intensifying the pressure on a market that was completely unprepared for the scale of demand that was arriving.

Sneakers were still sneakers, but they were quickly becoming something else: an asset class. Somewhere along the line, transactions for rare and vintage pickups took a backseat to deadstock releases (shoes that are new and have never been worn). “Instead of 10-year-old pairs, people started selling pairs that they’d just bought. Nike SBs drove this some, so did Jordan retro and Yeezy — the Nike pairs,” sneaker journalist Russ Bengtson shared. With the ability to buy a pair and flip them at a 1,000% markup in the same week, he says, “Sneakers became a commodity, and once that happened there were a lot more would-be buyers.”

Campless’ data and analysis on their blog helped this influx of collectors, shoppers and would-be sellers make informed decisions in the Wild West that was the sneaker landscape, but it also gave a clearer view of the money to be made flipping sneakers.

Unfortunately as their value increased and the brands released more exclusives or hard-to-find silhouettes, so did the frequency of sneaker-related violence. From shoes getting stolen at knifepoint to setups to rob a buyer or seller meeting for a private sale, a few incidents resulted in death or jail time. It was becoming increasingly clear that the needs of sneaker consumers were not being met by the existing structures — or lack thereof.

Campless Cavaliers and the genesis of StockX

In another realm away from the camp outs and backdoor deals, co-founder of Quicken Loans and Cleveland Cavaliers owner Dan Gilbert sat down with StockX’s now COO Greg Schwartz and shared an idea with him.

Schwartz recalls the Friday morning in March 2015 that he and Gilbert were discussing options for a new joint business venture. Gilbert was an investor in a private tech company that Schwartz was running at the time and curious to explore something new around the idea that the stock market model could be a more powerful form of commerce.

“We started thinking about the benefits of this model relative to other platforms for consumer goods, other marketplace platforms,” Schwartz said. “There was this conversation around trust, transparency, authenticity and all of these tenants that we maybe take for granted or just don’t think about as you’re buying or selling a share of a stock on a traditional stock market.” Between his children and owning an NBA team, Gilbert was exposed to the hyperengaged sneaker community and thought that a stock market model could gain traction here.

The following Monday, the pair hit the ground running. In addition to considering what the consumer experience of a potential stock market model could look like, they took a deeper dive into educating themselves on sneakers, and particularly the secondary sneaker market which was by then already valued at about $1 billion. They found that all roads led back to Luber and Campless.

“Josh was really the only person in the sneaker community taking a data-driven approach to sneakers,” Schwartz recalls. The information that Campless had compiled for years was crucial for Schwartz and Gilbert’s pitch decks and preliminary branding ideas. Through Gilbert’s network, they were able to find someone who knew Luber to make an intro for them.

“I don’t think Josh thought much of it at the time,” Schwartz said. “I think a lot of people had been talking to him about different sneaker marketplace ideas, but we decided to invite Josh to a Cavs game.”

They started the conversation at halftime during the Easter weekend game in Cleveland and found such common ground that Luber’s stay was extended to a trip to Detroit. They had a common goal: figure out how Gilbert could acquire Campless and to start the journey to building StockX together.

A month after that meeting, Gilbert invested an undisclosed amount into Campless. Luber left his hometown of Philadelphia and his role with IBM in May, and by February 2016 StockX launched in downtown Detroit, headquartered in Gilbert’s One Campus Martius building. Luber, Schwartz, Gilbert and Chris Kaufman, who today serves as chief design officer for the company, are credited as co-founders.

Sneaker Website Campless Relocates To Detroit Following Investment By Dan Gilbert

Growth, growth, growth and a breach of trust

Luber held the position of CEO from launch until June 2019, when the company raised $110 million in Series C financing at a $1 billion dollar valuation, giving it “unicorn” status. During his tenure, the company had raised three rounds of funding according to Crunchbase (not including this Series C), and in 2017, it expanded from selling exclusively sneakers to watches, streetwear and handbags.

But months later, the company ran into a major stumble. In a story first reported by TechCrunch’s security editor Zack Whittaker, StockX experienced a data breach in 2018 that the company initially downplayed. Claiming users’ passwords needed to be updated due to “system updates,” StockX had in fact been hacked and the data of 6.8 million users had been compromised. Stolen data included information like names, email addresses, encrypted passwords (believed to be hashed with the MD5 algorithm and salted), shoe sizes, trading currency and the users’ device type and software version. For a marketplace which had branded itself heavily on trust, the breach and the company’s public evasions would hit its reputation within the sneaker community.

Nevertheless, StockX had by then become the de facto player in the sneaker market, and the marketplace continued to see major growth, expanding internationally in 2019 with a new authentication center in the Netherlands as well as a new corporate office in Japan that year. The company introduced French, German and Italian translations to the platform and added four currencies — pounds and euros as well as the Australian and Canadian dollars.

When Luber stepped away from everyday operations in June 2019, Scott Cutler, formerly of NYSE and Stubhub, took his place. A bit more than a year later, StockX secured another $275 million in Series E funding in December 2020, its fifth funding round to date.

“I think my contribution since I’ve been here has really been expanding the company internationally, which we’ve aggressively expanded,” Cutler shared. He’s also focused on diversifying and growing the range of products available on the platform. “When I joined, it was just the very beginnings of [categories] outside of sneakers, and now we have collectibles as a category, apparel broadly as a category, electronics as a category.”

The original team has grown to nearly 1,000 employees worldwide between the Detroit headquarters, nine authentication centers and the hybrid drop-off and authentication center in New York City’s SoHo neighborhood.

As the world shelters at home, shoe sales continue their growth

Despite the worldwide economic volatility caused by the COVID-19 pandemic, StockX continued to see growth as everyone adjusted to the new normal. “We did not know how this company would perform during a recession. Up until last year, that had been pretty much only a bull market,” Cutler says. His eight years as the executive vice president at NYSE (including during the 2008 global financial crisis) and nearly three years as the president of eBay-owned StubHub offered as much experience as one could hope for during last year’s tribulations. The company conducted a round of layoffs last April affecting about 12% of its staff as it pursued profitability.

Cutler recognizes the circumstances around the pandemic — such as the inability to physically go to stores — drove more people to e-commerce. “I think the trends that we were seeing already prior to the pandemic about access to tough-to-find product became even more important in the pandemic,” he said.

Ultimately, the simplicity in connecting buyers and sellers for high-demand sneakers with limited supply has proven to become applicable to other goods within the hypesphere. As StockX closed its fifth year in operation in February, users spent the most money in its newest category: electronics. The company’s senior economist Jesse Einhorn says, “The two biggest products that sold last year were the PlayStation 5 and the Xbox series — two gaming consoles — in terms of total dollars spent.” But users can also buy and sell authenticated trading cards, sneakers, bags, watches, apparel and other hype collectibles. For this reason, Cutler says, “StockX serves as market data and pricing data for products for the consumers of current culture.”

Perhaps your hobby can turn you into an entrepreneur — for a price that is. But if you are going to pay top dollar for a product, you want to make sure you are getting what you bought. That means authentication and fighting a successful arms race with fraudsters, which is ultimately the secret to StockX’s entire success and where we turn to next in this EC-1.

Authentication and StockX’s global arms race against fraudsters

StockX EC-1 Table of Contents

- Part 1: Origin story

- Part 2: E-commerce authentication

- Part 3: Competitive and consumer landscape

- Part 4: Future and impact

Also check out other EC-1s on Extra Crunch.

Updated April 6, 2021: Josh Luber left StockX in June 2019 and not September 2020 as originally written. Also updated the timeline of the company’s venture fundraises and when it expanded to The Netherlands and Japan.

Comment