Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

A few weeks back we dug into the boom that savings and investing apps and services were enjoying. Companies like Acorns, M1 Finance, Robinhood and others were seeing rapid growth in their assets under management (AUM) and downloads. New data out today underscores how well finance apps are faring in the new, chaotic COVID-19 era.

You can run a simple test on yourself in this case. Since, say, January of this year, have you paid more or less attention to your banking and investing related apps and, more broadly, your financial life? Perhaps you are trying to put a bit more away? Or make sure your 401k isn’t invested in something silly?

If so, you are far from alone. To detail just how much more activity this slice of the startup world is enjoying, this morning we’re taking another look at the growth that this slice of the fintech world is undergoing. We’ll lean on some new data from a mobile app analytics provider (AppAnnie) and a report from a brokerage-infra startup (DriveWealth) to get a clearer picture of where investing and savings apps are growing and just how well they are performing.

Investing in a downturn

Most people think that retail investors are suckers. They buy when stocks are high (because they are going up!) and sell when they are doing down (get out now!). This leads to buy high/sell low behavior, which isn’t good if your goal is to make money from investing.

But that conventional wisdom might not be so true. After all, as the stock market took hits after hit earlier this year — it has recovered some, as we’ve written — retail investors appeared to flock to to investing apps.

This trend was solidified somewhat when we got some data from startups like Public (“Investing app Public told TechCrunch that, since the market downturn began, it has seen investment activity increase by more than 300%”) and M1 Finance (“Signups had surged by over 60%, while net deposits were up nearly 30% at the Chicago-based company”).

We were looking to narrowly, however. According to new data from App Annie, a provider of mobile app data products, finance apps are crushing it both at home and abroad. According to the late-stage startup, the United States recorded “55% growth in time spent in finance apps overall from the week of [December] 29 to peak week in March and April (April 12-18, 2020).”

Across the same timeframe, Japan and South Korea saw 85% and 90% jumps.

The same report includes some less manic data points, with Germany only seeing 30% more time spent in financial applications this year than in December of 2019, and a mere 10% in the UK over the same period.

Turning from the broader fintech app category (consumer fintech and finservices companies tend to be mobile-focused, and app-powered, so when we talk about fintech apps we’re discussing the consumer side of the sector) to what App Annie calls “Stock Market Monitoring and Trading Apps,” more extreme gains can be found. The same report notes that “weekly hours spent” in those applications rose 80% in the United States from a late January week to a late March week and a mid-April week, greater than the country’s 55% growth in time spent in fintech apps more generally.

In short, the boom in fintech app usage, at least domestically, appears to be even more concentrated when we niche from fintech applications more broadly to investing apps more specifically. And it doesn’t look like the trend is slowing down.

A retail boom

Based in Chatham, New Jersey, DriveWealth is a fintech API company that provides tools to other companies so that they can offer investing services to their user base. According to Crunchbase, the startup has raised $29.4 million to date, raising a $21 million Series B back in April of 2018.

Why does DriveWealth exist? Recall that as consumer-focused fintech companies reach scale, they tend to add more and more products to drive more business from their existing user base. Perhaps, say, investing. DriveWealth helps make that happen.

Which means that all sorts of useful information flows through the startup’s APIs. Data that it can collate into a report, detailing what’s going on with retail investors on some fintech apps. The resulting dataset is what you’ve already guessed given the first parts of this post, that volume is going up across a number of categories: newly opened accounts, trading activity, and shares traded, when comparing the last two months against the preceding several.

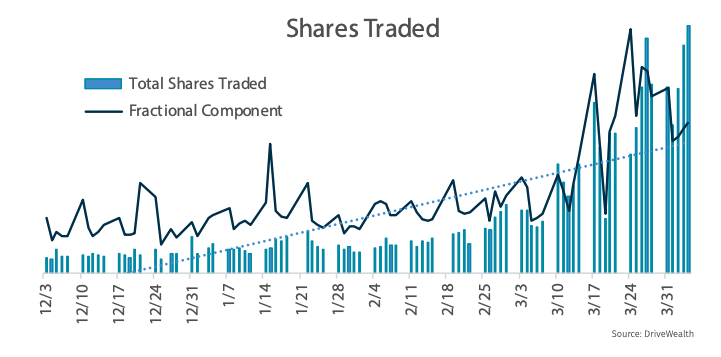

Sharing the most vivid chart, here’s the change in shares traded on DriveWealth’s platform in the last few months:

That’s pretty notable. Of course, DriveWealth doesn’t power every fintech app, but I don’t presume that it’s non-illustrative given what we’ve seen from other data sources like AppAnnie.

The fintech savings and investing boom, therefore, is very real.

Comment