Networking tech giant Cisco has just agreed to acquire cloud infrastructure startup Meraki, and my industry sources confirm the purchase price was $1.2 billion, all in cash. I’ve also gotten ahold of the letter to Meraki employees from CEO Sanjit Biswas. It’s a huge win for the 330-employee San Francisco startup. [Update: The PR just hit the wire, confirming our details on the acquisition and $1.2 billion price.]

Blogger Greg Ferro first mentioned a rumor about Cisco and Meraki early this morning, speculating they might announce a deal later this week. However, TechCrunch can confirm the purchase and the price tag.

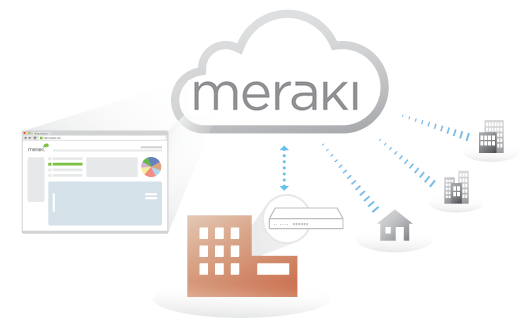

For those unfamiliar, Meraki began as a research project at MIT in 2006. It provides mid to large-size companies, schools, and organizations with on-premise mesh Wi-Fi networking and security devices plus the software to manage them. The tech makes it easy and affordable to run a powerful cloud network without a bulky IT department. It’s also designed to help businesses adapt as their employees increasingly access corporate networks from smartphones and tablets.

Earlier this year, an industry source leaked me financial data on Meraki from an all-hands meeting. It had quietly closed a $40 million funding round, was spending roughly $65 million a year, and it brought in $20 million dollars in Q2 2012 alone. Meraki had only raised $80 million in total before today’s acquisition, meaning early investors like Google, Felicis Ventures, and Sequoia may see a handsome return.

[Update: Cisco’s official release regarding the news explains “The acquisition of Meraki complements and expands Cisco’s strategy to offer more software-centric solutions to simplify network management, help customers empower mobile workforces, and generate new revenue opportunities for partners.”

Eventually, Cisco published a blog post by VP of corporate development Hilton Romanski stating ” Our build, buy, partner strategy has always been driven by customer need and on capturing market transitions…Today, we are excited to announce an important acquisition that addresses the rapidly occurring shift to cloud networking.” He went on to say Cisco was attracted to Meraki because it is “is growing exponentially with great margins.”

Sequoia Capital, who backed all of Meraki’s $5 million Series A in February 2007, wrote up a nice little congratulations blog post called “How 3 guys from MIT transformed the networking industry“. It opens “Quick: when was the last time you plugged in an Ethernet cable? If you have trouble answering that question, you’re one of the reasons why Cisco has agreed to acquire Meraki.”

General Partner Douglas Leone explains that it took a shaky year for Meraki to decide to concentrate on the small to medium enterprise market, but it really took off once it released software that let IT teams fix problems from home. The deal took four days to produce a handshake agreement, and will help Cisco weather the enterprise’s shift to access from mobile.]

The letter to Meraki employees from their CEO that we’ve pasted below notes that Meraki had reached a $100 million run rate, and at first refused Cisco’s acquisition bid as it planned to IPO. After considering the poor valuations tech companies were getting from IPOs as well as an integration plan that would help it retain the Meraki identity, it took the “very significant offer”.

All Meraki departments will continue operating for now, and the company will become the core of Cisco’s new San Francisco Cloud Networking Group office. The deal is expected to close in Cisco’s fiscal Q2 of 2013, which ends in January.

Meraki will continue supporting its existing hardware, services, and customers as well as building new products and features. Meraki licenses won’t change and it doesn’t plan to require its customers to buy Cisco’s SmartNet service. Once the acquisition closes, Meraki will look into expanding Cisco’s scale-centric enterprise offering, but for now will continue focusing on the mid-market and convenience.

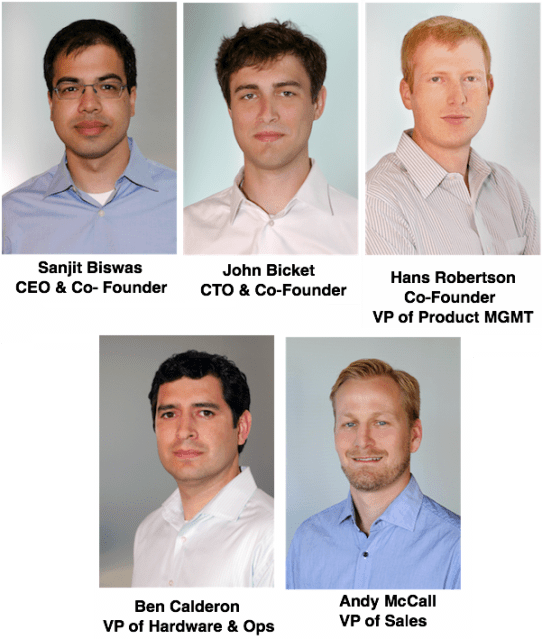

At a price of $3.6 million cash per employee, the exit is massive success for Biswas and his co-founders CTO John Bickett and VP of Product Management Hans Robertson. Meraki saw a big opportunity in making it easy for mid-size organizations to get connected — one the networking giants weren’t addressing. It had to face nimble competitors like Aruba Networks and Aerohive (which might now look like attractive buys), so it raised money fast to fan its wildfire growth and hit 20,000 customers.

And now, rather than risk dealing with fickle Wall Street investors, it took a mammoth cash buyout. Congrats to these scrappy lads from MIT.

Update 11/19: This morning, CEO Sanjit Biswas presented to Meraki’s San Francisco. team, with other offices watching via WebEx. We scored this photo of him explaining how the company will retain its identity and still have an SF office. Immediately after, some much deserved champagne was popped.

Here’s the letter to Meraki employees, which since the leak to me has been published on Meraki’s sassy “Cisco Acquisition FAQ“:

From: Sanjit Biswas, CEO of Meraki, Inc.

Hi everyone,

As some of you may have heard through Twitter or Google Alerts, there is a rumor out that Cisco intends to acquire Meraki. Our original plan had been to break the news to everyone tomorrow before it was officially announced, but it looks like social media beat us to it!

Given this is a big deal, both literally and figuratively, I wanted to take a few minutes to provide some more context about the upcoming announcement. I’d rather have done this in person at tomorrow’s event, but I think it’s important that everyone at Meraki is in the loop.

First of all, this was an unexpected event for Meraki. When we started out six years ago, we were three guys at MIT wondering where our bootstrapped venture would take us over the next few years. We had some exciting ideas about how to build networks, and knew we wanted to have a big impact on the world, but hadn’t figured out how we would connect the dots. Fortunately for us, our customers helped guide the way for us over the years and were able to organically build an amazing set of products and amazing company together.

This year has been particularly amazing for us (sorry to say amazing three times in a row, but it really has been). We successfully shipped another major product family, achieved a $100M bookings run rate, grew from 120 to 330 employees and did it all while achieving positive cash flow.

So, when Cisco approached with an acquisition offer a few weeks ago, our initial reaction was to politely say “thanks, but we’re planning to do our own thing and take Meraki public”. It turned out that was exactly why they were interested in talking to us — over the past six years, we’d developed an innovative product as well as sales model that was indeed our own thing and unique in the market. They had been hearing from customers, partners and analysts that Meraki had built something truly different, and wanted to see if Cisco could distribute the technology on a worldwide scale through their vast sales channels.

It was a very significant offer, so we took our time to think through its implications. First, we decided to break it down into two major components — the qualitative and the quantitative. Being engineers, the numbers were probably easier to reason about: we had been studying public company valuations, and were able to see the price was an attractive offer and gave us credit for high margins, high growth and great future execution. However, the qualitative portion was harder: would we be able to continue doing what makes us special as part of Cisco?

It turns out the Cisco team also understood how important our team, culture and environment are to us, and came prepared as part of their offer. They outlined a few key concepts that helped us with the decision:

- Cisco appreciates the way in which we develop innovative products: by focusing on our customers and quickly trying new ideas in both software and hardware. They’d like to see us continue to release new features and products in the years ahead, and hopefully “cloudify” other Cisco products.

- Beyond technology, they recognized our business model as being highly integrated and customer experience focused. This integration spans across teams, so they’d like all the departments to keep doing what they are doing while figuring out how to leverage Cisco’s distribution channels.

- Finally, Cisco recognized we built a culture and environment in San Francisco that has helped us recruit and retain phenomenal talent across departments. As a result, they’d like us to be a new “Cloud Networking Group”, based out of SF, fun office, free food and all.

After several weeks of consideration, we decided late last week that joining Cisco was the right path for Meraki, and will help us achieve our goal of having maximum impact. As founders, all three of us plan to stay on as leaders of the business unit and look forward to continue towards our goal of $1B in annual revenue. We continue to be transparent with you all, and while some things like our email addresses, etc. will change in our day-to-day operations, we will ensure the important things like our culture stay the same.

In terms of what happens next: this week our job is the same as it was last week — to build amazing products and deliver them our customers. We will also continue to operate as a separate company until the acquisition closes, which we expect before the end of Cisco’s fiscal quarter. The plan is for employees to transfer from Meraki to Cisco.

My apologies again for having to send out email about something so important to all of us. We will plan to cover our plans in more detail at tomorrow’s event, which is being rescheduling for 10:00am at the new facility and on WebEx (three hours earlier than originally planned). AJ/Kathy will email out more details about logistics this afternoon.

Thanks, and see you all tomorrow morning,

Sanjit

—

Sanjit Biswas, CEO

Meraki, Inc.

Comment