ServiceMax, a company that builds software for the field-service industry, announced yesterday that it will go public via a special purpose acquisition company, or SPAC, in a deal valued at $1.4 billion. The transaction comes after ServiceMax was sold to GE for $915 million in 2016, before being spun out in late 2018. The company most recently raised $80 million from Salesforce Ventures, a key partner.

ServiceMax competes in the growing field-service industry primarily with ServiceNow, and interestingly enough given Salesforce Ventures’ recent investment, Salesforce Service Cloud. Other large enterprise vendors like Microsoft, SAP and Oracle also have similar products. The market looks at helping digitize traditional field service, but also touches on in-house service like IT and HR giving it a broader market in which to play.

GE originally bought the company as part of a growing industrial Internet of Things (IoT) strategy at the time, hoping to have a software service that could work hand in glove with the automated machine maintenance it was looking to implement. When that strategy failed to materialize, the company spun out ServiceMax and until now it remained part of Silver Lake Partners thanks to a deal that was finalized in 2019.

TechCrunch was curious why that was the case, so we dug into the company’s investor presentation for more hints about its financial performance. Broadly, ServiceMax’s business has a history of modest growth and cash consumption. It promises a big change to that storyline, though. Here’s how.

A look at the data

The company’s pitch to investors is that with new capital it can accelerate its growth rate and begin to generate free cash flow. To get there, the company will pursue organic (in-house) and inorganic (acquisition-based) growth. The company’s blank-check combination will provide what the company described as “$335 million of gross proceeds,” a hefty sum for the company compared to its most recent funding round.

On the point of inorganic growth, ServiceMax also announced its purchase of LiquidFrameworks this week. The company intends to pay $145 million for the smaller company with help from those SPAC proceeds. LiquidFrameworks specifically gives ServiceMax a mobile service solution with an energy-industry focus, which gives the company some additional mobile engineering expertise along with access to a lucrative industry vertical.

It’s probably a wise choice to try and grow the company’s capabilities across verticals through acquisition as it tries to compete with ServiceNow and others who have been growing rapidly in this space. Consider that Salesforce Service Cloud revenue in its most recent earnings report for Q1 2022 was $1.5 billion for the quarter, more than the entire value of the ServiceMax SPAC, or that ServiceNow generated $1.23 billion in GAAP subscription revenue, up 30% year over year. So the company faces substantial competitive pressure from these firms.

So how is ServiceMax hoping to drive buyers of its shares once it begins to trade? Here’s the pitch.

GE’s digital future looking murkier with move to spin off Industrial IoT biz

How ServiceMax plans to expand its worth

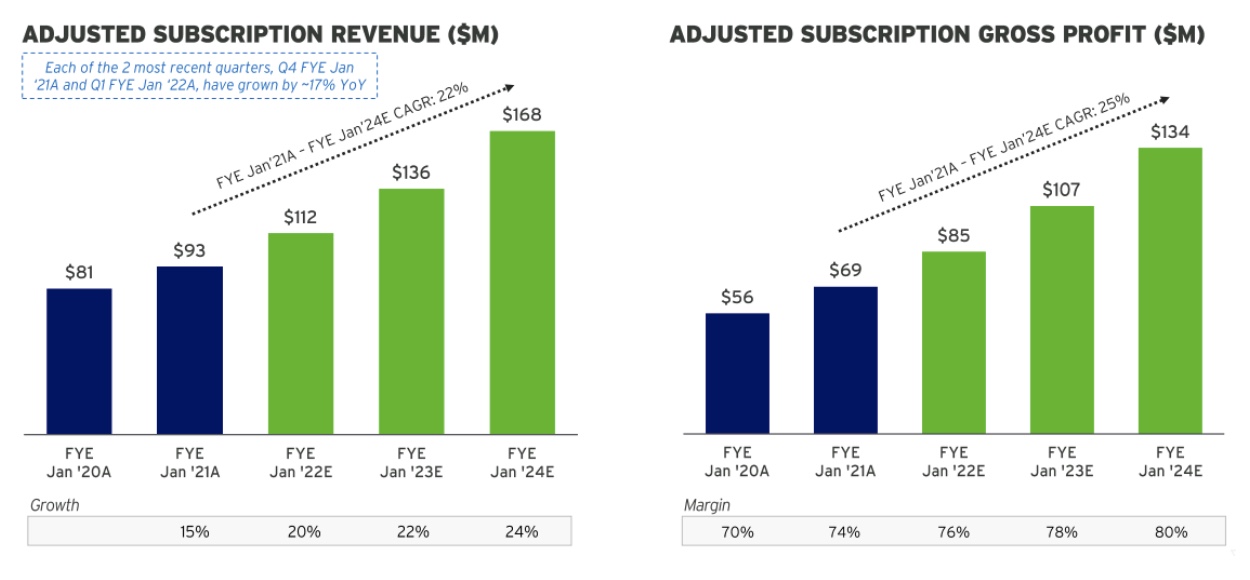

As grounding, ServiceMax runs on a fiscal calendar that concludes at the end of January each year. So, its most recent full-year period as a company closed January 31, 2021. In that 12-month period the company posted adjusted subscription revenues of $93 million, up 15% from its preceding fiscal year’s $81 million result, not bad but fairly modest when you look at the market leaders.

In the same fiscal year, ServiceMax generated $69 million in adjusted subscription gross profit, up from $56 million in its January 31, 2020 fiscal year, a gain of around 23%; the company managed quicker adjusted subscription gross profit growth than revenue itself thanks to expanding gross margins during the period.

Why are we discussing adjusted subscription revenue instead of total, unadjusted revenues? Because the company’s software business is where it generates value. The company’s human-powered professional services work is not worth much on its own. (Software companies often have a services group that helps power the sale, and use of its digital products that they provide customer access to effectively at cost.) So we’re leaning on the company’s adjusted subscription numbers thanks to some accounting matters relating to its relationship with private equity entities; we’re also trying to observe the company from the perspective of investors, and they are likely paying the most attention to the adjusted subscription metrics.

Investors may not be too taken by the 15% growth rate posted by the company’s software business in its most recent fiscal year. But ServiceMax has acceleration on the agenda:

Reading the bottom right line of figures, we can see that not only does ServiceMax expect to accelerate its adjusted subscription revenues in its current fiscal year (the period ending January 31, 2022), it also expects to further accelerate to the tune of 200 basis points in each of its following fiscal years.

Next observe the bottom-right line of figures. These represent the company’s gross margin expectations over time. Again we see the company forecasting not merely improvement in its current fiscal year, but also the same 200 basis points worth of expansion in the following two fiscal years.

The anticipated gains to both growth and gross margin are critical.

The value of a software company is essentially threefold, based on how quickly it is growing its subscription revenues, how strong their margins are, and how rapidly those two figures are changing. Inside those marquee figures are all sorts of other metrics, like net-dollar retention and others, but as they roll into aggregate subscription revenue growth we can speak broadly.

ServiceMax is telling investors that it will not only continue to expand its revenue growth, but also the quality of revenue that it will generate over time. That’s a twofor.

To understand why the expansions matter, let’s dig briefly into some data. Per Bessemer, a venture capital firm that makes startup investments, public software companies in the bottom quartile of growth are worth around 8.5x their revenues. A software company growing at median pace is worth around 14x its revenues. Software concerns that are growing in the top quartile of their category’s growth list are worth around 21x their revenues.

That ServiceMax is promising growth acceleration is therefore not a small matter. It’s perhaps the key metric in its investor deck.

It’s hard to know how much ServiceMax can grow, but it seems that the company has the capability to achieve its financial goals with the help of some more vertically focused acquisitions, especially in an expanding market. It’s worth noting, however, that its most recent yearly revenue pales in comparison to its rivals, whose quarterly revenues are significantly higher than ServiceMax’s entire year — it’s going to have to accelerate hard to go after them.

The price of ServiceMax in its SPAC deal is a bit hard to vet. The company’s trailing performance indicates it’s worth one figure, while its forecasts help paint the picture of a company worth much more. Investor interest in its shares once it begins to trade will hinge to a large degree on how bullish buyers are concerning its future growth prospects, more than they might be at a company with trailing results that indicate a more attractive growth history.

Silver Lake is trying to get something out of its two-year investment and a SPAC seems like a reasonable way to make what would appear to be a modest profit on its 2019 deal, but the question remains whether ServiceMax can achieve its financial goals and thrive as a public market company with all that entails. Only time will tell if that’s the case.

Comment