Bloomberg broke news earlier this week that Apple, the consumer hardware giant with a rising services focus, is building a buy now, pay later (BNPL) service that will integrate with its Apple Pay system. The news sent shares of Affirm down just over 10% by the end of the day, and it shed 2.5% of its value yesterday. It’s off a little more than 61% from the highs it set after debuting earlier this year.

In light of information that Apple could cut into Affirm’s business, investors decided the former consumer fintech unicorn and present-day public BNPL company was worth less. Why? Because rising competition from a player like Apple may limit its growth over time, impacting later profitability. Or more simply, public-market investors decided that the present value of its future cash flows had declined.

It’s not fair to focus on Affirm, of course. Afterpay is also a public BNPL firm; its shares also fell this week, slipping a similar 10% since its close on July 12, the day before the Apple news broke.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Those are just two names. There are a host of rival BNPL concerns in the world, from small startups to private-market giants like Klarna. Affirm and Afterpay, however, as focused companies in the space that also float, make for a useful window into how investors’ views on the sector are changing in light of the recent Apple announcement.

Our question is what impact the Apple news item may have on startups, given that Apple Pay itself already accounts for about 5% of global card transactions (according to one analysis at least). The answer, I think, is that it will vary a lot based on the focus of the BNPL startup in question. The more specialized the BNPL provider, the less likely that Apple’s eventual foray into the BNPL space may prove combative; the more general the BNPL player, the more likely that Apple could cut into its business.

Why? Distribution and customer expertise.

Why? Distribution and customer expertise.

This isn’t to say that Affirm, Afterpay and other BNPL players are set to follow the dodo; far from it. But if Apple wades into the BNPL market as anticipated, its Apple Pay service could provide a strong distribution network that may ease consumer onboarding. That Apple has also launched a credit card tied to its Apple Pay efforts and offers a lightweight cash-management solution in the United States could also lower the threshold for uptake of the product because consumers are already becoming comfortable with Apple as a banking player of sorts.

Apple also controls massive digital marketplaces, albeit places where BNPL services may prove less pertinent. But it controls brick-and-mortar stores for its own goods around the world, and a global e-commerce operation via its own websites that could provide extra distribution for BNPL services from the company. Simply: Apple sells a lot of pricey products that would be good candidates for BNPL purchases.

All of that will hit some startups. Let’s talk about which are going to dodge the incoming competitive bullet.

Startups, BNPL and investor enthusiasm

The Exchange has delved into the financial performance of several late-stage BNPL startups in recent quarters, including looks at Q4 2020 and Q1 2021 results. The context for those examinations was the sheer number of BNPL startup funding rounds that have landed on our radar, including:

- Dividio ($30 million, June 2021), a “white-label platform for retail finance that integrates with e-commerce platforms.”

- Zilch ($80 million, April 2021), a “London startup that has built an ‘over the top’ buy now, pay later (BNPL) business out of cutting deals directly with consumers.”

- Wisetack ($19 million, February 2021), a “startup that provides buy now, pay later services to in-person business transactions.”

- Scalapay ($48 million, January 2021), a Milan, Italy-based startup providing BNPL services.

- Alma ($59.4 million, January 2021), a French startup that has built a “new [installment] payment option for expensive goods.”

And then there’s Klarna, which raised $639 million at a post-money valuation of $45.6 billion in June. It also raised $1 billion in March at a post-money valuation of $31 billion. It’s still private, though the company is generally expected to go public in the near-ish future.

What about all those companies? Has their value changed in light of the Apple news? Probably, but not uniformly.

The BNPL players that target the general public are likely the most potentially impacted by the Apple news. Scalapay, for example, could run up against Apple’s eventual BNPL product given that Apple Pay is available in Italy. Alma could find itself competing with Apple in France where Apple Pay — and therefore Apple’s entry point to consumer fintech — is present.

But Wisetack, to pick a contrary example, probably isn’t in much trouble. Why? Because it integrates with vertical SaaS players that target specific parts of the IRL economy. If a software company that supports plumbers wants to offer a BNPL service, Wisetack will power it. It seems somewhat doubtful that Apple is about to charge into that particular market.

That’s the Apple side of things. What about the other megatech corp that is wading into BNPL?

What about PayPal?

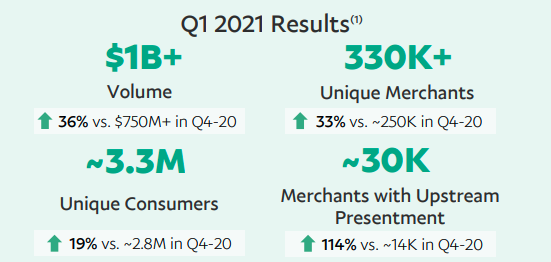

PayPal has shown that an established company can enter the BNPL space to great effect. The company’s “Pay In 4” installment credit service posted the following results in the first quarter (Q2 PayPal numbers won’t be out for a few weeks):

Those are impressive figures. PayPal and Apple are different beasts, of course, so the former company’s success with a BNPL system does not guarantee that Apple will manage similar results. But PayPal’s numbers do indicate that big operations with broad payment integration can quickly scale BNPL offerings.

Notably, Apple offers PayPal as the single third-party payment option in its online store, at least in the United States. That could change.

In the ‘buy now, pay later’ wars, PayPal is primed for dominance

This is where we say yes, but. Yes, but despite PayPal’s intrusion into the BNPL space, Klarna has continued to raise capital at an astounding pace, seeing its valuation soar in the process. This points to sufficient consumer demand to allow both PayPal and Klarna to grow, not to mention results from Affirm and Afterpay that also show growth.

Apple is bigger than PayPal, and the effect of added competition should still impact even the Klarnas of the world, despite their consumer mindshare and capital base. Apple will always be richer than nearly every company, which means it can carry weight into any market it so chooses.

Provided that Apple’s BNPL solution is rolled out over time to the same markets where Apple Pay is present, the Cupertino-based phone-and-computer company could consume market shares — and therefore oxygen — from generalized rival BNPL services. Those startups building more niche or targeted solutions will likely enjoy some shelter from the competitive storms.

An early tell regarding what impact investors consider Apple having on yet-private BNPL startups will be Klarna’s IPO. How well the company manages to price itself should give us a heat check on investor enthusiasm for BNPL equity beyond what we’ve already seen in the 10% cuts to the value of Affirm and Afterpay. Other debuts seem further out, so we’ll have to wait for more venture rounds to learn more.

Comment