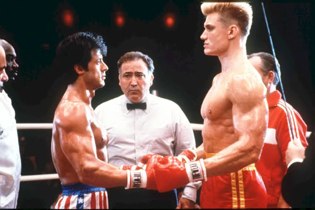

It’s a lot like the Cold War – most of the really interesting fights among startup investors – and there are lots of them – occur behind the scenes. Publicly everyone gets along just great. But declining returns, too much capital and the disruptive force of a new breed of angel investors has created enough tension in the system that some frustrations are beginning to boil over. And in some cases, the gloves are coming off.

It’s a lot like the Cold War – most of the really interesting fights among startup investors – and there are lots of them – occur behind the scenes. Publicly everyone gets along just great. But declining returns, too much capital and the disruptive force of a new breed of angel investors has created enough tension in the system that some frustrations are beginning to boil over. And in some cases, the gloves are coming off.

And entrepreneurs can and do get caught in the cross fire. Pick the wrong investor and you’ve closed the door on others. You’ll never even know why it happened, but it will.

Until very recently there was an established pecking order with venture capitalists. The top guys, most would include Benchmark, Kleiner and Sequoia on that list – would see every deal. They’d mostly compete amongst themselves for those deals. And if all of them passed, the other guys got to take a look. The system was so firmly established that some VCs gave up trying entirely. DAG, for example, built a fund based solely on the promise that they’d follow the big guys, in later venture rounds at much higher prices. For investors, it was a way to get in on the hottest deals, albeit at worse terms. And the top tier funds could show startups a way to raise more money over two rounds at a higher average price, helping to justify the premiums charged by these firms. Sometimes DAG would even be willing to step in and take the PR hit when things went wrong.

Today things are much more complicated. More funds are arguably in the top tier – guys like Accel, Andreessen and Greylock have risen. But more disruptive are the angel investors. It used to be that angels worked with venture funds, doing the very early rounds and then handing things off when a company did well.

But the last several years have seen the rise of the cheap startup. Internet startups can use open source software and new scripting languages to ship products fast and cheap. Often there’s no need to go past an angel round of funding until it’s time to decide between selling and doing a big marketing push. Either way the VCs lose, because even if they get in at that late stage the valuations are much higher and returns plummet.

An entire generation of entrepreneurs have stopped thinking about hitting up those top tier VCs as their first step in the startup process. Many now simply begin with Y Combinator, or take a small angel round. These angels are fast and nimble and they are hanging out with the entrepreneurs at events, incubators, etc. They are in the fray, while many of the old VCs remain above it all, waiting for the entrepreneurs to come to them, hat in hand.

And those angels aren’t shy about trashing the VCs. Angel investor Dave McClure goes on regular rants about venture capitalists, for example. As does Chris Dixon. And Jason Calacanis.

The VCs, for their part, fight back more quietly. They point out that very few angel funded startups end up very big or interesting. “An entire generation of entrepreneurs are building dipshit companies and hoping that they sell to Google for $25 million,” lamented a venture capitalist to me recently. He believes that angel investors are pushing entrepreneurs to think small, and avoid the home run swings. And you don’t get a home run unless you swing hard, he says. When you play it safe you nearly always lose.

I repeated this argument recently for the fun of it at a Y Combinator event for aspiring angel investors. You can imagine that it wasn’t much of a crowd pleaser. Y Combinator, which has spawned some 200 plus startups in just a few years, could be considered the king of this ecosystem, I said.

Whether there’s merit to the argument or not, it is relevant to the entire ecosystem. Some venture capitalists think that this “think small” attitude is driving entrepreneurs who may otherwise build the next Google or Microsoft to create something much less interesting instead, and then everyone loses. No IPO. No 20,000 tech jobs. No new buyer out there for the startups that don’t quite make it.

And without those occasional but huge exits, the entire ecosystem can fail. Venture firms need big returns to raise new funds. Without venture money a lot of the innovation in Silicon Valley would end.

So in effect, the argument goes, the angel investors are like a quickly growing cancer. Without radically invasive surgery, Silicon Valley will eventually flatline.

Dramatic? Yes. But now many of those angel investors are raising big funds and are starting to look like those old style venture capitalists. McClure has a $30 million fund. Dixon has a $50 million fund. Mike Maples and Chris Sacca as well. Aydin Senkut just raised a $40 million fund, notes the WSJ. And Jeff Clavier is raising a big fund of his own.

All of these guys previously invested their own money in small chunks that weren’t threatening to VCs. All are now investing much larger amounts of other people’s money in startups. They are most definitely putting pressure on the old guard.

What’s the cutoff? Around $500,000, says Ron Conway, probably the most successful angel investor in Silicon Valley history. Above that and the VCs see you as competition. Conway has stayed well below that threshold, and his companies regularly go on to raise traditional venture rounds from venture capitalists.

All of this competition is good for the individual entrepreneur looking for capital. Most of the bottlenecks have been removed, and it’s easier for a good idea to attract the cash it needs. But I think there is some merit to the idea that too many entrepreneurs are thinking small these days. Which is fine in a vacuum. But if big companies aren’t being built because of this small thinking, we’ll all suffer sooner or later.

So think big. And be mindful of the politics when you raise that angel round.

Comment