Digital media outfit BuzzFeed announced today that it will go public via a SPAC, or blank check company. BuzzFeed also disclosed that it will purchase Complex, another media company, for $300 million in cash and shares in BuzzFeed itself; the SPAC deal will help finance its purchase of Complex.

The transaction will see BuzzFeed merge with 890 Fifth Avenue Partners Inc., a public company, with the combined entity sporting an enterprise valuation of around $1.5 billion after its completion.

BuzzFeed’s SPAC partner is bringing $288 million in cash to the table, and BuzzFeed intends to raise another $150 million in a convertible debt offering.

In raw numbers, BuzzFeed is a large company with hundreds of millions of dollars in yearly revenue and a roughly break-even business in recent years. The company’s investor presentation anticipates a return to growth after a mostly flat 2020, and rising profitability over time.

So let’s get into the company’s investor presentation. We want to know about its historical growth, anticipated growth, revenue mix and profitability, as well as how the company thinks about its news division. Let’s go!

I’ve broken each of our points into its own minisection, so if you want to skate ahead to any particular point, feel free!

Historical revenue growth

Why is BuzzFeed buying Complex? In part, because it adds audience scale to its platform, a key to the company’s expected future advertising revenue growth (more on that in a moment). But also because Complex adds a lot of revenue to its overall top-line picture.

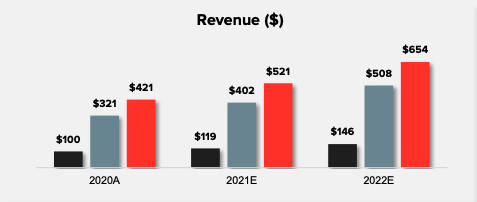

For example, in BuzzFeed’s historical revenue figures we see the following numbers:

- 2019: $425 million.

- 2020: $421 million.

But the company’s historical results are inclusive of Complex. Here’s the breakdown of the company’s historical revenues (gray) and Complex’s own (black). The combined figures are what BuzzFeed notes in its trailing metrics:

From this breakdown, we can see that BuzzFeed anticipates 19% growth from Complex in 2021, and just under 23% growth from the group it’s acquiring in 2022.

Per a later slide, BuzzFeed grew 4% in 2019, inclusive of historical Complex numbers. That figure fell to -1% in 2020.

Our read of the company’s historical revenue growth is that it weathered a turbulent 2020 in reasonable health; digital advertising took a huge hit in the first half of the year, likely impacting BuzzFeed’s operating results. To see it manage an essentially flat revenue result last year feels pretty OK.

Future revenue growth

Looking ahead, there’s lots of optimism in the BuzzFeed investor deck. This is true of all SPAC presentations, so don’t consider any of the following to be out of the ordinary for the 2021 SPAC climate, even if it may feel a bit aggressive.

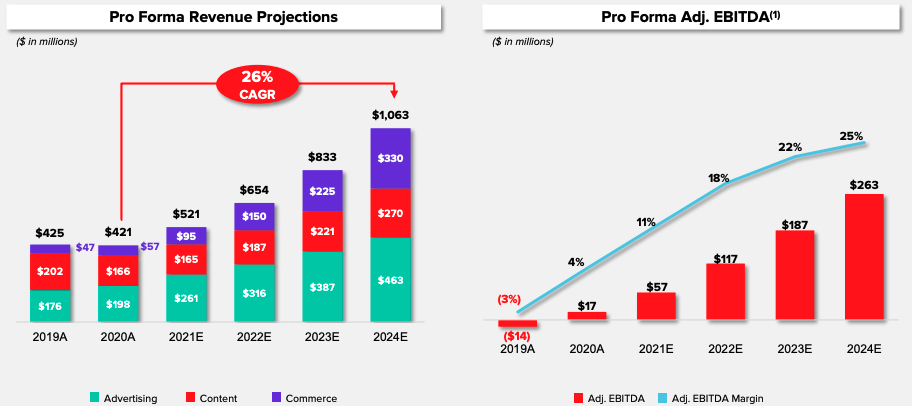

Here are the company’s aggregated revenue growth expectations, along with a chart showing off how BuzzFeed anticipates its adjusted profitability as it scales:

As you can see, BuzzFeed anticipates not merely a return to growth, but a rapid, compounding revenue expansion rate of 26% from 2021 through 2024. For a company that turned in essentially zero growth over the last two years, that’s bold.

The company’s adjusted profitability scales to an adjusted EBITDA margin of 25% by 2024, with most of the growth happening from 2021 to 2023. We can also see in the chart on the right that the company eked an adjusted profit of $17 million in 2020. Again, for a year that was a mess for advertising incomes, that’s pretty good.

Our takeaway from BuzzFeed’s anticipated revenue growth is that the company is being generous with itself, but more restrained than we’ve seen in some other SPAC decks.

To better understand how BuzzFeed figured out its projections, we have to talk revenue mix.

Anticipated revenue makeup

BuzzFeed makes money in three ways: It sells advertising against its audience, it sells content services, and it has a growing commerce business. Advertising is self-explanatory, as is content. The commerce side of its business, however, may be less clear to you.

This will help you understand:

the top ten stories on Buzzfeed are just…ads for Amazon pic.twitter.com/SBAY0hX3mR

— Sophia Benoit (@1followernodad) June 22, 2021

BuzzFeed leveraged Prime Day to write a host of coupon guides, from which it will earn commissions.

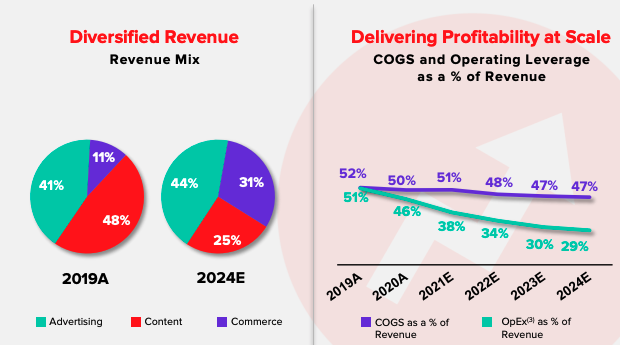

And the model is a good one, BuzzFeed thinks. In its investor deck, it said that it is “[r]apidly scaling higher margin commerce revenue stream [that is] expected to be ~31% of total revenue by 2024E.” Higher margin revenues becoming a large part of its revenue mix over time? That’s how a company can drive profitability long term.

In chart form, here’s what BuzzFeed has managed, and what it expects when it comes to future growth, broken down by category:

I was surprised to see that BuzzFeed anticipates its content business to be its slowest-growing, smallest top-line category in the future. With a mere 13% anticipated compound annual growth rate, it will fall behind commerce revenue by 2024, at least according to the company’s forecasts.

Advertising incomes will grow more quickly than content revenues, meaning that by the end of the company’s projections, the business of selling space on its sites will remain its largest revenue category. But with a compound annual growth rate of less than half of what commerce may manage, that won’t last for long.

The future of BuzzFeed, then, is heavily commerce-driven. Expect more of the Amazon deluge from above. Per its deck, BuzzFeed’s commerce work “drove ~$500 million in attributable transactions in 2020, up 62% YoY.” That’s pretty good!

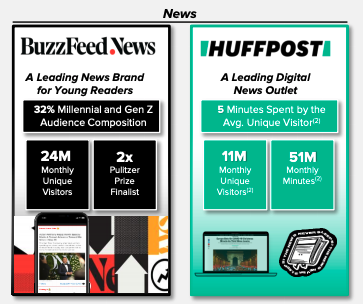

How does Complex fit into the mix? Per the company’s presentation, it’s a way larger property than the Huffington Post, which BuzzFeed recently absorbed from TechCrunch’s parent company Verizon Media. HuffPo has 11 million monthly uniques, per BuzzFeed. Complex has 14 million. And while HuffPo has 51 million monthly minutes from its users, Complex has 137 million.

Complex’s audience is highly engaged. If you are trying to sell stuff, that’s good news. More engaged audiences mean that digital properties have more chance to sell stuff. Unsurprisingly, BuzzFeed notes “[i]mmediate … monetization opportunities” with Complex.

To sum up: BuzzFeed anticipates that commerce revenues — which it claims sport higher margins than other revenues — will drive its future growth and profitability to a large degree. Advertising will take the second-place role in growth, and the leading position when it comes to top-line scale for the foreseeable future.

Content is a middling business that will accrete growth more slowly than the company’s other two income sources. If you are bullish on commerce revenues for digital media brands, you may find the BuzzFeed deal enticing.

Profitability

We’ve already seen that BuzzFeed anticipates more and more adjusted profitability in time. A good question is how it gets there.

Recall that BuzzFeed expects more commerce revenues over time as a percentage of its total revenue mix. And we’ve learned that the company’s commerce incomes are higher-margin than its other top-line categories. So we’d expect to see the company’s gross margins improve while the company scales, right?

Yep:

Let me translate for you. The chart on the left shows what we’ve already discussed: that commerce revenue becomes a bigger part of the BuzzFeed pie over time. The chart on the right shows a falling “COGS as % of revenue” line. Falling COGS, or cost of goods sold, implies expanding gross margins. Just what we anticipated.

The green line on the second chart matters as well. OpEx — operating expenses — declining as a percentage of revenue implies operating leverage at scale. That’s how you drive profitability growth more quickly than revenue growth, because marginal top line can be generated without a similar growth in operating expense.

BuzzFeed is telling investors that its changing revenue mix will lead to an improved economic picture for its business over time. Cool.

News and other fun things

I am a huge dweeb for BuzzFeed News, which has a great news team. It just won a Pulitzer for its reporting on the Chinese government’s mass incarceration of Muslims. And it got a shoutout in the deck:

I dig it. More fun? A mention of Hot Ones, a Complex video project that has lots of fans:

Very cool. Finally, even BuzzFeed can’t avoid sounding like a robot with an MBA when it talks about itself. Here’s the company discussing the Complex deal:

Hell yeah, second windowing opportunities for digital-first IP. What could be more exciting?

We’ve rambled too much. Long story short: The BuzzFeed deck shows a business that had a hard time with growth in 2020, but with big optimism about the future of its leading business (advertising) and growth business (commerce). Let’s see how investors react when it starts to trade in a few months.

Comment