It’s a big morning for fintech startups today: Flywire, a Boston-based magnet for venture capital, has filed to go public.

Flywire is a global payments company that attracted more than $300 million as a startup, according to Crunchbase, most recently raising a $60 million Series F last month. We don’t have its most recent valuation, but PitchBook data indicates that the company’s February 2020, $120 million round valued Flywire at $1 billion on a post-money basis.

So what we’re looking at here is a fintech unicorn IPO. A great way to kick off the week, to be honest, though I’d thought that Robinhood would be the next such debut.

Fintech venture capital activity has been hot lately, which makes the Flywire IPO interesting. Its success or failure could dictate the pace of fintech exits and fintech startup valuations in general, so we have to care about it.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Regardless, we’re doing our regular work this morning. First, what does Flywire do and with whom does it compete? Then, a closer look at its financial results as we hope to get our hands around its revenue quality, aggregate economics and growth prospects.

After that, we’ll discuss valuations and which venture capital groups are set to do well in its flotation. The company had a number of backers, but Spark Capital, Temasek, F-Prime Capital and Bain Capital Ventures made the major shareholder list, along with Goldman Sachs. So, a number of firms and funds are hoping for a big Flywire exit. Let’s dig in.

What is Flywire?

Flywire is a global payments company. Or, as it states in its S-1 filing, it’s “a leading global payments enablement and software company.” And it thinks that its market, and by extension itself, has lots of room to grow. While “substantial strides [have been] made in payments technology in the retail and e-commerce industries,” the company wrote, “massive sectors of our global economy—including education, healthcare, travel, and business-to-business, or B2B, payments—are still in the early stages of digital transformation.”

That’s the same logic behind Stripe’s epic valuation and the rising value of payments-focused companies like Finix.

Parsing its S-1 filing, the company views its product as three distinct offerings. First, a payments platform that “facilitat[es] global payment flows across multiple currencies, payment types, and payment options.” Second, a payment network that, via “global, regional and local banking partners” allows its customers “to accept and settle payments in over 240 countries and territories and in over 130 currencies.” And, third, a software package that can be tailored for vertical-specific use cases.

With this mix of capabilities, the company competes with any global payments provider, though it appears to be far more focused on providing services to companies than any consumer demographic. That constrains its competitive landscape somewhat.

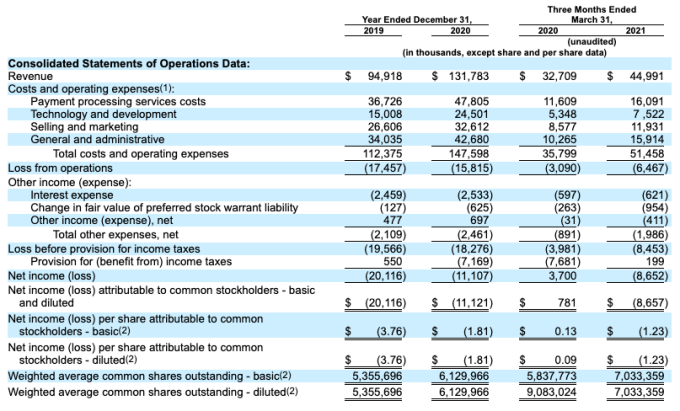

Yes, I know, that’s all probably very important if not terribly exciting. Welcome to infrastructure companies. Perhaps Flywire’s results will get our blood pumping a bit more? Here’s the income statement in question:

As you can see, the company grew from 2019 to 2020 while reducing its net loss over the same time period. That’s encouraging. Zooming into its most recent quarter, we can see a similar pace of growth, though one with a return to net losses. Flywire’s top line grew by 38.8% in 2020 compared to 2019. As for quarterly results, the first quarter of 2021 saw that growth rate move to just over 37.5% compared with a year earlier. So, the company’s growth is decelerating, perhaps, but not by much.

Returning to the question of profitably, if we deduct the cost of share-based compensation, not only does 2020 appear slightly less unprofitable than 2019, but Q1 2021 swings further into profit than its year-ago comp. So, the company’s GAAP net loss is only impactful if you are the sort of investor to whom dilution isn’t a material cost.

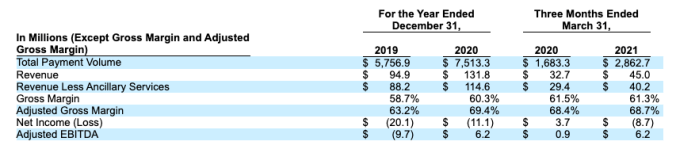

That result is reflected in the company’s adjusted profitability, which you can see in the bottom line of the following table:

You can also see that the company’s gross margins improved in 2020, but have since leveled off by a degree. And the company’s Q1 2021 TPV run rate rose to around $11.5 billion. That will rise further as the year continues, but it matters that we can see the company should be able to smash its 2020 TPV result by a larger percentage than it managed in that year compared to the preceding annum.

Digging into the company’s revenue a bit more, Flywire has two main top-line components: Transaction revenue, and “platform and usage-based fee revenue.” Transaction revenue (“fees charged for payment processing services”) are the bulk of the company’s revenues, making up $32.4 million of its $45 million in Q1 2021 revenues. But it’s growing more slowly (28.6%) than the company’s platform revenues (“fees earned for utilizing our platform” to collect payments, subscription fees and other services), which managed 68% growth in the first quarter of this year.

So, the company’s smaller revenue line item is growing at a faster clip than its larger revenue category. It never hurts to have a growth business inside a larger concern!

What impact did COVID-19 have on Flywire, and should we recast our view of its numbers in light of the pandemic? Here’s Flywire on the matter:

[S]helter-in-place orders, promotion of social distancing measures, restrictions to businesses deemed non-essential, and travel restrictions implemented throughout the United States and globally have significantly impacted the verticals in which we have been predominantly focused over the last decade. [ … ] However, we have not experienced any significant client attrition and our net dollar-based retention rate remained strong. In 2018 and 2019, our net dollar-based retention rate was 126% and 128%, respectively. In 2020, despite the impact of the COVID-19 pandemic on our clients and the industries we serve, we had annual dollar-based net retention rate of 100%, added over 400 new clients, and maintained strong client retention of approximately 97%.

So, the company’s dollar-based net retention (DBNR) rate did slip, but with limited logo churn, things mostly held up. In a sense, this is bullish — how much more would Flywire have grown if its DBNR hadn’t taken a whack due to the pandemic? More, right? And as the pandemic is clearing in some parts of the world thanks to vaccines, perhaps it will return to its 2018-2019 levels of DBNR, which could, perhaps, lead to faster growth.

You can see why the company is going public now: The stock market is strong, fintech is in demand and Flywire’s business could be about to regain its prior form, which could help it have a great first year as a public entity. Not to mention that even its COVID-impacted numbers are good enough to go public on.

I don’t know which company you would want to peg as the perfect comp for Flywire, but Adyen’s prices/sales ratio per Yahoo Finance is around 17.2x, using trailing revenue as the base of the calculation. That multiple, and Flywire’s 2020 revenues give the company a valuation of around $2.26 billion. Its actual trailing revenues are actually a bit higher, and you may quibble with the Adyen comp, so that’s a super rough valuation take. But the gist is that Flywire should have no problem matching, if not besting, its last known private valuation.

More when we have it, but let Q2 2021 be the quarter of fintech exits.

Comment