So far, 2020 has been mostly a garbage year, but it has also been consistently interesting in terms of the amount of change that it has brought.

Venture capital? Changed. Public markets? Very changed. How to go public? How about a SPAC? E-commerce? Going through a once-in-a-generation step change. E-commerce venture investment? Down. Fintech investing? More nine-figure rounds than ever. Fintech losses? New records.

The list goes on. But amidst the signals and noise, there has been a notable theme struck by some public companies in their earnings reports, and private companies’ investors in interviews: The digital transformation is accelerating.

This concept is something that TechCrunch has covered at length this year, including this column, where we’ve chatted with folks from Twilio and Qualtrics to collect their in-market observations.

But if companies of all stripes are racing to modernize operations with more software and more cloud, why aren’t we seeing more revenue acceleration amongst public SaaS companies?

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

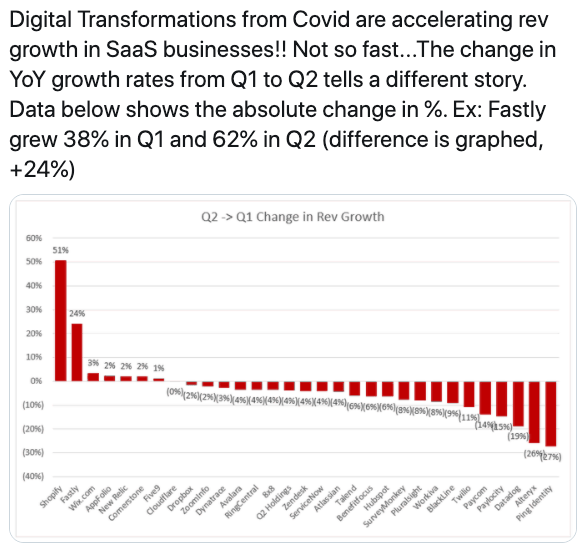

That’s a question Redpoint’s Jamin Ball asked the other day on Twitter, posting a chart showing that most SaaS and cloud companies posted revenue deceleration in Q2 2020 compared to Q1 2020. Less revenue growth during a longer period of supposedly COVID-led digital acceleration? Odd, given what you’ll hear talking to any booster of public or private cloud companies.

Indeed, the narrative in mid-Q2 was that things were looking better than expected amongst startups, at least, and by late Q2 that many were actually catching a COVID tailwind. But if their public brethren are any indication, things could be slower among private companies than anticipated.

But don’t worry, Ball is not a cloud pessimist. Neither am I, frankly. But recent results as demonstrated by the Q2 earnings cycle (incomplete as it remains) are worth discussing because if a new cloud boom is a ways off, shares of public cloud and SaaS companies could be in for a tumble. And falling public equities is never, ever a recipe for success amongst their private comps, the startups that we spend so much time to understand.

But don’t worry, Ball is not a cloud pessimist. Neither am I, frankly. But recent results as demonstrated by the Q2 earnings cycle (incomplete as it remains) are worth discussing because if a new cloud boom is a ways off, shares of public cloud and SaaS companies could be in for a tumble. And falling public equities is never, ever a recipe for success amongst their private comps, the startups that we spend so much time to understand.

So, to grok what’s happening with cloud and SaaS startups, let’s examine their elders. What follows are excerpts from a conversation with Ball about his market notes, and thoughts on what could be driving a set of Q2 results that may have left you expecting more.

Acceleration, cloud, transformation, SaaS

I reached out to Ball because he posted a fascinating chart, I’ll share here, as it grounds the entire point of our conversation:

There’s a small error in the Twilio bar, for what it’s worth — Ball publicly noted the slightly unfair comparison given that the telephony API company had acquisition-boosted Q1 revenue growth, making the Q1/Q2 comparison a little unfair — but you can see clearly that most cloud and SaaS companies did not accelerate between Q1 and Q2.

Some did: Shopify, Fastly, Wix and NewRelic. (We’ve covered the Shopify boom some here, and we have notes from an interview with Wix’s CEO here, and Fastly’s here.) But, mostly, a deceleration of modest-to-large degree is the name of the game.

Or as Ball put it, “the reality was outside of Shopify, outside of the businesses that had obvious tailwinds” like folks suddenly needing online stores, and users consuming more Netflix, changing the company’s own demand patterns, “the pure SaaS guys didn’t really accelerate.”

Our real question is why that is the case, and Ball has a few ideas: The nature of SaaS revenue, and slower-than-anticipated digital transformation, which is partially predicated on the fact that software is settling into tiers of requirement, which leaves some providers out of luck. Let’s explore each in sequence.

The why

After chatting with Ball about the above chart’s somewhat disappointing implications for cloud growth acceleration — that most companies aren’t seeing it, yet — he asked, “Does that mean that [the market stuck to] current course and speed, was there no acceleration? What happened? I think a couple of things happened, one [being] the way that SaaS revenue works.”

Ball explained that some buyers of SaaS and cloud software likely became more interested in doing so as Q2 rolled along, more in May than April. This could have meant that “more deals were signed in the latter half of the quarter, which means [ … ] you don’t get to recognize that much revenue from” those deals, as given how little of the quarter was left you only get to claim a “small piece” of the contract’s value.

So there could be a technical aspect to Q2’s cloud growth deceleration that we’re seeing.

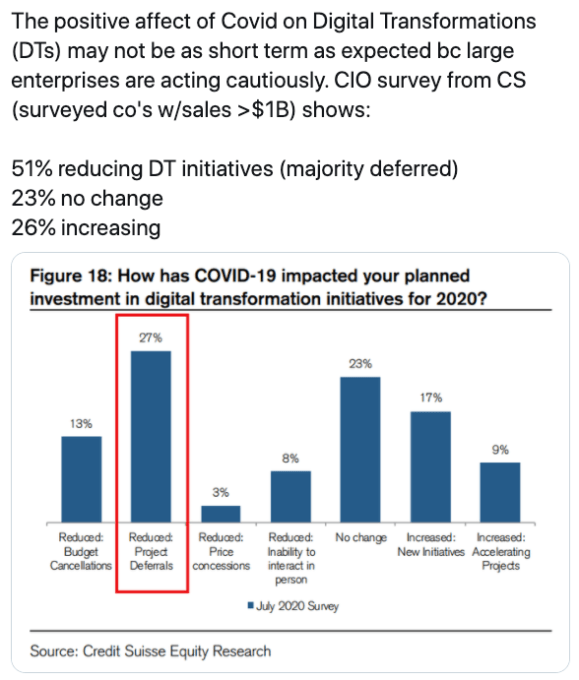

But Ball had another idea, this time leaning on data from various banks showing that while cloud spend will, in general, rise over time as companies pursue more modern methods of doing business, there is more reticence to spend in the near term than you might have guessed.

From Ball’s Twitter account yet again:

Ball said in our chat that cloud “acceleration might not happen immediately,” adding that it could happen in future quarters because companies are simply being more conservative with their cash during the COVID-19 pandemic than before. The situation could mean that some digital transformation projects are being deferred. That would lead to the data you see above, which is counter-narrative to the more sunny view that you’ll mostly see on Twitter and other social platforms.

The short-term data does not mean that legacy IT spend will not migrate to the cloud — it will. Nor does it mean that growth rates for cloud and SaaS companies are doomed to only deceleration — they may not be. Ball remains an optimist, saying that the digital transformation “will happen, and it will be accelerated,” but that it’s “just not happening right now.”

Big companies are at least partially to blame for the delay. Ball’s read of the markets via earnings reports and other inputs is that “slightly bigger companies who have lots of stuff to worry about [are] trying to think long term. They’re being extra careful with their cash. Sales cycles are longer,” and so forth. Ball also said private companies are seeing similar issues to public companies in this area.

So where do we stand? Some companies are buying more software and digital services, some are deferring those buys. But the era of on-prem workloads for most companies is fading into memory. Where does today leave us?

In Ball’s view, the need for more digital services and the requirement of cash conservation will lead to a stratification of the SaaS market. “There’s going to be a separation of tier one and tier two and tier three software names” as the market shakes out which are required and which are nice to have, with the latter groups likely seeing slower growth,” he said. Valuations should pick up on this trend, he added, because the difference in revenue multiples for the tiers will expand.

For startups not selling tier-one software, the next few quarters could be rough. For startups selling must-have delivered code, it’s going to be a damn hot year.

Slowdown

Undergirding all of the above is a slowdown in the growth of the bedrock substance of the cloud world, namely IaaS and PaaS revenues for major cloud players. SaaS and cloud companies that are not infra providers in the way that Amazon and Microsoft are, sit atop these larger platforms. As they grow, so, too, do the major cloud companies.

In a sense then, IaaS and PaaS revenues aren’t the first derivative to the smaller cloud players’ second, but are perhaps something of an averaged growth rate. If that’s right, the following chart from CNBC’s Jordan Novet is telling, and not so positive:

The numbers were always going down, but the declines accelerated. Some digital transformation acceleration, right? But all the data points in the same direction, which means that instead of trying to parse divergent signals we’re seeing a clear pattern.

Summing, as we’ve gone on for far too long, here’s what I think happened: Better than expected results on average from cloud and SaaS companies early in the recession calmed public and private investors. Outlier results from a minority of those companies gave the same investing groups hope that the acceleration that some were experiencing was broader than it was. Those notes filtered out into the media, and the narrative was somewhat set. But so far the results just don’t match the hype.

Q3 earnings are going to be hype, as they will give us a better understanding of the new reality now that we sit more than halfway through the three-month period. Who knows, maybe there’s be more growth in those numbers than we’ve seen so far. That would be good news for startups.

Comment