Walmart reported earnings this morning. Most of the numbers are immaterial to you and I, having little to nothing to do with the world of private capital and startups, but one metric did leap out: In its quarter ending July 31, Walmart’s U.S. “e-commerce sales” grew by 97% compared to the year-ago quarter, with what the company called “strong results across all channels.”

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Walmart’s total revenue grew 5.6%, so you can see the discrepancy between the company’s physical business and its e-commerce efforts, with one managing single-digit gains and the other nearly hitting triple digits. For reference, in its fiscal ending May 1, 2020, Walmart’s e-commerce sales grew by 74%. In the quarter ending January 31, 2020 that figure was a far-slimmer 35%.

The e-commerce acceleration is real, as shown through a host of numbers you can parse, including Walmart’s own. Heck, when The Exchange was digging through recent fintech venture capital results, we noted that rising e-commerce spend was perhaps part of the reason why late-stage fintech shops had such strong results.

The e-commerce acceleration is real, as shown through a host of numbers you can parse, including Walmart’s own. Heck, when The Exchange was digging through recent fintech venture capital results, we noted that rising e-commerce spend was perhaps part of the reason why late-stage fintech shops had such strong results.

So when I was reading Q2 venture capital data on the state of retail tech broadly, and e-commerce tech more specifically, I was expecting a stellar quarter with lots of dollars invested into a great many deals.

And yet, while Q2 2020 was a bit better than Q1 2020 for e-commerce VC results, it wasn’t much of a comeback. The first half of this year is pretty damn slow overall, when compared to prior results for e-commerce-focused venture capital deals.

What gives? I have an idea or two, but first, let’s parse the data that business market data provider CB Insights compiled, as we extend our apparently never-quite-ending look at the ridiculously interesting first-half of 2020 for startups and VCs.

VCs fall out of love with e-commerce startups?

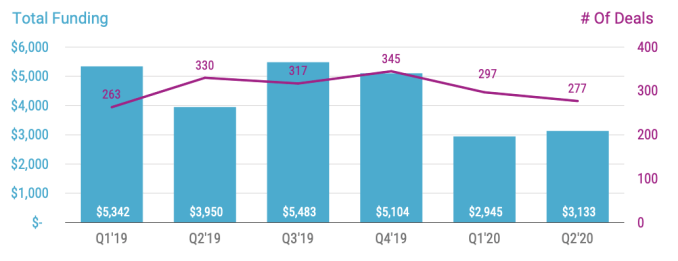

In 2019, e-commerce saw an average of 314 deals per quarter and just under $5 billion in invested capital, with the four-quarter pace for the year coming in at $4.97 billion per.

In 2020, through the first half of the year, those numbers are down to 287 deals and just $3.039 billion invested into e-commerce VC rounds. In percentage terms, the declines work out to a -8.6% reduction in deal volume and a a roughly 39% cut in funding, in quarterly terms.

The decline in deal volume feels somewhat light compared to the fall in dollars invested into e-commerce-focused startups, until we drill into Q2 itself.

Here’s the chart from CB Insights:

Image Credits: CB Insights

The second quarter of 2020 did bring a gentle bump in dollars invested, but saw a decline in total deals. The “recovery,” then, that Q2 could point to in terms of money spent on e-commerce startups is undercut by the worst (smallest) number of e-commerce rounds since at Q1 2019.

Weird, right? At a time when e-commerce is booming? Walmart isn’t the only company reporting big results. Amazon’s Q1 earnings reported year-over-year growth of 26%. Its second quarter growth rate shot to 40%. Shopify had a huge quarter. Square had a great quarter for online commerce as well, saying that “In the second quarter of 2020, [gross payment volume, or GPV] from online channels was up more than 50% year over year and made up more than 25% of our Seller GPV.”

What’s going on?

So what’s up with the somewhat lackluster venture capital investments into e-commerce startups?

I have a hunch, namely that it’s because the biggest players in the space are doing so well that startups are struggling to find their way to the trough as they once did. Would you fund an Instacart today, given where Amazon is on grocery delivery? Would you fund a service to help small vendors get online today in the era of both Shopify and BigCommerce being public, flush with cash and growing quickly?

Payments? Sorted. Still, there may be room in other places. The same CB Insights report notes that social commerce resale platforms are doing well. Toss in shoe marketplaces and other niches and you can find some opportunity, sure. But will companies building in those areas enjoy a total addressable market (TAM) as big as the bigs? Probably not. Though, directionally, niche players shooting for less TAM does feel appropriate for what has happened to e-commerce deal and dollar volume — smaller targets, fewer darts?

All of this is a big bummer, frankly. Amazon’s website is bad, and I have no affinity to Square and don’t really care where any smaller store is hosted. I am 100% ready for smaller players to show up and make things better. Yet that happening seems less likely than it did a year ago, given the venture totals that we can see. Alas.

Q2 was a wild period. If you want to catch up more on what we’re seeing, here’s our notes on VCs investing in AI startups in Q2, edtech fundraising in Q2, fintech startup investments from Q2, Robinhood’s Q2 ahead of its new funding round and big tech results from Q2 themselves. Who knows what Q3 numbers are going to look like, but if Q2 is any indication, we won’t be bored.