Coinbase reported its second-quarter earnings Thursday afternoon after the bell, beating market estimates.

During Q2, the second largest crypto exchange by trading volume generated total revenues of $707.9 million, down from $772.5 in the previous quarter and $808.3 million in the year-ago quarter. It also had a $97 million net loss and generated a positive adjusted EBITDA of $194 million during the quarter.

It was a mixed bag of estimates from analysts prior to the earnings report. Some expected lower results, while others were optimistic. But now crypto bulls and company shareholders alike can breathe a sigh of relief.

“One year ago in Q2 2022, we started reducing our expense base to operate more efficiently. One year later, we’re proud to say that our quarterly recurring operating expenses have dropped nearly 50% Y/Y,” the company said in its Q2 2023 shareholder letter.

In after-hours trading, shares of Coinbase rose 7% to about $96.70 after its earnings were posted, but retracted 2% to around $89 at the time of publication. Coinbase’s stock is up about 170% year-to-date.

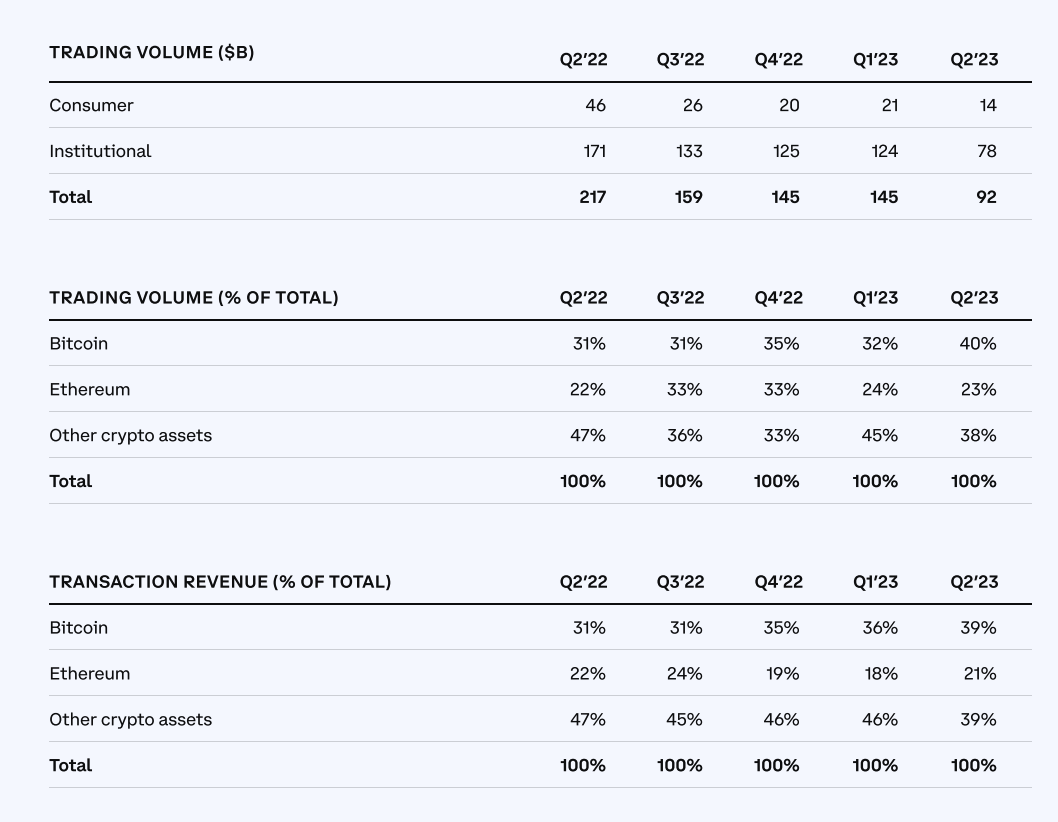

As of June 30, 2023, Coinbase had $92 billion in quarterly volume traded, $128 billion assets on its platform, according to its website. The firm’s Q1 earnings reported in May posted $773 million in revenue.

Retail (or “consumer,” as Coinbase calls it) trading activity remained a small percentage of its total volume, with institutional volume carrying most of the heavy weight. It’s important to note that its retail users are seen as the biggest focal point for the business, while the institutional side is often seen as an afterthought — but this data proves that’s not necessarily the case.

The lower volumes for both consumers and institutional users was a hefty discount, down about 37% to $92 billion from $145 billion in the previous quarter, signaling that trading activity is still weak amid the ongoing crypto bear market.

Focusing in on the cryptocurrencies themselves, Bitcoin regained trading volume dominance quarter-over-quarter at about 40%, almost even with other crypto assets at 38%, and Ethereum lagged at 23%. This is compared to Q1 at 32% for Bitcoin, 45% for other crypto assets and 24% for Ethereum.

Bitcoin taking back a slight lead might be due to more institutional interest in the top cryptocurrency with major firms like BlackRock filing for a Bitcoin ETF (exchange-traded fund) during this quarter. It’s also worth noting the strong footing that “other crypto assets” have for trading volume and transactional revenue. This could mean that users might care about more than just bitcoin and ether, the two largest by market cap.

Making sense of the market

These results come at a time when Coinbase and other crypto firms are facing U.S. regulatory headwinds.

In June, shortly after Coinbase reported its first-quarter results, the Securities and Exchange Commission (SEC) sued the exchange for alleged securities laws violations. The suit came just one day after the SEC sued Binance, the largest crypto exchange in the world by volume.

And they weren’t the only ones under the microscope. Many market players expect the industry to continue to be under a spotlight for regulators until more clear frameworks are established. The “momentum and urgency” for digital asset legislation and rules at a federal level in the U.S. have grown, Kara Calvert, head of U.S. policy at Coinbase, previously told TechCrunch+.

Coinbase’s chief legal officer, Paul Grewal, has said that he also expects new crypto laws to come in wake of the SEC lawsuits, but nothing has transpired since he made that statement in early June.

In the meantime, the crypto crackdown is leaving major companies like Coinbase in limbo, unclear of whether they can operate in a regulated manner in the U.S., given the differing views of the various agencies involved.

Building up the business

Regardless of the regulatory friction, Coinbase is still growing and moving forward. It recently launched new initiatives like its Coinbase One subscription service, which is available in 35 countries, and Onchain Summer, which is a collaboration with 50+ crypto and noncrypto brands like Coca-Cola and Atari.

Coinbase’s subscription and services revenue rose a whopping 138% to $361.7 million in the first quarter of 2023, from $152 million a year earlier. In Q2 2023, its subscription and services revenue fell 7% to $335.4 million quarter-over-quarter. In its shareholder letter, Coinbase attributed the decline to “lower interest income driven by lower USDC market capitalization.”

Coinbase’s CEO Brian Armstrong has also said he thinks the company can become a “super app” within the next five to seven years. While that doesn’t affect this current earnings season, diversifying the company’s revenue streams and business strategy could help it last (and grow) long-term if done properly.

Beyond the current Q2 earnings, Coinbase expects the third quarter to have subscription and services revenue lower again to “at least” $300 million.

“The crypto industry remains volatile, as evidenced by ongoing uncertainty in the regulatory environment,” Coinbase said in its Q2 shareholder letter. “While we can’t predict what will happen next, we continue to operate towards our goal of improving Adjusted EBITDA in absolute dollar terms versus full year 2022.”

The article has been updated to reflect Coinbase’s latest quarterly volume and assets metrics.

Comment