As the crypto markets continue to face uncertainty, Coinbase’s CEO Brian Armstrong sees greater potential for the digital asset ecosystem to grow.

Most people still think of crypto as an asset class that is traded and speculated on, but there are many more use cases for crypto than meets the eye, Armstrong noted during a fireside chat at Coinbase’s State of Crypto Summit on Thursday.

For example, the industry is being supported by traditional financial service players like BlackRock, which filed for a spot Bitcoin ETF last week, and Fidelity, which backed another crypto exchange.

In the next five to seven years, Armstrong envisions Coinbase turning into a “super app,” referring to apps like WeChat and Alipay, which are used for messaging, commerce, banking, loans, payments, and even for ordering food. “In Coinbase’s case, we want to be that super app, but it’ll be based on decentralized protocols, not just money but decentralized social, messaging, merchants accepting NFTs out there, simple interfaces for DeFi,” Armstrong said. “It should work in a more global way.”

Building with institutions

Despite some “negative rhetoric,” the crypto industry is “moving forward,” Armstrong said. And traditional finance players are “leaning in and crypto is having a bit of a rally.”

In fact, a majority of the attendees at the event were dressed in suits or business casual, as opposed to the shorts and hoodies I typically see people wearing. This perhaps points to more traditional finance players attending the event, in addition to developers and startup founders.

“If you want more fiat money flowing in, you need institutions engaged,” Armstrong said. But unlike retail investors, institutional players and firms have different sets of requirements for qualified custodians, auditing, cybersecurity and so on, he noted.

And in recent quarters, Coinbase has seen an increase in institutions signing up, Armstrong shared. And that might be true throughout the sector.

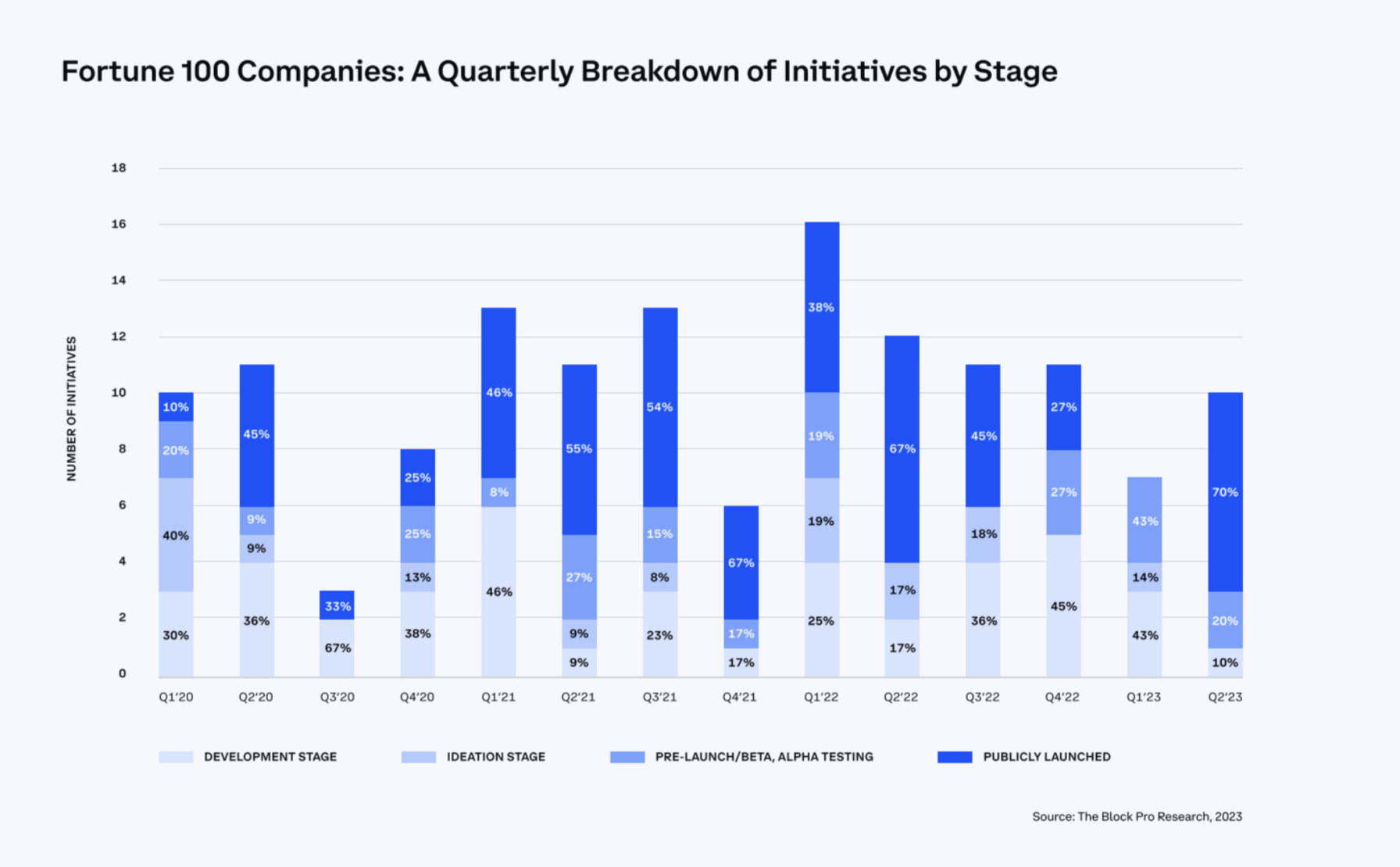

More than half of the Fortune 100 companies have “pursued crypto, blockchain or web3 initiatives since the start of 2020,” according to a new report on corporate adoption by Coinbase and The Block. And the majority, or 83%, of Fortune 500 companies surveyed have crypto-related initiatives on the books.

Image Credits: Coinbase, The Block (opens in a new window)

Regulatory setbacks alongside future use cases

In recent weeks, Coinbase has faced a number of regulatory challenges in the U.S., including an SEC lawsuit against the exchange for allegedly violating securities laws. Coinbase has refuted the claims.

Outside of crypto trading, Armstrong said he sees major use cases in a handful of industries like decentralized finance and identities, NFTs and stablecoins.

As it stands, the stablecoin market has gained popularity and traction in recent years with a combined $1.12 trillion market capitalization in the top two stablecoins, USDT and USDC, alone, according to CoinMarketCap data.

“Stablecoins help facilitate online trading, but another use case [is for] people who don’t have access to stable currencies; it gives access to a digital dollar or something like that,” Armstrong said. Stablecoins can also be used for cross-border payments, which are often costly through traditional providers like banks. And DeFi protocols could give people credit and more decentralized versions of financial services, offering faster solutions than what banks could typically provide.

While NFTs had their huge moment in 2021 and have fallen in popularity since, startups and big brands are creating new ways to reward artists and content creators. Just look at Nike’s marketplace and Reddit’s crypto wallet integrations.

Looking toward the future, Armstrong sees potential for three new(ish) use cases in crypto: decentralized social media, gaming in the metaverse, and opportunities for a coin not backed by fiat currencies. “There’s a lot of interesting ideas on the horizon — the future is exciting.”