The rollercoaster-get-rich ICOs of 2017 are over — crypto companies are waking up to the idea that professional investors aren’t so bad after all.

Companies used initial coin offerings (ICOs) to raise some $5.5 billion in cryptocurrency-based funding last year. As an emerging investment system with no regulation, nearly anyone was allowed in. The knock-on effect was that many who rode the wave made huge profits, often into the millions of U.S. dollars, as a 10X return seemed to become the minimum standard among those getting crypto-rich.

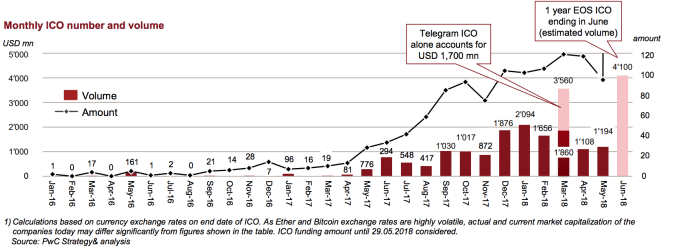

The trend went into overdrive in 2018, when the price of Bitcoin hit a peak of nearly $20,000 and Ethereum notched $1,200. ICO funding hit $6.3 billion in only the first three months of the year, as noted by Coindesk, but, fast forward six months and a new trend has emerged. Public ICOs, which allow anyone to invest, are increasingly replaced by a new approach of limited, private sales that consist only of accredited investors and close connections. Many ICOs today include no public sale component, with retail investors forced to wait until a token is listed on an exchange.

![]()

Private sale only

Telegram’s huge $1.7 billion ICO best exemplifies the change.

ICOs in 2017 began to include a private pre-sale before the ‘open’ public sale stage, the idea being to attract big bucks and in some cases give incentives like discounts. But Telegram opted to keep its entire sale public. It also stuck to accepting money from accredited investors in the U.S. — those who are legally certified to make investments — rather than opening its doors to anyone wanting to own a piece of its token sale.

That’s a trend that has been repeated in other ICOs, including the recent $32 million “seed” round for Terra and its stable coin project. Terra co-founder Daniel Shin explained to TechCrunch that it will hold a second round of private sale investment, but that’ll be reserved for investment professionals and others in the network.

Legally, of course, this makes absolute sense.

The SEC is steadily increasing its crackdown on ICOs, and it has long been standard for companies planning ICOs to overlook citizens of the U.S, China and often other countries where the legalities are unclear from taking part in the sales. But, actually, the rationale of private sales goes beyond legalities.

Professional investor benefits

The crypto industry has woken up to the reality that getting your capital from a handful of professional investors — be they VCs, family offices, hedge funds or strategic companies — can be more advantageous than a bunch of regular people.

For one thing, dealing with a dozen investors is far easier than a Telegram group that numbers tens of thousands. Professional investors are more accustomed to giving a company money and letting it use it independently, but retail investors in the crypto space tend to be more demanding and unrealistic as they seek a quick return on their money. While liquidity is a major appeal for all in an ICO, VCs tend to hold a longer-term approach than retail investors who look to flip and move to the next money-making opportunity. Or, in times of downturn such as right now, investors have deeper pockets to ride out recessions.

There’s a popular refrain that ICOs mean not having to deal with “Evil Venture Capitalists”, but a community of retail investors is demanding in its own way. Plenty of ICO projects waste time and precious resources putting out mundane press releases that are devoid of news just to produce something that they hope will placate their thirsty community of retail investors, and miraculously give their token a price jump. For example, inking a “strategic partnership” with the American Chamber of Commerce Korea isn’t news — getting actual sales is.

This kind of distraction and allocation of resources makes no sense when you are setting out building a company or a product, which ultimately the founders of these projects are doing. As any experienced founder or investor will say, retaining focus is key in those early times.

Added to that, professional investors can actually help with the building by leveraging their network. Whether that is assisting on hiring in the competitive blockchain industry, introducing potential customers — American Chamber of Commerce Korea eat your heart out — bringing on other investors, etc.

That’s why in the aforementioned case, Terra opted to bring four crypto exchanges into its private sale — no doubt their influence will be key in building what remains a hugely ambitious project. Other companies that raised large ICOs, including TenX and MCO, have publicly expressed interest in holding new investment rounds to bring in professional VCs. That’s because money alone won’t open doors, but often connections can.

To recap: professional VCs can be more trusting, less of a distraction and more useful, but there are some instances in which a more open public approach should be a part of an ICO. That’s when it comes to building a community.

The exception: Community

The term “community” has been thoroughly bastardized by ICOs, but there are some projects that — at least on paper — can benefit by allowing specific types of people, people that will use the product, to get involved early.

Huobi, the exchange, developed a token for its users earlier this year, while chat app Line is also minting a token that it hopes will be used as part of its messaging platform. In both cases, neither company held an ICO, but they did use a crypto token to build a community.

Civil, the startup hoping to ‘fix’ media using the blockchain, is holding an ICO that’s open to members of the public. That’s also a community play, as the CVL token will be required to create newsrooms on its platform, and also to interact with them, such as challenging stories written by reporters.

Other technical projects out there are doing the same — focusing squarely on the community they are building for and adopting lower target figures for their ICO fundraising.

The technology space is so vast that there are exceptions, but it is certainly notable that there are relatively few credible projects planning ICOs that include retail investor participation. A report co-authored by PwC shows that the general pace of ICO investing settled in Q2 2018. If you ignore outliers such as Huobi, Telegram and EOS — the $6 billion project that fundraised for a year — then activity has certainly settled down after an explosive 12-months of growth.

Increased stability is likely to mean that the trend of private sales continues. Traditional VCs are launching dedicated crypto funds and those in the crypto space are formalizing investment vehicles of their own, all while the SEC and other regulators across the world intensify their gaze on ICOs. VC capital is likely to play a more pronounced role in funding ICOs than ever before.

That’s not to say that the retail investment phase is over. Speaking at TechCrunch Disrupt last week, Coinbase CEO Brian Armstrong sketched out his vision of the future in which all company cap tables are “tokenized.”

He foresees retail investors across the world being free to invest in security tokens that operate as a more accessible offshoot to traditional investment systems like the New York Stock Exchange, the NASDAQ etc. Whether that extends to participation in ICOs themselves remains to be seen.

Disclosure: The author owns a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

Comment