Jake Bright

Jake Bright is a writer, author and advisor with a focus on global business, politics, and technology.

From 2017 to 2020, he was a contributing writer and advisor at TechCrunch where he published on Africa, mobility and politics. Bright helped spearhead consistent Africa coverage and co-produce the first Startup Battlefield competitions in Africa and Africa focused programming on the Disrupt San Francisco mainstage.

Bright’s first book, The Next Africa (Macmillan 2015), forecast the rise of Africa’s venture backed startup scene. Prior to this he worked in international finance and as a speechwriter in Washington, DC. Bright continues to contribute occasional guest pieces at TechCrunch.

More posts from Jake Bright

Harley Davidson will launch its first production e-motorcycle in 2019.

Yes, the iconic symbol of American steel and piston popping internal combustion is shifting to voltage.

“We announced we’ll invest more aggressively in…electric technology in premium motorcycles,” Harley Davidson CEO Matt Levatich said on the company’s recent earnings call.

“You’ve heard us talk about Project LiveWire…it’s an active project we’re preparing to bring to market within 18 months.”

The Milwaukee based company didn’t provide much more detail on its e-motorcycle plans. CFO John Olin added HD “expects to spend an incremental $25 million to $50 million per year” on EV infrastructure.

A spokesperson wouldn’t confirm specs on Harley’s first production e-motorycle to TechCrunch. But per the CEO’s comments, it will likely be an extension of HD’s LiveWire concept bike. The 460 pound battery powered machine debuted in 2014. It has 74 horsepower, a 93 mph top speed, 50 mile ride time, and automatic drivetrain (i.e., no clutch or shifting),.

HD’s battery-bike news comes as the American motorcycle market struggles to attract younger buyers and lags behind the auto-industry in EV development.

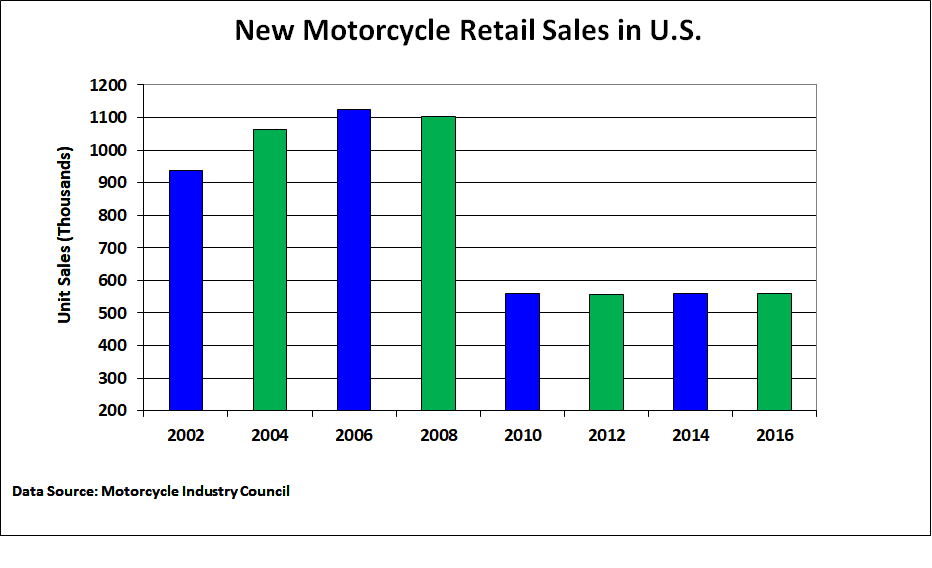

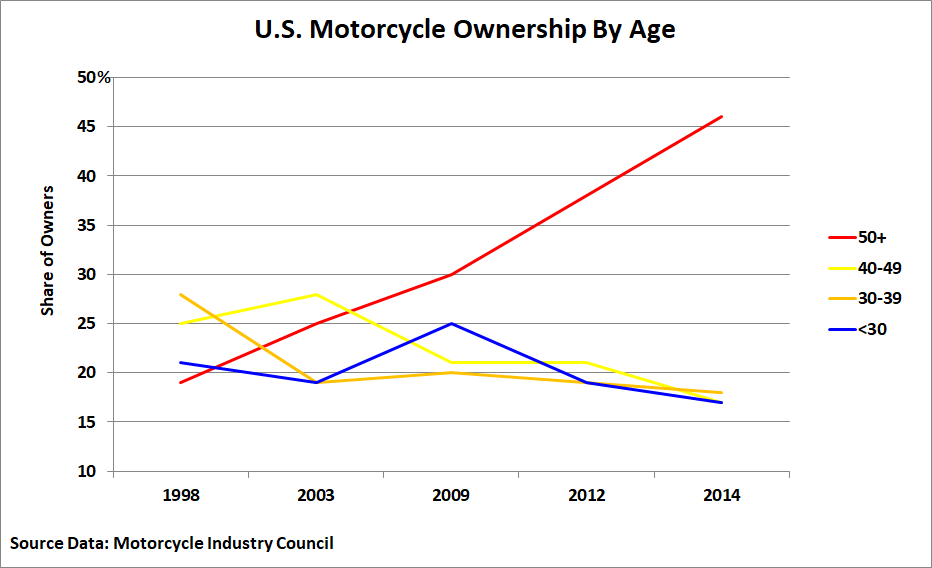

Overall U.S. sales have dropped by roughly 50 percent since 2008, with a sharp decline in ownership by those in their 40s and under 30. The majority of the market is now aging baby-boomers, whose “Live to Ride” days are winding down.

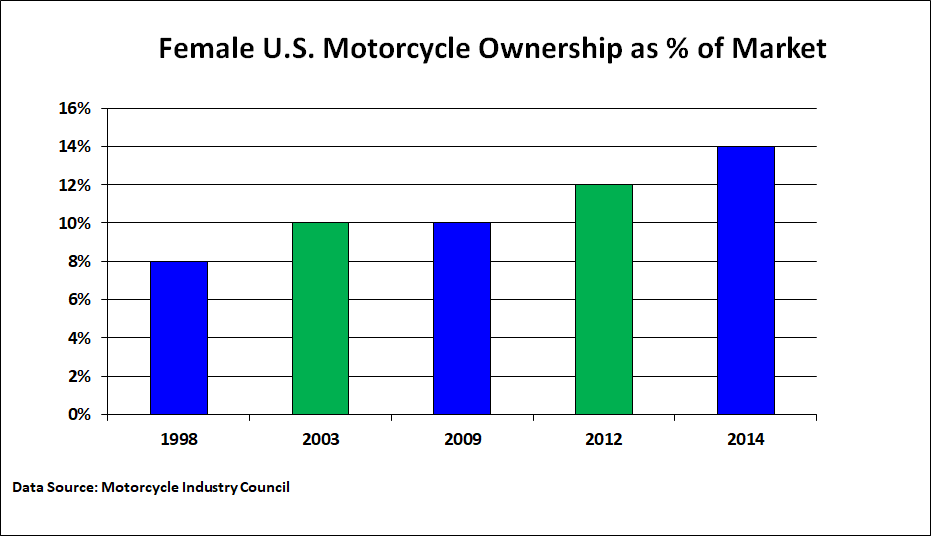

The one bright spot in American motorcycle demographics is increased female ownership. But by most straw polls women prefer lighter motorcycles with smaller engines—pretty much the opposite of Harley Davidson’s design template of the last half-century.

For years the company’s best sellers have come from its voluptuous cruising and touring lines, including the 798 pound, 1340cc Road King.

Unsurprisingly, prevailing trends have brought financial pains to many big motorcycle makers, including Harley Davidson. Along with HD’s EV news, the latest earnings call announced a Kansas City plant closure and 8 percent U.S. sales drop.

As for the overall U.S. motorcycle market, shrinking sales and shifting consumer preferences offer manufacturers a tricky equation. The industry is attempting to serve very different buyer groups: an aging segment that prefers yesteryears’ big engine cruisers and then women and millennials—who aren’t yet enthusiastic about buying bikes, but appear privy to lighter motorcycles and EVs.

Companies have mixed things up to cope with the shifting U.S. landscape. On design, Honda, Yamaha, Suzuki, and Kawasaki now offer more smaller engine, lower weight models. Harley Davidson launched its Street series of leaner bikes, including the 492 pound Street 500.

Companies are also launching learn to ride programs and lifestyle brands—such as Harley’s Riding Academy and Ducati’s Scrambler series—to bring in new buyers and create fresh social groupings around motorcycles.

On the tech side, two-wheel manufacturers have mostly stagnated around EV concepts. None of the big names—Honda, Kawasaki, Suzuki, BMW, KTM—offer a production electric street motorcycle in the U.S.

Meanwhile, some e-motorcycle startups have emerged. Italy’s Energica announced a 2018 U.S. sales campaign. California also has Alta Motors and Zero Motorcycles—whose Zero SR has 75 horsepower, a 135 mile range, and $10K price.

EVs from these new ventures are closing the gap on gas bikes in price, performance, weight, recharge times, and ride distance.

So how could this all come together to pivot the mainline motorcycle industry toward electric?

A combination of competitive pressure from these upstarts and the number 1 American motorcycle seller, Harley Davidson, debuting an e-bike.

This could prompt the likes of Honda, Yamaha, and Kawasaki to quickly transition their EV programs from concept to production.

Comment