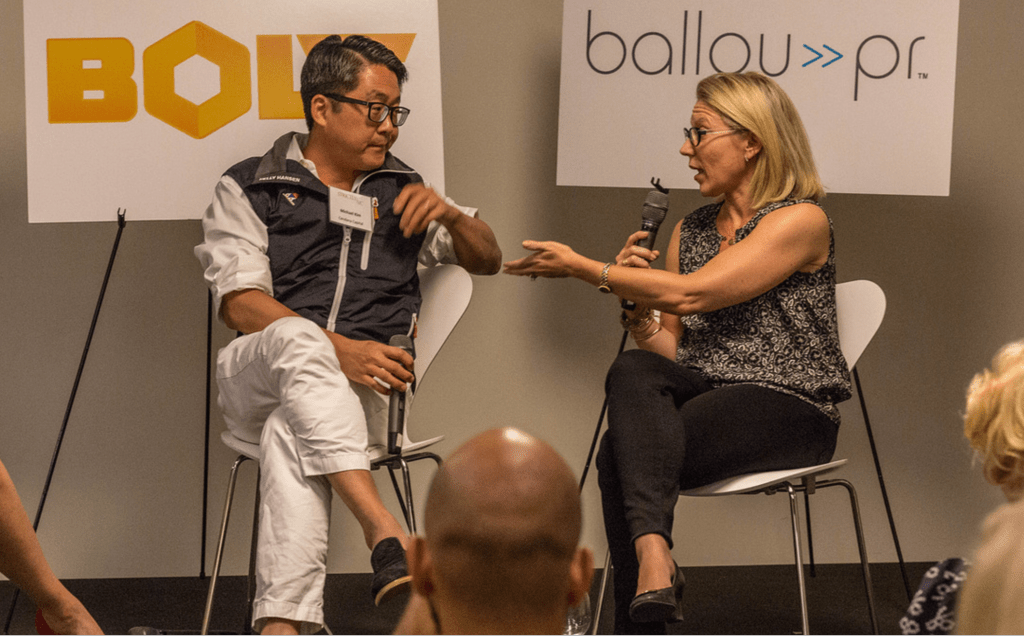

On Wednesday night, at the Autodesk Gallery in San Francisco, this editor sat down with Michael Kim of Cendana Capital and Elizabeth “Beezer” Clarkson of Sapphire Ventures. I’d invited these fund of fund managers to a small industry event as they’re two of very few limited partners — meaning people who give VCs money to invest — who speak publicly about their work.

Typically, these investors, called LPs, prefer to operate in the shadows so they won’t be inundated with pitches by venture firms looking for capital. But they also refrain from raising their hand because they are “sheep,” said Kim, whose firm has stakes in SoftTechVC, Lerer Hippeau Ventures, and roughly two dozen other firms.

Noting that many LPs work for institutions like pension funds and universities and have investment committees to answer to, he borrowed the old catchphrase that “no one ever got fired for buying IBM,” meaning LPs often prefer to write checks to established firms rather than gamble on up-and-comers. (For good measure, Kim also called his LP peers “not that smart, typically.”)

It was that kind of conversation, to the crowd’s delight. More outtakes from our chat with Kim and Clarkson — whose bets include Data Collective, August Capital, and Point Nine Venture in Berlin — follows here.

TC: Let’s start with sexual harassment, an issue that rocked Silicon Valley this summer. How does someone with the reported reputation of an investor like Justin Caldbeck raise a fund — and continue to raise funds?

MK: First, Cendana invests in seed funds; we did not invest in [the fund Caldbeck cofounded] Binary, which is a Series A fund. But I would have to say that when I heard about the story, I was thinking, ‘It finally came out. ‘

Those topics were out in the market for at least two years, and I know a lot of reporters were looking into it, they just couldn’t get people to go on record. I think that Reed [Albergotti, the reporter who broke the Binary story] was able to [persuade his sources to speak up] represents a sea change in terms of how people are viewing the topics around this, and it’s a great thing.

TC: So LPs knew.

MK: I would say a lot of LPs probably didn’t know, because I don’t think most LPs do their work and they don’t do their due diligence. If they’d scratched the surface, it would have been very obvious to them.

TC: Beezer, what do you think?

BC: I think Michael is right about there being a sea change. Over the summer, you had so many people coming forward about Binary, and what was going on in some [other] portfolio companies – there was suddenly pre all that and post all that, and the nice thing is that I now have people saying, “I would probably have never told an LP before, but I want to tell you X. ”

This information is now connecting, and I credit that to the fact that before, questions may not always have been asked, but also people didn’t always answer. Now, there are conversations you can have that you couldn’t before, and dialog is changing at every level. Companies are acting differently, VCs are acting differently, and while I can’t speak for every LP, I think LPs have a license now to ask questions that are uncomfortable, and I think people are more likely to answer them fully.

TC: What part of this saga surprised you most?

MK: What was shocking was that [follow-up] New York Times article where [one of Binary’s investors] Legacy Venture said they knew about [Caldbeck’s reputation], yet they invested. They are actually really good guys and their mission, since they are a little bit older, was to donate all their carry to charity. For people of that experience and reputation to say on record, it’s totally stupid but also unbelievable that they would go ahead with that [investment in Binary].

Part of the sea change is that before, they didn’t think it was a Big Deal. Now people are probably thinking, okay, that’s a major red flag.

TC: What sort of off-road due diligence do both of you do to find out more about your fund managers?

MK: We invest in a lot of first time fund managers. We invested in Kirsten Green at Forerunner, committing $10 million to her – we were the first to commit to her – she basically had a $3 million pool of capital that a hedge fund gave her, so how do you diligence something like that? Well, we called each portfolio company. We called the guys at [eyewear company] Warby Parker and asked them, “If she had a $40 million fund, would you have let her lead the deal?”

So we talk with founders. We have our own advisory board. And we hear a lot of scuttlebutt. We now have 20-plus GPs that we can talk with, as well. Leveraging your network is what it is.

BC: I had a GP say to me recently, “I heard you’re still doing reference calls, and you invested in me three years ago,” and I was like, “Oh, I’m always going to do reference calls.” I want to hear the good things. Listening for bad things is part of it, too. But the idea is, markets change and who is a great seed investor one day may not be the next day. Or, if someone is moving into Series A stage deals, it’s like, okay, well who’s growing up, or what kinds of deals are people doing, or who likes what? So references need to keep going.

TC: VCs are bringing on more women, slowly. They appear to be paying more attention to the demographics of their portfolio company CEOs. What’s happening at the LP level? Do you feel compelled to look at more diverse venture teams or are you in the business of making money, full stop?

MK: The pool of great entrepreneurs is substantially more diverse than it was in the ’50s and ’60s, so VC firms have to have [general partners] who can relate to people. One easy way that people think about this is: we need younger GPs to work with these twentysomethings, because some 60-year-old from Sequoia might have more difficulty relating. So I think we’re seeing the silent hand of the market play a role in getting VC firms to bring on GPs with this more diverse group of entrepreneurs.

TC: But can you imagine an institution putting down its foot and saying, Andreessen Horowitz or Accel — firms that I’m sure are talking with women but don’t have a female GP right now — would any LP said, “Nope, we’re not funding those guys”?

BC: It’s possible that some LPs would and others would not. There’s a ton of money that’s looking at getting into venture funds and LPs come in so many different forms all over the globe that it’s hard [to generalize]. But I still don’t think it takes a rocket scientist to realize that diversity is better. There are umpteen studies that show this, so it’s a bizarre concept to think that at a tech startup, this isn’t also true.

TC: Are you being pitched by more women creating their own funds?

BC: More women are starting funds, which is great. But the funds they are starting are smaller. You see a lot at the seed level, then you look at women at the Series A and B and C level [firms] and [their numbers] rapidly diminish, so the question is how do you pull that up? And if everybody is starting a $5 million fund, it’s just going to take a really long time. So the question is how do you stand up a Series A fund that has diversity. I would like to see more.

TC: The industry is changing so fast. Do you worry about threats to your own business? What about AngelList, which has begun forming small venture funds but presumably has plans to help launch bigger ones down the line?

BC: I like that [AngelList is] democratic. Not everyone [has access to capital] and there are theories out there that great GPs aren’t happening because they don’t happen to know wealthy families. So I think AngelList and the ability to get seed capital to do angel deals is really interesting and could provide some more ways of getting people launched.

It’d be interesting to see a Series A fund get launched that way. I think we have a little bit of time.

MK: It’s a hard question to answer. If I knew the answer, I’d be doing something about it.

I love [AngelList cofounder] Naval [Ravikant]. I think he’s a genius; he’s done a lot of creative things. But I don’t think AngelList is a meaningful thing. They can point to the number of dollars they’ve raised, but ultimately people are using it to top off rounds of probably not-great companies. I mean, he can point to companies like Uber or Cruise automation [both deals involved investors who used AngelList to help fund their investments in the companies]. But I think the GPs we work with don’t think it’s [so disruptive].

TC: I think it’s fair to say you will not be receiving holiday cards from some people this year.

MK: Maybe so. [Laughs.]

Comment