LPs

Featured Article

LACERA decreases venture capital allocation range, but experts say it doesn’t signal a trend

The Los Angeles County Employees Retirement Association (LACERA) voted to decrease its allocation range to venture capital at a March 13 meeting. The board of investments voted to decrease its allocation range to venture capital and growth equity from between 15% and 30% of the pension system’s private equity portfolio, to between 5% and 25%.…

Gale Wilkinson just closed a $23.4 million fund after two years of raising. She shares her advice for unlocking LPs.

Blockchain Capital launches two new funds for a total of $580M

The crypto bear market may be ongoing, but Blockchain Capital is still going big. It closed two new funds for a total of $580 million, the firm’s general partner Spencer…

20SALES closes $5M inaugural fund to invest in early-stage B2B SaaS startups

Although the focus of the fund is not just to solely back women, it hopes to focus its efforts there when possible.

Yeah, the data is bad, but I’m still optimistic about emerging managers

Emerging managers saw the funding declines of 2022 continue into 2023. But I think the space is worth getting excited about.

New wave of VC funds show it’s time to rethink how many LPs is ‘too many’

More LPs means more organizational issues, but many firms see the benefit of having more backers. Others don’t have a choice.

Featured Article

Stop spending so much time on your product when pitching to investors

It’s natural for founders to live and breathe for their customers and product, but the dirty little secret of fundraising is that your investors are extraordinarily unlikely to care about your product

Coming out of COVID, investors lose their taste for board meetings

Two weeks ago, longtime venture capitalist Chris Olsen, a general partner and cofounder of Drive Capital in Columbus, Ohio, settled into his seat for a portfolio company’s board meeting. It…

Featured Article

More LP transparency is overdue

Both LPs and VCs have reasons to want to keep their involvement confidential. But when these reasons aren’t solid enough, the anonymity of a fund’s limited partners might diminish.

Three years ago, I met with a founder who had raised a massive seed round at a valuation that was at least five times the market rate. I asked what…

Singapore’s Openspace Ventures closes new $135M fund for Southeast Asia

It seems like everyone is out there raising new funds in Southeast Asia. Weeks after we reported Golden Gate Ventures hit a first close on its third fund aimed at…

GV partner Lo Toney wants to raise $50 million to fund diverse investors

GV partner Lo Toney is looking to raise up to $50 million for his new fund, Plexo Capital, Axios first reported. Since 2017, Toney has been incubating Plexo Capital inside…

In the world of VC, harassment claims aren’t necessarily a deal killer

A storm fueled by greater awareness about sexual assault and harassment has been gaining momentum in the U.S. ever since a former Uber engineer named Susan Fowler hit “publish” on…

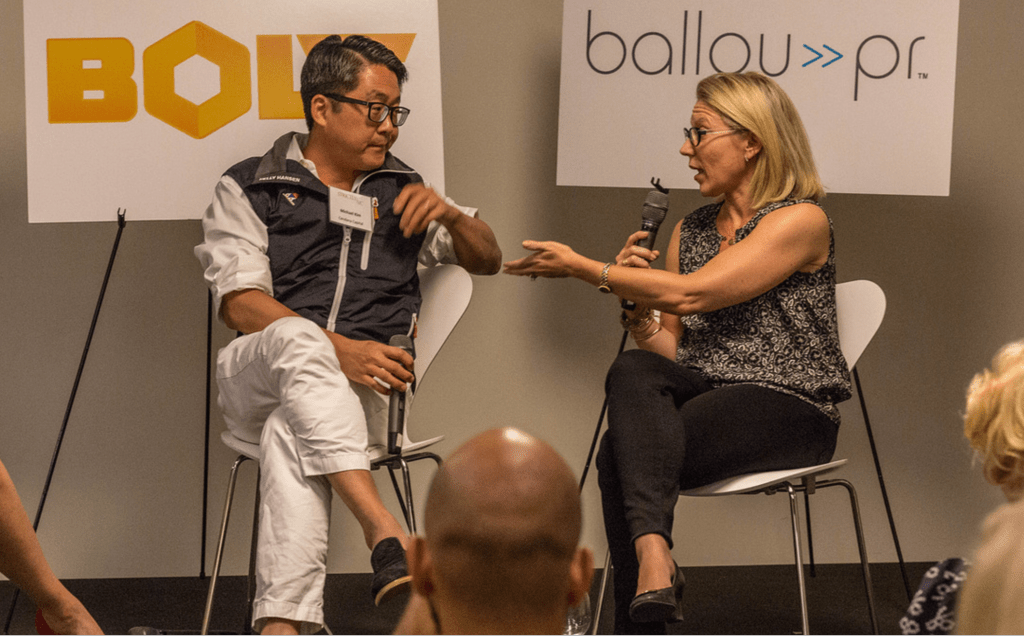

“LPs have a license now to ask questions that are uncomfortable”

On Wednesday night, at the Autodesk Gallery in San Francisco, this editor sat down with Michael Kim of Cendana Capital and Elizabeth “Beezer” Clarkson of Sapphire Ventures. I’d invited these…

Venture capital used to be such an insular, under-the-radar industry that entrepreneur-investor Marc Andreessen has said that he’d never heard the term before arriving in the Bay Area in 1994.…