Meet Dave: an AI dressed up in a bearsuit that’s just launched to save you from the evils of expensive overdraft fees. Hand Dave access to your checking account and the app’s machine learning algorithms will get busy crunching your spending data so the bear can warn you about pending transactions — like a monthly subscription for Netflix or your typical Saturday night Uber bill — which might push you into the red and incur an expensive bank penalty.

The US-only app predicts a user’s “7 Day Low”, aka the lowest it thinks your bank balance will drop in the next seven days, in order to encourage and support better money management. The ultimate aim being to help people avoid having to fall back on their overdraft as “an expensive form of credit”, says co-founder Jason Wilk, describing it as a sort of “weather forecast” for money management.

Dave also includes a payday loan facility — so users who face the inevitability of having to dip into a negative balance can opt to borrow up to $250 ahead of their next paycheck to see them through. But unlike payday loan companies (such as Wonga), which also offer a short term borrowing facility to mobile users but typically charge very high rates of interest, Dave’s payday loans are 0% interest.

Wilk tells TechCrunch it will also merely be asking users to pay it back when they can. “We’re not even tying this to a timeframe. Unlike the payday loan. All we’re saying is to users pay us back whenever you have the estimated income come it,” he says.

If all this is sounding too good to be true there may be a reason for that: Dave hopes you’ll be so thankful of the service its machine learning algorithms are doing for your spending habits that you’ll give a donation when the bear asks for a tip — although this is also entirely voluntary. How much you choose to pay (if you pay) is also up to you.

To further incentivize the opt-in fee, Dave has partnered with Trees for the Future — and says that for every percentage users tip it will plant the equivalent number of trees via its charity partner (so a tip 2% will equal two trees planted).

An FAQ on its website says this of its partner cause:

Trees for the Future provides families in Sub-Saharan Africa with sustainable food sources, livestock feed, products to sell, fuel wood and up to a 500% increase in their annual income. Since 1989, Trees has planted over 115 million trees in dozens of countries and revitalized hundreds of thousands of acres of soil while changing people’s lives forever.

So, in essence, Dave is about rebranding the roundly hated bank overdraft fees, which apparently do nothing except enrich banking giants, and trying to replace them with feel good donations attached to a worthy cause. A line on its website claims: “Dave lives off of donations”, although Wilk says it does also charge a small subscription for its app — $0.99 per month. Albeit, this subscription appears radically reasonable beside the typical cost of overdraft fees.

The team behind Dave has raised seed funding from a string of high profile investors. Since being “officially” founded in September last year, they’ve pulled in $3M from investors including Mark Cuban, SV Angel, The Chernin Group, Jonathan Kraft, Skip Paul, Diplo and others. So, safe to say, this is not Wilk’s first startup; indeed, he says it’s his “fourth go around”. (One of his prior startups — a video syndication platform called AllScreen TV — exited to Zealot Networks for $85M, having raised just $330k in seed funding and grown revenue to $20M.)

The idea for Dave came about because Wilk says he and a couple of his co-founders were “chronic overdrafters” in college. “I would always be overdrafting my account. I had hundreds and hundreds of dollars overdraft use on my account. So this is a problem that I’ve always had and I knew it needed to be solved. And I’m also an active Redditor and I can see on a weekly basis that somebody is posting about being upset with bank fees.”

He also points to the rising cost of overdraft fees in the US, as another reason he wanted to do something here, noting they amounted to $36BN last year alone, and couching the problem as “upsetting”.

To figure out how they could help, the team set about doing market research to find out why people were overdrafting, and said their survey turned up two main reasons: people not being aware of upcoming expenses, and people being short before their next paycheck.

Another factor they unearthed was that people were often going to ask a friend or family for a short term loan to cover the shortfall and see them through — which was the inspiration for giving the app a human name. As for bears, well, everyone loves bears right?

“We wanted Dave to be this alternative to your friends and family who can help save you from unnecessary bank fees and lets you know about all your upcoming expenses,” says Wilk.

Discussing the loan element of the product, he says the average user only needs to borrow about $130 at this point, so the team hasn’t decided yet whether to offer larger loans that do charge an interest fee in future. “$250 seems like a safe limit… But as we look to other things we might raise that, we’re just not quite sure yet,” he adds.

Wilk describes Dave as an “honor system product”, and reckons its friendly approach will help buttress it against the risk of users’ taking advantage of the loan facility — i.e. by borrowing money and not paying it back (although he says if a user continues to default their account will be suspended, ergo Dave’s patience is not infinite).

Users are not credit checked for the loan facility. Although they are required to have an active checking account — so essentially to be employed with a regular wage coming in. And of course Dave knows whether you’re employed because you’re sharing access to your bank account with the app so it can see everything coming in and going out of your account.

Users log into the app with their checking account, with Wilk noting the app currently supports “about 3,000 institutions”. “As opposed to us offering banking services ourselves we figured a much better way to start was by helping people enhance their own account that they already have,” he adds.

On the prediction front, he concedes Dave obviously can’t predict unexpected and/or random spending — but says the idea is to structure a series of notifications (warning of pending overdraft, warning of pending transactions etc) so that users are given enough advanced notice to be able to take action to better manage their money — and either avoid going into overdraft in the first place or else take a short term loan to cover the shortfall.

The app initially sends an advance notification of the seven day low balance to make users aware when they might need to cut back on their spending. It also warns about any pending transactions which may also push an account into a negative balance — giving a user time to act before money is actually taken from their account. A final warning gives the chance to borrow to cover an inevitable overdraft.

“We’ll send you a final notification that you have an extremely high risk of overdrafting,” notes Wilk. “If your current balance is negative, we still have some time to help you by the end of the day. So the predictions don’t need to be perfect for us to help you out — we’d like to be as useful as possible. But we have three times that we can intervene to help you out.”

Why do people need an algorithm to help them avoid overspending? Why aren’t they able to manage their own spending? Wilk reckons technology is a pretty big part of the problem here. “People use their debit card or credit card so often now it’s sort of hard to keep track,” he argues, noting that pending transactions can be especially tricky to keep on track of as it’s not clear exactly when the money will be taken.

“How could somebody be on top of that and know that they have another bill that’s going to be processed at some point during the week,” he adds. “Plus we’ve got all these digital services, they’re billing you on every thirty day period so who knows [which day it’s going to be]. If you’re down to $5 or $10 in your account it’s kind of frustrating to have to log into your bank account, go back into your statement, figure out when that last bill hit… It’s confusing.”

While the app is ostensibly being targeted at Millennials, Wilk says early positive feedback from testers has not been limited to this age-group — and reckons there could be something useful here for “all ages”. “If we could have one million installs after 12 months we’d be really happy,” he adds.

He also confirms that overdrafts are just the first target for Dave — with the idea being to use the same approach to, potentially, address other types of bank fees or even move to tackle unpopular fees in other industries. “We’re not sure yet we just know that people are mad about lots of different things — so this is just the first one,” he says.

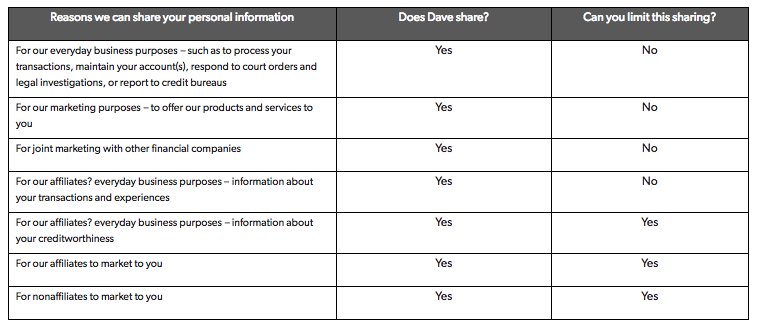

Privacy

One factor that concerned me when I looked over Dave’s privacy policy is that it included an apparent ability for the app to share user information with third parties for marketing purposes. And considering how much personal and sensitive data is contained in a person’s bank account — e.g. spending patterns, salary info, subscription data etc etc — this seemed pretty alarming. And made its low fee claim look more like a cynical grab for user data.

Here’s what a table on its Privacy Policy page contained for ‘reasons we can share your data’ when I first looked at it — note that it said Dave shares personal data for joint marketing with other financial companies and for nonaffiliates to market to you:

Asked whether Dave would indeed be sharing user data with third parties for marketing purposes, Wilk said it would not and that he was unaware of the clauses TechCrunch had flagged up. “We have no interest in selling anyone’s data,” he told us, pledging to look at the privacy policy and get it changed.

Sure enough, the new privacy policy has been changed to state Dave will not share personal data for joint marketing with other financial companies nor for nonaffiliates to market to you:

“Advertising to users based off their data is not a business we’re interested in,” added Wilk. “That’s not something that we’re looking to do — this service is really something we’re trying to build to better everyone’s banking experience in the US, because we don’t think it’s a good one. And we certainly wouldn’t want to do anything to make someone feel uncomfortable or harm them in any way.”

So, as ever, it pays to read the small print — including, and perhaps especially, if you’re a founder and the print in question is your own privacy policy.

Comment