Jake Bright

Jake Bright is a writer, author and advisor with a focus on global business, politics, and technology.

From 2017 to 2020, he was a contributing writer and advisor at TechCrunch where he published on Africa, mobility and politics. Bright helped spearhead consistent Africa coverage and co-produce the first Startup Battlefield competitions in Africa and Africa focused programming on the Disrupt San Francisco mainstage.

Bright’s first book, The Next Africa (Macmillan 2015), forecast the rise of Africa’s venture backed startup scene. Prior to this he worked in international finance and as a speechwriter in Washington, DC. Bright continues to contribute occasional guest pieces at TechCrunch.

More posts from Jake Bright

Some of Africa’s best funded ecommerce startups just secured more capital. Africa Internet Group (AIG)—which owns online retailer Jumia and 9 other e-ventures—will receive €75 million ($83 million) from Europe’s AXA Insurance in exchange for 8 an percent equity stake.

AIG will use the funds to support all points of its business model aimed at expanding ecommerce services across Africa’s core economies. The investment buys AXA access to AIG’s expanding startup network.

“AXA not only sees this as an opportunity to invest in a company that will bring financial returns, they also see us as a great partner to accelerate distribution of insurance products in Africa,” AIG CEO Sacha Poignonnec told TechCrunch.

“We have a solid ecommerce vertical across things like retail, travel, real estate…and cars. First, we’ll use the investment to strengthen…our existing businesses. Longer term we’ll look at launching new African companies and services and entering new countries.” Poignonnec said AIG would start operating in DRC this year.

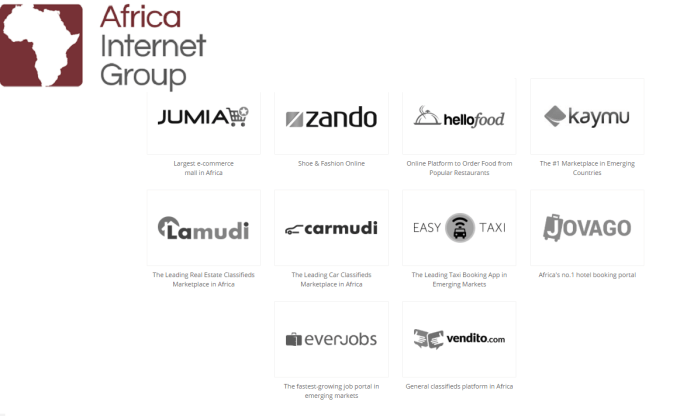

Owned by Germany’s Rocket Internet, AIG’s startup network includes online platforms across hotel (Jovago), fashion (Zando), employment (Everjobs), real estate (Lamudi), and transportation (EasyTaxi) services.

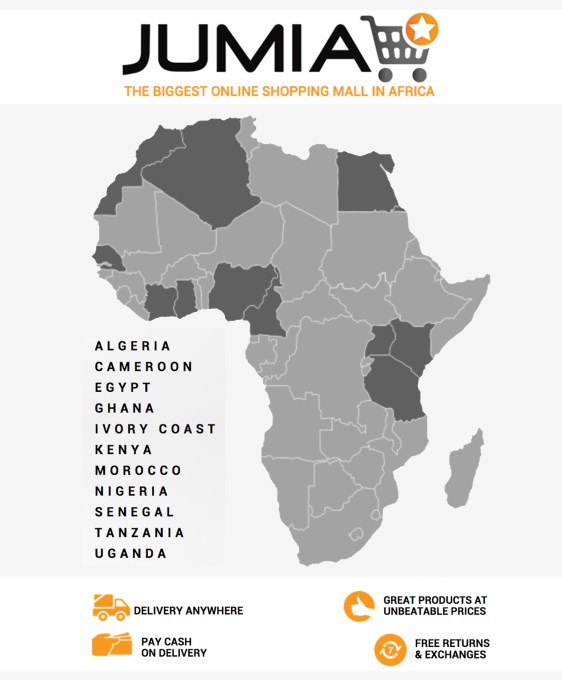

AIG’s best known venture is online retailer Jumia, one of Africa’s better funded startups, backed by $211 million in (known) VC from investors including Summit Partners and telecoms company Millicom.

Since its inception in Lagos in 2012, the company now operates in 11 African countries selling everything from diapers to IPhones and microwaves.

While Poignonnec would not divulge Jumia valuation or profitability figures, he said the company had €206 million in revenues the first 9 months of 2015, for growth of 265 percent over the previous year.

Poignonnec also noted AIG is exploring ecommerce models to deliver credit and fintech services to unbanked actors in frontier markets. “Many of the consumers and small businesses we work with do not have access to financing, credit ratings, or other financial services. We’ve been looking at some examples in India and Indonesia where consumers can gain access to loans, ratings, and financial services through performance on ecommerce platforms.”

The equation for online commerce and fintech in Africa is bolstered by fast growing youth populations, expanding consumer power, and increased smartphone penetration. Africa’s consumer spending is expected to reach over $1 trillion by 2020, increasingly amount of it shifting online. Ecommerce spending in Nigeria, Africa’s largest economy is expected to reach $8 billion by 2025.

While these trends bode favorably for ecommerce on the continent, the baseline infrastructure U.S. online sales platforms take for granted is challenged: electricity, affordable internet, digital payments, and delivery options.

African ecommerce platforms, such as Jumia, face higher operating costs for generator power, managing fleets of delivery vehicles, and accepting 95 percent cash on delivery over e-payments in Nigeria due to customer preferences for cash and low mobile money penetration.

Africa’s core economies have also started to take hits due to China’s slowdown (China is Africa’s largest trading partner) and the slump in commodities prices—oil makes up 90 percent of Nigeria’s exports and oil revenues account for roughly one third of its GDP.

AIG’s Poignonnec points to greater diversity in many of Africa’s economies and the longer view for ecommerce, “Internet broadband and digital access will only improve across the continent. Many Fortune 500 companies we talk to are also realizing they need to make investments now to take advantage of digital consumer trends that will peak over the next 5 years,” he said.

Poignonnec also alluded to more investment for AIG in the near future, noting the AXA funding is the first stage of an ongoing funding round to be announced over 2016. That could make for interesting tech news and another potential African tech unicorn (see Interswitch fintech story).

If AXA’s $83 million stake represents an 8 percent equity stake in AIG’s ongoing 2016 financing that moves another VC backed African startup operation toward a $1 billion valuation. Stay tuned.

Comment