This is a guest post by Nick Halstead, CEO and founder of fav.or.it

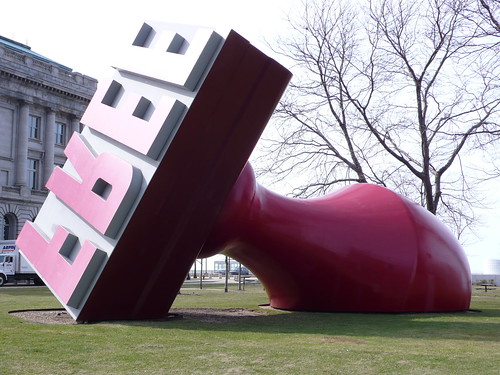

As I am in the midst of raising another round of funding for fav.or.it I wanted to cover some of my thoughts on the government’s recent announcement of further funding for business that is meant to help SME’s survive through the credit crunch. The question is: is there real substance to any of this, or is it just a lot of hot air?

ENTERPRISE FINANCE GUARANTEE SCHEME

This is just a fancy new name for what you probably know as the SFLG (Small Firm Loan Guarantee) – this is a scheme in which the government guarantees 75% of a loan with the rest covered by the banks.

A year ago this allowed loans of up to £100,000 – which was then increased to £250,000. It was something you fell back on if the bank turned you down for a normal loan (in fact it was a requirement that you first applied for a normal loan). I have previously raised a SFLG (over 2 years ago) and found the process reasonably painless except for the fact they take a debenture against your Intellectual Property.

The problem though is that since the beginning of the credit crunch the Banks have not been lending. I inquired to a friendly senior figure in HBOS about 4 months ago and was told not to even bother. I also contacted a few other people in the know within SEEDA and the answer was the same, no lending.

So when I heard about the new initiatives I was curious to find why anything would have changed. Well the statement from the UK GOV declares ‘This scheme will support up to £1.3bn of new lending by banks.’ However, there is one BIG problem, the banks still do not want to lend. I heard today from someone who was at a senior meeting of the “Big Four” banks (that we as tax payers now own) that they declared that in no way was there any going be any lending via SFLG.

My Advice: Ask your bank manager, but when he laughs at you don’t be surprised.

CAPITAL FOR ENTERPRISE FUND

This used to be a fund created by the government that was bid for by various private venture funds who would then invest it. The scheme was originally setup to fill ‘the equity gap’ that being investment between £250,000 and £2million – an area that traditionally is not covered by Angels or VC’s. The fund is re-invested by companies such as Seraphim Captial and Oxford Technology. Both of these in general only deal only with companies that are already generating good revenue.

The confusing part is that the new announcement seems to have converted this equity based funding model into a ‘debt to equity fund’ this may be due to the fact that not enough of the fund has been spent, and or they see it better used to convert bad debt.

My Advice: If you are already generating cash then talk to them, but if you are in that position then the VC’s (such as Balderton) are already in the prowl for good deals.

REGIONAL DEVELOPMENT AGENCIES

The last minor announcement was that a further £25m was going to be invested through the RDA’s. This in theory is the best news for startups as RDA’s such as SEEDA are slightly better at distributing money out via other agencies. One which I have dealt with at length is Finance South East – they have a range of funding models from equity based matching funds (up to £250,000), debt based accelerators (up to £100,000) and also a few other small funds for very early stage ventures.

My Advice: For startups at pre-revenue stage there are a number of good options, but be prepared for a 4-5 month process + a lot of paperwork.

NESTA

Lastly let me just make a scathing attack on NESTA who in theory cover ‘Science, Technology and the Arts’ but in fact would rather not touch Technology with a 9 foot investment stick. I was clearly told that “We do not invest in anything web 2.0 at the moment.” – So feel free to go waste time talking to them, but I would warn against it.

My Advice: Tell them to stick it where the sun don’t shine.

Other Resources

- Region Development Agencies – What They Do

- Assess your eligibility for government guaranteed lending schemes

- Enterprise Capital Funds

If anyone wants contacts into SEEDA, FSE or advice on other government schemes then get in touch via Twitter.

Comment