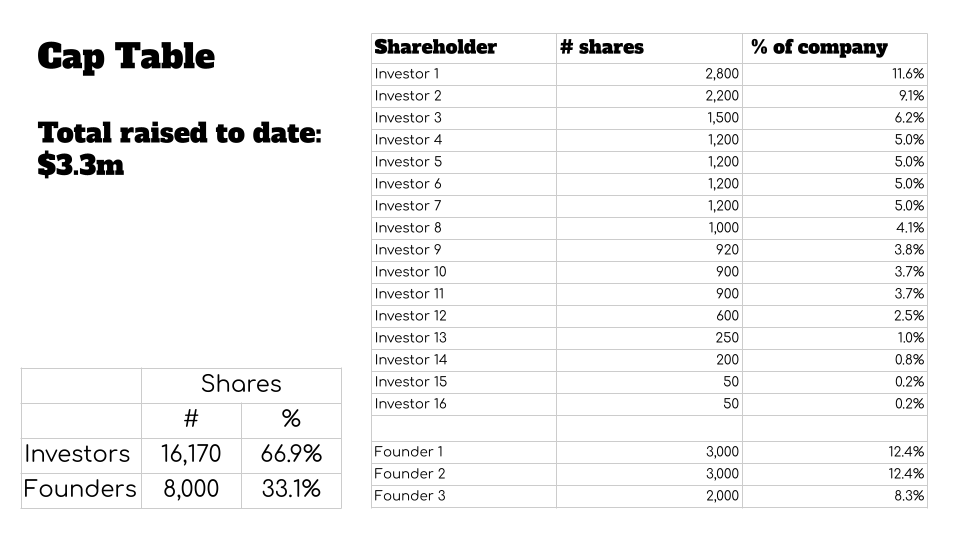

The CEO of a Norwegian hardware startup shared a pitch deck with me that had an unusual slide: It included the company’s capitalization table — the breakdown of who owns what part of the company. Typically, cap tables are shared in the diligence phase of investing.

Taking a closer look at the table, something is significantly amiss:

The problem here is that the company has given up more than two-thirds of its equity to raise $3.3 million. With the company starting a $5 million fundraising round, that represents a serious hurdle.

TechCrunch spoke to a number of Silicon Valley investors, posing the hypothetical of whether they would invest in a founder who presented a cap table with similar dynamics as the one shown above. What we learned is that the cap table as it stands today essentially makes the company uninvestable, but that there is still hope.

Why is this such a big problem?

In less sophisticated startup ecosystems, investors can be tempted to make short-sighted decisions, such as trying to take as much as 30% of a company’s equity in a relatively small funding round. If you’re not familiar with how startups work in the long run, that can seem like a sensible goal: Isn’t it an investor’s job to get as much as they can for the money they invested? Perhaps, yes, but hidden within that dynamic is a de facto poison pill that can limit how large a startup can possibly get. At some point, a company’s founders have so little equity left, that the cost/benefit analysis of the grueling death-march that is running a startup starts shifting against them continuing to give it their all.

“This cap table has one giant red flag: The investor base owns twice as much as the three founders combined do,” said Leslie Feinzaig, general partner at Graham & Walker. “I want founders to have a lot of skin in the game. The best founders have a very high earning potential — I want it to be unquestionably worth their time to keep going for many years after my investment in them … I want the incentives to be completely aligned from the get go.”

Feinzaig said that this company, as it stands, is “essentially uninvestable,” unless a new lead comes in and fixes the cap table. Of course, that, in itself, is a high-risk move that is going to take a lot of time, energy, money and lawyers.

“Fixing the cap table would mean cramming down existing investors and returning ownership to the founders,” Feinzaig said. “That is an aggressive move, and not many new investors are going to be willing to go to those lengths. If this is the next OpenAI, they have a fair shot at finding a lead who will help clean this up. But at the seed stage, it is brutally hard to stand out so clearly, let alone in the current VC market.”

With unmotivated founders, the company would potentially exit sooner than it might have otherwise. For those of us who live and breathe venture capital business models, that’s a bad sign: It leads to mediocre outcomes for startup founders, which limits the amount of angel investing they will be able to do, taking the entry-level funding out of the startup ecosystem.

Such an early exit would also limit potential upsides for the VCs. A company that exits later at a far higher valuation increases the chance of a huge, 100x fund-returning outcome from a single investment. That, in turn, means that the limited partners (i.e. the folks who invest in VC firms) see reduced returns. Over time, the LPs will get bored of that; the whole point of VC as an asset class is incredibly high risk, for the potential of ludicrously good returns. When the LPs go elsewhere for their high-risk investments, the entire startup ecosystem collapses due to lack of funds.

There is a potential solution

“We definitely want to try and keep seed and Series A cap tables looking ‘normal,’” Hunter Walk, general partner at Homebrew, told TechCrunch. “Typically investors own a minority of the company in total, the founders still have healthy ownership, which they’re vesting into, and the company/team/pool has the rest of the common [stock].”

I asked the CEO and founder of the hardware company in question how the company got itself into this mess. He asked to remain anonymous so as not to endanger the company or leave his investors in a bad spot. He explains that the team had a bunch of large-company experience but lacked experience in the startup world. That means they didn’t know how much work it would take to get the product to market. Internally, he said that the company accepted the terms “just for this round,” and will pursue a higher valuation for the next round. Of course, as the company kept running into delays and issues, the investors ran a hard bargain, and facing the choice of running out of money or taking a bad deal, the company decided to take the bad deal.

The CEO says the company is building a solution for a problem experienced by 1.7 billion people, and that the company has a novel, patent-pending product that it has been successfully testing for six months. On the face of it, it looks like a company with multibillion-dollar potential.

The current plan is for the company to raise the current $5 million round, and then make an attempt at correcting its cap table later. That’s a good idea in theory, but the startup has ambitions of raising from international investors who are going to have some opinions on the cap table itself. And that may raise questions about the founders themselves.

Cleaning up a cap table

“Situations like these which deserve ‘clean up’ certainly aren’t automatic ‘passes’ but they require the company and cap table to be comfortable with some restructuring in order to fix the incentive structure alongside the financing,” Walk said. “If we feel like it’s going to be near impossible to reconcile (even if we play the ‘bad guy’ on behalf of the founders), we’ll often advise the CEO to solve it before raising more capital.”

Mary Grove from Bread & Butter Ventures agrees that it’s a red flag if founders own so little of their company at the seed stage — and in particular that the investors own the other 66%, rather than some of the equity having gone to key hires.

“We’d want to understand the reasons behind why the company has taken such dilution this early. Is it because they are based in a geography with limited access to capital and some early investors — either not experienced with VC or bad actors — took advantage?,” Grove told TechCrunch. “Or is there an underlying reason with the business that made it really hard to raise capital (take a look through revenue growth/churn, did the company make a major pivot that made it essentially start from scratch, was there some litigation or other challenge)? Depending on the reason, we could get behind finding a path forward if the business and team met our filter for investment and we believe it is the right partnership.”

Grove said that Bread & Butter Ventures likes to see the founders own a combined 50-75% at this stage of the company — the inverse of what we see in our above reproduction — citing that this ensures alignment of interest and that founders are given recognition and incentive to build for the distance ahead for a venture-backed company. She suggests that her firm might have a term sheet that includes corrective measures.

“We would request that the founders receive additional option grants to bring their ownership up to the combined 50-75% prior to us leading or investing in the new round,” Grove says, but she points out the challenge in this: “This does mean existing investors on the cap table would also share in the overall dilution to make this reset happen, so if everyone is onboard with the plan, we’d hope to be all aligned on the path forward to support the founders and ensure they have ownership to execute their big vision and to take the company through to a big exit.”

Ultimately, the overall risk picture depends on the specifics of the company, and depends on how capital-intensive the business will be in the future. If one more raise could get the company to cash-flow neutral, with healthy organic growth from there, that’s one thing. If this is a type of business that will continue to be capital-intensive and will require multiple rounds of significant funding, that changes the risk profile further.

Rewinding the choices

The CEO told me that the company’s first investor was a Norwegian corporate, which sometimes spins out its own companies based on technology innovations it has developed. In the case of this company, however, it made an external investment at what the founder now describes as “below-market terms.” The CEO also mentioned that existing investors on its board suggested raising money at low valuations. Today, he harbors regrets, understanding that the choices might put the company’s long-term success in jeopardy. He said he suspected that VCs wouldn’t think his company was investable, and making sure that this issue was front and center for future investors is why he put the cap table as a slide in the slide deck in the first place.

The problem may not be isolated to this one founder. In many developing startup ecosystems — such as Norway’s — good advice can be hard to come by, and the “norms” are sometimes decided by people who don’t always understand how the venture model looks elsewhere.

“I don’t want to alienate my investors; they do a lot of good things as well,” the CEO said.

Walk says that bad actors are, unfortunately, not as rare as he’d like, and that Homebrew often comes across situations where an incubator or accelerator owns 10% or more on “exploitive terms,” or where greater than 50% of the company already sold to investors, or where a large portion of the shares are allocated to fully vested founders who might no longer be with the company.

The upshot could be if non-local investors want to invest in early-stage companies in developing ecosystems, they have an incredible opportunity: By offering more reasonable terms to promising early-stage startups than the local investors are willing to give, they can pick the best investments and leave the local investors to fight over the scraps. But the obvious downside is that this would represent a tremendous financial drain from the ecosystem: Instead of keeping the money in the country, the wealth (and, potentially, the talent) goes overseas, which is precisely the kind of thing the local ecosystem is trying to avoid.

If you have news tips or information for Haje, you can share it with him over email or Signal.

Comment