It was an eventful week in fintech startup land, and we did our best to capture the highlights. We covered some raises, new product lines, at least one M&A deal and more. Oh, and if you want to receive this in your inbox in the future, sign up here.

Lula tightens its belt and raises $35.5M at a 5x valuation

One of the coolest things about covering startups is covering them in their earlier stages and then watching them grow and raise more money over time. During the 2021 funding boom, it was very common for companies that I had previously covered to raise another round at a higher valuation. During this quieter funding season in 2023, it’s far less so.

But last week, I did get to report on Lula, a startup that aims to be the “Stripe for insurance.” Twin brothers Michael and Matthew Vega-Sanz started the company at the age of 24 in early 2020 and went on to raise an $18 million Series A (which I covered here) in 2021. This past week, they announced a $35.5 million Series B co-led by NextView Ventures and Khosla Ventures. Unfortunately, they did not disclose valuation, noting only that it was up “5x” compared to two years ago. With so many flat and down rounds taking place, though, such a big spike is certainly impressive.

I was curious as to how the company managed this feat in this current funding environment. In an interview, Michael told me that he and his brother/partner could feel that the market was about to take a turn in late 2021/early 2022. And while they didn’t need to yet raise more money, they sensed that it might be harder to do so when the time came. So they did something that was counter to a lot of other fintechs during that time: They tightened their belts. They adopted a more frugal mindset internally and when making new hires.

“In the last 12 months it certainly has been challenging trying to get the entire company to buy into this frugal, cost-conscious mentality,” Michael told me during an interview. “But we did, and I think that was the reason why the Series B process went smoothly for us. And to be honest with you, we expected it to be really, really, really difficult. We braced ourselves, and said, ‘Let’s go ahead and prepare like this is going to be a race that takes six to eight months. Let’s go ahead and prepare like this is going to be a race that none of our internal investors want to step up. Let’s just go ahead and brace for the worst.’”

The strategy seems to have worked. Revenue is up over 20x compared to last year and while at first it was hard, hiring quality employees actually ended up being not too difficult when candidates saw the value of a company that was focused on reducing cash burn and avoiding down rounds and layoffs.

“I think the fact that we just stuck to the core principles of building a really strong fundamentally sound business and being able to sustain that for the last two years — even in this crazy market — I think that primed us really well. And, we went from a few $100,000 in monthly recurring revenue in the first quarter of last year,” Michael said. “Today we’re doing a few million dollars in monthly revenue. And I think it’s important to call out that this is not gross written premium — this is actual revenue recurring revenue.”

Early investor NextView Ventures tripled (quadrupled?) down on its investment in the company, co-leading Lula’s latest round. Lee Hower — managing partner at NextView, co-founder of LinkedIn and early PayPal employee — actually first met the Vega-Sanz brothers at the end of 2018 when the pair was more focused on trying to build a ride-sharing network business. He kept in touch with them and took notice when they pivoted to focus directly on building an API for insurance needs. In 2020, his firm made a pre-seed investment in the company, which went on to participate in his firm’s virtual accelerator program that was launched that summer. “The Lula team took this from an idea to live with paying customers in their first market segment within about 5 months. They quickly ramped to seven-figure recurring revenue just a few months after that.”

Now Lula is targeting to reach $100 million in annual recurring revenue sometime over the next three to four quarters — and profitability even sooner. It’s come a long way from the days that co-founder Matthew says he remembers “photo shopping techcrunch headlines in my dorm room and hanging it on our walls hoping to one day get a story.”

It’s a type of growth story we’re not used to hearing as much these days. — Mary Ann

Get ’em while they’re young

As the parent of two teenagers, I’d like to know that I am setting them up to handle whatever financial things they may face in their adulthood. However, sometimes you need help. I’m not that savvy with investments — I leave that up to the experts that I pay to monitor my retirement portfolio (something my parents, in turn, taught me to set up out of college) — which is why I was eager to write about Bloom this week.

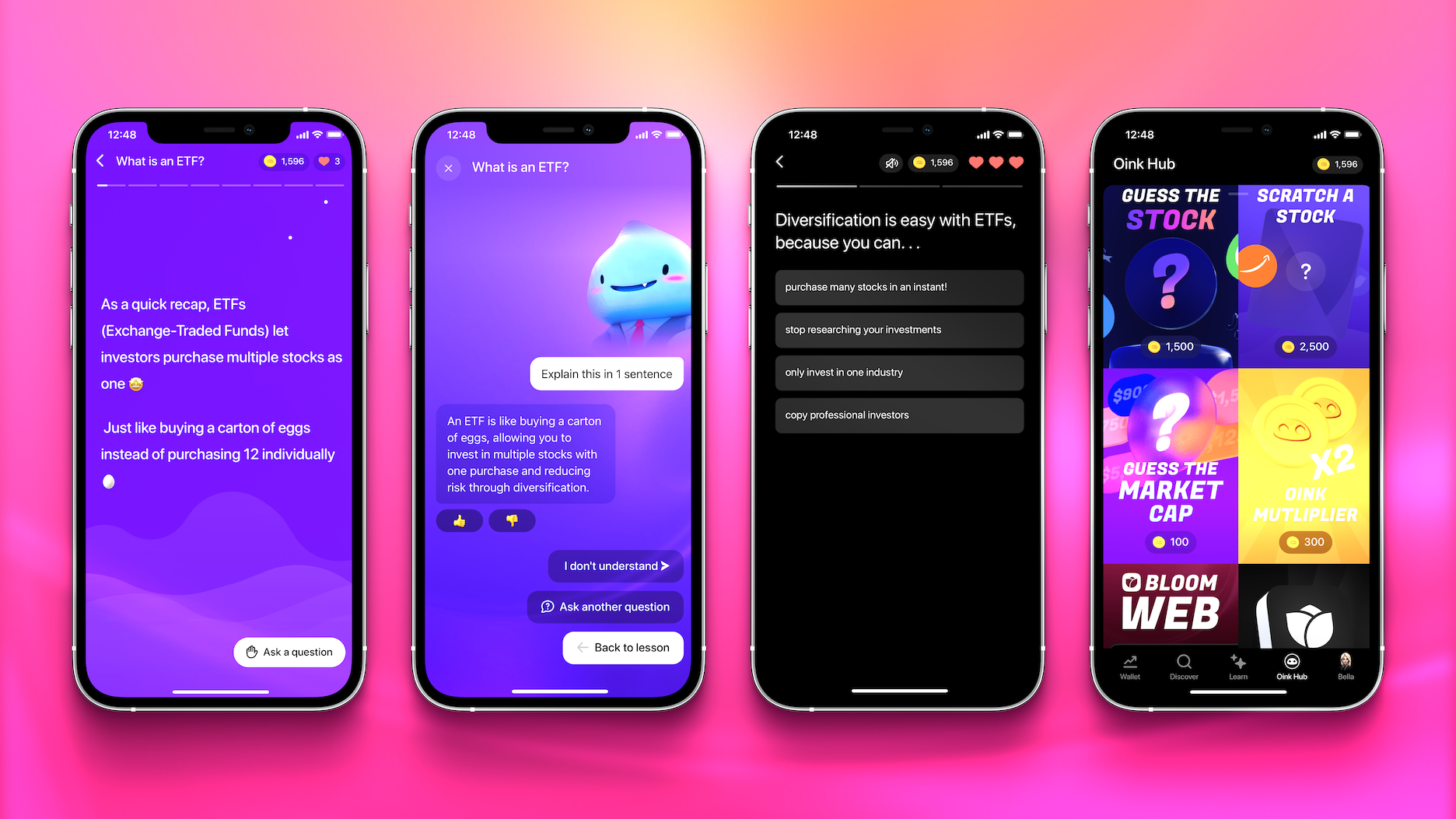

The venture-backed company was started by Allan Maman and Sam Yang a few years ago and offers a zero-commission stock investing tool for teenage investors that includes a brokerage account and teaches those aged 13 and older how to build wealth through interactive lessons on investing, stocks and finance.

Maman and Yang didn’t want to provide any old content, either. They developed an Instagram-like structure to their educational material, and when a user aces one of the quizzes, they get rewarded with points to spend within the app.

Bloom just passed 1 million downloads and over 10 million games played in the app. For those of you who are cash-conscious, it costs $15 a month or $120 for a year to utilize the app, and there are no minimums for the account balance.

Though Bloom started out with a focus on younger teens, Maman and Yang saw people aged 18 to 25 flocking to the site, so now they are leaning into that demographic going forward. Some companies targeting financial education for teens and Gen Z, like Copper, Step and Greenlight, are expanding in the “setting up a bank account and debit card” phase, so it is nice to see an app take on investing beyond just offering a free trade. — Christine

Spend management race continues and startups clamor to offer accounts payable products

If it feels like every week a different spend management company is announcing new features, it’s because it nearly is. This past week alone, Ramp, Brex and Rho shared their own respective news.

Ramp announced its entrance into the procurement space, added new customers in Shopify and Virgin Voyages, and had annualized revenue of “several hundred million” dollars. Meanwhile, Brex and Rho both announced AI-powered accounts payables (AP) products — both of which interestingly were built in partnership with AI startups. Brex has teamed up with companies such as Scale AI and Photon while Rho has partnered with OpenAI (with whom it shares an investor).

On the topic of bill pay, Bluevine is another fintech company that also recently announced a new AP product. Bluevine started as an SMB lender but has since grown its offering over time with digital banking aimed at small businesses.

The company via email also disputed Brex’s claim that it was the only fintech that offered its AP product for free, with a spokesperson for the company emailing me to say: “Bluevine also offers our AP solutions for ‘free’ from within the Bluevine Business Checking account (no min balance, no monthly fees, etc.) — with the only costs associated with money movement (wires, cross-border, etc.).”

Meanwhile, Zip also reached out to say that its CEO Rujul Zaparde believes that the expanding ecosystem in the procurement space “is a clear indicator that there is growing demand for this type of tech.” He subtly took a dig at Ramp’s new offering by adding: “It can be notoriously difficult to serve enterprise procurement teams effectively. In an industry known for years-long implementations and 100-page PDF guides describing to employees how to correctly make a purchase, balancing the need for ease of adoption via a modern user experience while capturing the needed procurement governance, vendor risk controls and executive reporting requirements can be incredibly challenging.” TechCrunch covered Zip’s latest raise of $100 million at a $1.5 billion valuation, and I talked to Rujul myself when I covered the company’s $42 million raise in May of 2022. — Mary Ann

Other weekly news

Mary Ann reported on Better.com‘s mixed news as of late. On the positive side for the company, an SEC investigation did not recommend an enforcement action against the digital mortgage lender after an investigation on the part of the SEC to determine if violations of the federal securities laws had occurred. Still, amazingly, the company continues to try to go public — despite recording large net losses quarter after quarter and downsizing its staff by 91% over the past 20 months or so. More here.

As reported by Aisha Malik: “Allo, a new financial app that can be described as Headspace for personal finance, is aiming to help users meaningfully engage with their finances without becoming overwhelmed with numbers and spending. The idea behind Allo is to help users create a mindful money practice that allows them to approach their earnings, spending, saving, investing and giving with a sense of fulfillment.” Read more here.

Also from Aisha: Apple announced last week that “Apple Card’s high-yield Savings account offered by Goldman Sachs has reached over $10 billion in deposits from users since launching in April. The Savings account offers an APY (annual percentage yield) of 4.15%.” Read more here. It’s also important to note that Goldman Sachs is looking to get out of the partnership, so it’s not clear how that would affect things, if at all, moving forward.

Robinhood beats revenue estimates, shares fall on decline in users: The company also was profitable during the three-month period — for the first time ever. Despite that good news, Third Bridge analyst Andrew McGee noted that Robinhood’s “large drop” in monthly active users was concerning given the believe that MAUs “were highly correlated with stock market returns.” He added, via an email statement: “MAUs were highlighted as the highest risk area for Robinhood by our specialists due to historical trends demonstrating that when retail traders lose significant amounts of money, they never come back. Additionally, the specialists believe the customers that left during the GameStop incident won’t return due to a lack of trust in the company.” McGee also warned that Robinhood needs to be careful if interest rates decrease to offset lost net interest revenue through additional products or increasing transactional volumes. Makes sense considering we won’t be seeing these rates forever.

KPMG issues its latest Pulse of Fintech report, looking at the first half of 2023. The report noted that “while both total fintech funding and the number of fintech deals globally dropped from $63.2 billion across 2,885 deals in H2’22 to $52.4 billion across 2,153 deals in H1’23, the news wasn’t all negative. Despite market turbulence and declining funding in both the EMEA and ASPAC regions, the Americas saw fintech funding climb from $28.9 billion in H2’22 to $36 billion in H1’23.” That’s a surprise! And completely in line with our lead story on Lula above, KPMG found that insurtech continues to attract interest in the Americas and the U.S. specifically, noting that “funding in the space will likely remain strong in the long term, as the technologies being used by many legacy insurance is quite antiquated — investors recognize that there is a real opportunity to upgrade.”

Meanwhile, AI officially overtook fintech as the hottest investment category in the second quarter of 2023, at least according to recent State of Venture report findings from AngelList and Brex. Specifically and unsurprisingly, the report found that the AI/ML sector showed “incredible” momentum in the first quarter of 2023, capturing the second highest share of investment volume and sixth highest share of capital deployed. Then in the second quarter, the AI/ML sector captured 14% of investment volume and 13.4% of capital deployed. Meanwhile, fintech was the second most popular investment activity sector in the second quarter but showed a “marked decline” over the previous three-month period. When it came to capital deployed, fintech actually ranked below AI, food and beverage and health tech in the second quarter of 2023 with 7.7% of dollars deployed.

Income and employment API Pinwheel is now American Express’ direct deposit switching partner for its new checking account. TechCrunch covered Pinwheel’s last raise — a $50 million Series B at a $500 million valuation — here.

ICYMI: US lawmakers are calling for a Department of Labor investigation into $12B HR startup Deel over its use of independent contractors, citing Insider’s investigation. TechCrunch also reported on the topic a few weeks ago.

Other items we are reading

Unpacking the end of Luko’s solo journey in insurtech (TC+)

The new banking as a service reality

Fintech unicorn Stax picks British finance exec Paulette Rowe as next boss

Primary Ventures hires Emily Man to be first fintech-focused partner

Stripe brings tax product to platforms, taps AI

Melio launches BNPL tool for SMBs

American Express partners with Skipify to enhance checkout process

Far Homes new financing tool helps Mexico seem much closer

Pathward, Dash Solutions tackle disbursements with real-time payments

Fundings and M&A

Seen on TechCrunch

Rapyd acquires a piece of PayU from Prosus for $610M to scale its fintech-as-a-service platform

Pockit, an all-in-one financial services app for UK consumers, lands $10M

Traction raises $6M seed as Nigeria’s merchant acquiring space continues to heat up

Tradeshift raises $70M, launches financing JV with HSBC focused on B2B trade

Emtech to advance its regtech and CBDC stack solutions with $4M led by Matrix Partners India

And elsewhere

Merger between Stavvy and Brace announced

Knot API raises $10M from Amex, Plaid amid deposit war

Jerry’s AI-powered revolution in car insurance accelerates with $110M raise (TechCrunch reported on Jerry’s $75 million raise at a $450 million valuation in August of 2021 here.)

Join us at TechCrunch Disrupt 2023 in San Francisco this September as we explore the impact of fintech on our world today. New this year, we will have a whole day dedicated to all things fintech, featuring some of today’s leading fintech figures. Save up to $600 when you buy your pass now through August 11, and save 15% on top of that with promo code INTERCHANGE. Learn more.

Join us at TechCrunch Disrupt 2023 in San Francisco this September as we explore the impact of fintech on our world today. New this year, we will have a whole day dedicated to all things fintech, featuring some of today’s leading fintech figures. Save up to $600 when you buy your pass now through August 11, and save 15% on top of that with promo code INTERCHANGE. Learn more.

Comment