Rory O’Driscoll

More posts from Rory O’Driscoll

“How fast do I need to be growing to be interesting to a venture investor?”

This is a question we get asked all the time by CEOs, and we realize “it depends” is not the most actionable answer to give. Instead, we have come up with a simple model that allows us to give a clear numerical answer to this question.

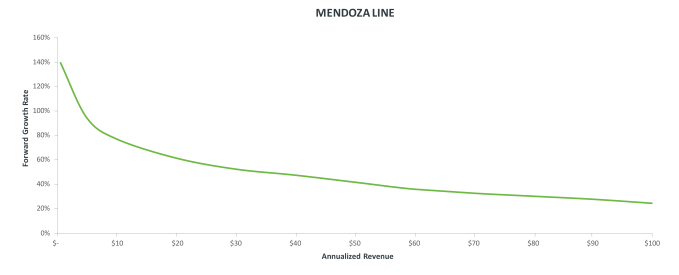

The model allows us to identify, at every stage in the life of a SaaS company, a growth rate, below which that company is not on a clear, venture-backable trajectory. We call the graph of those growth rates the Mendoza Line for Growth. For non-baseball fans, the Mendoza Line is a baseball term for the batting average below which a hitter is not worth hiring for Major League Baseball.

We admit to the massive simplifications of this Mendoza Line model, and recognize several ways to poke holes in the analysis, but we believe that, as for all decision heuristics, the gain in simplification is worth the sacrifice in precision.

The Mendoza line is based on just two assertions.

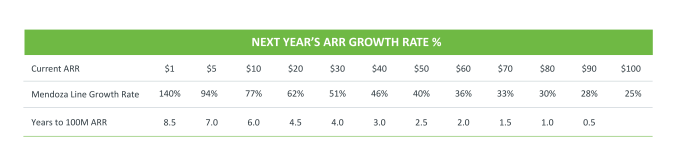

The first is that most venture investors prefer to invest in companies that have at least the chance to become standalone public companies (which is not to say most achieve this objective). Looking at the realistic low bar of what it takes to be a public company, this implies being at run rate revenue (ARR) of $100 million at the time of IPO, while still growing at 25 percent or greater in the following year.

The second is that most of the time, growth rates only decline, but do so in a way that is on average fairly predictable. For a best-in-class SaaS company, the growth rate for any given year is between 80 percent and 85 percent of the growth rate of that same company in the prior year. We refer to this as growth persistence (and this assumption holds true from about a $10 million run rate on). Based on our most recent estimates, we use a growth persistence estimate of 82 percent in this article.

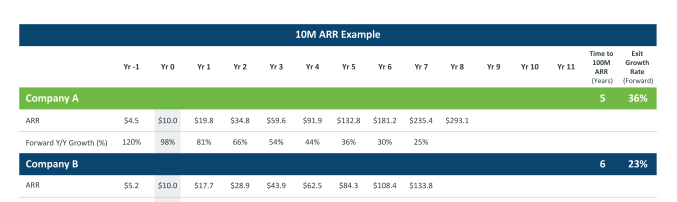

Using just those two assumptions, look at the chart below, which shows the trajectory of two $10 million ARR run rate software companies.

Company A grew last year at 120 percent, from $4.5 million to $10 million in ARR. The projection for growth rate next year is just under 100 percent (98 percent, reflecting the assumption of 82 percent growth persistence). The company is nearly doubling at a $10 million run rate, and if the growth rate continues its steady decline per the growth persistence math, in five years it will be at $133 million ARR run rate, still growing with a forward growth rate of 36 percent. Company A is on a path to go public.

Company B grew last year at 94 percent, from $5.2 million to $10 million, and plans to grow this coming year at 77 percent, again, reflecting the same growth persistence calculation. It will take this company six years to cross $100 million in ARR, at which point the company has a forward growth rate of just 23 percent. This is right at, or just below, the threshold at which a software company can go public, so Company B at a $10 million revenue run rate and a forward growth rate of 77 percent is on the Mendoza Line.

The calculation can be repeated for each revenue level because the growth rate required for escape velocity at $50 million is obviously different (and lower) than the growth rate required at $10 million. The numbers can then be shown in a simple graph as seen below.

The table below shows the same data in numeric form, which is sometimes easier.

Is this analysis a universal truth?

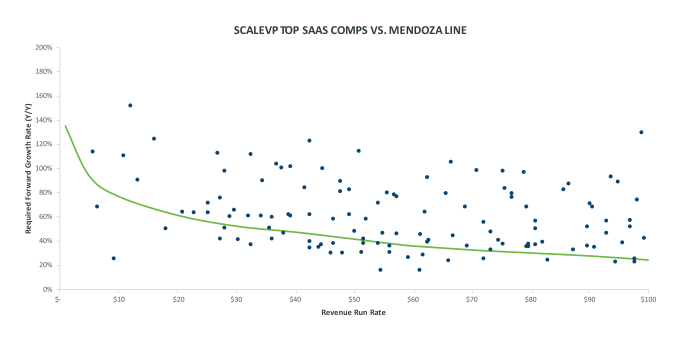

This is a heuristic, not a law of physics. In other words, it is rule of thumb that works well on average, recognizing there are exceptions. For a quick visual illustration of how useful this rule is, look at the graph below, which shows the Mendoza Line in green. The individual dots represent the revenue and forward growth rates of 21 successful SaaS IPOs for the years before IPO, when they were private and below $100 million in revenue. The clear majority of the points are above the line, which emphasizes the fact that successful IPOs exhibit a growth trajectory while private that is above the Mendoza Line. It is also worth noting there are even fewer points below the $100 million in ARR line at the time of IPO. This says that growth must be there before an IPO is possible.

Diagnosis is not death — change is possible

The good news is that trajectories can change so that a company that is below the Mendoza Line at $40 million can reverse trajectory and be compelling at $80 million. But it is not easy.

We work with a lot of companies to improve their go-to-market (GTM) models. It is amazing how small changes in key variables such as churn and sales efficiency can lift growth rates by the crucial 5 percent to 10 percent at $10 million that makes all the difference in a world of compounding growth. Sometimes it is as simple as the application of capital in what had been a capital-starved business; more often it requires a retooling of the GTM model to make it work.

As an example, we invested in ExactTarget when it was doing $90 million in revenue with a forward growth rate of 38 percent. The company was attempting to go public, but in early 2009 amid the financial crisis, a sub-scale IPO was not on the cards. Instead, the company raised venture capital and then, led by CEO Scott Dorsey, went on to retool the GTM model to focus more on enterprise customers and add additional products beyond email. One year later the company had raised its growth rate to >50 percent, implying growth persistence above 100 percent, and went public at a $200 million run rate in an extremely successful IPO before being acquired by Salesforce for $2.5 billion.

We were lucky enough to see a similar story at Box, which was at a $6.6 million run rate growing at 110 percent when we invested — in retrospect, very close to the Mendoza Line. CEO Aaron Levie had complete clarity on what he needed to do to accelerate, which was relentlessly add enterprise features to the product and hire enterprise software sales reps. It took capital (a lot of capital!), but two years later it was at $30 million and growing at 140 percent, well above the Mendoza Line and locked on a trajectory that has taken them to $500 million.

Diagnosis is thus clearly not death, but insanity is repeating the past and expecting the outcome to be different. Change is hard. Of 44 public companies over five years, only 30 percent of them had one year of growth re-acceleration (growth persistence greater than 100 percent) and only 10 percent had two or more years of growth re-acceleration. In our private portfolio, the story is the same. Only 35 percent had at least one year of growth re-acceleration, but less than 10 percent of them have been able to show two or more years of growth re-acceleration.

What this shows is that your current growth rate, times an estimate of growth persistence, is your most likely future. To change that future, to raise that trajectory, requires an active act of will to overcome the inertia that all businesses face. It may mean new executives, new products or changing business models.

Mendoza Line is implicitly understood

It is very typical for participants in a market to “know” a rule of thumb long before anyone writes it down. In 20-plus years of venture I have not heard anyone call out this concept explicitly, but investors know it in their gut. It manifests itself in situations where some companies’ financings get done fast, at high valuations and with very clean terms. There are other deals that get done, but slowly and often with structure, all devised to ensure a minimum return in the absence of that clear IPO trajectory.

The chatter is often about the team, the process and the investors, but under the surface is the reality that markets are efficient, and there is a step function of value difference between a company that has escape velocity versus one that does not.

There really is a Mendoza Line for growth.

Jeremy Kaufmann contributed to this article.

Comment