Tucker Smith

From baby boomers to Generation X to millennials, it seems that each generation faces a new set of problems that they believe to be tougher to solve than those faced by the former generation. Baby boomers grew up during the height of the Cold War, Gen Xers took the brunt of the recession and millennials are burdened with more student debt than ever before.

Retirement is a hotbed issue that elicits different reactions depending on the age of the individual in question, but proves to be a problem that affects all three generations. Varying degrees of access, familiarity and trust in technology and differing definitions of a successful retirement are at the root of each demographic’s approach to the subject.

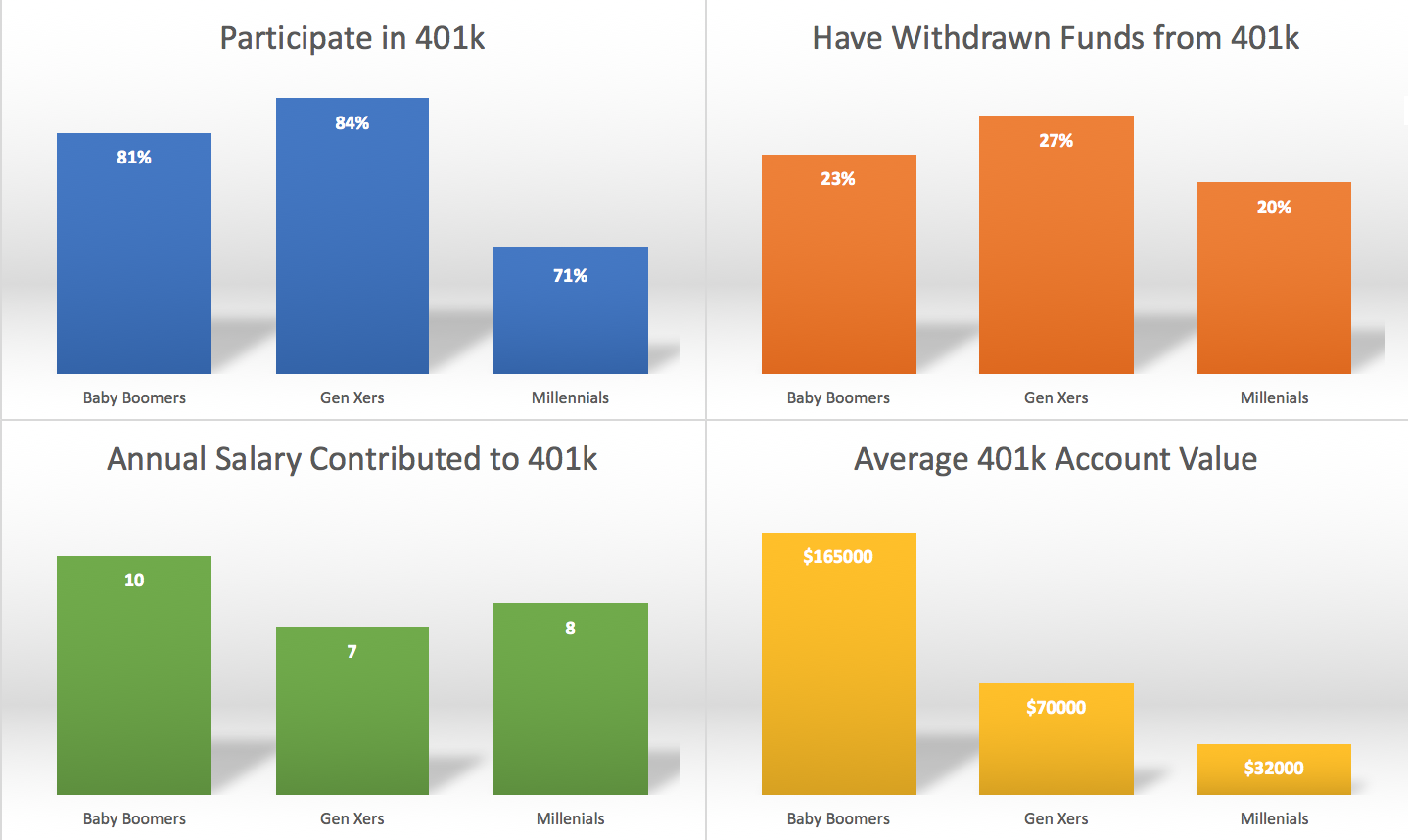

What’s interesting is that some traditional forms of investing, such as real estate and stock trading, are thought of differently by each demographic, while other traditional mediums, such as the 401k, are utilized in relatively the same manner.

401ks by generations

But more on that later. First, let’s break down how each generation handles retirement planning.

Baby Boomers (the Social Security generation)

Born between 1946 and 1964, the baby boom generation was raised in a conflicted and industrialized world that witnessed the Korean War, Vietnam and the creation of the United States as an industrial superpower. They were among the first to be born into an America that had a plan for their retirement: Social Security.

Passed in 1935, the Social Security Act was intended to provide the elderly with the means to exit the workforce at age 65. Baby boomers were raised to have full confidence in the program, which explains why one-third of their population today plans on using Social Security as their primary source of retirement income.

In theory, the concept is simple: Those who are able to work will give a portion of their wages to those who are no longer able to work, which by today’s numbers amounts to 2.8 workers for every Social Security beneficiary. The average beneficiary can expect $1,229.85 each month from Social Security, making that the primary source of income for 24.31 million baby boomers in retirement.

This cold, hard fact has caused almost two-thirds of baby boomers to plan on retiring after the age of 65, with more than half of them classifying a reduced work schedule and retirement as the same.

Though they grew up hearing the benefits that came with Social Security, baby boomers are quickly realizing that it is not enough to retire on, and they are scrambling like crazy to make ends meet.

Generation X (the 401k generation)

Born between 1965 and 1978, Gen Xers are products of the early-stage technology boom. Witnessing the rise of the Internet in adulthood, they are familiar with technology but face trust issues with it from time to time. They are also the first generation to question the capabilities of Social Security, and saw their employers adapt the 401k on a wide scale as they began entering the workforce in the mid to late 1980s, making them the “401k generation.”

Gen Xers pioneered the idea of structured, personal retirement planning by integrating the 401k into the core of their retirement plans. Compared to the other two generations, Gen Xers are more likely to opt into a 401k, if offered, and are more likely to use professional financial planners than baby boomers. Around 83 percent of Gen Xers do not believe that Social Security will be there for them at their desired retirement age, which will be after the age of 65 according to 54 percent of them. Their lack of confidence in Social Security has caused most of them to believe they will need to work part-time into “retirement” strictly for financial reasons.

Though they came of age in a digital world, Gen Xers are less likely to trust financial technology, fintech, which is why we see a denser consolidation of retirement funds in their 401k accounts compared to their millennial successors. Gen Xers show an important progression in retirement planning by taking the baby boomer approach a step further with a more hands-on, personal approach.

Millennials (the innovation generation)

Born between 1979 and 1996, millennials are the generation that everyone seems to have an opinion about, but there seems to be a general consensus that they are in one way or another disruptive. Essentially born with technology in hand and little, if any, memory of a world without the Internet, millennials stereotypically tend to more quickly accept change and are open to challenging traditional ways of thinking and living. Consequently, this coexistence with technology comes with an inherent need for instant gratification and access to information.

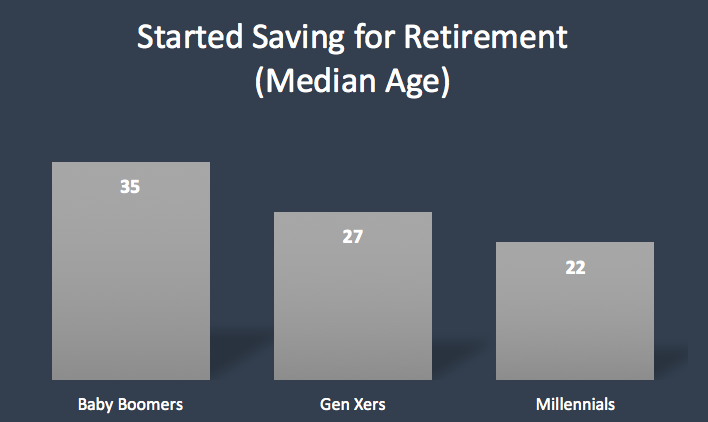

Contrary to what the 401k graphs mentioned above might have alluded to, surveys have shown that millennials are actually more conscious and proactive about retirement than the two previous generations. On average, they began saving for retirement 13 years before the baby boomers and five years before Gen Xers.

However, the results of this trend are not reflected in the most obvious of ways. A little bit of math reveals that millennials actually contribute less to 401ks each year than the baby boomers ($2,357.14) and Gen Xers ($1,372.55) at an average of only $864.86. But that doesn’t mean that they are saving less. In fact, studies have shown quite the opposite.

The story behind millennials’ smaller 401k contributions is actually that they have progressed Gen Xer’s retirement approach a step further by being more open to adapting new tech-savvy platforms and services that enable them to diversify their investment funds. Innovations in fintech and real estate have allowed millennials to capitalize on their adaptive nature and enter positions that were previously unavailable to the twenty-somethings of past generations.

Robo investment services like Wealthfront and Betterment have given them the confidence to begin stock trading earlier than previous generations, which had to learn the ins and outs of the industry in order to be effective with their money. We can see this boosted confidence again with increased adaptation of services like Acorns, which make saving and investing automated, and Robinhood, which makes stock-trading decisions free and mistakes less significant.

The investment platforms mentioned above have all made stock trading accessible to a wider range of people through different approaches, but have uniformly shifted the millennial generation’s perception of the industry.

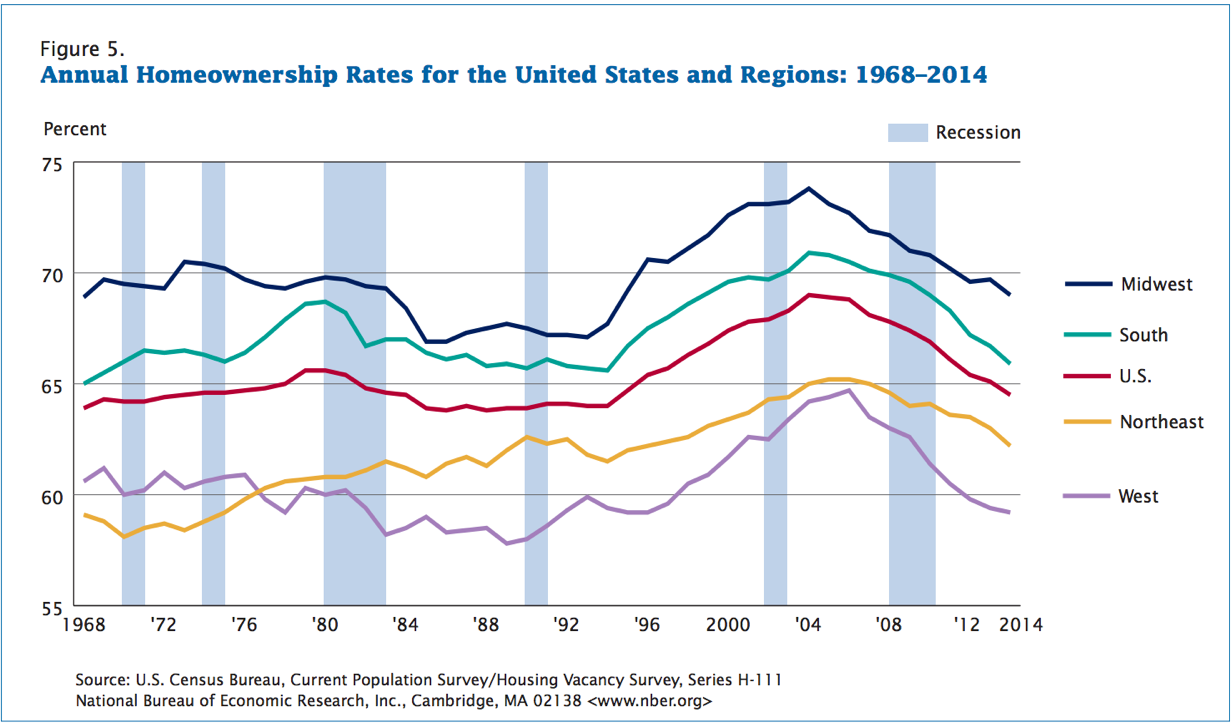

Baby boomers, Gen Xers and millennials all perceive real estate differently, as well. Growing up in an America with new suburbs popping up every month, baby boomers view properties as nest eggs that people plan on living in for years. To them, owning a home was an accomplishment that checked off a box on their adulthood to-do list, or, in other words, it was expected.

In general, Gen Xers originally viewed finding a place to live similarly to baby boomers, but when the housing bubble burst in 2007, and a lot of them lost the homes in which they were supposed to raise their new families, their views changed. Since the burst, the United States has become a nation of renters, with recovering Gen Xers and non-stationary millennials leading the trend. In turn, landlords have seen great profits due to landmark increases in rent rates, making buy and hold rental properties a “must have” in one’s retirement portfolio.

Comment