Tallat Mahmood

Euphoric reaction to superstar tech businesses is rampant — so much so that the tech industry is in denial about looming threats. The tech industry is in a bubble, and there are sufficient indicators for those willing to open their eyes. Rearing unicorns, however, is a distracting fascination.

The Perfect Storm

Raising funding for tech startups has never been so easy. Some of this flood of money has been because of mutual funds and hedge funds, including Fidelity, T. Rowe Price and Tiger Global Management. This is altering not only the funding landscape for tech startups, but also valuation expectations.

There are many concerns that valuations for businesses are confounding rationale. Entrepreneurs and their investors are deviating from more traditional valuation and performance metrics to more unconventional ones. Another cause cited for increasing valuations is the trend of protections for late investors that cause valuations to inflate further. The combination of a number of these factors has put the sector into a state of artificial valuations.

Meanwhile, the companies themselves are burning through cash like there is no tomorrow. Throwing money at marketing, overheads and, in particular, remuneration has become the accepted investment strategy for startup growth. All this does is perpetuate the vicious cycle of raising more money and spending more money. For the amounts that some of these businesses have raised, the jury is still out on actual profitability.

Unicorn Season

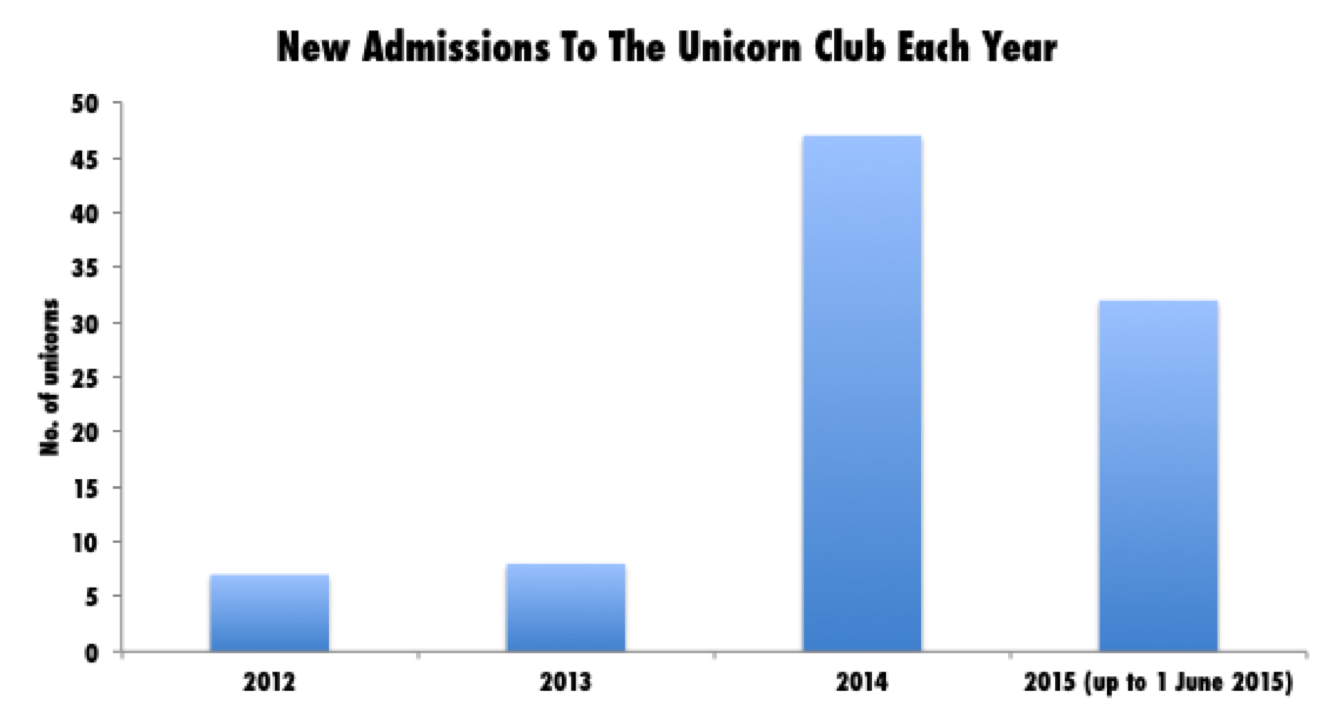

CB Insights publishes information on unicorns (companies with a valuation above $1 billion), which shows that access to the club has become increasingly less exclusive in the last couple of years. The chart below shows that the number of companies valued at $1 billion or above in 2014 exceeded previous years by quite some margin (47 unicorns joined the club in 2014 vs. 7 and 8 in 2012 and 2013, respectively). In addition, for the first 5 months of 2015, this trend shows no signs of abating (32 new unicorns as of June 1, 2015).

Different Experts, Same Conclusion

In the face of these trends, a small group of well-respected and influential individuals are voicing their concern. They are reflecting on what happened in the last dot-com bust and identifying fallacies in the current unsustainable modus operandi. These relatively lonely voices are difficult to ignore. They include established successful entrepreneurs, respected VC and hedge fund investors, economists and CEOs who are riding their very own unicorns.

Mark Cuban is scathing in his personal blog, arguing that this tech bubble is worse than that of 2000, because, he states, that unlike in 2000, this time the “bubble comes from private investors,” including angel investors and crowd funders. The problem for these investors is there is no liquidity in their investments, and we’re currently in a market with “no valuations and no liquidity.” He was one of the fortunate ones who exited his company, Broadcast.com, just before the 2000 boom, netting $5 billion. But he saw others around him not so lucky then, and fears the same this time around.

A number of high-profile investors have come out and said what their peers all secretly must know. Responding to concerns raised by Bill Gurley (Benchmark) and Fred Wilson (Union Square Ventures), Marc Andreessen of Andreessen Horowitz expressed his thoughts in an 18-tweet tirade. Andreessen agrees with Gurley and Wilson in that high cash burn in startups is the cause of spiralling valuations and underperformance; the availability of capital is hampering common sense.

As Wilson emphasizes, “At some point you have to build a real business, generate real profits, sustain the company without the largess of investor’s capital, and start producing value the old fashioned way.” Gurley, a stalwart investor, puts the discussion into context by saying “We’re in a risk bubble … we’re taking on … a level of risk that we’ve never taken on before in the history of Silicon Valley startups.”

The tech bubble has resulted in unconventional investors, such as hedge funds, in privately owned startups. David Einhorn of Greenlight Capital Inc. stated that although he is bullish on the tech sector, he believes he has identified a number of momentum technology stocks that have reached prices beyond any normal sense of valuation, and that they have shorted many of them in what they call the “bubble basket.”

Meanwhile, Noble Prize-winning economist Robert Shiller, who previously warned about both the dot-com and housing bubbles, suspects the recent equity valuation increases are more because of fear than exuberance. Shiller believes that “compared with history, US stocks are overvalued.” He says, “one way to assess this is by looking at the CAPE (cyclically adjusted P/E) ratio … defined as the real stock price (using the S&P Composite Stock Price Index deflated by CPI) divided by the ten-year average of real earnings per share.”

Shiller says this has been a “good predictor of subsequent stock market returns, especially over the long run. The CAPE ratio has recently been around 27, which is quite high by US historical standards. The only other times it is has been that high or higher were in 1929, 2000, and 2007 — all moments before market crashes.”

Perhaps the most surprising contributor to the debate on a looming tech bubble is Evan Spiegel, CEO of Snapchat. Founded in 2011, Spiegel’s company is a certified “unicorn,” with a valuation in excess of $15 billion. Spiegel believes that years of near-zero interest rates have created an asset bubble that has led people to make “riskier investments” than they otherwise would. He added that a correction was inevitable.

What Does A Bubble Look Like?

To shed light on how close we may be to the tech bubble bursting, it is worthwhile trying to understand what determines being in a bubble. Typically, this refers to a situation where the price of an asset exceeds by a large margin its fundamental value.

In his 1986 book Stabilizing an Unstable Economy, economist Hyman Minsky’s theory of financial instability attracted a great deal of attention, and gathered an increasing number of adherents following the crisis of 2008-09. Minsky identified five stages that culminate in a bubble, as described in this Forbes article: displacement, boom, euphoria, profit taking, and panic.

Uber is an enviable company for much of what it has achieved, and the team is to be commended for how they have grown this business, as well as their previous successes. However, it serves as a good example to illustrate the dynamics of the tech bubble.

Displacement: Investors’ excitement with a new paradigm, such as advances in technology or historically low interest rates. The explosion of the “sharing economy” has resulted in companies such as Uber, Lyft and Airbnb growing exponentially in recent years by taking advantage of this new mode of operation.

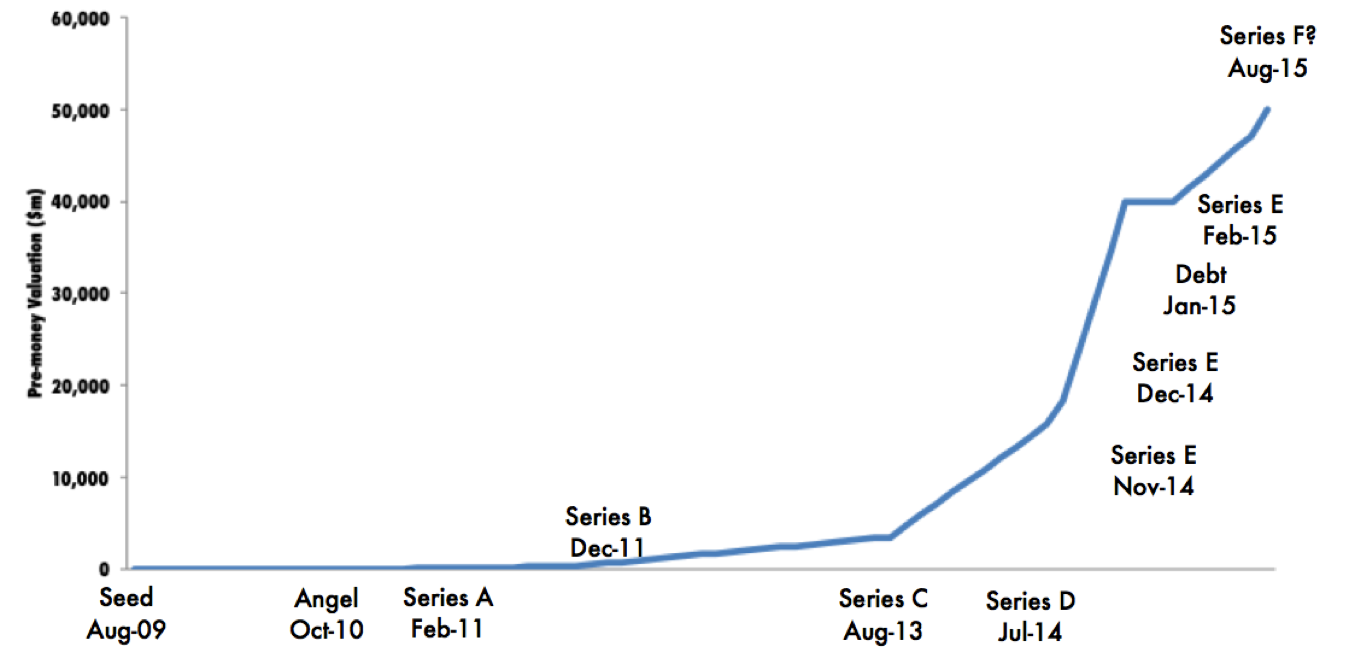

Boom: Prices rise slowly at first, but then gain momentum as more participants enter the market. Fear of missing out (FOMO) attracts even more participants. Consequently, publicity for the asset class in question increases. Reviewing investment rounds for Uber since 2010 when they completed their seed round shows a large variety of investors wanting a piece of the action, perhaps in part due to a fear of missing out on the golden goose. The introduction of hedge funds and investment banks funding the business can also be seen, which underlines the facelift happening in this sector.

Euphoria: Asset prices increase exponentially; there is little rationale evident in decision making. During this phase, new valuation measures and metrics are touted to justify the unrelenting rise of asset prices. Uber’s increased valuation between funding rounds symbolizes the euphoria around the business. The chart below shows the evolution of Uber’s pre-money valuation over the last number of funding rounds.

Although the pace of revenue growth at Uber is astounding (doubling approximately every 12 months at the moment), profitability is less certain. Profitability margins should increase over time as recognition and saturation are achieved in newer markets, but it is difficult to ignore the regulatory burdens and lawsuits the business is facing, which could steer it off course.

Profit taking: The few that have identified what’s going on are making their profit by selling their positions. This is the right time to exit, but is not seen by the majority. This is the next indicator on the horizon that will underline that we are in a tech bubble, and that it is about to burst. The catalyst for profit taking could be regulatory strains or excessive cash consumption that isn’t reflected by profitability gains in startups. Savvy investors will take the opportunity to exit while valuations are still high. The exits may well be too late for investors who are further behind on the FOMO curve or new types of investors who don’t appreciate that the market has moved.

Panic: By now it’s too late and asset prices collapse as rapidly as they once increased. With everyone trying to cash in realizing the situation, supply outstrips demand and many face big losses. Watch this space for the unfortunately impending examples.

Conclusion

The fact that we are in a tech bubble is in no doubt. The fact that the bubble is about to burst, however, is not something the sector wants to wake up to. The good times the sector is enjoying are becoming increasingly artificial. The tech startup space at the moment resembles the story of the emperor with no clothes. It remains for a few established, reasoned voices to persist with their concerns so the majority will finally listen.

Comment