Editor’s Note: This is a guest post by Mark Suster (@msuster), a 2x entrepreneur, now VC at GRP Partners. Read more about Suster at his Startup Blog, BothSidesoftheTable.

I recently spoke at the Founder Showcase at the request of Adeo Ressi. I asked what the audience most needed to hear and he said, “They need an unbiased view of the fund raising environment because there is too much misinformation and everything seems to be changing fast.”

This was an audience of mostly first-time entrepreneurs. They have seen one side of a market where many of us have seen the ebb and flow multiple times. Still, market amnesia by ordinarily rational actors always surprises me.

I spoke about a lot of things during the keynote. If you are interested the Vimeo is here. I spoke about whom to raise capital from (funding options), how much I thought they should consider raising (18-24 months), how fast they should spend it (lean until product/market fit, then fat when they’re ready to scale), how fast they should raise it (now, now, now) and at what valuation (at a fair price that I call “the top end of normal“).

I spoke about how Amazon Web Services deserves far more credit for the last 5 years of innovation than it gets credit for and how I believe they spawned the micro-VC category. I said that I felt that Micro-VCs were the most important change in our industry. I believe that. It is great for entrepreneurs and great for VCs. I will write more about this in the next 2 weeks.

I also spoke about why I believe we’re in a “localized” bubble. I suppose I should have imagined that this line would get more press than all other comments combined. Fair enough.

But a certain amount gets lost in the headlines – especially when not everybody actually heard the video and knows the nuance of the message.

So here is what I have been telling entrepreneurs privately for the past 6 months.

1. Why I believe we’re in a bubble

People get too worked up over the word. I’m no great scholar on bubbles – I have more interesting things to spend my time worrying about than the exact definition, but having been around a few I have at least given them intellectual consideration. I know that most people who are close to them tend to deny their existence, as we saw in the great housing bubble of 2002-2007 and the dot com bubble of 1997-2000.

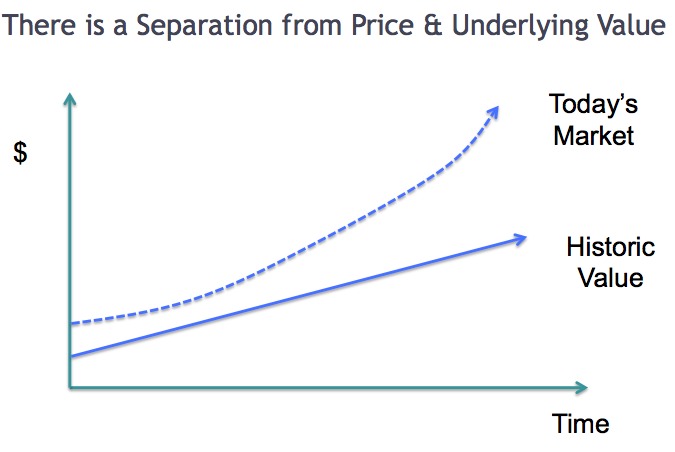

I believe a bubble occurs when a market is willing to pay greater than intrinsic value for an asset class. That asset class need not represent the broader market. As any historian of bubbles will tell you – there were periods of bubbles in assets as arcane as tulips, South American trading companies, dot-com bubbles & housing bubbles. They are often bound by geographies and asset classes. But they also often have a rippling effect on broader markets as all of our economies seem to be intertwined these days. I said that at the Founder Showcase, too.

The fact that today’s Internet bubble does not represent all companies does not disprove its existence.

Ah, but today’s Internet companies have real revenue! and profits! Sure, that makes them better companies than those of 12 years ago. But that doesn’t mean that people are paying rational prices as investors based on intrinsic value. Rational people can disagree and some may argue that today’s prices are rational and under-pinned by economic drivers. That’s fine. It’s just not my judgment based on the data I see.

Ah, but today’s Internet companies have real revenue! and profits! Sure, that makes them better companies than those of 12 years ago. But that doesn’t mean that people are paying rational prices as investors based on intrinsic value. Rational people can disagree and some may argue that today’s prices are rational and under-pinned by economic drivers. That’s fine. It’s just not my judgment based on the data I see.

In the past I have publicly commented on some specific companies that seemed over valued. Responses ranged from, “hey, they’re in a HUGE market” to “it is an amazing company and their technology rocks.” Sure. But everything has intrinsic value. And you may choose to overpay hoping that the future value will be worth your while. That doesn’t mean it’s not a bubble. It’s like people arguing that there’s a beautiful beach house in 2006 that represents great long-term value due to scarcity of similar property. All of that might be true, but the 2006 price might still be over-valued

What I believe is happening is that private-market investors are getting ahead of themselves for fear of FOMO: fear of missing out. If you are an early investor in Facebook, Twitter, Zynga, Tumblr, GroupOn, LivingSocial, etc. – you’re very well positioned as a fund. I guess that makes USV, Spark Capital, Foundry Group, Accel, Benchmark, Revolution (along with several others) pretty happy right now. And well they should be.

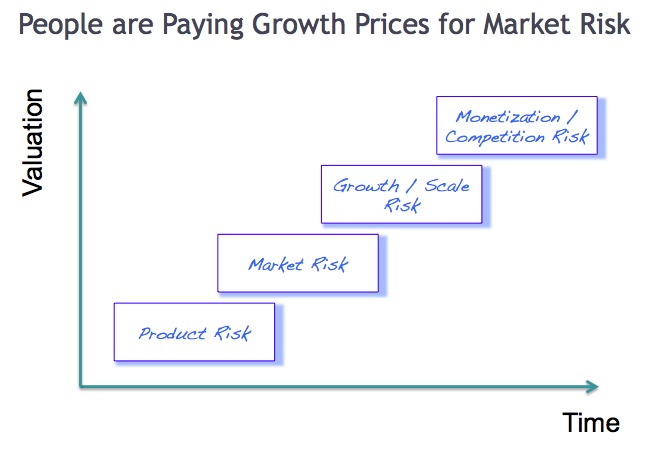

But this mania to not miss out on the next big thing is driving some investors to pay growth-equity prices for traditional market risk (as in, they’re paying up before it is clear there is product / market fit). And so on down then line.

But this mania to not miss out on the next big thing is driving some investors to pay growth-equity prices for traditional market risk (as in, they’re paying up before it is clear there is product / market fit). And so on down then line.

In addition to FOMO it is partly driven by massive increase in valuations for earlier-stage companies who raised money at bit seed prices but who still have product risk. If a company that would traditionally raise $500k at a $3.5 million pre-money valuation is now raising $1 million at a $12 million valuation the next investor has nowhere to go but up (or sit out the investment). Just because the valuation in absolute terms isn’t a big difference does not mean that people aren’t paying higher than intrinsic value for these investments.

And this is happening in mezzanine (pre-IPO) deals as well. And post IPO deals, although these tend to correct more quickly.

Why does all this matter?

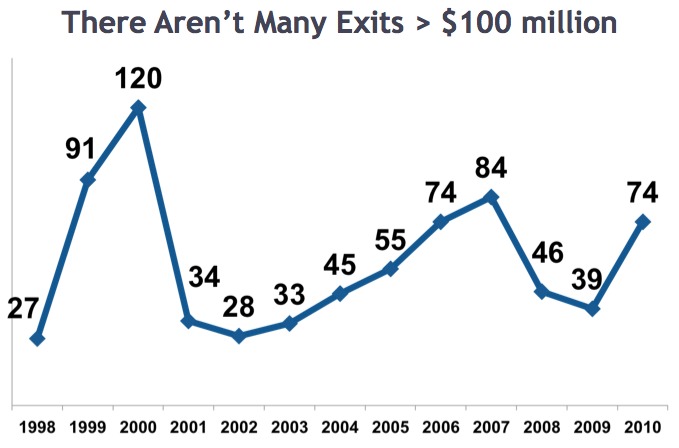

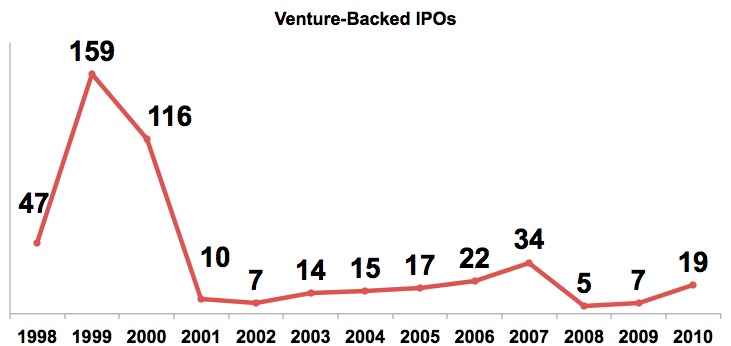

2. There are fewer big deals than people imagine

If everybody is over-paying for early-to-mid stage deals you’d imagine that these all need to feed into a frenzied M&A and IPO market that will garner big returns for these risks investors are taking. Perhaps this will trend up massively but historical data doesn’t bode well.

In any given year there are about 50 venture-backed companies or so that are bought for $100 million or more. And for many of these they were (over) funded 7-10 years ago and don’t necessarily all represent great returns for investors or founders. I would guess (I don’t have the data) that less than 5 companies / year are purchased above $100 million that have been funded within 5 years of the being started and have raised less than $10-15 million in capital.

And as you probably guessed the data aren’t any better on IPOs with less than 20 / year average for the past 10 years. Yes, everybody expects a continued uptick given the euphoria of LinkedIn & Pandora and long anticipated Facebook, Zynga, GroupOn and one day, Twitter. But it’s not enough to justify over-paying for deals.

3. What a bubble means for each entrepreneur

To anybody who asks my advice I repeat the same line, “I don’t know whether this party will last 6 weeks, 6 months or 18 months. But it will end. And when it does the market will shut off immediately. Investors will focus only on protecting existing deals. They will enter the “triage phase” of the market where they figure out which of their existing deals will survive. Many good companies will not get funded. New investors hate down rounds. Vultures will start circling looking for deals. Get funded now, if you can.”

Note: I did not say, “funding is easy” as some people have quoted me. I said, “It’s much easier now than it was in 2008/09.” That’s a fact. And for some it is actually easy. For others it feels like a two-speed economy, where rules apply to hot tech startups that don’t apply elsewhere. Huge structural under-employment in much of the country and full employment in some niche tech markets where it’s impossible to hire developers, designers or sales professionals. You know what I’m talking about. You feel it, too. It’s surreal.

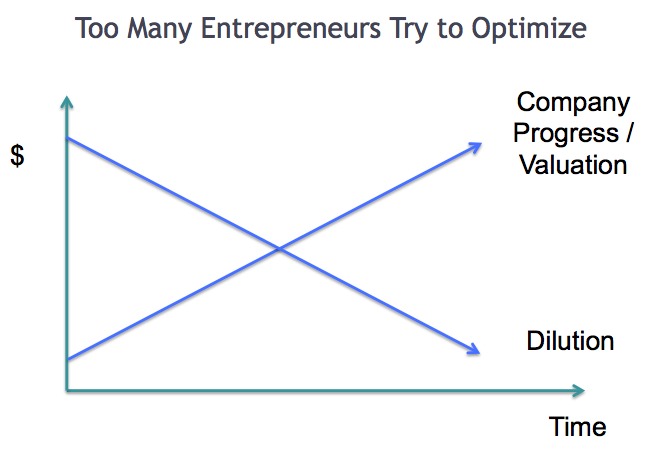

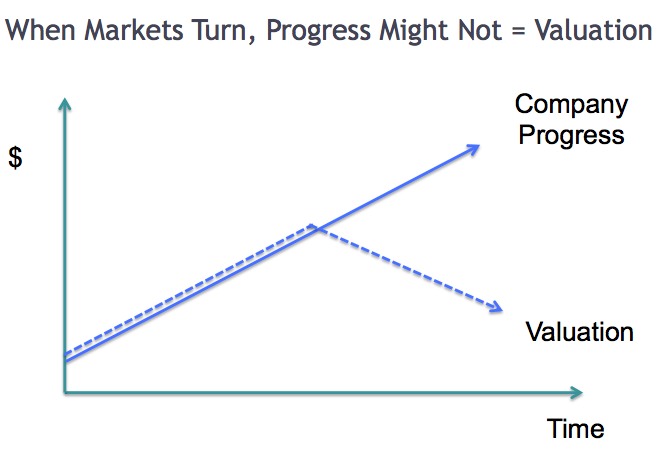

So I’m not advocating panic or a need to rush your funding round. I just think that some entrepreneurs try to “optimize” too much for short-term prices. They hope to delay fund raising (or only raise small amounts now) so that they can raise at a much bigger price later. That may happen.

So I’m not advocating panic or a need to rush your funding round. I just think that some entrepreneurs try to “optimize” too much for short-term prices. They hope to delay fund raising (or only raise small amounts now) so that they can raise at a much bigger price later. That may happen.

That’s the problem – you never know when the party’s over. And time is the enemy of all deals so start sooner rather than later, as anybody who was planning to raise in October 2008 will tell you.

And for some that means that despite waiting they may see worse valuations in the future than now. Or worse yet they may never get financed. That happened a lot in 2002 and again in 2008.

And for some that means that despite waiting they may see worse valuations in the future than now. Or worse yet they may never get financed. That happened a lot in 2002 and again in 2008.

I tell people to raise money when you can, but don’t ramp up your spending in a crazy way afterward. Have a cushion. Raise at “the top end of normal” but not so high that future financings in a corrected market become impossible.

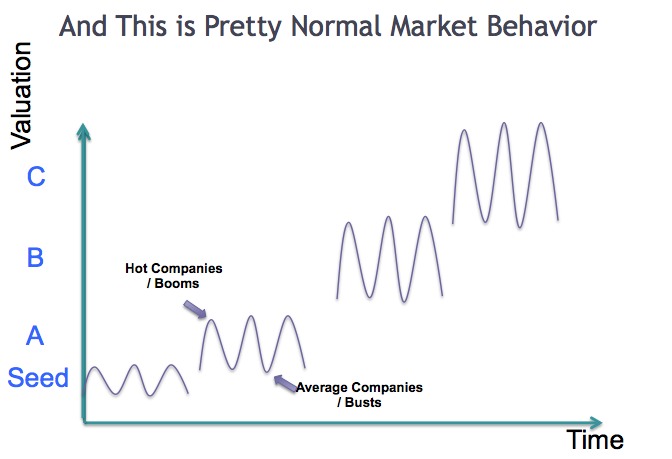

4. Bubbles are inevitable

I guess it’s an inevitable process that we seem to go through where markets heat up, get euphoric & irrational and then external market drivers remind us all at once that we were being irrational as a market. We go through our “Bear Stearns moment.” I learned long ago at the University of Chicago where I got my MBA that investors tend to want to invest when markets become over-valued and sell when they become undervalued. Exactly the opposite of what a rational investment strategy would advise.

Why?

In a booming market your investment is worth more than you paid almost instantly. You come in at a $10 million price and somebody else invests at $50 million 6 months later. Feels good.

In a booming market your investment is worth more than you paid almost instantly. You come in at a $10 million price and somebody else invests at $50 million 6 months later. Feels good.

In contrast, when the market is falling, by definition your investment is worth less THE DAY AFTER you have invested. In a public market this is measured immediately. You are “catching a falling knife.” You have to have patience, which is hard when you see red. So people sell or at least don’t invest.

Some people argue that we’re not in a bubble because the prices are not as crazy or as inflated as they were in the late 90’s. That may be. It may also be that this lasts another 18 months. But when it’s all over and they define the era of this mini run up in stock prices I suspect they’ll include 2011 in the “over valued” category.

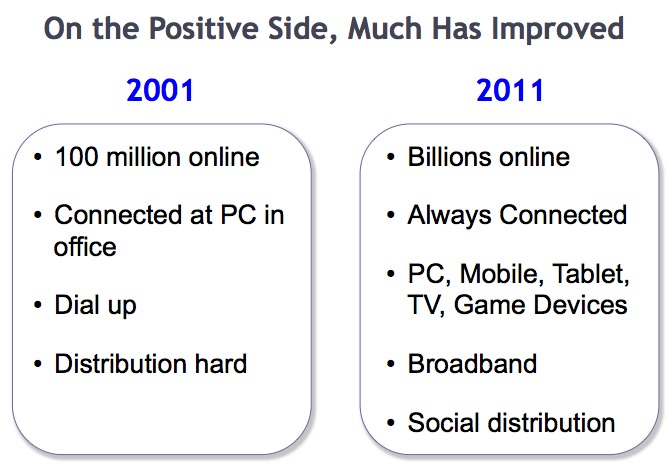

5. Good things may come out of bubbles

Bubbles are not all bad. There are great societal benefits that sometimes come out of bubbles. One example is that the telecom bubble of the late 90’s left both the US and the international markets with a greatly expanded footprint of fiber-optic cables laid at the expense of many an over-zealous investor and entrepreneur. I can’t argue that this is better than slow, rational growth. I only point out that there are side benefits of the bursts of energy, enthusiasm and investment dollars.

And the bursting of bubbles isn’t bad for everybody. Those with strong business models suddenly stand out when the tide goes out. An obvious example is Google who may have gotten less market attention if there would have been 8 well-financed competitors during the 2001-2005 timeframe. Or Salesforce.com who rose to prominence in this same period where they were ramping up PR and shouting from mountain tops when everybody else in the market was mute.

6. Why the bad side of bubbles affects entrepreneurs & investors alike

Another misconception of bubbles is that they only hurt investors. That’s not true. When you’re building a startup and can’t hire the engineers you need, can’t retain staff, can’t get press coverage and can’t hire sales people – it certainly affects you. When your competition does irrational things to grow fueled by low-cost capital it makes it harder for you to compete by playing by the conventional rules.

I remember in the late 90’s trying to charge fair prices for software when my well-financed competitors were giving things away for free.

7. Why the bursting of bubbles also affects more than investors

I also point out that bursting of bubbles also affects us all. Sometimes callous observers say, “Who cares if some VCs lose money in a bubble?”

Um …

- many people also lose their jobs when bubbles burst

- some founders lose their life savings

- people who poured their hearts into projects see their efforts vanish over night

- customers who paid for services often get burned

- many ancillary businesses (legal, real estate, services) are affected

- and those VCs are actually investing money from places like state pension funds & university endowments

Trust me, we’re all hurt when bubbles burst. Just think about how you felt the impact of the real estate bust even if you didn’t own property or if you bought well before 2006/07. This market will be the same.

8. The road ahead

I’m not an alarmist person, I’m rational. The sky isn’t falling. There are many things to be encouraged about.

I see opportunities for disruption all around me and am meeting amazingly talented entrepreneurs. I’m looking for ones that understand that in order to build huge, meaningful companies they’ll need to likely build through these boom years and some lean ones. When I find people like that it’s great chemistry.

I see opportunities for disruption all around me and am meeting amazingly talented entrepreneurs. I’m looking for ones that understand that in order to build huge, meaningful companies they’ll need to likely build through these boom years and some lean ones. When I find people like that it’s great chemistry.

When I look at the headwinds we face as a country and as a society they are also big. This concerns me about the growth rates we can anticipate for the next 5 years.

I’ve wrote about this 9 months ago. If you want a more detailed analysis see that post. Nothing has changed in my mind since then but it does go to show how difficult it can be to predict the timing of economic impacts. In economics we call these “exogenous events” and if they happen (Greek debt crisis, problems raising the US debt ceiling, trouble in Saudi Arabia) – you will not be shielded.

I’ve wrote about this 9 months ago. If you want a more detailed analysis see that post. Nothing has changed in my mind since then but it does go to show how difficult it can be to predict the timing of economic impacts. In economics we call these “exogenous events” and if they happen (Greek debt crisis, problems raising the US debt ceiling, trouble in Saudi Arabia) – you will not be shielded.

That said, for every set of global challenges there are entrepreneurs dreaming of solutions, solving big problems and ready to lead us into the next 20 years. It’s what I love about entrepreneurship and about venture capital. We get the opportunity to serve these amazing talents that hold our futures in their hands & minds.

9. Why I will still be investing

I know prices are higher than the norm right now. I am confident they will be lower at some point on a relative basis. But as an investor you cannot simply sit out period of great innovation. As Fred Wilson once pointed out to me, he invested in both Twitter & Tumblr during a high-valuation period.

So at GRP Partners we’re very active now. We’re just conscious to invest in realistic entrepreneurs who know that it will take years of hard work, who are committed to building large businesses over time, who have exceptional skills & passionate about the disruption they’re causing and who are cost-conscious enough to be around for the long haul. Building billion-dollar businesses requires 7-10 years which means operating through at least one full economic cycle, if not two.

We may invest at the “top end of normal” but not at such a high price that we create future problems. We’re not cheap, but we’re disciplined. We are definitely still open for business.

Bubble image courtesy of Fotolia.

Comment