As a business model, SaaS has expanded to epic size. A number of major SaaS companies filed to go public last week, and there are now thousands of SaaS startups growing all around the world. That scale makes it easier for banks and financial institutions to offer tailored solutions to this market around everything from equity to debt.

We’ve talked a bit about SaaS securitization the last few weeks, a crop of new financial products that use the metrics of a SaaS company to underwrite its debt (e.g. better churn = more debt available and at better terms) as opposed to traditional benchmarks like total revenue and company age. We also did a deep dive with Kentik CEO Avi Freedman on how he approached his recent venture debt fundraise and the terms he got across his five term sheets (Extra Crunch membership required).

SaaS securitization will disrupt VC’s biggest returns this coming decade

Every SaaS company these days is considering its financial options and the trade-offs between equity and debt. But sometimes, they just need cash, and cash as quickly as possible. Startups sign contracts with customers that might be paid over a year or more, but they want to access that cash now, and at the best terms possible. The product that solves this problem is known as an accounts receivable line, and you can go to many banks to get them, with all the drudgery of that process.

Or, four founders hope, you’ll head to Capchase.

Capchase is an online platform for rapidly getting cash from your accounts receivable. Startups upload key details of their customer contracts and financial history to Capchase, and the company uses its underwriting algorithms to quickly assess the quality of those contracts and extend a debt line. The startup calls itself part of the “non-dilutive revolution,” and it’s headquartered in Boston.

“We’re targeting B2B SaaS or ‘X-as-a-service’ companies with recurring revenue, and we’re targeting companies around the seed to Series B/C stage having more than $1 million of ARR and at least eight months of revenue generating history,” Miguel Fernández, CEO and co-founder, said.

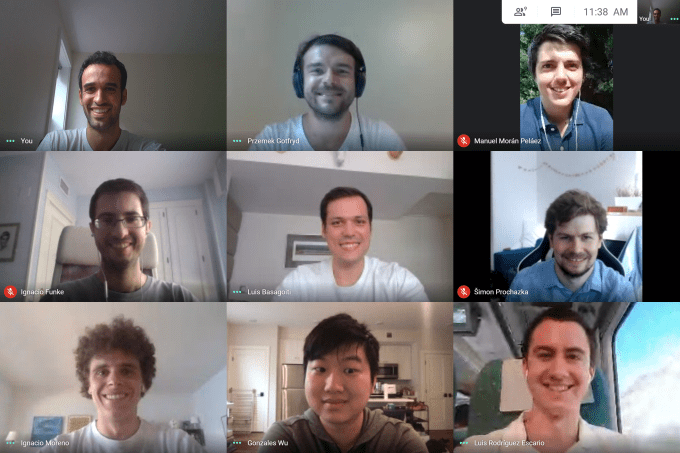

He linked up with three other founders earlier this year to launch Capchase: Luis Basagoiti, Ignacio Moreno, and Przemek Gotfryd. Fernández and Gotfryd met while at Harvard Business School where Fernández was thinking about “working capital and cash conversion cycle optimization” after his previous experiences at SaaS companies. Gotfryd had previously worked at growth investor TCV in London, where he acutely saw the challenges of raising non-dilutive cash.

Despite its early operational history, the company has already raised its own cash quickly. It closed on $4.6 million in VC seed funding led by Caffeinated Capital, Bling Capital and SciFi VC, along with BoxGroup, ONEVC and a number of angels.

To get cash early today, startups often resort to negotiating terms with their customers, offering discounts — sometimes massive discounts — for them to pay an entire contract’s value upfront. Fernández saw an opportunity to arbitrage the difference between interest rates and those discounts with Capchase.

From a user’s perspective, after syncing their startup’s financial data to Capchase, they will see a projection of what their runway extension will look like after selecting a debt line, and then Capchase will extend its terms after going through an underwriting process (“which takes a couple hours now, and is very rapidly decreasing to take minutes” Fernández said). In terms of traction, he said that “we’re working with around 3-4 customers right now.”

Startups are charged a discount on their total contract value, which is where Capchase makes its money. For instance, if $100,000 is going to be paid by a customer over the next 12 months, Capchase may offer $95,000 to the startup upfront, and keep the remaining $5,000 as those payments roll in. That discount fluctuates based on the startup in question and the payment risk of the underlying customer contracts.

Fernández said that venture debt is often cheaper on a pure interest rate basis, but that once additional elements of those products are added in, such as warrants, the simplicity of Capchase’s product will prove competitive for founders.

Simpler, easier and fully digital financial products are always welcome, and Capchase hopes that it will nestle itself in a suite of new financial products for SaaS founders looking to avoid dilution and extend their cash longer.

Comment