Jason Rowley

Let’s say you randomly selected 1,000 seed-stage startups based in the United States. How many of those would go on to raise a Series A? Of companies that go on to raise a Series A, how many would go on to raise a Series B? You could keep this process going until only a few companies remain.

But it’s not enough to just ask what the survival rate of companies is from round to round. The bigger question is what happens to those that don’t make it through the fundraising gauntlet? Sure, mortality is a fact of startup life. But there are also happier reasons for not making it to the next round, like when companies exit the funding rat race by way of acquisition or IPO. So what share of those companies find an exit?

Today, we’re going to answer those questions with funding data from around 15,600 U.S.-based technology companies founded between 2003 and 2013. Let’s first take a look at the survival curve and just how steep the drop-off is.

The steep startup survival curve

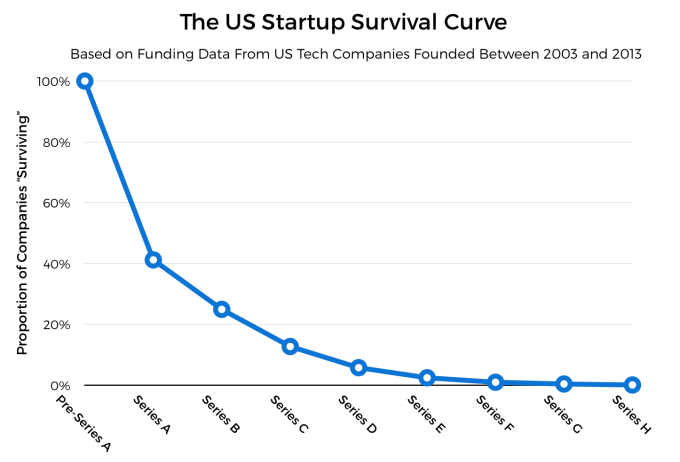

Below, you’ll find a chart that answers how many (or how few) startups that raised capital in previous rounds raise in the next one:

Out of our hypothetical 1,000 startups that successfully close a Pre-Series A round (e.g. a Seed or Angel round, a convertible note or equity crowdfunding round), we’d expect to see a little over 400 of them make it to Series A. In other words, our data set suggests that around 60 percent of companies that raise Pre-Series A funding fail to make it to Series A or beyond.

On a linear scale, the drop-off rate is quite dramatic. But a fair bit of detail is lost after Series E on that chart. Let’s take a look at the same data using a logarithmic scale:

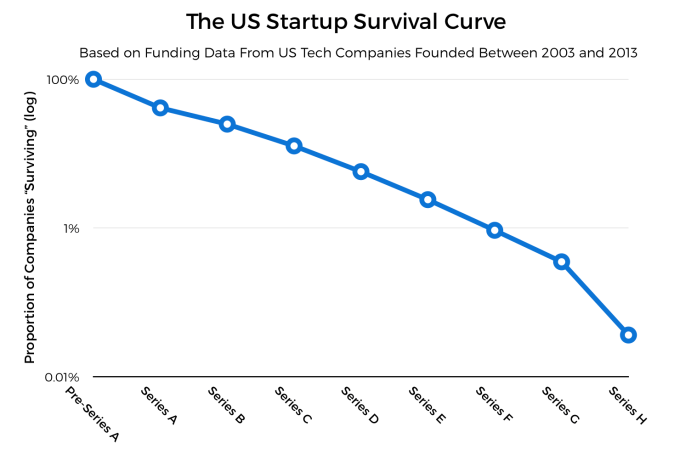

(This is the same data as the chart from above, just displayed on a scale that helps to show the near-exponential decline in the population of startups moving through the fundraising cycle.)

According to our analysis, only roughly 1 percent of companies founded between 2003 and 2013 have successfully raised a Series F round. Out of around 15,600 companies in our data set, just four — Pivot3, Smule, Glassdoor and Aquantia — raised Series H rounds.

Last exit on the right

As we discussed earlier, there are plenty of reasons for companies to stop fundraising.

For those companies that don’t close up shop or achieve financial sustainability, an exit from the fundraising cycle comes in one of two varieties: an acquisition or an IPO. Let’s take a look at when companies are most likely to make one of those exits by way of acquisition. In our data set, there were more than 16 times as many companies that took the acquisition path compared to going public.

We’ll map out this path to exit in two ways. First, we’ll zoom in to analyze just the set of companies that have been acquired to find out the stages at which acquisitions are most likely to occur. And finally, we’ll take a look at the overall chance of being acquired as a company moves through the fundraising cycle. On to the first.

Stage of acquisition

When do most companies get acquired? Intuition might suggest it’s when the stock in that company is the least expensive, so acquisitions are likely to happen at a relatively early stage. But just how early? It might be surprising just how few steps down the fundraising alphabet one needs to take to account for as much as 90 percent of the acquisitions.

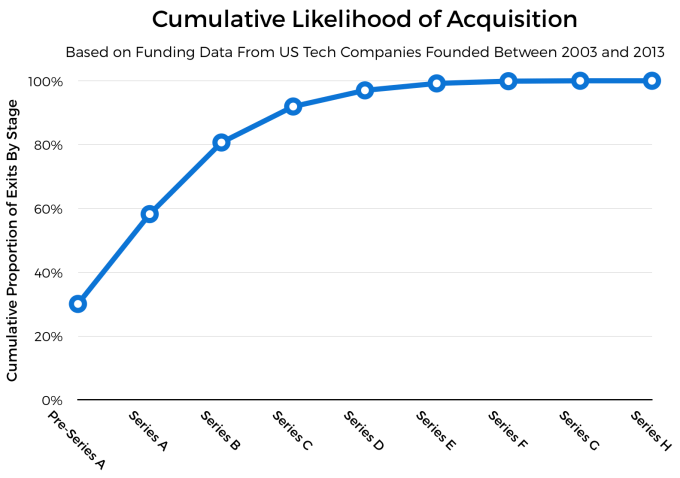

Here’s what the cumulative distribution of acquisitions looks like, starting with companies that didn’t raise anything beyond Pre-Series A funding all the way through those that closed Series H rounds:

To adjust for the (rapidly) declining population of startups as we move forward through the funding cycle, we divided the number of exited companies at each stage of financing and divided it by the total number of companies listed as acquired through that stage. This produces the proportional share of companies that were acquired after each round of funding, showing the relative likelihood of an exit.

To reiterate: The chart above does not suggest that around 92 percent of companies are acquired after raising a Series C round. It shows that, of the companies in our data set that were acquired and have raised venture financing, around 92 percent of those raised through Series C. So entrepreneurs, if you’re dead set on starting a company that gets acquired, you have a one in 10 shot at being acquired at or after Series C.

Companies acquired at each stage of funding

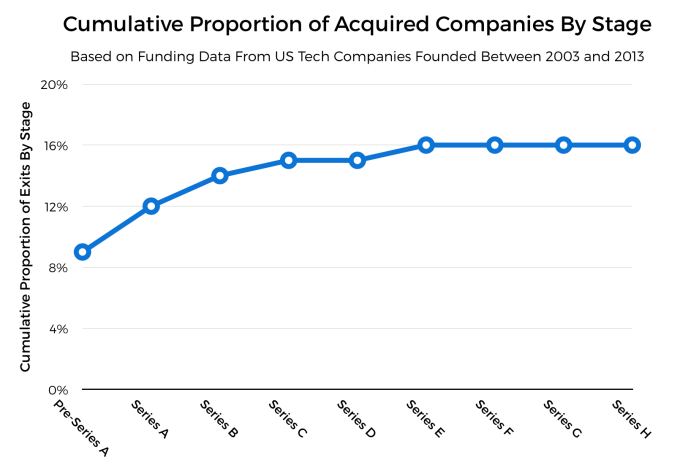

The chart above shows when startups that have been acquired do get acquired, but it doesn’t answer an obvious question. Let’s just give it to you straight: Here’s the share of companies that have been acquired through each stage of funding:

The proportion of the total startup population that winds up getting acquired maxes out at around 16 percent at Series E-stage companies, with only the slightest variation after that. Ultimately, roughly one in six companies in our data set ended up being acquired to date.

Revisiting the drop-off in funding

Like we mentioned earlier, there are several reasons why companies stop raising money. Some achieve financial sustainability, others close up shop and still others find an exit through acquisition or going public. As far as exits go, we focused primarily on acquisitions. That’s the exit most companies take, and it’s the exit option for which we had the most data to draw conclusions from.

The cause of the very steep drop-off in the population of early-stage startups is complicated, but if one thing is clear, it’s that most of the exit opportunities come early, as do the primary causes of startup failure. Team breakups, running out of capital before finding product-market fit, failing to scale, simple bad luck and plenty of other company-killing pitfalls are just more prevalent when startups are, well, starting up.

There are other factors to be mindful of here, like the possibility that later-stage rounds were labeled as “private equity” because of the type of investors involved, which we didn’t account for here. It’s possible that the scenario we painted is a bit more dire than reality, but if so, it isn’t by much. It’s still hard to raise money.

Out of all the things that make starting a successful company difficult, the steep curve of startup survival through the fundraising process might be one of the most significant. So if your company isn’t too far down the alphabet of VC funding rounds and you’re having a hard time finding a path out of the woods, exit if and while you can. You won’t be alone in doing so.

Comment