greylock

Trace announces $8M seed to help companies coordinate budgets

Trace, an early startup that wants to bring a taste of SaaS to the finance side of the house, announced an $8 million seed round today led by Greylock and…

Wisetack raises $19M as its buy-now-pay-later service for IRL services scales

This morning Wisetack, a startup that provides buy-now-pay-later services to in-person business transactions, announced that is has closed a total of $19 million across two rounds, a seed investment and…

Featured Article

Nuro acquires autonomous trucking startup Ike

Autonomous delivery company Nuro has acquired Ike, a startup founded by veterans of Apple, Google and Uber Advanced Technologies Group that aimed to commercialize self-driving trucks. The deal, the latest in a busy season of acquisitions and consolidation in the autonomous vehicle industry, brings together two companies that have deep ties and shared technology. And…

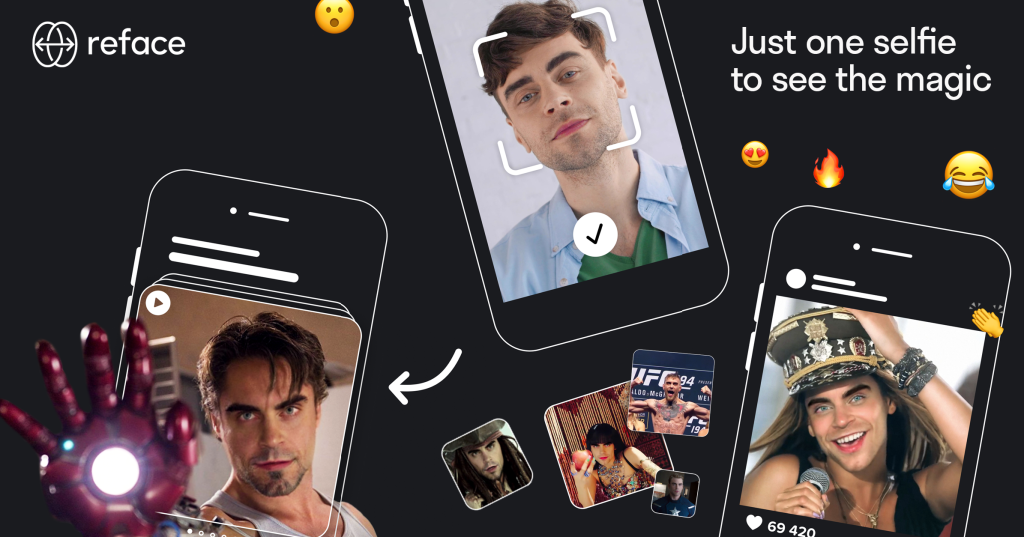

Reface grabs $5.5M seed led by A16z to stoke its viral face-swap video app

Buzzy face-swap video app Reface, which lends users celebrity ‘superpowers’ by turning their selfies into “eerily realistic” famous video clips at the tap of a button, has caught the attention…

This Week in Apps: The year’s best apps, 2020’s biggest downloads, the App Store’s newest hire

Welcome back to This Week in Apps, the TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry is as hot as ever,…

Gretel announces $12M Series A to make it easier to anonymize data

As companies work with data, one of the big obstacles they face is making sure they are not exposing personally identifiable information (PII) or other sensitive data. It usually requires…

Greylock’s Asheem Chandna on ‘shifting left’ in cybersecurity and the future of enterprise startups

Last week was a busy week, what with an election in Myanmar and all (well, and the United States, I guess). So perhaps you were glued to your TV or…

Extra Crunch Live: Join Greylock’s Asheem Chandna today at 3pm EST/12pm PST on the future of enterprise and cybersecurity investing

Yes, there is an election, but that’s getting pretty boring at this point. What’s far more interesting is the future of enterprise and cybersecurity startups, markets where companies are dumping…

Join Greylock’s Asheem Chandna on November 5 at noon PST/3 pm EST/8 pm GMT to discuss the future of enterprise and cybersecurity investing

The world of enterprise software and cybersecurity has taken multiple body blows since COVID-19 demolished the in-person office, flinging employees across the world and forcing companies to adapt to an…

Rockset announces $40M Series B as data analytics solution gains momentum

Rockset, a cloud-native analytics company, announced a $40 million Series B investment today led by Sequoia with help from Greylock, the same two firms that financed its Series A. The…

Remotion raises $13M to create a workplace video platform for short, spontaneous conversations

One of the broader trends of the pandemic has been the unbundling of Zoom, with startups pulling out a feature or two and designing entire products centered around a specific…

Greylock and MLT are trying to diversify tech’s wealth cycle

Greylock Partners has teamed up with Management Leadership for Tomorrow to address issues of diversity and inclusion in the technology industry. “Our view is this has to be a comprehensive…

Benchmark used to be the quintessential Silicon Valley venture firm. It was small. It was focused. It was aggressive while also remaining founder friendly. It stuck to its knitting when…

Featured Article

Figma CEO Dylan Field discusses fundraising, hiring and marketing in stealth mode

You’d be hard pressed to hang out with a designer and not hear the name Figma. The company behind the largely browser-based design tool has made a huge splash in the past few years, building a massive war chest with more than $130 million from investors like A16Z, Sequoia, Greylock, Kleiner Perkins and Index. The…

Featured Article

The VCs who founders love the most

Update July 2021: The TechCrunch List has been officially retired. Over the past month, we have been asking founders to submit recommendations of VCs for The TechCrunch List, our newly-launched curated directory of investors who are ready to write first checks and lead venture rounds into startups. You can head over to the list itself…

TC Early Stage on July 21 and 22 will virtually bring together 50+ experts across startup core competencies to give you the tools you’ll need to be able to keep…

Partners at Sequoia, GGV, General Catalyst and Greylock join Valence’s VC initiative for Black founders

The new, Los Angeles-based online professional network for Black talent, Valence, has launched a new initiative called the Valence Funding Network to link Black entrepreneurs with top partners at firms…

It’s ‘bullshit’ that VCs are open for business right now, but that could change in a month

Earlier today, to get a sense of what’s happening in the land of venture capital, the law firm Fenwick & West hosted a virtual roundtable discussion with New York investors…

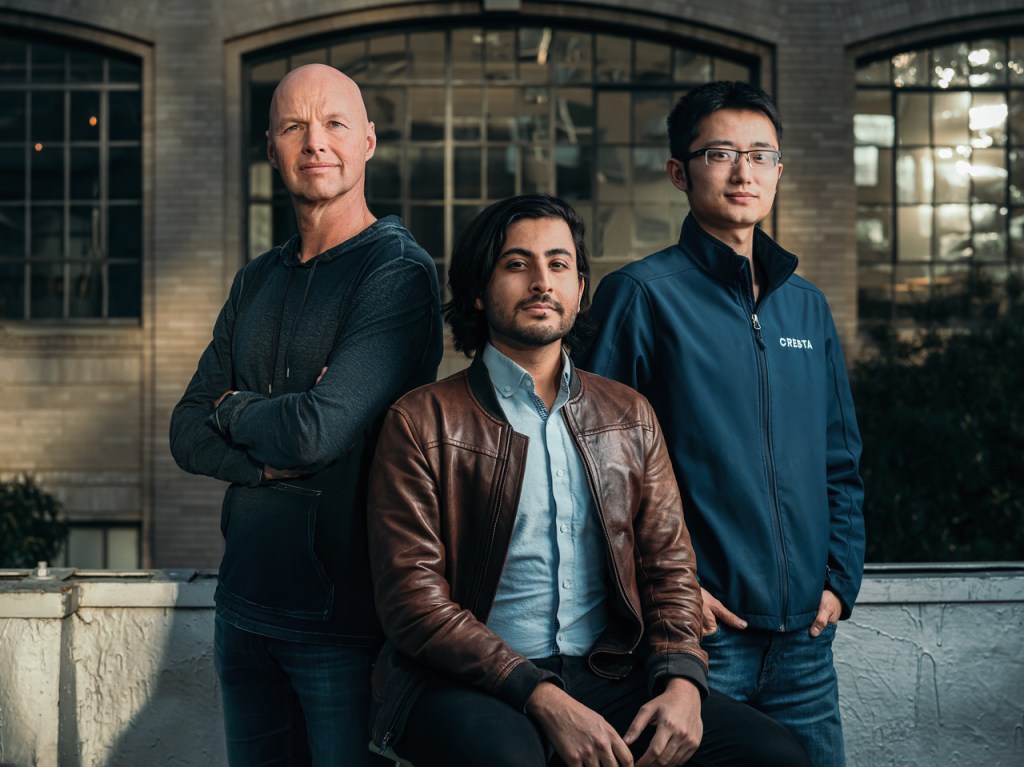

AI startup Cresta launches from stealth with millions from Greylock and a16z

As Silicon Valley’s entrepreneurs cluster around the worldview that artificial intelligence is poised to change how we work, investors are deciding which use cases make the most sense to pump…

Chronosphere launches with $11M Series A to build scalable, cloud-native monitoring tool

Chronosphere, a startup from two ex-Uber engineers who helped create the open-source M3 monitoring project to handle Uber-level scale, officially launched today with the goal of building a commercial company…

All Raise has established new chapters in Los Angeles and Boston.

Featured Article

Higher Ground Labs is betting tech can help sway the 2020 elections for Democrats

When Shomik Dutta and Betsy Hoover first met in 2007, he was coordinating fundraising and get-out-the-vote efforts for Barack Obama’s first presidential campaign and she was a deputy field director for the campaign. Over the next two election cycles the two would become part of an organizing and fundraising team that transformed the business of…

Almost every organization, regardless of size, is inundated with meetings, so much so it’s often hard to find dedicated time to do actual work. Clockwise wants to change that by…

Hyundai takes minority stake in self-driving car startup Aurora

Hyundai Motor Group has invested in Aurora, the latest sign that the scope of the year-old partnership between the automaker and self-driving car startup has expanded. Aurora and Hyundai didn’t…

Okta Ventures wants to fund the next generation of identity, security and privacy startups.

Young founders who want to start companies while still in school have an increasing number of resources to tap into that exist just for them.

Google’s head of its $110B+ ads and commerce business is leaving for Greylock Partners

Sridhar Ramaswamy, Google’s head of commerce, is leaving the company after more than 15 years and will be joining Greylock Partners, sources inside the company told us and Google confirmed. Ramaswamy…

Robinhood hires Josh Elman as VP of product, who’ll stay at Greylock

Zero-fee stock trading app Robinhood is getting some product firepower as it dives into cryptocurrency and weighs platform aspirations. Investor Josh Elman will join Robinhood as its VP of product…

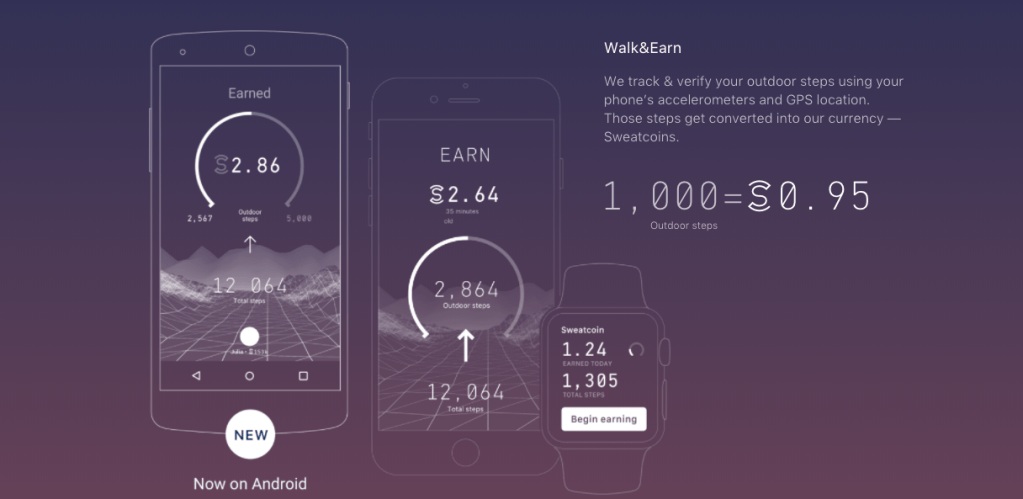

Want a way to workout and earn some coin? Sweatcoin has risen to the top of the App Store for helping folks get something more than just a glow for…

Nauto raises $159M to fuel expansion of its autonomous driving data platform

Nauto, a Palo Alto company focused on retrofitting existing vehicle fleets with networked safety camera-equipped devices, has raised $159 million in a Series B round led by SoftBank. The company’s…