It’s hard to call a billion-dollar investment in an emerging market anything less than a major win, but for Lazada, the Rocket Internet-backed e-commerce firm in Southeast Asia, there’s more than an element of relief. The four-year-old company nearly ran out of money right before Alibaba swooped in with a majority investment, including $500 million in fresh capital and the acquisition of $500 million in stock from existing investors.

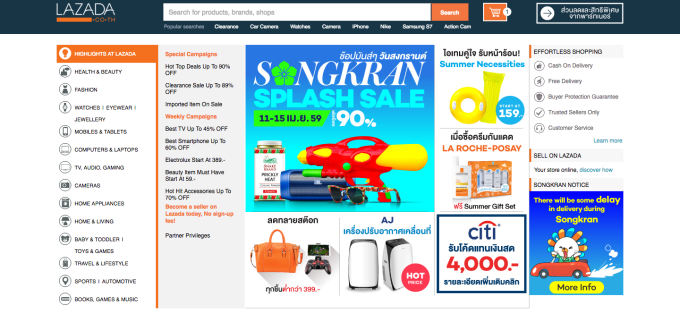

Lazada has long been billed the Amazon or Alibaba of Southeast Asia. While it may be the largest e-commerce player in the region in terms of size, under the hood, the company is far from financially healthy.

Rocket Internet’s latest financials are due Thursday, but the most recent data shows that Lazada grossed $191 million in sales during the first nine months of last year. Not bad, but the company carded a $233 million operating loss for the period, much of which was driven by the cost of acquiring users, incentives to paid to merchants and general marketing costs.

Building an e-commerce company in an emerging market sure isn’t easy.

A Savior Arrives

Through conversations with multiple former and current Rocket Internet employees in Southeast Asia, TechCrunch has come to understand more about Lazada’s financial situation immediately prior to this deal.

Lazada has raised some $700 million from investors, but its cash burn from the challenge of serving six different emerging markets, where online commerce remains nascent, ate into the unprofitable company’s cash hoard and worried executives throughout 2015. The company spent most of the year shopping itself around for investors, with the aim of raising a bridge round by December 2015 as executives were “very nervous as they were running out of money,” one source told TechCrunch.

Ultimately that round was out of reach. While Rocket Internet companies seem to land funding like water when things are rosy, raising out of necessity is distinctly harder.

“Not that many people can write those big checks,” our source said. “And it’s not so easy to raise lots of money for Rocket companies, as they are not the normal founder led startups in the first place.”

Ultimately, we understand, Rocket Internet and Kinnevik, a Sweden-based Lazada investor, stepped in to help the company hold out until a longer term deal was found.

Intermingled in all of this is Alibaba. Alibaba emerged as the company’s “savior” — to use one ex-Rocket Internet executive’s words — late in 2015. The Chinese company firmed up its interest and signed a term sheet in January for either a full-out acquisition or a strategic majority investment. Ultimately, Alibaba chose the latter following months of due diligence, although it seems to harbor longer term ambitions.

As part of yesterday’s announcement, Alibaba has the option to purchase the remaining shares from almost all of Lazada’s investors over the next 18 months. With the right performance indicators and signs of development from Lazada, Alibaba will swallow the company up whole and fully integrate it into its e-commerce empire, which now stretches to India via an investment in payments and commerce firm Paytm.

Modest returns for investors

This is the first billion dollar acquisition in Southeast Asia, and a major sign of confidence in e-commerce in the region, but there are plenty of curiosities, too.

As we reported yesterday, nearly every investor opted to sell just under half of their stock now and commit to selling the remainder over time.

The following companies disclosed their sales, but others followed suit without revealing figures:

- Rocket Internet: sold 9.1 percent stake for $137 million

- Tesco: sold 8.6 percent stake for $129 million

- Kinnevik: sold 3.8 percent stake for $57 million

All in all, insiders told us that more than 35 current or former employee shareholders cashed out a maximum allocation of 43.83 percent, while all but one investor — Singapore’s sovereign wealth fund Temasek, an Alibaba shareholder which led Lazada’s last round in November 2014 — opted to sell to Alibaba.

Rocket Internet, which founded Lazada back in 2012, came away with an impressive 15X return on its investment of €18 million ($20.5 million at today’s exchange rates) whilst retaining half of its stock for now, but those who came to the party late got modest returns.

Many major investors who have backed multiple Rocket Internet projects, like JP Morgan and Summit Partners, “will be disappointed with the outcome,” a source told us. “Rocket made a lot of money, but the other early investors have very poor returns,” the person added.

It’s unclear why large corporate investors exited, rather than sticking with the company. Perhaps the rollercoaster ride was enough at this point, but with Alibaba in control with a more experienced team, deeper pockets and an array of logistics and e-commerce tech at its disposal, you’d think this is a horse to win the race.

Targets Set Too High

One major issue that Lazada has battled with constantly is expectation. Rocket Internet has gone after ‘green market’ opportunities by building e-commerce companies in markets like Southeast Asia, Latin America, Africa and the Middle East — parts of the world that the likes of eBay and Amazon (and maybe even Alibaba) would consider too nascent right now.

In Lazada, the promise of building the ‘Amazon of Southeast Asia’ never came true. Lazada’s $1.5 billion valuation that Alibaba invested at is impressive for Southeast Asia, but it seems far more modest that the vision that snared hundreds of millions in investment from the likes of Tesco and JP Morgan. Then there’s the fact that it is lower than other Southeast Asian startups with far less funding, like Garena, which is reportedly valued at $3.75 billion.

One early Lazada founder admitted to TechCrunch that the initial projections set when the business was founded in 2012 were “way too high.” E-commerce has grown over the those years but, as Alibaba readily admitted in its press release announcing the deal, online represents just three percent of total sales in Southeast Asia. Being optimistic, that’s an opportunity for Alibaba. In reality, it was a major constraint for Lazada, which anticipated things would develop at a much faster clip.

In one of his first media interviews (with this reporter) in 2013, one year after Lazada’s founding, CEO Max Bittner said the company was on track to be profitable by 2015.

“There’s no reason e-commerce shouldn’t be big in Southeast Asia. There are a number of ‘social media capital cities’ [Bangkok and Jakarta are among the world’s most populous Facebook cities], while tens of millions of people use messaging apps like Line, all of which indicates that there’s clearly a strong Internet culture across the region,” Bittner said.

Well, Lazada missed that target spectacularly. The general consensus of e-commerce figures — many of whom spoke to TechCrunch off the record for this story — is that Lazada, on its current path, is three to four years away from profitability.

Bittner’s words are true, no doubt, but when you sell an idea to investors and then find your own projections are off kilter, you have a massive problem. The business is burning more money than expected, putting its existence into jeopardy, and raising new cash becomes all the harder. That, coupled with the money woes of 2015, could be why many investors were happy to take their modest returns and get out.

The bigger question is whether that experience, and the underwhelming result, deters them (and other institutional investors) from looking at emerging markets in the future, or does it simply arm them with greater understanding of what to expect? Southeast Asia is undoubtedly a region with potential, but the growth curve for smartphone adoption, internet access and online spending is far longer than many first thought.

A Big Win For Southeast Asia

But Lazada has made it through. For all its problems — higher-than-expected competition, inconsistent logistics, staff churn and slower market growth than expected — Lazada represents a great opportunity for Alibaba. The Chinese e-commerce giant gets a business that serves Southeast Asa’s six biggest countries — with a combined population of over 500 million people — and the basis of a platform that it can knock into shape as it seeks growth outside of China.

Or, as one ex-Lazada exec put it: “Alibaba has bought the chassis, now it needs to completely change the internals.”

Beyond the nuts and bolts of the deal and Lazada’s struggles, investors and startups in Southeast Asia greeted the news with optimism and a belief that it can kick off a new wave.

“This is a big win for Southeast Asia,” Vinnie Lauria, founding partner at Singapore-based Golden Gate Ventures, told TechCrunch.

“It’s a validation to U.S. and global investors on the potential of this region and why they should look at deploying more money here. The big boys in China have a real interest here in the region. So, while there’s a slow down in China, Southeast Asia is way undervalued and Chinese firms see that,” added Lauria, whose firm recently released a report on M&A potential in Southeast Asia and is in the process of closing a $50 million fund.

“The large investment by Alibaba into Southeast Asia is a testament to how fast the region has grown over the last years and the potential it has,” said Stefan Jung, founder partner of Venturra Capital, a $150 million Indonesia-based fund started last year, and the former head of Rocket Internet in Southeast Asia.

“We are just at the beginning and I expect this investment to have a trigger effect of more investors to look at Southeast Asia as a huge opportunity,” Jung said.

Startups in the region are also bullish that Alibaba’s newly increased focus on Southeast Asia will bring with it opportunities for the wider e-commerce market.

“This might attract more capital into not just e-commerce but many other business models in the region, hopefully putting the growth of our tech sector on steroids. It could really be a great thing for the market,” Ankiti Bose, CEO and co-founder of e-commerce marketplace Zilingo, which is backed by Sequoia, told TechCrunch.

Golden Gate Venture’s Lauria echoed those thoughts, adding that it could light up e-commerce verticals, which Alibaba could be hungry to buy into, too.

“Does this mean local and new e-commerce companies can’t compete? I don’t think so. There’s a huge opportunity for vertical e-commerce in Southeast Asia. If you look at Amazon in the U.S., their footer has all the companies they’ve bought and it covers something like 20-plus verticals,” he added.

Southeast Asia is already amok with ex-Rocket Internet people who have founded new startups or made their way to other companies. With nearly 40 shareholders cashing a hefty portion of their shares now — those still at Lazada are subject to a four-year golden handcuff, by the way — there could be an influx of new investors who, gilded by their experience with Lazada, are ready to invest in upcoming startups across the region.

What Next?

The two most immediate areas to follow post-deal are how Alibaba will change Lazada, and whether its rivals will follow suit and up their interest in Southeast Asia.

Lazada had struggled on logistics, but Alibaba owns a big chunk of logistics player SingPost and has its own $7.7 billion-dollar valued logistics company Cainaio which is beefing up its presence outside of China. It seems entirely feasible that Alibaba might (again) increase its SingPost holdings to build out a logistics network to complement Lazada’s business, and/or deploy funds to expand Cainaio.

Secondly, how do its rivals respond?

Amazon has flirted with the idea of acquiring e-commerce players in Southeast Asia although it hasn’t formally bid for any, according to industry sources. Will that change?

JD.com, Alibaba’s biggest rival in China, stepped into Indonesia — Southeast Asia’s most populous country — last year, and it may yet have plans to increase its base now. SoftBank-banked Tokopedia, well-funded Matahari Mall and newly merged Orami are all also eyeing Southeast Asia’s regional e-commerce play.

First up though, Alibaba has plenty of work to do with Lazada if it is to make it into the Alibaba of Southeast Asia.

Comment